Losing someone is hard. And when that person is the sole owner of an HDB flat, it often leaves families unsure what to do next. Can we stay? Who gets the flat? What if there’s no will?

It’s a lot to process — especially during a time of grief. But understanding how HDB flat inheritance and ownership transfer works can help you navigate things with more clarity and less stress.

In this guide, we’ll walk you through what really happens when the flat owner passes away — whether you’re an essential occupier, a child, or just trying to plan ahead.

💡 Need help planning your next move? Try our mortgage loan repayment calculator or speak to a mortgage broker in Singapore for personalised advice.

What Happens to the Flat When the Sole Owner Dies?

When the sole owner of an HDB flat passes away, the next steps depend on whether there’s a will and who’s eligible to take over the flat. Understanding HDB inheritance rules can help families avoid confusion and make informed decisions during a difficult time.

What to Do Within the First 30 Days After the Owner’s Death

The first thing to know is: don’t panic. If the HDB flat owner passes away, you don’t lose the flat overnight. But there are steps to take early — especially if you intend to stay in the flat or eventually take over ownership.

Here’s what needs to happen within the first month:

- Obtain the official death certificate from ICA.

- Notify HDB via MyHDBPage or at the HDB Branch Office managing the flat.

- Secure any important flat-related documents like the mortgage statement or flat ownership details.

- Check if the deceased left behind a valid will.

If the owner was paying off an HDB loan, HDB will temporarily pause action — but it’s still important to initiate communication early. If there’s a bank mortgage, contact the bank immediately to discuss loan status and next steps.

💡 Expert Tip: If you’re unsure about the loan impact, use our mortgage loan repayment calculator to get a sense of ongoing costs — especially helpful if a family member plans to take over the flat.

If There’s a Will — What Beneficiaries Need to Know

If the flat owner made a valid will, the person listed to inherit the HDB flat is known as the beneficiary. But — and this is important — being named in the will doesn’t mean automatic transfer.

Here’s what happens next:

- The family must apply for a Grant of Probate through the Family Justice Courts.

- Once granted, the beneficiary can apply for HDB transfer of ownership, provided they meet eligibility criteria (citizenship, income ceiling, property ownership limits, etc.).

- If the flat has an outstanding loan, the new owner will need to take over the mortgage or refinance it.

💡 Being listed in the will is just one part. If you’re unsure whether you qualify to take over the flat, talk to a mortgage broker in Singapore to understand your financing and eligibility options early.

No Will? Here’s What the Intestate Succession Act Decides

If the flat owner passed away without a will, things are handled under the Intestate Succession Act (ISA) — which determines who inherits the property based on fixed rules. The order usually goes:

- Spouse

- Children

- Parents

- Sibling

But here’s the catch: even if you’re next in line, you must apply for Letters of Administration — a legal document that gives you the authority to manage and distribute the estate.Also, the same HDB rules apply: the heir must still meet HDB ownership eligibility before taking over the flat. If no one qualifies, the flat may have to be sold or returned to HDB.

