Let’s be honest — applying for a BTO flat can feel like trying your luck at Toto. You submit your application, wait weeks for the results… and end up with a queue number that’s 1,248 out of 300 units. Sound familiar?

The good news? BTO balloting isn’t just pure luck.

In fact, there are smart ways to boost your chances — from using HDB priority schemes to picking the right launch and knowing what affects your queue number.

In this guide, we’ll break down everything you need to know to stop crossing your fingers — and start applying with confidence.

What Is the BTO Balloting System and How Does It Work in 2025?

You’ve probably heard people say that getting a BTO flat is “just luck” — but that’s only half true. While HDB’s balloting system does have a random element, there’s a lot more going on behind the scenes. If you know how it works (and how to play it smart), you’ll stand a better chance in 2025’s increasingly competitive launches.

What exactly is the HDB BTO balloting system?

Every time a BTO project is launched, eligible applicants are entered into a digital ballot — kind of like a lucky draw. But unlike a pure lottery, not everyone’s chances are equal.

Here’s how it works:

- HDB first filters applications by eligibility

- Then, they allocate specific quotas to different groups (e.g. first-timers, second-timers, families with kids)

- Ballot numbers are drawn within each group, not across the board

So yes, it’s random — but priority groups get more favourable odds. If you’re applying without any scheme or as a second-timer, your chances naturally dip.If you’re unsure which options apply to you, speaking to a mortgage advisor in Singapore can help you better understand the balloting mechanics and financing options.

How are queue numbers assigned during balloting?

Once the ballot is done, you’ll get a queue number — and this number determines if and when you can book a flat.

Simple breakdown:

- If your number is within the flat supply = you’re in

- If it exceeds the number of units = you’re out (unless others drop out before you)

Now, queue numbers aren’t just pulled from a hat. Factors like:

- Applicant type (first-timer vs second-timer)

- Use of priority schemes

- Project demand

…all influence whether your number lands early or late.

Quick tip: Even if your number looks hopeless, don’t give up until HDB officially ends the booking. Dropouts happen more often than you think.

Is the BTO process based purely on luck or other factors?

Short answer: It’s both.

The ballot is random — but the system heavily favours certain profiles, including:

- Married couples with children

- First-timers applying near parents (e.g. under the Married Child Priority Scheme)

- Applicants for non-mature estates

So if you’re applying solo, as a second-timer, or aiming for a Prime location — yes, your odds are slimmer.

That’s why it’s also important to be financially ready. You can use a mortgage loan repayment calculator to estimate your monthly payments before balloting.But don’t stress — there are real strategies to tilt the odds in your favour, and we’ll get into those next.

What Affects Your BTO Balloting Chances Most in 2025?

Not all BTO applicants are treated equally. In fact, who you are and what you apply for can dramatically shift your chances — even before the balloting begins. Here’s what really matters.

