Buying a home in Singapore can feel like a stretch — especially with rising flat prices and unpredictable interest rates.

But “affordable housing” doesn’t have to mean compromising on everything. Today, there are still smart ways to own a home without overstretching your budget, thanks to new CPF grants, BTO classifications, and competitive home loan rates in Singapore.

Whether you’re eyeing a 2-room Flexi flat, comparing HDB loan vs bank loan, or simply want to know what you can safely afford — this guide will walk you through it all.

Let’s make homeownership realistic, not risky.

What Does “Affordable Housing” Really Mean in Singapore?

Nowadays, “affordable housing” in Singapore isn’t just about finding the cheapest flat — it’s about owning a home without sacrificing your lifestyle or peace of mind.

With rising home loan interest rates in Singapore and tighter lending rules, what truly matters is how sustainable your monthly repayments are — not how much the flat costs in total.

How does HDB define housing affordability?

HDB’s guideline is straightforward:

Your monthly housing installment should not exceed 30% of your gross monthly income.

This is based on the Mortgage Servicing Ratio (MSR), which applies whether you take an HDB home loan or a bank loan for your HDB flat.

📌 Example:

If your monthly income is $5,000, your monthly loan commitment should ideally stay below $1,500.

✅ Expert tip: Don’t just chase the biggest loan. The more space you leave below your MSR cap, the more flexible you are if interest rates rise or income dips.

Why “monthly commitment” matters more than flat price

Let’s say you’re eyeing a $500,000 BTO. That figure alone doesn’t tell you much.

What really matters?

👉 How much you’ll be paying every month — especially if interest rates climb.

How Interest Rates Affect Monthly Housing Loan Repayments (2025)

| Interest Rate | Estimated Monthly Repayment (25-year loan) |

|---|---|

| 2.6% (HDB loan) | ~$2,270 |

| Bank loan (2.1%) | ~$2,150 |

Note: HDB loans have a fixed 2.6% rate. Bank loans are typically floating and may vary — many are seeing rates around 1.3-2.5%. Contact us to find out the latest rates for your profile.

That’s a $400 difference per month — which adds up to nearly $5,000/year.Use our mortgage loan repayment calculator to test different interest rates, loan tenures, and property prices.

Common myths about what’s considered “affordable”

Here’s what many buyers mistakenly believe:

❌ “If I can get approved, I can afford it.”

Nope. Loan approval only shows eligibility — not whether it fits your lifestyle.

❌ “HDB loans are always more affordable.”

Not always. While the HDB rate is fixed at 2.6%, some bank mortgage rates (especially fixed or promo packages) may be lower — at least for the first few years.

❌ “Only BTO flats are truly affordable.”

Wrong again. With CPF housing grants and a good financing plan, even a resale flat can become a great value buy — especially if you’re looking in non-mature estates or buying near family.

3 Core Factors That Impact How Much Home You Can Afford

Before you even start comparing flats or browsing listings, you’ll need to figure out one key thing:

How much house can you really afford without stretching yourself too thin?

In 2025, the answer depends on more than just your income. Here are the three biggest factors that shape your true housing affordability — beyond what the bank says you can borrow.

Your income, debt, and the TDSR limit

The Total Debt Servicing Ratio (TDSR) is one of the key affordability gates in Singapore. It caps your total monthly debt obligations — including your housing loan, car loan, student loans, and credit card minimums — to 55% of your gross monthly income.

So, if you earn $6,000/month:

- Your total monthly debt repayments must stay below $3,300

- That includes your mortgage loan in Singapore

This is the government’s way of keeping households financially healthy, especially in a climate of rising mortgage interest rates in Singapore.

📌 Pro tip: If you’re planning to buy soon, clear off any small debts (e.g. credit cards or personal loans). That way, more of your TDSR can be used for your home loan.

How interest rates and loan tenure change your affordability

Even if your income is stable, changes in loan tenure and interest rates can dramatically shift what you can afford in monthly repayments.

In Singapore, here’s how it works:

- For your first housing loan — whether it’s an HDB loan or a bank loan — you’re limited to a maximum of 25 years loan tenure.