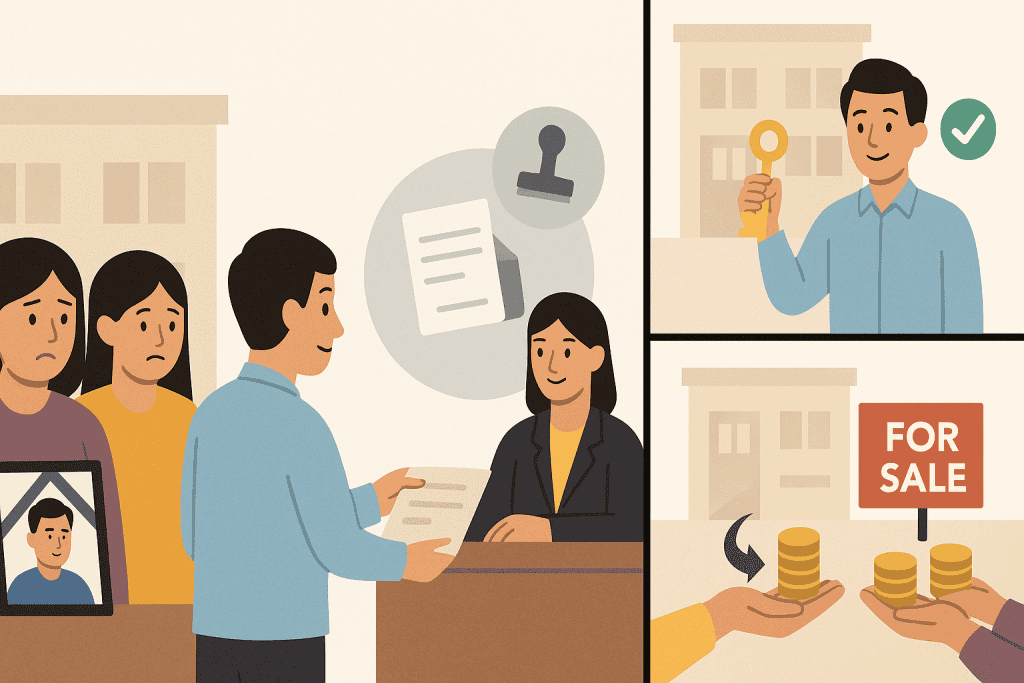

What Happens to an HDB Flat When the Owner Passes Away? (At a Glance)

The outcome for an HDB flat after the sole owner passes away depends on factors such as whether a valid will was made, the eligibility of beneficiaries, and the status of essential occupiers. Below is a quick summary of the possible scenarios:

HDB Flat Inheritance Scenarios: What Happens After the Owner Passes Away

| Scenario | What Happens to the Flat |

|---|---|

| Flat owner dies with a valid will | Flat can be transferred to named beneficiary (if eligible) after Grant of Probate |

| No will left behind | Flat passed to next-of-kin under Intestate Succession Act (requires administration) |

| Beneficiary/next-of-kin ineligible | Flat may be sold or surrendered to HDB |

| Essential occupier meets all criteria | May apply for ownership transfer via HDB, subject to approval |

Can the Flat Be Inherited or Transferred?

If you’re wondering “Can I take over the HDB flat?” — the answer is: maybe. In Singapore, HDB inheritance rules don’t just look at family ties. You must meet strict criteria before HDB allows you to inherit or take over ownership of the flat.

Let’s break it down step by step.

Can You Take Over the Flat? Use This 3-Step Eligibility Checklist

To qualify for HDB transfer of ownership, the person inheriting the flat — whether through a will or as next-of-kin — must meet all three of the following conditions:

1. You must be an eligible person under HDB rules:

- A Singapore Citizen or PR

- At least 21 years old

- Related to the deceased (e.g. spouse, child, parent)

2. You must meet HDB ownership eligibility:

- Do not own another HDB flat or private property (locally or overseas)

- Within income ceiling limits (for certain flat types)

- Must be able to form a valid family nucleus if required

3. You must have lived in the flat or intend to continue living in it:

HDB doesn’t allow purely investment-based transfers. The flat must be used for owner occupation.

Honestly, it’s always better to find out sooner rather than later. The rules around HDB inheritance can be surprisingly strict. Assuming you’ll automatically get to keep the flat can lead to disappointment.

If I were in that situation, I’d take a bit of time to read through the eligibility rules carefully before making any big decisions.

How to Apply for Ownership Transfer (Step-by-Step)

If you meet the criteria above, here’s how to start the HDB ownership transfer process after death:

- Gather key documents:

- Death certificate

- Grant of Probate or Letters of Administration

- NRIC of proposed new owner(s)

- Proof of relationship to the deceased

- Death certificate

- Submit the request to HDB:

- Go to the HDB Branch managing the flat

- Or submit a request via MyHDBPage under “Change in Flat Ownership”

- Go to the HDB Branch managing the flat

- Wait for approval:

HDB will review eligibility, check for any loan or CPF usage issues, and assess the property profile. - Handle the mortgage (if any):

- You may need to refinance or take over the remaining HDB loan or bank loan

- You can use our mortgage loan repayment calculator to estimate your monthly instalments

- You may need to refinance or take over the remaining HDB loan or bank loan

You cannot inherit the flat just by living there. There needs to be a formal approval and financial capacity.

If you’re inheriting a flat with an outstanding loan, explore refinancing your HDB loan to ease monthly payments.

What Happens If No One Qualifies to Inherit the Flat?