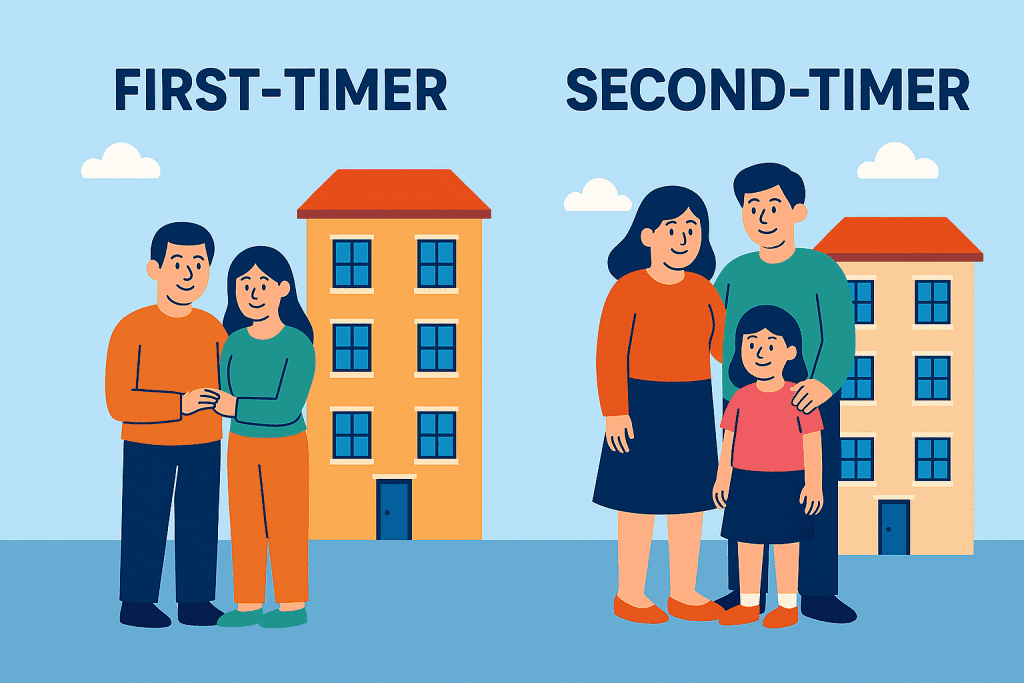

Does being a first-timer or second-timer impact your chances?

Yes — especially if you’re a first-timer vs second-timer.

First-timers enjoy priority in nearly every BTO launch. HDB typically reserves up to 95% of flats in non-mature estates for this group. Second-timers? Much less.

If you’re a couple and only one of you has bought before, apply under the first-timer’s name — it can boost your BTO balloting chances significantly.

Need help planning your loan or application? A good mortgage broker in Singapore can guide you.

Do income, age, and household profile matter in the ballot?

Not directly in the ballot draw — but yes, overall.

For example:

- Low-income buyers may qualify for more CPF housing grants

- Singles must be at least 35 to apply under the HDB Single Scheme

- Families with kids may get extra ballot chances under the Parenthood Priority Scheme

So while these don’t change your queue number, they affect what you can apply for — and how competitive you’ll be.

Why estate popularity and unit type heavily affect success rates

Big time.

If you’re aiming for a 5-room flat in Queenstown, expect heavy competition. But if you’re open to a 3-room in Tengah or Woodlands, you’ll likely face fewer applicants — and better odds.

Generally:

- Non-mature estates = higher chance

- Smaller flats = less demand

Before you apply, it helps to run the numbers. This mortgage loan repayment calculator can show you what’s realistic based on your budget.

Which Priority Schemes Can Boost Your BTO Success Odds?

Not all ballot chances are equal — some applicants get priority by default, thanks to HDB’s special schemes. If you fall under any of these, your odds are way better than average.

How the Parenthood Priority Scheme (PPS) gives you an edge

For first-timer married couples with at least one child (or expecting one)

- Up to 30% of BTO flats are set aside for families under this scheme

- Balloting happens in a smaller pool = less competition

- Works especially well in non-mature towns where quotas are higher

Expert Tip: Want to maximise this advantage? Make sure you’ve secured financing early. You can explore HDB loan options to get ready even before the launch opens.

What is the Married Child Priority Scheme (MCPS) and how it helps

For couples applying to live with or near their parents

- Gives you priority if you’re staying within 4km of your parents

- 30% of flats in each launch are set aside for this scheme

- Popular in mature estates like Toa Payoh and Queenstown

💬 Why it works: It supports caregiving and multi-gen living — and you’ll be balloting against fewer applicants.

Thinking of using MCPS but unsure about affordability? Speak to a mortgage advisor in Singapore to see what your monthly loan commitments would look like.

Can rental flat tenants and multi-generation families qualify for priority?

Often overlooked, but powerful if you qualify

a) Tenants’ Priority Scheme

- For families in public rental flats (min. 2 years)

- Gives you a rare shot at home ownership with better odds

b) Multi-Generation Priority Scheme (MGPS)

- For multi-gen families applying together (e.g. you and your parents)

- Reserved quotas for 3Gen flats

- Strong in launches with family-sized units

Planning a joint application? Use a mortgage loan repayment calculator to map out a realistic budget across both households.

Bottom line: If you qualify for any of these schemes, use them. They don’t just improve your balloting odds — they improve your queue number, which could be the difference between booking a flat or missing out.

Best Strategy to Choose the Right BTO Project in 2025

Once you understand how balloting works, the next step is strategic: choosing the right BTO project. Not all launches give you the same odds — and in 2025, the game has changed with the new Standard, Plus, and Prime model.

Here’s how to plan smart.

What are Standard, Plus, and Prime BTO flats — and which is best for you?

Introduced under the new HDB framework, these categories affect both eligibility and resale conditions — and they also influence balloting competition.