- But when you refinance a bank loan, our mortgage advisors can often help you extend the tenure up to 30 years, which can significantly reduce your monthly repayment.

This matters because many buyers are still feeling the pinch of elevated home loan interest rates in Singapore, especially if they’re on floating rate packages.

How Loan Tenure Affects Monthly Housing Loan Repayment (Based on $500,000 loan at 3.5%)

| Loan Tenure | Estimated Monthly Repayment |

|---|---|

| 25 years | ~$2,500 |

| 30 years | ~$2,245 |

That $255/month difference might not seem like much now — but over the years, it adds up. It also affects how banks assess your mortgage loan eligibility under MSR and TDSR rules.

✅ Use our mortgage loan repayment calculator to test different scenarios side by side — and speak to a broker if you’re considering refinancing to stretch your loan tenure safely.

The lifestyle factor: what trade-offs are you willing to make?

Finally, and often most overlooked — your lifestyle choices.

Maybe you can technically afford a $2,400/month mortgage. But are you ready to:

- Cut back on dining out or travel?

- Delay that new car purchase?

- Pause plans for renovation or a wedding?

Here’s where personal priorities come into play. Buying a flat you “technically qualify” for doesn’t mean it fits your lifestyle or long-term plans.

✅ Expert insight: Many buyers regret maxing out their loan just to get a slightly bigger flat or “better” location. A smaller flat with a lower loan might actually bring you more peace of mind — and more options later on for upgrading or refinancing.

The 3-3-5 Rule for Housing Affordability — Should You Follow It?

If you’ve been researching how much house you can afford in Singapore, chances are you’ve come across the “3-3-5 rule”. It’s a simple formula — but does it still hold up?

Let’s break it down, and see when it’s helpful… and when it might actually limit your options unnecessarily.

What is the 3-3-5 rule and why is it popular in Singapore?

The 3-3-5 rule is a quick affordability guideline often used by financial planners in Singapore. Here’s what it says:

- 3 – Your available cash + CPF should be at least 30% of the property price

- 3 – Your monthly mortgage repayment should be no more than 30% of your gross income

- 5 – The total property price should not exceed 5 times your annual income

Example:

If you earn $80,000 a year, your max property price under this rule should be around $400,000.

It’s simple, easy to remember, and conservative — which makes it a good starting point for first-time buyers trying to avoid overcommitting.

When it’s smart to stick strictly to the rule

The 3-3-5 rule works especially well if:

- You’re a first-time buyer with limited savings

- You want maximum peace of mind and financial flexibility

- You’re uncertain about your job stability or income growth

- You’re buying under a fixed-rate HDB loan or low-entry bank loan package like DBS home loan rates

Following this rule means you’re unlikely to face financial strain, even if interest rates go up or if life throws you a curveball.

✅ Bonus: You’ll probably have enough buffer for renovation, emergencies, or even early loan repayment — especially if you use a mortgage repayment calculator to plan ahead.

When it’s okay to stretch — and the red flags to watch for

Let’s be honest — Singapore’s property prices don’t always fit neatly into formulas.

You can go slightly beyond the 3-3-5 rule if:

- You’re dual-income, stable, and have no other major debts

- You’ve secured solid housing grants to offset the cost

- You’re buying for the long term (e.g. a 10+ year stay)

However, here are red flags that mean you shouldn’t stretch:

- You’re relying on the maximum loan eligibility with zero buffer

- You’ll be left with under $500/month after loan repayment

- You’re locking into a floating interest rate without understanding the risks

Important: If you’re going to stretch beyond the 3-3-5 rule, it’s worth reviewing options with a Singapore mortgage broker to compare packages and assess long-term risks clearly.

Bottom line? The 3-3-5 rule is a great starting point — but it shouldn’t be your only rule. Think of it as a safety guide, not a hard limit. Flex only when you have the income stability and loan clarity to back it up.

What Types of Housing Are Still Considered “Affordable”?

With rising prices and new BTO classifications, many Singaporeans are asking:

“What can I actually afford without overstretching?”

The good news? There are still practical, lower-risk options — if you know where to look and understand how housing types fit your budget.