This is where things get more complicated. If no one in the family is eligible — or willing — to take over the flat, here’s what usually happens:

- The flat must be sold in the open market

- Or returned to HDB, especially if it’s under a subsidised scheme or still within the Minimum Occupation Period (MOP)

- Sale proceeds (after settling outstanding loans and CPF refunds) will go to the estate

In short: if no eligible heir steps forward, the family cannot keep the flat — even if someone has been living there for years.

This is why estate planning is so important. A will alone isn’t enough — the person you’re passing the flat to must also qualify under HDB’s rules.

What Happens to Essential Occupiers After the Owner’s Death?

If you’re listed as an essential occupier in an HDB flat, and the owner passes away, you might be left wondering: Can I stay? Do I have any rights? It’s a tough position to be in — especially if the flat has been your home for years.

Unfortunately, HDB occupiers do not have automatic legal rights to the property. But that doesn’t always mean you have to leave. Let’s break it down.

Do Occupiers Have Any Legal Rights to the Flat?

Short answer? No. Essential occupiers are not co-owners — they don’t appear on the flat’s title deed, and they have no legal claim to the property if the owner dies.

Even if you’ve lived there throughout the Minimum Occupation Period (MOP), contributed to household expenses, or supported the owner financially — HDB recognises legal ownership, not contribution.

This means:

- You cannot sell the flat

- You cannot apply for a bank loan or use CPF for the flat

- You cannot prevent HDB from reclaiming or reallocating the unit

From a personal perspective, it’s heartbreaking but important to understand this reality early. Many people only find out too late that being an occupier doesn’t protect their place in the flat.

Can an Occupier Apply to Take Over the Flat? (Only If They Meet These Conditions)

Yes — but only if the occupier meets HDB’s full eligibility criteria for flat ownership.

This includes:

- Being a Singapore Citizen or PR

- At least 21 years old

- Meeting HDB’s income, property ownership, and family nucleus requirements

- Intending to live in the flat (not rent it out or hold it as an investment)

If you qualify, you’ll need to:

- Obtain a Grant of Probate or Letters of Administration

- Formally apply to take over ownership via HDB

- Refinance or settle any outstanding HDB loan or bank loan

Before applying, it’s smart to explore your HDB loan refinancing options — especially if taking over the flat means you’ll be responsible for ongoing repayments.

What to Do If You’re an Occupier With No Legal Claim — But Want to Stay

If you don’t qualify to take over the flat but want to continue living there, your options are limited — but not impossible:

- Appeal to HDB with special circumstances (e.g. long-term caregiving, elderly with no other home)

- Seek support from remaining family members who may be eligible to inherit and co-stay with you

- Plan ahead — you may need to explore options like applying for your own flat or moving to a family-owned unit

If you’re living as an occupier , especially elderly parents or unmarried children, it’s worth having open conversations about future ownership early on. It’s not just about housing, it’s about security and peace of mind.

Quick FAQs: Flat Inheritance & Occupier Rules

- Can occupiers inherit an HDB flat?

Only if they’re legally eligible and named in a will or approved by HDB. - Can children take over a parent’s HDB flat?

Yes — but they must meet all eligibility rules for ownership. - What happens if no one can inherit the flat?

HDB may require the flat to be sold or returned; proceeds go to estate. - Can I stay in the flat if I’m just an occupier?

Temporarily, yes. Long-term, you’ll need to apply for ownership or exit.

👉 Need to restructure flat ownership after inheritance? Read: Can I Add or Remove an Occupier from My HDB Flat?

Common Scenarios Families Ask About

When an HDB flat owner passes away, the legal process isn’t always straightforward — especially in real-life situations involving kids, elderly parents, or religious-specific inheritance. Let’s walk through some of the most common questions families in Singapore face during these moments.

The Flat Owner Dies Without a Will — and Their Children Live in the Flat

If the flat owner passes away without leaving a will, the Intestate Succession Act will determine how the property is distributed. This can become tricky if the children — especially adult children — are currently living in the flat but not listed as co-owners.

In this case:

- The children do not automatically inherit the flat just because they live there

- One or more children must apply for Letters of Administration

- The appointed administrator may then request a transfer of HDB ownership, provided they meet eligibility

If none of the children qualify under HDB rules, the flat may need to be sold, and proceeds split among eligible heirs.

