Thinking of buying a condo or executive condo, but not ready to commit to full loan repayments yet? That’s where the Deferred Payment Scheme (DPS) comes in.

It lets you lock in a property today — and delay your mortgage payments until the project is ready. No monthly instalments right after signing. Just a 20% downpayment, and the rest comes later.

In this quick guide, we’ll break down how DPS works in Singapore, when to use it, and whether it’s the right fit for your next big property move.

If you’re considering a private property loan, this is something worth knowing.

Let’s get started.

How Does the Deferred Payment Scheme Work?

If you’re buying a new launch condo or EC and want to ease your upfront costs, the Deferred Payment Scheme (DPS) could give you a strategic edge. Instead of paying bit by bit during construction, DPS lets you buy now and pay later — literally.

Let’s break it down

What’s the upfront cost and timeline like?

Under DPS, you only need to pay 20% of the property price upfront:

- 5% in cash

- 15% via CPF or cash

No monthly mortgage required during construction

You’ll only resume payment when the project reaches TOP — usually 2–3 years later.

Expert tip: Developers often charge 2–3% more for DPS units. Use a mortgage loan repayment calculator to weigh the trade-off in price vs cash flow benefits.

Want to go deeper? Check out this URA guide on residential purchase procedures for official process breakdowns.

When do you start your home loan repayments?

You’ll only begin your mortgage repayments after TOP, when the unit is ready for occupation. This means:

- No loan disbursement

- No progressive payments

- Full financing starts much later than usual

This flexibility is a major draw for buyers who want time to sort out finances, especially those waiting to sell their flat. If that’s you, consider locking in a private property loan early — or speaking with a mortgage broker in Singapore to compare rates across banks.

Who typically benefits from using DPS?

DPS works best for:

🏠 HDB upgraders still marketing their current flat

💼 Investors who want to lock in now and finance later

📈 Buyers expecting future income, CPF top-ups or bonuses

But be warned — this scheme isn’t for everyone. If you want to avoid paying a developer premium or you already have solid financing ready, a traditional progressive scheme may save you more in the long run.

Pro tip: Always compare home loan rates in Singapore before deciding. A small interest difference now can save you thousands later.

Where Is the Deferred Payment Scheme Offered in 2025?

Not every property in Singapore comes with the Deferred Payment Scheme — it’s usually offered as a developer incentive for selected new launch condos and Executive Condominiums (ECs).

If you’re eyeing DPS in 2025, here’s where to look and what to know

Which new launch condos and ECs come with DPS?

DPS is typically available for:

🏗️ New launch private condos nearing TOP (Temporary Occupation Permit)

🏢 Executive Condominiums (ECs) — but only after the 15-month restriction from land sale

Some developers quietly roll out DPS during slower sales periods, especially for unsold units. You’ll often spot it in places like:

- Copen Grand EC

- North Gaia EC

- Boutique condos along Dairy Farm, Bartley, or Upper Thomson

💡 Tip: DPS isn’t always advertised publicly. Ask your mortgage advisor or check developer brochures for the fine print.

EC vs private condo vs resale – what’s allowed?

Not all property types in Singapore qualify for the Deferred Payment Scheme. Here’s a quick breakdown of which types are eligible, so you don’t waste time chasing units that don’t offer it

Eligibility and Availability of Deferred Payment Scheme Across Property Types (2025)

| Property Type | DPS Available? | Key Notes |

|---|---|---|

| Private Condominiums | ✅ Often offered | Especially near TOP; comes with slight price premium |

| Executive Condos (ECs) | ✅ With conditions | Only after 15-month cooling period from land sale |

| Resale Properties | ❌ Not applicable | DPS not available for resale units; only developer sales |

Can second-timers or foreigners apply for DPS?

✅ Yes, second-timers can apply — especially useful for HDB upgraders who need time to sell.

✅ Foreigners are eligible too, but only for non-EC projects, since ECs are restricted to Singapore Citizens and PRs.

Pro tip: If you’re planning to sell an HDB flat and buy a DPS unit, time your financing right. Use our mortgage loan repayment calculator to prep for post-TOP repayments.

