Buying an HDB flat? Whether it’s a BTO or resale, you’ve probably heard of the Minimum Occupation Period (MOP) — but what does it really mean for you in 2025?

In short, the MOP is the minimum number of years you’ll need to live in your flat before you can sell, rent it out entirely, or buy a private property. Sounds simple — but there are key differences depending on your flat type, whether you used CPF housing grants, and the latest Prime/Plus/Standard flat rules.

In this guide, we’ll break it all down — clearly, quickly, and with no jargon — so you can avoid costly mistakes and plan your next move confidently.

What Is the Minimum Occupation Period (MOP)?

If you’re buying an HDB flat — whether it’s a BTO or a resale unit — the Minimum Occupation Period (MOP) is one of the first rules you need to know. It affects when you can sell, rent out, or upgrade your home. And in 2025, with changes like the new flat classifications and tighter resale controls, understanding your MOP is more important than ever.

What does MOP mean for HDB buyers in Singapore?

The MOP is the minimum number of years you must physically live in your HDB flat before you can:

- Sell your flat on the open market

- Buy a second property (including a condo or landed home)

- Rent out the entire unit

For most HDB flats, that means a 5-year stay is required — regardless of whether you used an HDB home loan or a bank loan. If you’re still weighing your financing options, check out this guide to HDB home loans to compare rates and rules.

Why it matters: Even if you find a low home loan interest rate in Singapore, you’re still bound by your MOP — so your financing flexibility doesn’t equal selling flexibility.

Why does HDB enforce a MOP for flat owners?

The MOP exists to protect the spirit of public housing — making sure flats are homes first, not investments. It’s especially relevant when you consider how many buyers benefit from:

- CPF housing grants

- Generous HDB loan interest rates

- Additional subsidies when buying BTOs

Without MOP rules, it’d be too easy for buyers to flip flats or treat them as short-term rental properties.

✅ If you’re unsure whether a bank loan for your HDB might offer better flexibility down the road, use our mortgage loan repayment calculator to compare total costs before locking in a loan.

How does MOP affect your ability to sell or invest?

Until you finish your MOP, here’s what you can’t do:

- ❌ Sell your flat (even if it’s gone up in value)

- ❌ Buy a second property (yes, even a condo)

- ❌ Rent out the whole unit (room rental may be allowed)

You can, however:

- ✅ Reprice or refinance your HDB loan for a better rate

- ✅ Rent out individual rooms (with HDB approval)

- ✅ Stay informed on how the MOP impacts your upgrade path

Pro Tip: Planning to upgrade after MOP? Bookmark our blog page to stay updated on home loan rates, refinancing tips, and expert mortgage advice — so you’re always one step ahead when it’s time to plan your next move.

MOP Duration for Different Flat Types

Not all HDB flats come with the same Minimum Occupation Period (MOP). The duration depends on the type of flat you buy — and whether you used any CPF housing grants. Understanding this helps you plan when you can sell, upgrade, or even buy a second property.

What is the MOP for BTO, resale, SBF, and EC flats?

Here’s a quick breakdown of the standard MOP durations across different flat types in Singapore:

MOP Duration by Flat Type in Singapore (2025 Update)

| Flat Type | MOP Duration |

|---|---|

| BTO (Build-To-Order) | 5-10 years |

| SBF (Sale of Balance Flat) | 5 years |

| Resale HDB (with grants) | 5 years |

| Executive Condo (EC) | 5 years + another 5 before full privatization |

Note: The MOP for ECs is stricter — you must wait 10 years total before selling to foreigners or corporations.Planning to upgrade after your EC MOP?

Use our mortgage loan repayment calculator to check how much private property you can afford once you’re eligible.

How does grant usage (e.g. CPF or PHG) affect MOP?

If you buy a resale flat with CPF housing grants like:

- The Enhanced Housing Grant (EHG)

- The Proximity Housing Grant (PHG)

- The Family Grant

- You’ll be subject to the full 5-year MOP, just like with a BTO.

These grants come with conditions — and the MOP is one of the biggest. You won’t be able to sell or rent out the entire flat until your MOP ends.

Tip for grant buyers: Be sure to weigh the long-term lock-in of the MOP against the upfront savings from grants. If flexibility is more important to you, a bank loan for HDB resale without grants may make more sense.

Is there MOP for resale flats bought without grants?

