Planning to buy an HDB flat in 2025? You’ll need an HFE Letter — short for HDB Flat Eligibility — before you can even apply for a BTO or resale unit.

It tells you whether you’re eligible to buy, how much CPF grant you can get, and the maximum loan amount you qualify for — whether it’s an HDB loan or bank loan.

Not sure which loan is better? Check out this guide on HDB Loan vs Bank Loan to learn more.

Let’s walk you through the HFE process — step by step.

Before You Apply: What to Know About the New HFE Letter in 2025

If you’re buying a flat in Singapore, the HDB Flat Eligibility (HFE) Letter is now your first big step — not just a formality. Introduced to make the homebuying journey clearer and faster, it replaces older processes like the HLE and grant checks. But before you dive in, here’s what you really need to know.

Why HDB Changed the Home Loan Eligibility Process

In the past, applying for a flat meant juggling multiple forms — one for eligibility, another for grants, and yet another for your home loan. It was messy.

To simplify things, HDB launched the HFE Letter, which now combines everything into one application. With this single letter, you’ll know:

- If you’re eligible to buy a BTO or resale flat

- Whether you qualify for any CPF housing grants

- Your maximum loan amount from an HDB loan or bank mortgage

It’s faster, clearer, and helps you plan your budget right from the start — especially in a hot market like 2025.

What Mistakes First-Time Buyers Often Make

One of the most common mistakes? Applying for your HFE too late. Many first-time buyers wait until a BTO launch is announced, only to realise the HFE processing takes time — and without it, you can’t even join the queue.

Others assume they’ll automatically qualify for the maximum housing loan or full CPF grant. But your income, credit history, and even debt levels can reduce what you’re eligible for.

Quick tip: Try this mortgage loan repayment calculator before applying — it gives you a realistic idea of what your monthly payments might look like.

What You Should Prepare Before Starting

Before logging into the HDB Flat Portal, have these ready:

- Your Singpass login

- Latest payslips or CPF contribution history

- IRAS Notice of Assessment (especially if self-employed)

- Any loan or credit obligations you’re currently repaying

If you’re applying under the Single Scheme or Joint Singles Scheme, make sure all applicants prepare their documents early too.

Getting everything ready ahead of time avoids delays — and improves your chances of securing a flat you really want.

What Is the HFE Letter in Singapore?

Think of the HFE Letter as your official green light from HDB. It tells you whether you’re eligible to buy a flat, which grants you can receive, and how much you can borrow — either from HDB or a bank. As of 2025, you can’t book a BTO or resale flat without it.

What does HFE stand for and what does it replace?

HFE stands for HDB Flat Eligibility.

It replaces three separate processes that used to confuse buyers:

- HLE Letter (to check if you qualified for an HDB loan)

- Eligibility check for buying a flat

- CPF housing grant application

Now, with just one application on the HDB Flat Portal, you’ll receive a single letter covering everything — eligibility, grant support, and loan assessment.

What’s the difference between HFE and HLE?

The old HLE (Home Loan Eligibility) letter was focused on just one thing: how much you could borrow from HDB.

The new HFE Letter is much more comprehensive:

- It checks if you’re eligible to buy a flat (not just take a loan)

- It includes your CPF grant eligibility

- It even evaluates your options for both HDB loans and bank loans

So if you’re planning to compare mortgage rates in Singapore or go with a fixed-rate HDB loan, the HFE Letter will tell you what’s possible.

Why did HDB change to a single integrated system?

Simple — the old way wasn’t working.

Applicants had to guess their eligibility and submit multiple forms at different stages. That often led to last-minute surprises, missed launches, or wrong assumptions about grants and loans.

With the HFE system, everything is done upfront:

- You know where you stand before shortlisting flats

- You can plan your finances more accurately

- And you avoid wasting time on flats you can’t afford or aren’t eligible for

Pro tip: The HFE Letter also helps you decide whether to go for a bank mortgage loan or stick with an HDB loan — based on real numbers.

Who Needs to Apply for an HFE Letter?

Short answer? Pretty much everyone planning to buy an HDB flat in 2025.

Whether you’re going for a BTO, looking at the resale market, or eyeing something via open booking, the HFE Letter is now your first required step — no exceptions.

