About to sign your OTP and lock in your dream flat? 🏠

Wait — don’t rush.

The Option to Purchase (OTP) might look like standard paperwork, but one wrong move can cost you time, money, or even the flat itself.

From missing the 21-day deadline to collecting the OTP without loan approval, we’ll show you the most common mistakes buyers in Singapore make — and how to avoid them smartly.

Let’s make sure you get the keys, not regrets.

1. Don’t Exercise OTP Before Your Loan Is Approved

You found the right flat, the seller agrees on the price… and now you’re ready to lock it in. But if you haven’t gotten your home loan approval yet, here’s one thing you shouldn’t do:

Don’t collect the Option to Purchase (OTP).

Once the seller issues you the OTP and you pay the option fee, the countdown begins. And if your financing isn’t sorted, one small mistake could cost you the unit — and your hard-earned money.

Let’s break it down.

1.1 Why you need an HLE or bank IPA before signing

In Singapore, home buyers typically choose between two types of loans:

- HDB loan (you’ll need an HLE letter)

- Bank loan (you’ll need an Approval-in-Principle, or IPA)

These documents confirm how much you can borrow — and they’re essential before you accept any OTP.

Why? Because sellers expect serious buyers. And without official loan approval, you’re just guessing what you can afford. With interest rates and home loan options in Singapore shifting regularly, guessing isn’t a good strategy.

💡 Expert tip: Always sort out your loan approval first, even if you think your finances are solid. Many rejections happen due to credit score issues, CPF limits, or TDSR miscalculations.

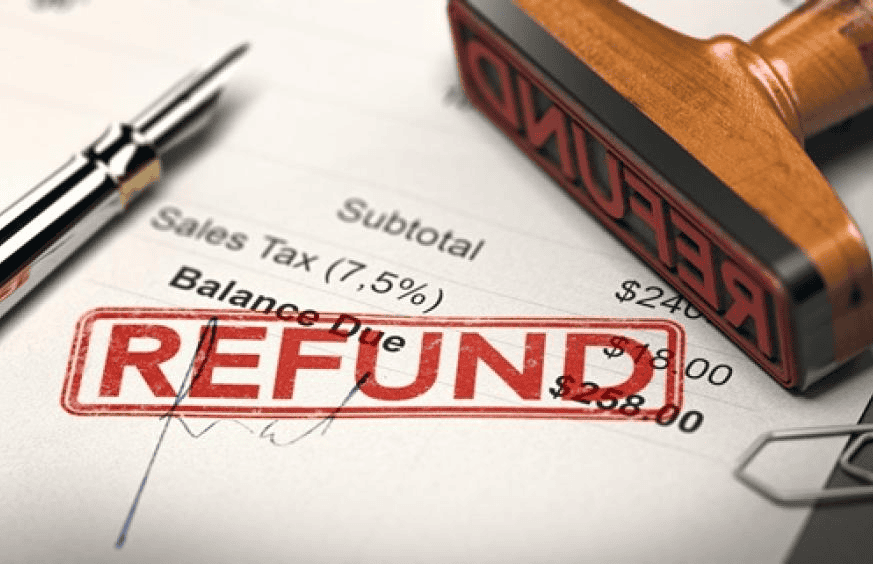

1.2 Real risk: loan rejection = lost option fee

Here’s the painful truth: if your loan gets rejected after you’ve collected the OTP, you’ll lose the option fee — no refunds.

For HDB flats, this fee can go up to $1,000. For private condos, it’s often 1% of the purchase price — easily over $10,000.

What Happens If You Collect the OTP Without Loan Approval

| Scenario | Outcome |

|---|---|

| Loan rejected after OTP | You forfeit the full option fee |

| Can’t meet cash or CPF portions | You can’t proceed — seller may relist flat |

| Need to back out suddenly | Restart the entire buying process |

That’s a lot of risk just to hold a unit for 21 days.

What to do instead: get financing sorted first

Here’s what to do before you collect any OTP:

✅ Apply for your HLE letter (if using HDB loan)

✅ Get an IPA from your chosen bank

✅ Use a mortgage loan repayment calculator to check affordability

✅ Confirm your CPF usage and cash savings

✅ Make sure you’re comfortable with the monthly repayments and interest rate

Once those boxes are ticked, then go ahead and collect the OTP confidently.