2-Room Flexi and BTOs under Standard classification

If you’re buying on a single income, or you’re a first-timer starting small, 2-Room Flexi flats and Standard BTOs remain the most affordable entry point into the property market.

📌 What makes them affordable:

- Lower starting prices

- Available CPF housing grants like the Enhanced Housing Grant (EHG)

- No resale levy if it’s your first flat

And under the new Prime, Plus, Standard framework, Standard flats offer the most flexibility — no 10-year MOP, and fewer resale restrictions.

If you’re considering a Standard flat but unsure about monthly payments, use our mortgage loan repayment calculator to plan ahead.

Resale HDB flats — are they still a cost-effective choice?

Resale flats used to be seen as expensive. But with the right combination of CPF grants and smart location choices, they’re surprisingly viable — especially for those who:

- Need a bigger space quickly

- Want to live near family (for Proximity Housing Grant eligibility)

Prefer mature estates with full amenities

Resale Flat vs BTO (Affordability Comparison for 4-Room, Non-Mature Town)

| Factor | BTO (Standard) | Resale Flat |

|---|---|---|

| Price | ~$350,000 | ~$480,000 |

| Wait Time | 3–5 years | Move-in within months |

| CPF Grants Available | EHG | EHG + PHG + Singles |

| Renovation Needed | Yes (bare unit) | Varies |

🎯 With multiple CPF housing grants, you could reduce a resale flat’s cost by up to $160,000 — making it a serious contender in the affordability race.

Can Executive Condos still be considered “affordable”?

Here’s the truth: Executive Condos (ECs) are no longer cheap — but they can still be considered affordable for higher-income first-time buyers.

Why ECs may still work:

- They’re priced 20–30% lower than private condos

- You can use CPF and HDB grants (if eligible)

- You get condo-like facilities with MOP and resale value

💡 Reality check: ECs are best for dual-income households earning above the BTO ceiling but still wanting a home with upside potential. Just be sure to compare private property loan packages carefully — especially if you’re stretching beyond the 3-3-5 rule.

✅ Expert tip: ECs launch at a subsidised price, but once they cross the MOP, many appreciate in value significantly — making them a longer-term financial strategy.

From 2-room BTOs to resale gems and entry-level ECs, affordable housing in Singapore still exists — but only if you align your choice with your income, timeline, and future goals.

Housing Grants That Can Lower Your Costs Significantly

One of the biggest reasons housing in Singapore is still within reach is because of CPF housing grants.

These aren’t just small subsidies. If you plan smart, grants can shave off tens (or even hundreds) of thousands from your flat’s total cost — making options like resale flats or larger units far more affordable than they first appear.

What’s new with the Enhanced Housing Grant (EHG)?

The Enhanced Housing Grant (EHG) is still the backbone of affordability support in Singapore — and it’s designed to benefit buyers with lower to middle incomes.

As of today:

- You can get up to $80,000 in EHG

- It applies to both BTO and resale HDB flats

- Your grant amount depends on average household income, not just current salary

Note: To qualify, you must be employed continuously for 12 months and have a monthly household income not exceeding $9,000.This means even dual-income families can still benefit — especially if they’re buying a flat under the Standard classification or looking into resale with location flexibility.

Grant support for singles, families, and caregivers

Grants are no longer “one size fits all” — and that’s a good thing.

Here’s how different groups benefit:

CPF Housing Grants Available in 2025 for Different Buyer Profiles

| Buyer Type | Applicable Grants |

|---|---|

| Singles (35+) | - Singles Grant (up to $40,000) - EHG for Singles |

| Families | - Enhanced Housing Grant (EHG) - Family Grant - Proximity Housing Grant (PHG) |

| Siblings or Orphans | - Joint Singles Scheme - Orphan Scheme housing support |

| Caregivers | - Family Care Grant (for multi-generational living support) |

Planning to live near parents? You may be eligible for the Proximity Housing Grant — up to $30,000 if you live with them.

And don’t forget: grants can be stacked in many cases, especially for resale buyers. That’s how affordability changes drastically.