If you’re unsure whether to keep the flat, selling may be an option — use a Buyer’s Stamp Duty calculator to plan costs for your next purchase.

The Occupier Is an Elderly Parent or a Dependent Child

This is one of the most emotionally difficult scenarios. If the owner passes and the remaining family member is an elderly parent or a young adult child listed only as an occupier, they may not be able to retain the flat — unless they’re eligible to take over ownership.

What to consider:

- HDB generally does not grant ownership based on dependency or emotional hardship

- If the occupier qualifies (e.g. is 21+, Singapore Citizen/PR, meets income rules), they can apply to inherit

- If they don’t qualify, the flat will likely need to be sold or returned to HDB

In some cases, families can plan ahead by restructuring flat ownership or transferring shares early. If refinancing is needed, you can explore refinancing home loan options to manage future costs.

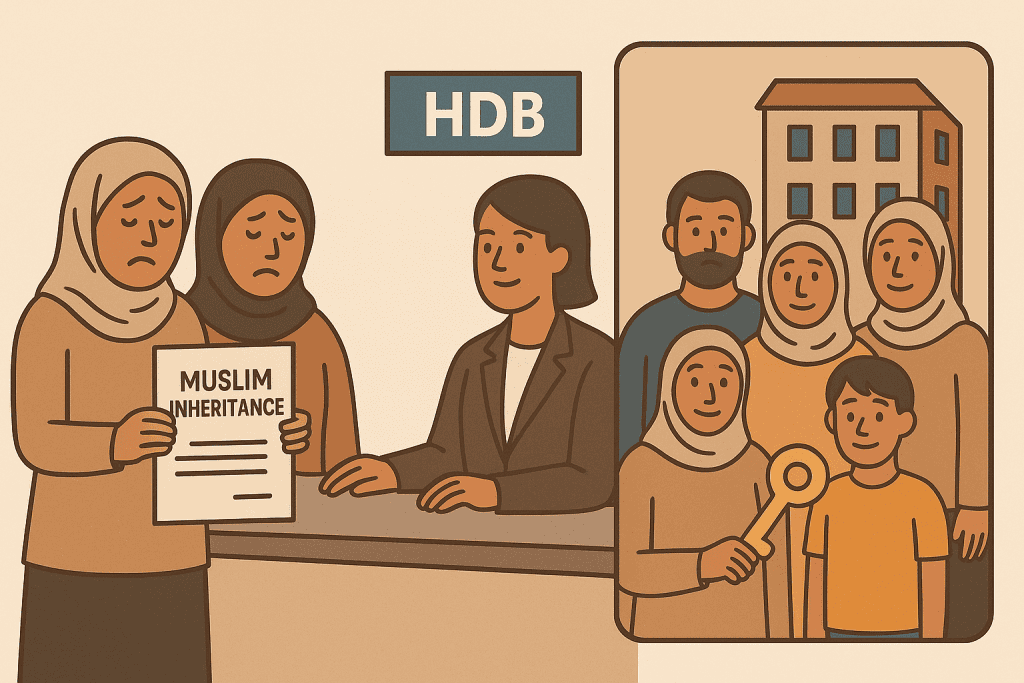

The Flat Owner Is Muslim — Does Faraid Law Apply?

Yes — Muslim inheritance in Singapore is governed by Faraid, not the Intestate Succession Act. This means the HDB flat will be distributed according to Islamic inheritance laws, which follow fixed shares for eligible heirs.

Key points:

- HDB still requires formal application of Grant of Probate or Inheritance Certificate from Syariah Court

- Heirs must still meet HDB eligibility before the flat can be transferred

- If multiple heirs qualify, they must agree on who takes over or opt to sell and divide proceeds

Even under Faraid, ownership transfer is not automatic — the flat must be handled according to both Islamic law and HDB regulations.

Myths vs Facts About Inheriting an HDB Flat

When it comes to HDB flat inheritance, misinformation can cause families to lose their homes — or miss out on options they didn’t know they had. Let’s bust some of the most common myths and replace them with facts.

“Occupiers Will Automatically Get the Flat” — Not True

Just because someone is listed as an essential occupier doesn’t mean they’ll inherit the flat. HDB doesn’t recognise emotional connection or caregiving as legal grounds for ownership.

✅ Fact: Only legal owners or eligible family members who apply through the proper legal channels can take over the flat. Occupiers must still meet HDB’s criteria to qualify for inheritance or transfer.