Good news — if you buy a resale flat without taking any CPF grants, there is no MOP in most cases.

That means:

- You can sell your flat anytime

- You can rent out the entire unit without waiting

- You may be eligible to buy private property right away

However, this only applies to specific flat types and scenarios, so it’s best to consult a licensed mortgage advisor before you commit. They’ll help you understand whether this path is truly open to you — and if a bank loan might offer better terms than an HDB one.

What You Can and Cannot Do During MOP

Your Minimum Occupation Period (MOP) isn’t just a timeline — it’s a legal restriction. Many new homeowners are surprised to learn how tightly controlled your options are during this period.

So before you plan that overseas move, rental side hustle, or condo upgrade, here’s what the MOP actually allows (and what it really doesn’t).

Can you rent out rooms or move overseas before MOP ends?

Yes, but with limitations.

You’re allowed to rent out individual rooms in your flat during the MOP, but you must continue living there and seek approval from HDB. Whole unit rental? That’s a hard no.

As for moving overseas — you’ll need to seek permission from HDB if you’re not planning to return regularly. Otherwise, leaving the flat vacant while you’re away could be seen as violating occupancy rules.

💬 Expert Tip: If your long-term plans involve flexibility, it may be worth exploring options with a private property loan instead of HDB, which comes with stricter conditions.

Can you buy another property (e.g. condo) during your MOP?

No — HDB flat owners cannot own or co-own any other residential property, locally or overseas, until the MOP is complete. That includes:

- Private condos

- Landed homes

- Executive Condos still under MOP

- Inherited residential property

This rule applies regardless of whether you used a bank loan or HDB loan. Even if you qualify for better mortgage interest rates in Singapore, you’re not allowed to invest in a second home until your first one meets MOP.

Thinking ahead? Start shortlisting your next move now — from condo upgrades to refinancing options. Planning early ensures you’re ready to act the moment your MOP is up, without scrambling to figure out your financing or loan eligibility.

What happens if you break MOP rules?

Breaking MOP rules isn’t just frowned upon — it’s serious business. HDB may:

- Force you to return your flat

- Recover any CPF housing grants you received

- Bar you from future flat applications

- Pursue legal action for false declarations

Bottom line: It’s not worth the risk. If you’re not sure whether your plan violates the rules, speak to a licensed mortgage consultant first to explore alternatives — like room rentals, loan repricing, or planning for a post-MOP upgrade.

When Does the MOP Start and End?

Knowing your MOP timeline is crucial — because many buyers get caught off guard by when it officially starts. It’s not based on when you move in or renovate, but on something far more specific. Here’s what you need to know to avoid confusion (and disappointment) when planning your next move.

Does MOP begin from key collection or actual move-in date?

Your MOP officially starts from the date you collect the keys to your HDB flat — not the day you actually move in.

Even if renovations take months and you only move in later, your MOP clock is already ticking. That’s great news if you’re planning to upgrade soon — and even more reason to secure your keys promptly after your flat is ready.

Tip: If you’re getting a bank loan for an HDB flat, your loan tenure will typically begin at key collection as well. Use a mortgage loan repayment calculator to estimate your total monthly costs right from Day 1.