Are you a first-time HDB buyer in 2025?

If you’ve never owned an HDB flat before, you’re considered a first-time buyer — and yes, you’ll need to apply for the HFE Letter before you can:

- Join a BTO ballot

- Book a flat

- Apply for any CPF housing grants

- Check if you qualify for an HDB home loan or mortgage from a bank

First-timers usually get more grant support and higher priority in BTO applications, but the HFE Letter is what confirms those details.

Can second-time buyers and singles apply for HFE?

Yes — the HFE Letter isn’t just for first-timers.

If you’re a second-time buyer, upgrading, or returning to the HDB market after selling a previous flat, you’ll also need to apply for a fresh HFE.

And if you’re applying under the Single Singapore Citizen Scheme or Joint Singles Scheme, the same rule applies. You’ll need to:

- Meet the age and citizenship requirements

- Submit supporting income documents

- Pass credit checks for loan eligibility

🔍 Reminder: Even singles buying a resale flat or 2-room Flexi will need an HFE Letter before proceeding.

Do you need an HFE for BTO, resale, and open booking flats?

Absolutely — the HFE Letter is mandatory for all types of flat purchases starting from 2023, and in 2025, there are no exceptions:

- BTO launches: You can’t enter the ballot without it

- Resale flats: You’ll need it before applying for any grants or home loans

- Open booking: Even quick-selection units require HFE approval

In short: no HFE, no flat — regardless of the route you’re taking.

How the HFE Letter Works for BTO vs Resale Flats

Whether you’re applying for a brand-new BTO or eyeing a resale unit in a mature estate, the HFE Letter is required in both cases. But the way it fits into each timeline — and the things you need to prepare — can be slightly different.

Do You Still Need to Get the Letter Before Booking?

Yes — you must get your HFE Letter before you can book any flat. This applies to:

- BTO applications

- Resale flat purchases

- Open booking exercises

Without it, you won’t even be able to submit your interest in a BTO launch, much less apply for CPF housing grants or a home loan. It’s your official “go-ahead” to proceed with any kind of HDB flat transaction.

Does the Process Differ for Resale vs New Flats?

The application for the HFE Letter is the same, but the timing and next steps differ slightly.

For BTO flats:

- Apply for your HFE before the launch

- Wait for the letter before submitting your flat application

- If successful, use the letter to apply for an HDB loan or compare bank mortgage rates

For resale flats:

- Apply for HFE as soon as you start your search

- You’ll need the letter before signing the Option to Purchase (OTP)

- It will also help you budget better for stamp duties, renovations, and cash top-ups if needed

What to Watch Out For with Resale Timelines

With resale flats, the biggest risk is time sensitivity. Once you secure an OTP, you only have 21 calendar days to exercise it — and without a valid HFE Letter, you can’t proceed with the purchase.

Pro tip: Always make sure your HFE is approved before making any offers. Don’t assume you can rush the application — HDB may take time to review income, CPF, or credit records.

And if you’re planning to use a bank loan for your resale flat, consider getting early advice from a mortgage advisor — they can help coordinate approval timelines so you don’t miss critical deadlines.

How to Apply for the HFE Letter (2025 Step-by-Step)

Applying for your HDB Flat Eligibility (HFE) Letter isn’t difficult — but doing it right can save you weeks of delay. In 2025, the entire process is fully online via the HDB Flat Portal, and you’ll only need to apply once to get everything you need to move forward with your home purchase.

What documents and Singpass access do you need?

Before you start, make sure all applicants have Singpass and their documents ready. Here’s what you’ll typically need:

- CPF contribution history (automatically retrieved)

- Latest IRAS Notice of Assessment or payslips

- Info on any existing loans or financial commitments

- Details of your employment or self-employed status

If you’re applying under the HDB Single Scheme, ensure your income meets the eligibility criteria for grants and loan limits.

Pro tip: Double-check your documents to avoid getting your application “pended” or delayed. A clean, complete submission speeds up approval.

How to submit your application through the HDB Flat Portal?