If you’re living in an HDB flat as an occupier, don’t assume you’ll be protected — it’s worth having the conversation early, especially if you’re caring for elderly parents or plan to stay long-term.

“I Can Nominate My HDB Flat Like CPF” — Also False

This is a very common belief — but it’s incorrect. You cannot “nominate” your HDB flat like you can with CPF savings or insurance payouts.

✅ Fact: If you want your flat to go to a specific person, you need to draft a legal will. Without a valid will, the flat will be handled under the Intestate Succession Act (or Faraid for Muslims).

Tip: If you’re planning for the future, it’s not just about who lives in the flat — it’s also about who can legally own and finance it. That’s a completely separate process from CPF nomination.

“We Can Sort It Out Later” — Why Inaction Can Lead to Surrender

Families often delay sorting out flat ownership, especially during periods of grief — but this can have serious consequences.

✅ Fact: If no eligible heir steps forward to claim ownership or no one qualifies, HDB may require the flat to be surrendered. This means the surviving family members — even if they’ve lived there for years — may have to vacate.

In my view, this is the saddest outcome — one that’s entirely avoidable with some early planning and candid family discussion.

Final Checklist for Families Planning Ahead

Losing a loved one is already hard enough — the last thing any family needs is confusion over the flat. Whether you’re a current owner or living as an occupier, planning early can make all the difference between a smooth transition… and an unexpected eviction.

5 Mistakes That Delay or Block Flat Inheritance

Some of the most common inheritance problems come down to simple oversights. These are the five issues that can derail everything:

- ❌ No will or unclear instructions

- ❌ Assuming occupiers can inherit without eligibility

- ❌ Not applying for probate or administration on time

- ❌ Flat owner not updating HDB records or household members

- ❌ Unresolved CPF or outstanding HDB/bank loans

Even a fully paid-up flat can hit roadblocks if the paperwork isn’t sorted. Start now — don’t wait till it’s too late.

Why Every Owner Should Have a Will — Even for a 3-Room Flat

It doesn’t matter if it’s a 5-room resale or a humble 3-room BTO — your HDB flat is your legacy. Without a will, your family may need to apply for Letters of Administration, which takes more time and can cause disputes.

✅ With a will:

- You control who inherits the flat

- Your loved ones avoid legal delays

- You can plan for situations where your beneficiaries may need to sell, refinance, or retain the home

A simple will can save your family months of legal stress. It’s not just for the rich — it’s for anyone who wants to protect their home and the people in it.

When to Speak to a Lawyer vs Mortgage Broker

Knowing who to talk to can make all the difference during estate planning or when someone passes on:

Speak to a lawyer if:

➤ You need to draft a will

➤ You’re applying for probate or Letters of Administration

➤ There’s disagreement among heirs or unclear ownership

Speak to a mortgage expert if:

➤ You’re planning to take over the flat and need to manage financing

➤ You’re unsure about loan repayments, refinancing, or CPF usage

➤ You need help comparing home loan rates in Singapore

If it were me, I wouldn’t want to go through this alone. When emotions are high and the rules feel overwhelming, having someone guide you, even just to explain your options can really lighten the emotional load. It’s okay to ask for help early.

What to Remember When an HDB Flat Owner Passes Away

Losing a loved one is never easy — and when a home is involved, the emotional weight can feel even heavier. Whether you’re a spouse, child, or essential occupier, it’s important to understand that HDB ownership doesn’t automatically pass on, even if you’ve lived in the flat for years.

From legal eligibility to financial obligations, every case is different. The key is to act early, get the facts right, and plan with clarity — so that your family’s home doesn’t become a source of confusion or loss.

💛 What I’ve seen is that families who ask the tough questions early — even while the owner is still around — are the ones who protect their loved ones best.

Need Help Navigating Your Next Step?

Whether you’re figuring out who can inherit an HDB flat, planning to transfer ownership, or simply need to understand your financing options — you’re not alone.

✅ Use our mortgage loan repayment calculator to check affordability

✅ Explore HDB home loan refinancing options if you need to take over the loan

✅ Or speak to a licensed mortgage advisor in Singapore for tailored guidance

🧡 Your home is more than a property — it’s where your family’s memories live. Let’s protect that, together.