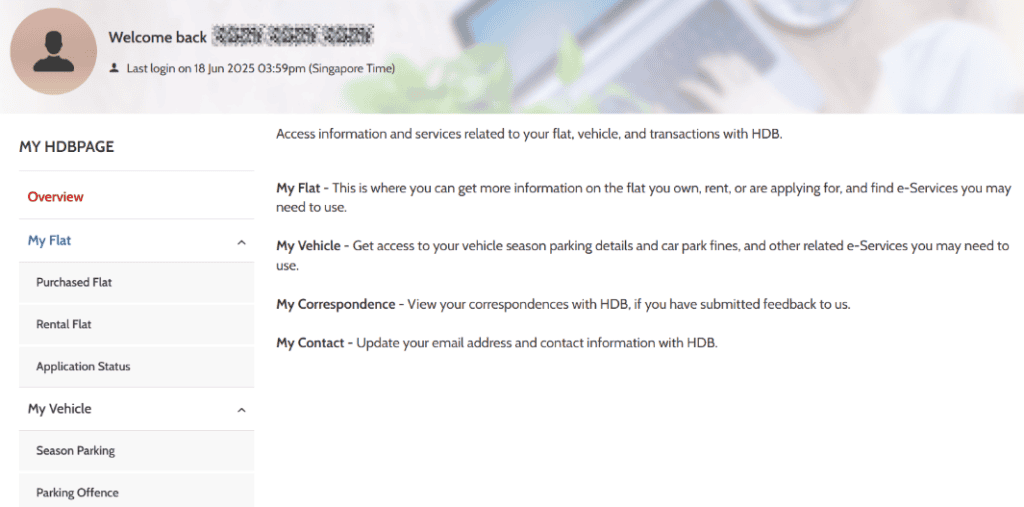

How to check your official MOP status

Not sure if your MOP is over? Here’s how to find out:

- Log in to My HDBPage using Singpass

- Navigate to My Flat > Purchased Flat > Flat Details

- Scroll to see your MOP end date and eligibility status

If you’ve refinanced, received CPF housing grants, or added co-owners, the system will reflect the adjusted MOP accordingly.

Will renovations, refinancing, or legal changes reset your MOP?

Generally, no — but there are exceptions:

- Renovations do not reset or delay your MOP

- Refinancing your HDB loan won’t affect your MOP

- Legal changes like divorce, change of ownership, or adding a co-owner can reset the clock depending on circumstances

If you’re unsure whether your situation affects your eligibility to sell or buy another home, it’s best to speak to a licensed mortgage advisor in Singapore before making any major moves.

Special Cases: Singles, Divorcees, Orphans, and Inheritance

MOP rules aren’t always one-size-fits-all. If you’re buying under the Singles Scheme, dealing with a divorce, or applying under the Orphan Scheme, the rules may differ slightly — and knowing those differences can save you time, money, and unexpected delays.

What are the MOP rules under the Singles Scheme?

If you’re buying under the Single Singapore Citizen Scheme or the Joint Singles Scheme, the MOP works just like it does for couples:

What makes a bigger difference is what type of flat you buy. Singles can typically only buy 2-room Flexi BTOs in non-mature estates or any resale flat — which will still come with standard MOP conditions.

- 5 years if you’re buying a BTO or resale flat with grants

- No selling or full-unit rental until your MOP ends

- No buying private property or second homes during this period

Thinking of buying solo or with a friend? Read up on HDB home loans vs bank loans to find the best fit for your budget and timeline.

What if divorce happens before the MOP ends?

If you divorce during the MOP, you can’t just sell the flat immediately. HDB will assess your situation, and the flat typically must be:

- Transferred to one party who continues to fulfill the MOP

- Sold only if neither party can retain the flat, and with HDB approval

Key considerations include child custody, grant usage, and financing eligibility. If your loan needs to be adjusted, explore whether a refinance of your HDB loan can help you retain ownership under new income conditions.

Can orphans or co-owners sell early under special schemes?

Under the Orphan Scheme, unmarried siblings who are both Singapore Citizens may buy an HDB flat together — but MOP rules still apply.

That means:

- 5-year MOP if buying BTO or resale with grants

- No early sale unless under exceptional hardship (subject to HDB approval)

- If one sibling passes away, the surviving party may retain the flat — but selling early may still not be allowed

These cases can get complex quickly, especially if CPF grants or inheritance are involved. Before making changes to ownership, speak with a trusted mortgage consultant in Singapore to understand your rights and responsibilities.

Latest MOP Rule Changes in 2025

With the rollout of HDB’s new Prime, Plus, and Standard flat classifications, 2025 marks one of the biggest changes to flat eligibility and resale conditions in years. And yes — these updates also affect your Minimum Occupation Period (MOP).

If you’re applying for a new BTO this year or thinking of resale options in a newly classified estate, here’s how these changes may reshape your future plans.

How the Prime, Plus, and Standard classifications affect MOP

HDB introduced three categories to ensure housing affordability while balancing access and equity:

MOP Duration and Resale Rules by HDB Flat Classification (2025)

| Flat Type | MOP Duration | Additional Conditions |

|---|---|---|

| Prime | 10 years | Subsidy recovery, resale restrictions, no renting entire flat even after MOP |

| Plus | 10 years | Milder resale restrictions, subsidy recovery applies |

| Standard | 5 years | Same rules as traditional BTO/resale flats |

With Prime and Plus flats, the longer 10-year MOP aims to discourage short-term flipping and keep high-demand areas more stable and owner-occupied.