Here’s a quick step-by-step for applying through the HDB Flat Portal:

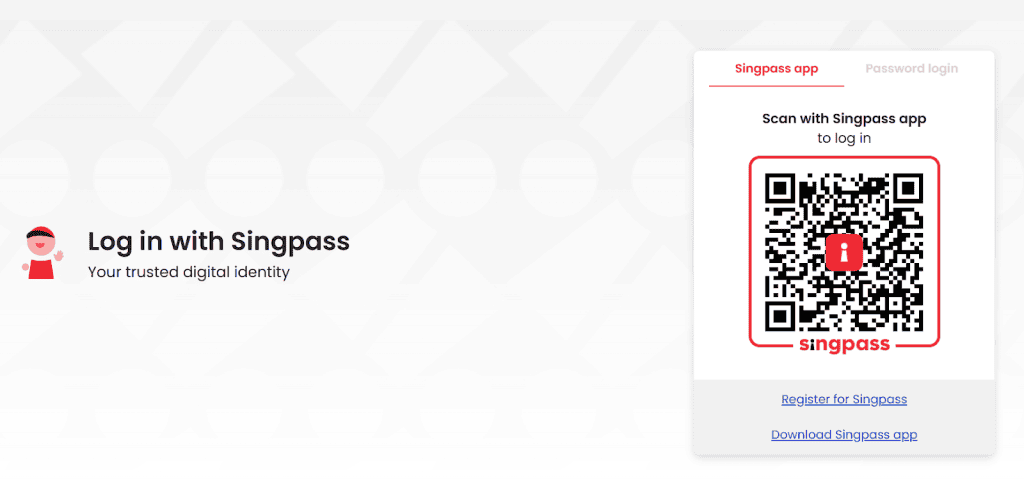

- Log in with Singpass

- Navigate to Apply for HFE Letter

- Fill in your personal details and household information

- Upload or verify supporting documents

- Review and submit

The portal is mobile-friendly, but it’s still easier to complete everything on a laptop or desktop.

If you’re planning to explore bank home loans later, the HFE Letter also helps you confirm eligibility upfront — no guessing needed.

What happens after you apply and how long it takes?

Once submitted, HDB will process your application by checking:

- Your income records (from CPF/IRAS)

- Your credit history (via Credit Bureau Singapore)

- Your housing and ownership status

💬 Processing time: Usually within 21 working days, but may be faster if your documents are clean.

When ready, you’ll receive an official HFE Letter outlining:

- Whether you’re eligible to buy

- Your loan options (HDB vs bank)

- Your CPF housing grant eligibility

You can then use this letter to apply for your desired flat, plan your mortgage repayments, or start comparing home loan rates in Singapore.

What Is Checked During the HFE Assessment?

The HFE Letter may seem like just another step — but behind the scenes, it’s a pretty detailed financial check. HDB (and participating banks) want to make sure you’re eligible not just to buy a flat, but to manage the financial commitment that comes with it. Here’s what goes into the review.

What financial documents are reviewed for HFE?

When you submit your HFE application, HDB pulls data from several sources — you don’t have to upload everything manually, but you do need to ensure the records are up to date.

Here’s what they’ll review:

- CPF contribution history (to check employment consistency)

- Latest Notice of Assessment from IRAS (for income verification)

- Payslips or income declarations (especially if you’re newly employed or self-employed)

- Details of any existing loans (car, education, renovation, etc.)

Self-employed applicants may also be asked for bank statements or business income proof.

Tip: Want to be extra safe? Scan your credit standing before applying using your CBS report — it’s what HDB and banks use too.

How does HDB assess your income and credit profile?

HDB uses your income to determine:

- Whether you’re eligible to buy a flat

- The maximum housing loan amount (HDB or bank)

- How much CPF grant support you qualify for

They also check your creditworthiness via the Credit Bureau Singapore (CBS) — to see if you’ve defaulted on loans, maxed out credit cards, or have any existing debt that could affect your ability to repay.

If you’ve recently taken a large loan (e.g. car or personal), it may reduce your loan quantum.

What affects the outcome of your loan and grant eligibility?