Real-life examples: How much grants can reduce your flat cost

Let’s take a real scenario — a first-time buyer couple earning $5,000/month combined, looking at a $450,000 resale flat.

🧮 Grant Breakdown

- Enhanced Housing Grant (EHG): $45,000

- Family Grant: $50,000

- Proximity Housing Grant (PHG): $20,000

✅ Total Grant Support: $115,000

Final Price After Grants?

👉 $335,000 — and you can offset even more using CPF.

🎯 Use this to your advantage: if you’re comparing options like resale vs BTO, grants can often make resale flats just as affordable — with the added benefit of moving in earlier.Bottom line? Grants are not just for low-income households. With the right combinations, they can make flats across different towns and categories far more accessible — especially when paired with the rightHDB loan orbank mortgage package.

Where to Find the Most Affordable Flats in Singapore Today

Looking for a home that fits your budget and your lifestyle? You’re not alone. Affordability isn’t just about how much you can borrow — it’s also about where you buy.

While certain towns have seen price spikes, there are still pockets of value if you know where to look — especially with the new Prime, Plus, and Standard BTO classification system.

Best-value towns with stable or rising amenities

Some towns may not make the headlines — but they offer great value, good connectivity, and room for growth.

Here are a few budget-friendly choices to consider:

- Woodlands – Improved MRT network (Thomson-East Coast Line), near upcoming Northern Agri-Tech and Food Corridor

- Choa Chu Kang – Affordable 4- and 5-room options, close to new healthcare facilities and Jurong Innovation District

- Tengah – Singapore’s newest HDB town, smart and green features, and future-proof amenities

✅ Why it matters: These towns may not be central, but they’re supported by long-term infrastructure plans — which means more upside for both convenience and resale.

Prime, Plus, and Standard classification — what to expect

HDB flats are no longer one-size-fits-all. With the new classification system, affordability also depends on the category of the flat you’re applying for.

BTO Classification Comparison in 2025 and Affordability Implications

| Classification | Typical Price Range | Restrictions | Target Buyers |

|---|---|---|---|

| Prime | $$$ (e.g. Central, Queenstown) | 10-year MOP, subsidy clawback | High-income buyers, long-term stay |

| Plus | $$ (e.g. Bidadari, Kallang) | 10-year MOP | Buyers seeking location + balance |

| Standard | $ (e.g. Bukit Batok, Tengah) | 5-year MOP | Budget-conscious first-timers |

📌 If you’re looking to keep your monthly housing loan within budget, Standard flats will usually give you the most flexibility. You can also pair them with HDB home loan or DBS home loan promotions depending on your income profile.

Hidden gems: Less-hyped BTOs that are still affordable

Not all affordable flats make the news — but these “quiet launches” often have the best chances for buyers who want value without a crazy queue number:

- Yishun – Still has 4- and 5-room units under $450K

- Sembawang – Less central, but peaceful with new amenities and underrated value

- Bukit Panjang – Mature yet affordable, with good schools and the Downtown Line

💡 Pro tip: If you’re open to location flexibility, your chances of securing a unit improve dramatically — and you’ll likely qualify for better CPF grants and lower monthly commitments using our mortgage repayment calculator.

How to Check Your Own Home Affordability

So you’ve found a flat you like. Great! But before you get emotionally attached, here’s the million-dollar question:

Can you really afford it — without financial stress later on?

Figuring that out is easier than ever with online tools, clear loan rules, and expert help. Let’s break it down.

Use a mortgage calculator to find your safe monthly budget

Before anything else, plug your numbers into a reliable mortgage loan repayment calculator. It helps you estimate:

- Monthly instalments based on loan amount, tenure, and interest rate

- Total interest paid over time

- Whether your repayment is within the 3-3-5 or MSR limits

💡 Pro tip: Don’t calculate based on the max you can borrow — calculate based on what you can comfortably repay each month while still saving.