Comparison of Standard, Plus, and Prime BTO Flats in Singapore

| BTO Type | Location & Features | Restrictions | Who It’s Best For | Balloting Odds |

|---|---|---|---|---|

| Standard BTO | Typically in non-mature estates | Fewer resale restrictions, shorter MOP | First-timers prioritising speed & flexibility | ⭐⭐⭐⭐ High |

| Plus BTO | Well-connected, amenity-rich areas (some mature, some not) | Tighter resale & subsidy clawbacks | Buyers wanting balance between access & price | ⭐⭐⭐ Moderate |

| Prime BTO | Central locations like Bukit Merah and Queenstown | Longest MOP, strict resale rules, income caps | Long-term stayers seeking premium locations | ⭐ Low |

Advice: If you’re buying for stability, Standard or Plus flats in emerging towns often give you the highest BTO balloting chances — especially for first-timers.

Need help comparing home loan options across different flat types? Use our mortgage loan calculator to weigh your monthly payments before balloting.

Non-mature vs Mature estates: Where do you stand a better chance?

Here’s the rule of thumb: non-mature estates = better odds.

Non-mature towns like Tengah, Sembawang, and Bukit Batok often have:

- Lower application rates

- Larger flat supply

- Less intense competition

On the other hand, mature estates like Bishan or Toa Payoh are hot — but heavily oversubscribed. Even first-timers with priority may struggle to get a queue number.

Bonus tip: Many Plus BTO projects now blur the line between mature and non-mature — keep an eye out for upcoming launches in places like Kallang and Bedok with hybrid appeal.

Want to secure financing before applying? A mortgage broker in Singapore can help you prep early.

Is there a “best month” to apply in 2025?

Not exactly — but timing does matter.

BTO launches happen four times a year, and here’s how to think about them:

- Feb/May launches tend to attract fewer applicants (less buzz)

- Aug/Nov launches usually feature bigger towns = higher competition

Also, launches with fewer mature estate options = better chances overall.Pro tip: Monitor HDB’s upcoming launch schedule and prep your HFE letter and financing early. Many applicants miss out simply because they weren’t ready when the launch opened.

Common Mistakes That Reduce Your BTO Success Rate

You’ve submitted your application, crossed your fingers, and waited. But no queue number again?

Before blaming luck, it’s worth asking: are you making one of these common mistakes that unknowingly lower your BTO balloting chances?

Why only applying to popular towns hurts your odds

It’s tempting to go for the “hot” towns — think Queenstown, Bukit Merah, or Toa Payoh. But here’s the truth: these mature estates often have 10 to 15 times more applicants than units available.

When demand is sky-high:

- Even first-timer families with priority can get edged out

- Your chances are drastically lower compared to applying in non-mature areas

- Queue numbers tend to stretch far beyond flat supply

If you really want to secure a flat sooner, consider lesser-hyped towns like Tengah, Sembawang, or Woodlands — your balloting odds go up instantly.

Not sure if your loan works for different towns? Use this mortgage loan calculator to check.

What happens if you reject a BTO flat offer?

Many assume “just reject and try again.” But HDB tracks this.

Here’s what can happen:

- First rejection: No penalty

- Second rejection: You lose priority in the next application

- More than two rejections: You may be treated as a second-timer — even if you’re not

This is called non-selection penalty, and it affects future balloting.

Moral of the story: Only apply if you’re serious about the location and unit types. If you’re unsure, speak to a mortgage advisor to figure out what’s realistic before balloting.

How incomplete HFE applications or wrong documents delay results

Since 2023, all BTO applicants need an HDB Flat Eligibility (HFE) letter before applying. And in 2025, HDB has tightened checks even more.

Common mistakes:

- Missing CPF contribution records

- Incomplete income documents

- Outdated NRIC info or supporting documents

If your HFE application isn’t approved before the launch closes, your BTO application is invalid — you’re not even in the ballot.

Always get your HFE letter ready early. And if you’re comparing HDB loan vs bank loan, or not sure what to submit, use a mortgage broker in Singapore to help you prepare.

Real Examples and Insider Tips to Improve Your Odds

Balloting can feel discouraging, especially if you’ve failed once (or five times). But we’ve seen firsthand that strategy can change everything — even for those with lower priority.

Here are some real-world insights and smart moves you can use to improve your BTO chances in 2025.

Case Study: How a second-timer couple succeeded with MCPS

Meet Jason and Mei, a second-timer couple with a toddler. After two failed applications, they decided to apply under the Married Child Priority Scheme (MCPS) — choosing a Plus BTO project just 3km from Mei’s parents in Tampines.

Despite being second-timers, they received a queue number within the booking range — and secured a 4-room unit on the 9th floor.