Several factors can lower your approved loan amount or reduce your CPF grant:

- Income ceiling: Earning too much could disqualify you from certain grants

- Irregular income: Freelancers or commission-based roles may get a more conservative loan estimate

- Age: Older buyers may receive a shorter loan tenure

- Outstanding debts: Existing loans reduce your monthly loan servicing ability

- Credit history: Missed payments or past defaults can result in a rejection

Planning to upgrade or refinance later? Understanding your current profile now helps you decide whether to go with an HDB loan or start comparing bank mortgage options.

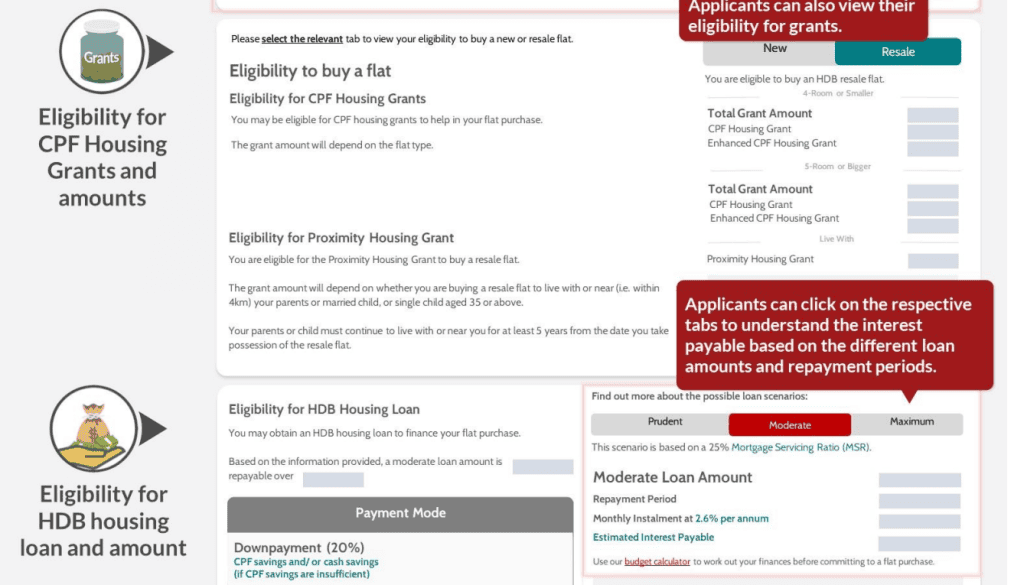

What You’ll See Inside the HFE Letter

Once your HFE application is approved, you’ll receive a digital letter summarising your full eligibility profile. This isn’t just a yes-or-no — it’s a breakdown of what you qualify for, how much you can borrow, and what types of housing support you’re entitled to.

What loan amount and grant details will be shown?

Your HFE Letter will clearly state:

- Your maximum HDB loan amount (if eligible)

- Whether you’re eligible for a bank home loan

- How much CPF housing grant you qualify for (e.g. Enhanced Housing Grant, Proximity Housing Grant)

- The flat types you’re eligible to buy

This makes budgeting easier, especially when deciding between a BTO, resale, or open booking flat.

Need help calculating your monthly repayments? Use our mortgage loan repayment calculator to plan based on the loan amount shown in your letter.

Can you use the letter for both HDB and bank loans?

Yes — that’s one of the biggest improvements of the HFE system.

Instead of applying separately for a loan later, your loan eligibility is pre-assessed for both options:

- HDB housing loan — if you meet the income and citizenship criteria

- Bank home loan or mortgage — with standard credit checks applied

This gives you time to compare interest rates, loan packages, and even explore refinancing options early on.

What if you disagree with the outcome — can you appeal?

Yes, you can — but only under specific circumstances.

If you believe there’s been an error (e.g. outdated income data, missing grant eligibility, or incorrect credit record), you can:

- Submit an appeal through the HDB Flat Portal

- Provide updated supporting documents or clarification

- Request a reassessment

That said, HDB’s decisions are generally strict, especially when based on official income or credit bureau data.

💡 Tip: If your HFE shows a lower loan than expected, consider speaking to a mortgage advisor to explore what bank options may still work — some lenders have more flexibility than HDB.