Understand your loan eligibility based on MSR and TDSR

Here’s a quick breakdown of the two key loan rules in Singapore:

MSR vs TDSR – What’s the Difference in Singapore Housing Loans?

| Loan Limit Type | Applies To | Max % of Income | Includes |

|---|---|---|---|

| MSR (Mortgage Servicing Ratio) | HDB & EC buyers using HDB/bank loans | 30% | Mortgage repayments only |

| TDSR (Total Debt Servicing Ratio) | All property loans | 55% | All debt: mortgage, car, credit cards |

MSR is stricter and often the limiting factor for HDB buyers.

TDSR becomes more relevant if you’re looking at a private property loan or already have other financial commitments.

Why getting pre-assessed helps avoid overstretching

One of the best things you can do before applying is to get pre-qualified by a mortgage advisor or broker.

Here’s what it does for you:

- Gives you a clear max budget before you shop

- Helps you compare bank loan packages early

- Prevents disappointment or delays after getting a ballot

🎯 Book a quick chat with a Singapore mortgage broker to get clarity on your affordability range, available loan options, and grant potential — no guesswork needed.

Should You Buy Now or Wait?

It’s the question every homebuyer in Singapore asks:

“Should I go for it now — or wait and hope prices come down?”

The answer isn’t straightforward. It depends on where the market’s headed, your financial readiness, and how interest rates affect your loan.

Let’s break down the key factors.

Are prices going up, or will supply cool the market?

Over the past few years, we’ve seen steady price increases — especially for resale HDB flats and ECs. But with more BTO supply being released in 2025 and 2026, prices in some areas could stabilise slightly.

However, don’t expect a crash.

Property Price Trends in Singapore (2025 Outlook by Segment)

| Loan Limit Type | 2025 Trend |

|---|---|

| BTO (Standard towns) | Stable, moderate increases |

| Resale (non-mature) | Cooling slightly with more options |

| Resale (mature estates) | Holding value, still in demand |

| EC / Private condos | Mixed, depends on location & launch |

If you’re going for affordability, standard BTOs in non-mature towns still offer the best long-term value — especially when paired with CPF housing grants.

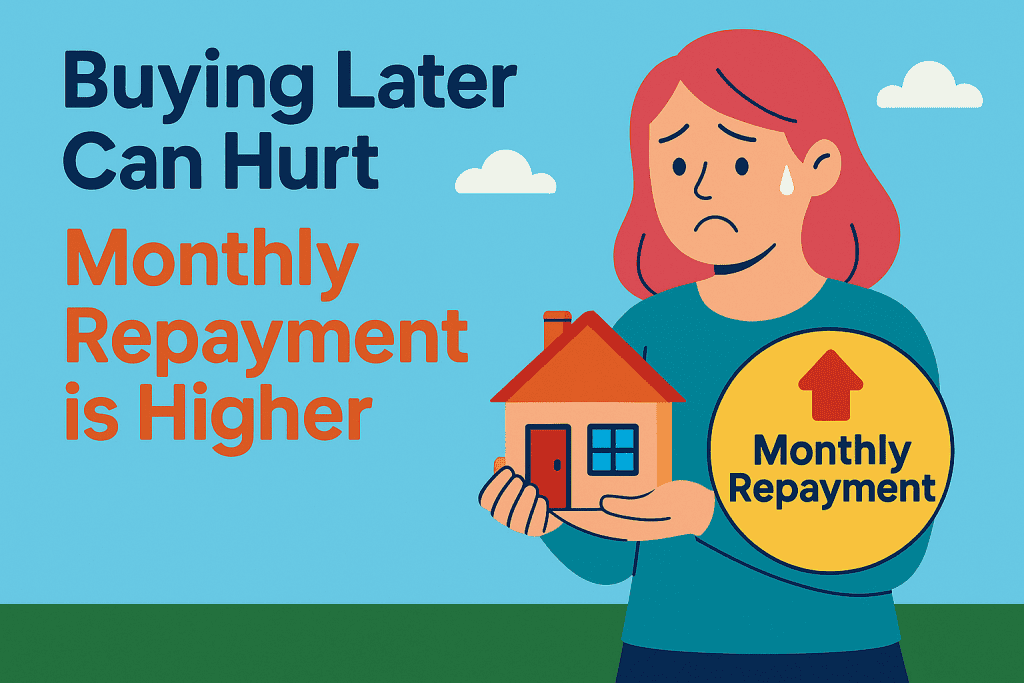

When rising interest rates mean “buying later” can hurt

While you may be waiting for prices to drop, there’s a hidden danger:

Even if flat prices fall slightly, rising interest rates could make your monthly repayments higher.