Why it worked:

- They chose a non-mature town with decent supply

- They applied under MCPS, which increased their priority

- They avoided over-subscribed towns like Queenstown

If you’re living near parents (or planning to), check if you qualify for MCPS — and make sure your financing is sorted with a mortgage advisor in Singapore early.

Pro Tip: How to use HFE timing to your advantage

Here’s a common mistake: applying for a BTO flat before your HFE letter is approved — or rushing your documents last minute.

In 2025, smart applicants are:

- Getting their HFE letter ready at least 1 month before launch

- Comparing HDB home loan vs bank loan offers early

- Using the HFE eligibility output to plan unit types and locations

The earlier your HFE is ready, the smoother your application — and the fewer surprises when you finally ballot.

Should you consult a mortgage advisor before applying?

If you’re serious about getting a flat — absolutely.

A mortgage advisor can:

- Help you compare home loan rates and assess your budget

- Guide you on CPF usage, grants, and loan approval timelines

- Spot gaps in your application that might cause delays or rejection

Plus, working with a mortgage broker in Singapore is typically free for buyers — so there’s really no downside.

💡 Bottom line: Treat your BTO application like a real home-buying decision — not a lucky draw.

Visual Summary: Your 2025 BTO Balloting Success Formula

Short on time? Here’s a quick, no-fluff overview of how the BTO balloting system works — and what to do if you want to maximise your odds in 2025.

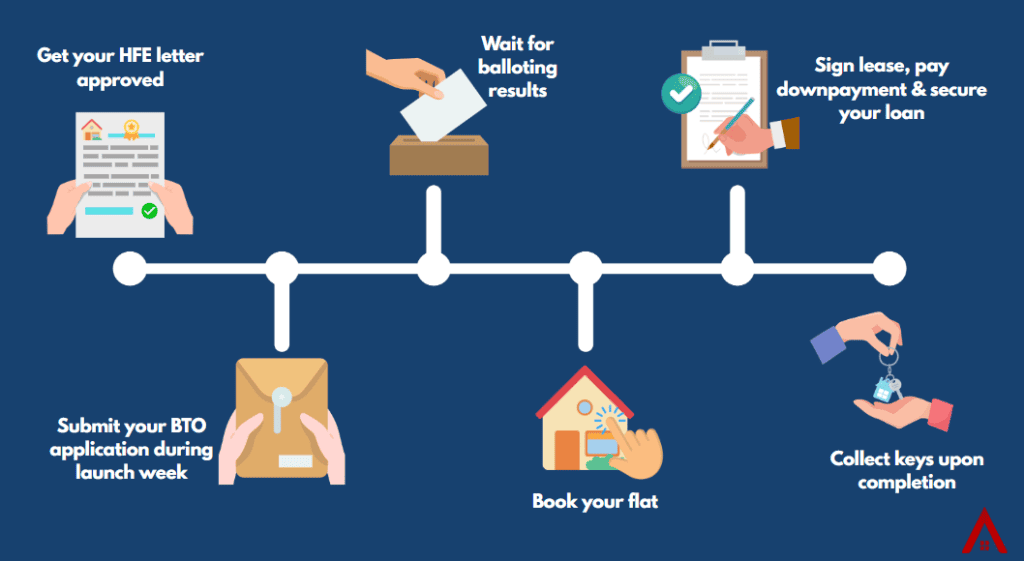

Step-by-step flow from application to key collection

1. Get your HFE letter approved

Make sure all your income, CPF, and eligibility documents are ready — you need this before applying.

2. Submit your BTO application during launch week

Choose your preferred estate, unit type, and indicate any priority schemes you qualify for.

3. Wait for balloting results

If successful, you’ll receive a queue number. If your number is within the flat supply — congrats!

4. Book your flat

Attend your appointment, pay the option fee, and secure your unit.

5. Sign lease, pay downpayment & secure your loan

Compare home loan options early — delays here can cost you the unit.6. Collect keys upon completion

This happens 3–5 years later depending on the project timeline.

How priority schemes are layered into the system

Here’s how HDB allocates flats before the general ballot even begins:

- 30% set aside for Parenthood Priority Scheme (PPS)

- 30% for Married Child Priority Scheme (MCPS)

- Smaller quotas for Tenants’ & Multi-Gen Schemes

What this means: you’re not competing with the entire applicant pool — just the people in your scheme. If you’re not in a scheme, your ballot is still valid, but your odds are lower.

📌 Want to check if you qualify? Talk to a mortgage advisor in Singapore who can walk you through the process while helping with financial planning.