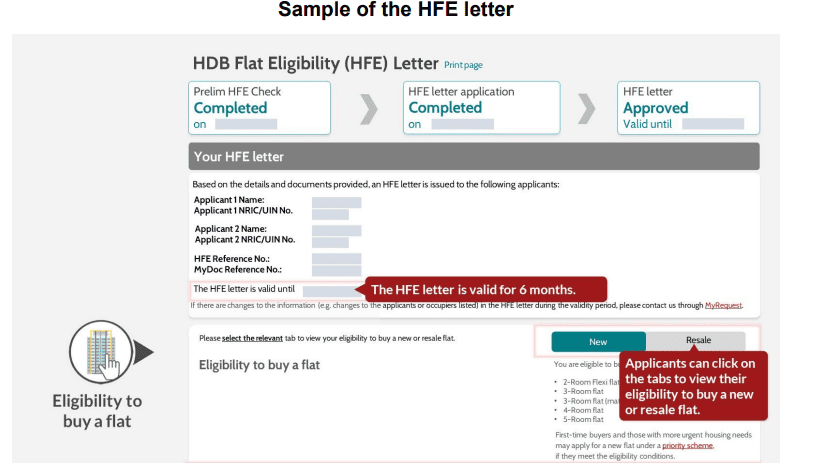

Sample HFE Letter Breakdown (With Visual Guide)

The HFE Letter isn’t just a “yes” or “no” — it’s a detailed document that helps you plan your property journey with real numbers. If it’s your first time seeing one, it can look a little overwhelming. Here’s how to read it, section by section.

Where to Find Your Loan Eligibility and Grant Breakdown

Your HFE Letter will include two key sections right up front:

- Loan Eligibility: Shows the maximum loan amount you can get from HDB or a participating bank

- CPF Grant Eligibility: Lists the housing grants you qualify for, such as:

- Enhanced Housing Grant (EHG)

- Family Grant or Singles Grant

- Proximity Housing Grant (PHG)

- Enhanced Housing Grant (EHG)

📌 Pro tip: The numbers are based on your income, age, and loan tenure — if you’re eyeing a resale flat, this is where you’ll see how much support you’ll get to offset the price.

How to Interpret the Results in the Letter

Here’s how to make sense of what your HFE Letter is telling you:

- A high loan ceiling usually means you have stable income and low existing debt

- If you see only bank loan eligibility, it means you don’t meet HDB loan criteria (e.g. income too high, citizenship mismatch)

- Your CPF grant amount depends on your income tier — the lower your income, the higher your grant

- Some applicants may see notes or conditions (e.g. need to clear debts before approval)

Need help planning next steps? Our mortgage consultants can break it down for you and compare HDB vs bank options based on your actual letter.

When You Need to Update or Reapply

Your HFE Letter is valid for 6 months, but there are some situations where you might need to update or reapply:

- Your income changes significantly (promotion, job switch, self-employed jump)

- You or your co-applicant take on a new loan

- You let the 6-month validity expire before booking a flat

Don’t wait till the last minute — if you’re planning to apply for a BTO or make a resale offer, always check your HFE’s expiry date.

Need a fresh loan assessment? Use our mortgage loan repayment calculator to plan ahead before reapplying.

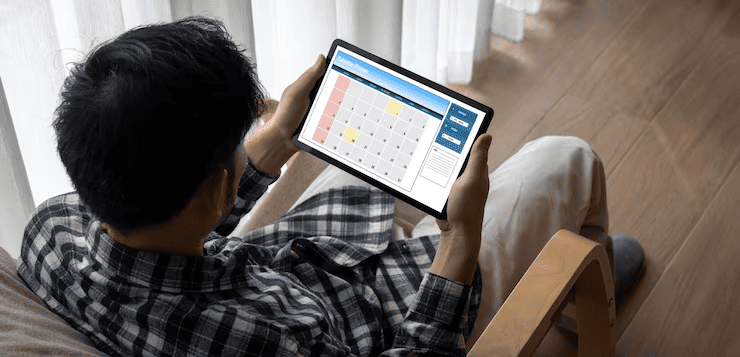

How Long Is the HFE Letter Valid and When to Apply?

The HFE Letter may feel like a one-time step, but timing really matters — especially with flat launches happening throughout the year. Knowing when to apply (and reapply) could be the difference between booking your dream BTO or missing the window entirely.