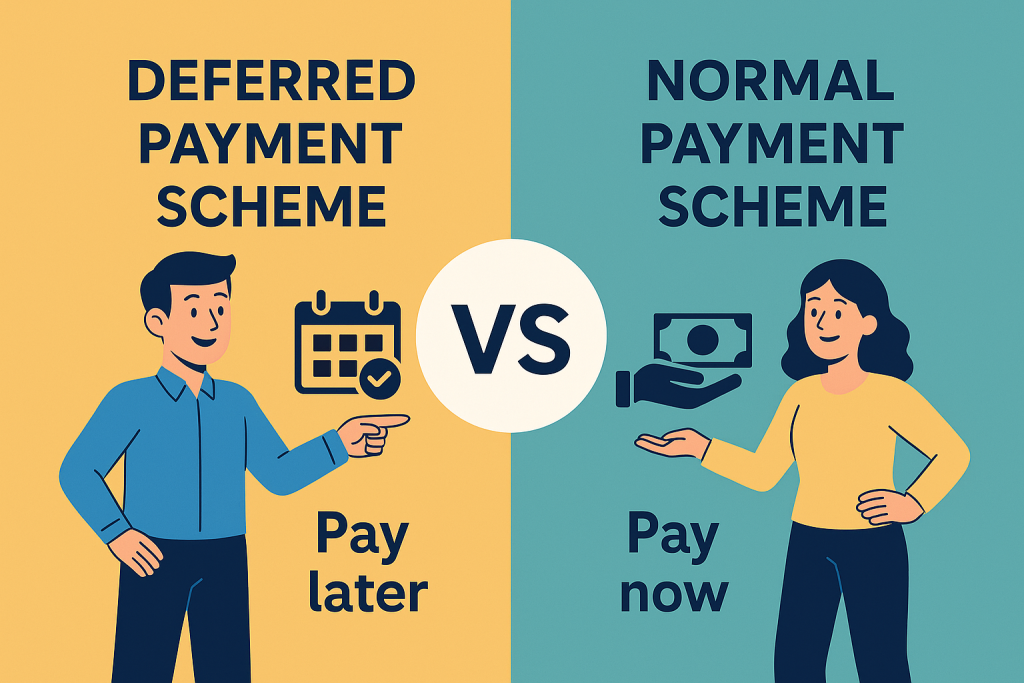

Deferred Payment Scheme vs Normal Payment Scheme Singapore

Before you decide, it’s important to understand the key differences between the Deferred Payment Scheme and the Normal Payment Scheme in Singapore — from when your loan starts to how much flexibility you get.

Deferred Payment Scheme vs Normal Payment Scheme in Singapore (2025)

| Feature | Deferred Payment Scheme (DPS) | Normal / Progressive Payment Scheme (PPS) |

|---|---|---|

| Upfront Payment at Booking | 20% downpayment (typically 5% cash + 15% CPF/cash) | Same 20% downpayment (progressively paid) |

| When Home Loan Kicks In | Only after Temporary Occupation Permit (TOP) is issued | Begins as construction progresses (within 9–18 months) |

| Monthly Loan Repayments Start | Deferred till TOP – you don’t pay anything monthly until property is ready | Starts immediately after bank disbursement (stage by stage) |

| Cash Flow Flexibility | More flexibility in the short term | Requires financial readiness earlier |

| Developer Price Premium | Often comes with a 2–3% markup on sale price | Typically lower price (no deferment buffer) |

| Best For | Buyers who need time to sell an existing property or build up liquidity | Buyers with steady income and long-term financing plans |

| Loan Eligibility (TDSR Impact) | Easier to qualify initially, but re-evaluation needed at loan application | Loan approval based on current income/assets at time of purchase |

What are the cash flow advantages of DPS?

✅ You don’t need to pay your monthly mortgage until the condo is completed and ready.

✅ You can sell your current flat first, then use the proceeds later.

✅ It gives time to build up CPF savings or wait for a bonus or business windfall.

Pro tip: If you’re planning to sell your HDB or upgrade, DPS can give you breathing room — especially if you also apply for a bridging loan to cover the gap.