Are there longer restrictions for Prime and Plus flats?

Yes — and not just in terms of MOP length.

Even after the 10-year MOP, owners of Prime or Plus flats may face:

- Resale limitations, such as selling only to other eligible buyers

- Subsidy recovery, where a portion of government grants may need to be repaid

- Restrictions on renting out the entire flat, especially for Prime units

Heads up: These rules also make it harder to upgrade quickly. If you’re planning to move to a condo later, you’ll want to factor this into your long-term strategy. Consider using a mortgage loan repayment calculator to assess the best path forward after MOP.

How 2025 policy changes affect resale and upgrading plans

The longer MOPs and tighter resale restrictions introduced in 2025 mean:

- You may have to wait longer to sell or upgrade

- You’ll face narrower buyer pools for Prime and Plus flats

- You’ll need to plan for the cost of subsidy recovery during resale

If flexibility and faster upgrading are priorities, a Standard flat or even a resale unit with no grants might offer fewer strings attached. And when your MOP ends, working with a trusted mortgage broker in Singapore can help you compare refinance options and prepare for your next property move.

Frequently Asked Questions About MOP

Still got lingering questions about the Minimum Occupation Period? You’re not alone. Here are answers to the most common MOP-related concerns that trip up buyers and homeowners in Singapore.

Can I apply for another flat while still under MOP?

No — you must complete your MOP before applying for another subsidised flat, such as a BTO or Sale of Balance Flat (SBF).

Even if you’re applying jointly with a family member or spouse, all listed owners must have fulfilled the MOP on their existing flat first. This includes those using CPF grants or any form of HDB housing loan.

💬 Planning your next move after MOP? Consider checking current DBS home loan rates or UOB home loan packages early so you can budget for your upgrade without delay.

Do CPF housing grants lengthen my MOP?

Not directly — but they lock you into a full 5-year MOP, even for resale flats.

So if you buy a resale unit and take grants like the Family Grant, Enhanced Housing Grant (EHG), or Proximity Housing Grant (PHG), you must serve a 5-year MOP regardless of flat type or location.

If you want to avoid the MOP entirely, it’s only possible in very limited cases — usually when buying a resale flat with no grants and no subsidies. Talk to a mortgage consultant in Singapore to explore if that route works for you.

Can I transfer ownership or inherit a property during MOP?

This is where things get tricky:

- Inheriting a property during MOP is allowed in name, but you can’t own and benefit from another property while under MOP

- Transferring ownership of your HDB flat (e.g. during divorce or family planning) typically isn’t allowed unless under special circumstances

- Any change in flat ownership or addition of co-owners is subject to HDB approval and may affect your resale timeline

Tip: If you’re navigating legal changes or family matters, it’s smart to check your financing flexibility. You can explore refinance options to reduce monthly payments and adapt to your new situation.

Final Thoughts: Planning Your Flat Strategy Around MOP

Whether you’re buying your first BTO or planning for a resale upgrade, understanding your Minimum Occupation Period (MOP) isn’t just about compliance — it’s about timing your property goals smartly.

Why you should factor in MOP before buying your next home

The MOP can shape your life more than you think. It affects:

- When you can sell or rent your flat

- Whether you can buy a second property

- If you’re allowed to apply for another BTO or EC

If you plan to start a family, move closer to work, or invest in a condo down the road, your MOP timing could make or break your ideal timeline.

💡 Pro Tip: Before committing to a flat or loan, use our mortgage loan repayment calculator to check how your housing decisions line up with your 5- or 10-year plans.

When to start planning for upgrading or resale

Don’t wait until your MOP ends to start thinking about what’s next. Ideally, you should begin planning:

- 1 to 2 years before MOP ends — especially if buying private property

- 6 to 12 months prior if you’re looking to refinance, renovate, or sell

- Immediately, if your current loan package isn’t giving you the best value

You can start by exploring current packages like the OCBC home loan or refinancing options for HDB flats.

Where to get help navigating MOP rules in 2025

Still unsure about how your MOP affects your housing or loan options? You don’t have to figure it all out alone.

Working with a mortgage broker in Singapore gives you:

- Clarity on HDB vs bank loan options

- Guidance on timing your upgrade

- Access to the best home loan rates in Singapore — across DBS, UOB, OCBC, and more