What’s the HFE letter validity period in 2025?

As of 2025, your HFE Letter is valid for 6 months from the date of approval.

This means:

- You can use it to apply for BTO, resale, or open booking flats anytime during that period

- You’ll need a new application if it expires before you book a flat or exercise an Option to Purchase (OTP)

📌 Tip: The expiry date is printed clearly at the top of Page 1 of your letter, so take note of it and set a reminder if needed.

When is the best time to apply for your HFE?

The best time is as early as possible — ideally before any upcoming BTO launches or house viewings.

Here’s why:

- It can take up to 21 working days to process

- You can’t apply for a flat or OTP without it

- It helps you budget realistically with loan and grant info in hand

✅ Pro tip: If you’re exploring both HDB loans and bank mortgage packages, your HFE will help you compare mortgage interest rates in Singapore with more clarity.

What happens if your letter expires or info changes?

If your letter expires — or your income, household size, or financial commitments change — you’ll need to submit a new application via the HDB Flat Portal.

Common reasons to reapply include:

- Change in job or salary

- Adding or removing a co-applicant

- New loan taken (e.g. car loan, renovation loan)

Heads up: Reapplying doesn’t guarantee the same result — your loan eligibility or CPF grant might change based on your new profile.

To prep for your next application, use our mortgage loan repayment calculator to reassess your loan budget quickly.

Common Issues with HFE Applications and How to Avoid Them

Most people think the HFE Letter is a sure thing — until they hit a delay or rejection. Whether it’s a missing document or a credit issue, here’s what to watch out for and how to fix it quickly (before you miss a BTO or resale deadline).

What are the most common reasons for HFE rejection?

HDB doesn’t often “reject” applications without reason — but if yours is delayed or denied, it usually comes down to:

- Incomplete income records (especially for self-employed or commission earners)

- Incorrect household info (e.g. unlisted spouse or dependents)

- Existing home ownership not declared

- Unfavourable credit history (loan defaults, maxed-out credit cards)

- Income ceiling exceeded (for CPF grant eligibility)

⚠️ If you’re planning to take a bank home loan, a bad credit report can also limit your options — even if you’re not applying for an HDB loan.

How to fix application errors or missing documents?

The good news: most issues can be resolved without restarting the process. Here’s how:

- Check the HDB portal for status updates — if your application is “pending”, it may be waiting for you to upload documents

- Re-upload any missing files (payslips, CPF records, NOA) through the portal

- If you’re self-employed, include 12-month bank statements or your IRAS tax filing

✅ Tip: Avoid uploading screenshots — always send official PDFs or clear scans. And don’t wait for HDB to chase you; stay proactive.

When should you seek help from a mortgage advisor?

If you’re unsure why your loan amount is lower than expected, or confused about why you didn’t qualify for certain CPF grants, speaking to a mortgage advisor in Singapore can save you a lot of guesswork.

Here’s when to get help:

- You were told you’re not eligible for an HDB loan, but don’t understand why

- You want to explore alternative bank loan packages after your HFE result

- You’re planning to refinance your HDB loan and want to get ahead on approval timelines

💬 Good advisors can help you navigate both the HFE process and secure better loan terms — without all the paperwork stress.

HFE Letter vs HLE Letter – Full Comparison

Still confused about how the new HFE Letter differs from the old-school HLE? You’re not alone — thousands of buyers are adjusting to the change. Let’s break it down and see what’s actually improved.

What did the old HLE cover and what’s changed now?

The HLE (Home Loan Eligibility) Letter was used solely to check if you qualified for an HDB loan, and how much you could borrow. That’s it. You still had to:

- Separately check if you could buy a flat

- Apply for CPF housing grants on your own

- Contact banks if you wanted a loan comparison

The new HFE Letter does all of that in one shot:

- Checks your eligibility to buy a flat

- Assesses CPF grant eligibility

- Gives you your loan options — from both HDB and banks in Singapore

💡 It’s a more complete snapshot of what you can afford and qualify for — crucial when planning for BTO or resale.

Which process is easier — HFE or HLE?

Hands down: HFE is easier — once you understand it.

With HLE, many applicants submitted multiple documents at different times and were only told late in the process if something was missing.