Are there downsides like pricing or loan risks?

Yes — and they’re important to consider:

❌ Developers often mark up DPS units to offset the wait.

❌ You might face higher interest rates later when applying for a mortgage loan in Singapore if rates rise before TOP.

❌ Your loan eligibility may change, especially if income fluctuates in the next 2–3 years.

It’s crucial to speak with a mortgage broker in Singapore to lock in good terms or plan for future loan approval.

Which scheme suits different types of buyers?

Here’s a quick cheat sheet:

HDB Upgraders

- Go for DPS if you’re selling your current flat — it helps avoid double repayments.

Investors

- DPS buys you time to rent out, flip, or fund with future profits.

Young professionals with stable income

- PPS may be better. You avoid paying the price premium and can start building equity earlier.

🎯 Every case is different. Use a mortgage loan calculator to test your repayment capacity under both schemes.

Common Questions About Deferred Payment in Singapore

Still unsure if the Deferred Payment Scheme (DPS) is right for you? Here are answers to the most common questions buyers ask before committing.

Can I use CPF or a bank loan with DPS?

Yes, you can.

For the initial 15% downpayment, you can use your CPF Ordinary Account — the same as with any condo or EC purchase. The 5% booking fee, however, must be paid in cash.

As for your loan, you can still take a bank mortgage loan in Singapore — but the loan only disburses upon TOP. That means no monthly repayment until the keys are ready.

Tip: Always get your In-Principle Approval (IPA) early — even if your loan starts later. This ensures you won’t be caught off guard when financing kicks in.

What happens if I cancel the purchase before TOP?

You’ll likely forfeit your booking fee and legal costs.

Cancelling a DPS unit isn’t like walking away from a rental deposit. Once you’ve exercised the Option to Purchase (OTP) and signed the Sales & Purchase Agreement, you’re legally committed.

In most cases:

- The 5% cash booking fee is non-refundable

- There may be developer penalties

- You could even face a loss of CPF funds used

Pro tip: Speak to your mortgage advisor before signing — especially if you’re unsure about your finances or housing plans.

Is DPS worth it for first-time or investor buyers?

That depends on your situation.

✅ First-time buyers may benefit if they need time to save more CPF or are expecting a salary jump soon. But do note — DPS units often come at a price premium, and waiting could mean losing out on cheaper progressive schemes.

✅ Property investors love DPS because it gives them the flexibility to secure a unit without tying up cash or taking a loan immediately. It’s also helpful if you’re timing the market or planning a quick flip.

But remember: defer doesn’t mean disappear. Eventually, repayments will begin — and if interest rates rise, so will your monthly commitment. Always compare home loan interest rates in Singapore to stay ahead.

Final Thoughts — Should You Consider DPS for Your Property Purchase?

The Deferred Payment Scheme isn’t a one-size-fits-all solution. But for the right buyer, it can be a smart way to manage cash flow while securing your ideal property early.

Let’s sum it up

When does DPS make the most sense?

DPS works best when:

- You’re upgrading and need time to sell your existing home

- You expect a CPF top-up, bonus, or capital inflow in the next 1–2 years

- You want to commit to a unit today but defer the loan and repayments

It’s especially helpful if you’re buying near TOP, as you get ownership certainty without upfront financial pressure.

Why speaking to a mortgage advisor can help

DPS delays your mortgage, but it doesn’t eliminate the risk. Loan eligibility, interest rates, and bank policies may shift before TOP. A licensed mortgage advisor in Singapore can help you:

- Compare bank loan packages

- Lock in the best home loan interest rate

- Avoid common financing pitfalls buyers overlook

Explore your best loan options before you commit

Before you say yes to a DPS unit, make sure you’re financially ready when the scheme ends.

Use our:

- Mortgage loan repayment calculator to project future instalments

- Buyer’s Stamp Duty calculator to estimate upfront taxes

- Private property loan guide to understand loan types and bank choices

Ready to move forward?

Don’t make big property decisions without expert advice.

Book a free consultation with a licensed mortgage broker today — and let us help you plan smarter.