📌 Example:

A $450,000 flat at 2.6% = ~$1,800/month

Same flat at 4% = ~$2,100/month

That’s a $300/month difference — just from interest.

Tip: If you’re considering a fixed-rate mortgage or HDB loan, locking in now might give you more stability than waiting for a price dip that may never come.

What to consider before postponing your purchase

If you’re unsure, here are 3 smart questions to ask:

- Is your financial situation stable enough now?

If yes, and you’re within MSR limits, waiting may not be necessary. - Are you eyeing a flat in a high-demand area (e.g. Prime/Plus towns)?

These rarely fall in price, and demand often increases over time. - Are you hoping for better loan deals in the future?

With mortgage rates in Singapore still fluctuating, betting on lower rates later can be risky.

✅ Pro tip: If you’re on the fence, speak with a mortgage advisor who can help you compare loan scenarios now vs later — factoring in both price and interest.

Final Thoughts – Prioritise Affordability Over FOMO

In a market like Singapore’s, it’s easy to feel the pressure — friends getting keys, BTO balloting updates on your feed, or rising prices making you want to “just buy something before it’s too late.”

But here’s the truth:

Buying a home is not a race. It’s a long game.

And affordability should always come before FOMO.

Why your first home should match your budget, not your ego

We get it — it’s tempting to go for the biggest flat, the better estate, or a flashy EC.

But your first home isn’t meant to impress anyone. It’s meant to give you:

- Financial security

- Breathing room each month

- A safe stepping stone to upgrade later

💡 The real flex? Paying your loan comfortably, even when life throws a curveball.

If your goal is long-term wealth, it’s smarter to pick a modest unit with a sustainable housing loan rate than to max out a bank loan for a resale flat you can barely afford.

How to future-proof your housing decision

Here’s how you make an affordability-first decision that still lets you grow later:

- Stick to the 3-3-5 rule (or stay safely under your MSR cap)

- Use a mortgage loan calculator to plan your repayments over time

- Choose locations or flat types that match your income and lifestyle

- Keep some buffer for renovations, life events, or emergencies

🎯 The best home loan is not the biggest one — it’s the one you can still manage five years from now.

Book a free consultation to calculate your true affordability

Not sure if your budget makes sense?

Want to compare DBS, OCBC, or UOB home loan rates in one go?

Get expert help — no fees, no pressure.

Book a quick chat with a licensed Singapore mortgage broker who can:

- Run your TDSR and MSR for you

- Compare the best fixed and floating rate packages

- Show you how to structure your loan for long-term safety

You deserve a home you love — and one you can truly afford. Plan smart now, and your future self will thank you.

Conclusion: How to Own an Affordable Home in Singapore Without Overstretching

Buying a home in Singapore doesn’t mean pushing your budget to the edge. With smart planning, careful loan selection, and the right use of CPF housing grants, affordable housing is still very possible — even in today’s market.

Here’s what we covered:

- Understand what “affordable” really means — it’s about monthly commitment, not just flat price

- Use the 3-3-5 rule and TDSR/MSR checks to stay financially safe

- Choose from real options — Standard BTOs, resale flats, and even Executive Condos in the right situations

- Tap into up to $160,000 worth of CPF grants to lower your true cost

- Avoid overstretching by comparing home loan interest rates in Singapore early

Ready to Find Out What You Can Afford — Without Guessing?

Book a free consultation with a licensed Singapore mortgage broker to:

✅ Calculate your safe loan amount

✅ Compare DBS, OCBC, and UOB home loan rates

✅ Discover grants and flat options that fit your budget

✅ Get help applying for an HDB loan or refinancing if needed

No pressure. No fees. Just personalised, unbiased advice — so you can buy your home with confidence.

Book your free affordability review now »