With HFE:

- Everything is handled through the HDB Flat Portal

- Documents are auto-pulled from CPF and IRAS (you just need to verify)

- The system guides you from eligibility → grants → loan in one seamless flow

✅ You’ll also get clear information upfront, helping you avoid nasty surprises later — especially when shopping for fixed-rate home loans or exploring bank mortgage options.

Are the criteria for bank loan and HDB loan still different?

Yes — they still follow different rules, even under the HFE system.

Here’s a quick comparison:

HDB Loan vs Bank Loan Comparison Chart (2025 HFE Letter Guide)

| Criteria | HDB Loan | Bank Loan |

|---|---|---|

| Citizenship | At least 1 Singaporean | PRs and foreigners allowed |

| Income ceiling | Yes (e.g. $14,000 for families) | No ceiling |

| Interest rate | Fixed at 2.6% | Market-based (e.g. SORA-linked) |

| Downpayment | 20% (can be fully CPF) | 25% (minimum 5% cash) |

| Loan tenure | Max 25 years | Max 30–35 years |

If you’re not eligible for an HDB loan — or want to compare interest savings — you can speak with a mortgage consultant to help you weigh your options.

Frequently Asked Questions About the HFE Letter

Have a few quick questions? Here are some common ones Singaporeans (and PRs) ask before or after applying for their HFE Letter.

Can I apply for HFE without Singpass?

No — as of 2025, Singpass is mandatory to apply for an HFE Letter.

This is because your income, CPF contributions, and tax information are pulled automatically from government systems during the application process.

If you’ve lost access to Singpass or need help retrieving your login, it’s best to get it sorted before attempting to apply on the HDB Flat Portal.

Can I change my loan type after getting my HFE letter?

Yes — but only within limits.

Your HFE Letter will show your eligibility for both an HDB loan and a bank loan. If you originally intended to take an HDB loan but later decide a bank mortgage suits you better (or vice versa), you can proceed with that — as long as your choice is still supported by the letter.

Tip: If you need help comparing rates or switching loan paths, it’s wise to speak with a mortgage advisor before committing.

Can permanent residents apply for HFE?

Yes, Singapore PRs can apply for the HFE Letter, but some restrictions apply.

- You must be buying with a Singapore Citizen (e.g. spouse or family nucleus)

- PRs are not eligible for HDB loans, so the HFE will only assess your bank loan eligibility

- PRs are also not eligible for most CPF housing grants

If you’re a PR buying private property or exploring bank loans for condos, the HFE isn’t required — but getting pre-approval is still recommended.

Final Thoughts: Get Your HFE Letter Before House Hunting

If there’s one thing you take away from this guide, it’s this: the HFE Letter isn’t just a formality — it’s your foundation. Whether you’re applying for a BTO, resale, or even just browsing listings for fun, getting your letter early can help you avoid disappointment and buy with clarity.Why you shouldn’t delay your HFE application

Why you shouldn’t delay your HFE application

BTO and resale timelines are tight. Without a valid HFE, you can’t:

- Enter the BTO ballot

- Get an Option to Purchase (OTP) for resale

- Apply for grants or home loans in Singapore

Plus, approval can take up to 3 weeks. If you apply too late, you risk missing your dream flat because your paperwork isn’t ready.

How the HFE letter gives you confidence in your flat budget

The HFE Letter spells out your:

- Loan amount (for both HDB and bank options)

- Grant eligibility

- Flat types you can actually buy

This means no second-guessing your budget. You’ll know from Day 1 what’s affordable — and what might require cash top-ups or refinancing later on.

Knowing your numbers also helps you shortlist flats realistically, instead of wasting time on units you can’t finance.

Where to get expert help comparing loan options in 2025

Even with your HFE Letter in hand, choosing the right loan is another story. Between HDB, DBS, UOB, OCBC, and countless SORA-linked packages, the options are overwhelming.

That’s where a mortgage advisor in Singapore comes in — they’ll help you:

- Compare interest rates from different banks

- Understand your monthly repayments

- Find the best home loan rates based on your HFE results

And the best part? It’s free. No pressure, no sales talk — just advice that makes your flat journey smoother.