Snapshot of low vs high demand BTO launches

Here’s what typically happens in each type of estate:

Comparison of BTO Balloting Odds by Estate Type in Singapore (2025)

| Estate Type | Examples | Application Rate | Balloting Odds |

|---|---|---|---|

| Non-Mature Town | Tengah, Bukit Batok, Sembawang | 2–5 applicants per unit | ⭐⭐⭐⭐ Higher success |

| Plus Model Areas | Bedok South, Kallang, Jurong East | 6–8 applicants per unit | ⭐⭐⭐ Balanced |

| Prime Estates | Queenstown, Bukit Merah, Bishan | 10–15+ per unit | ⭐ Low (even for first-timers) |

Tip: Don’t just chase “central” — think strategically. A slightly less popular town could mean booking a flat this year instead of next.

BTO Balloting FAQ

Got questions about your ballot, queue number, or what to do next? You’re not alone. Here are some of the most common things Singaporeans ask during every BTO cycle — answered clearly and updated for 2025.

When will the next BTO results be out?

HDB typically releases BTO balloting results 3–4 weeks after the application window closes. For example, if you applied in the May 2025 launch, you can expect results by mid to late June.

📆 Launches in 2025 are expected in:

- February

- May

- August

If you’re planning ahead, be sure to get your HFE letter and financing sorted early so you don’t miss the application window.

Can you check your queue number before ballot results?

No — you can’t check your queue number before the official results are released.

Here’s how it works:

- Once balloting is done, HDB will email or SMS you with either a queue number or a message saying you’re unsuccessful.

- You can then log into the HDB portal to view your position.

🚫 There’s no way to “peek early” or pay to find out sooner — anyone claiming otherwise isn’t legit.

What to do if you keep failing your BTO application?

It happens — especially if you’re applying for mature estates or Prime BTOs.

If you’ve failed a few times:

- Switch to less competitive estates — like Tengah, Yishun, or Woodlands

- Use a priority scheme (e.g. Parenthood, Married Child, Tenant) if you qualify

- Avoid rejecting units if offered, as repeated non-selections affect your priority

- Get help from a mortgage advisor to assess your grant eligibility and financing options early

- Consider resale or ECs if timelines are flexible

Repeated failures aren’t a sign to give up — they’re a sign to rethink your approach.

Is BTO Still Worth It in 2025? Here’s What to Consider

After going through multiple rounds of balloting (and maybe rejections), it’s normal to wonder: is BTO still worth the wait?

The answer depends on your goals, timeline, and flexibility. Here’s how to decide what’s right for you.

When to consider a resale flat instead

A resale flat may be a better option if:

- You need a home faster than the 3–5 year BTO wait

- You want a specific location or flat size not available in new launches

- You’re a second-timer with low BTO priority

While resale flats cost more upfront, you may qualify for CPF grants like the Enhanced Housing Grant (EHG) and Proximity Housing Grant (PHG) — which can help offset the price.

Still unsure? Compare monthly costs using a mortgage loan repayment calculator to see what fits your budget best.

Why long-term planning matters more than short-term balloting

Balloting feels like the big moment — but it’s just the start.

What matters more is:

- Choosing a flat that fits your future plans

- Locking in a home loan with the lowest long-term interest rate

- Making sure you’re financially secure when key collection happens

A unit in a slightly less popular town may still offer great capital growth — especially as new MRT lines and amenities roll out.

Don’t just ballot for the hype. Ballot for what fits your life.

Book a free consultation with a mortgage advisor to strategise your next move

Whether you’re on your third BTO attempt or deciding between HDB loan vs bank loan, don’t wing it.

A professional can help you:

- Compare home loan rates in Singapore

- Plan your CPF usage across downpayment, stamp duties, and monthly repayments

- Review your grant eligibility and financial readiness

Book a free consult with an experienced mortgage advisor — it could save you from costly mistakes, and even improve your chances in the next launch.

Final Thoughts: Your BTO Balloting Strategy Starts Before You Apply

Winning the BTO ballot in Singapore isn’t just about luck — it’s about preparation, timing, and smart decisions. From choosing the right estate to applying under the right HDB priority scheme, every detail matters.

But the real key? Being financially ready before the launch even begins.So whether you’re a first-timer, second-timer, or exploring resale as a fallback, don’t leave things to chance.

Ready to Secure Your Future Home?

Start by speaking with a trusted mortgage advisor in Singapore who can:

- Help you compare home loan rates in Singapore

- Show you how much you can really afford with CPF

- Prepare you to apply with confidence — not guesswork

Book your free consultation now and let’s turn your next BTO ballot into a home you’ll love