Because when your financing is sorted, you’re not just a hopeful buyer — you’re a prepared one.

Condo OTPs Work Differently — Here’s What to Know

Buying a private property or condo in Singapore? The Option to Purchase (OTP) works a little differently than HDB.

- The option fee is usually 1% of the purchase price (not $1,000).

- If you decide to go ahead, you’ll need to exercise the OTP by paying another 4%, making it a total of 5% upfront.

- The option period is typically 14 calendar days (instead of 21 for HDB), though you can negotiate for more time with the seller’s consent.

That’s a lot more money on the line — and less time to secure your bank loan. So if your mortgage loan isn’t ready, you risk forfeiting thousands.

Expert tip: Use a mortgage broker in Singapore to compare condo loan packages early. Many lenders offer preferential condo loan rates based on property type, tenure, and income profile.

2. Ignoring the 21-Day Deadline Can Cost You the Flat

When it comes to the HDB Option to Purchase (OTP), time is not on your side. From the moment the seller issues the OTP, the clock starts ticking — and you’ve got exactly 21 calendar days to exercise it.

Miss that deadline, and your option fee is gone. No appeal, no refund.

Many buyers assume they can just “handle it later” — but in practice, that mindset is how deals fall apart. Here’s what actually happens if you cut it too close (or worse, miss it altogether).

What happens if you miss the OTP expiry

If you don’t exercise the OTP by Day 21, it expires automatically — and the option fee, which can be up to $1,000 for HDB flats, is forfeited. No refund. No negotiation.

At that point:

- The seller can relist the flat or offer it to someone else

- You’ll have to start all over again — even if you already secured your HDB home loan

- Any time or money spent preparing for the deal is wasted

This is why the OTP deadline is one of the most common pitfalls for buyers who aren’t tracking their calendar closely.

Why last-minute submission is a risky move

Too many buyers wait until Day 20 or 21, thinking they’ll “settle everything quickly.” But here’s the reality — last-minute submissions are risky because:

- Your mortgage loan might still be pending approval

- CPF withdrawals might be delayed

- The seller may not respond in time to co-submit the resale application

And if just one step is late, everything falls apart — including your option fee.

💡 Buffer at least 3–5 days before Day 21 to avoid unnecessary panic.

How to plan your option period timeline

The key is to treat the option period like a project deadline. Block out time for each step and work backward from Day 21.

HDB OTP Timeline Planning Table (2025 Guide)

| Timeline | Recommended Action |

|---|---|

| Day 1 | Receive OTP & pay option fee |

| Days 2–7 | Lock in home loan (IPA or HLE), check CPF usage |

| Days 8–14 | Prepare exercise fee, documents & check BSD costs |

| Days 15–18 | Exercise OTP, pay balance deposit & submit HDB resale application |

| Days 19–21 | Final buffer days (use only if necessary) |

📌 Pro tip: Use digital calendar reminders to stay on track. Your timeline starts from the OTP grant date, not the day you remember to check.

3. Signing Without Reading the Fine Print

Let’s be real — nobody loves reading legal documents. But when it comes to the HDB Option to Purchase (OTP), skipping the fine print is one of the biggest buyer mistakes we see in Singapore.

The HDB OTP form looks standard and straightforward, but there are important clauses that directly affect your rights — and your money. If you sign without checking the details, you might be stuck with hidden costs or unfair conditions you didn’t agree to.

Here’s what to look out for before you put pen to paper.

What HDB buyers often overlook in the OTP form

Most buyers focus only on the sale price and option fee — but the devil is in the details. Some key things to double-check:

- Option fee amount: Must be within the legal range ($1–$1,000)

- Option expiry date: This is your countdown clock

- Exercise deadline: Confirm you can meet it comfortably

- Flat details: Double-check block, unit, and price figures for accuracy

You’d be surprised how many buyers miss basic errors like incorrect unit numbers — which can delay your HDB home loan approval or resale submission.

🧠 Quick tip: Always snap a photo of the signed OTP for your records — especially before handing it over.

Can the seller back out? What your rights really are

This one causes a lot of confusion: once the seller issues the OTP and collects your option fee, can they back out?

The short answer is: No — they can’t.

Once the OTP is issued, the seller is legally bound to hold the flat for you for 21 days. They’re not allowed to:

- Accept offers from other buyers

- Cancel the OTP unless you fail to exercise it

- Change the agreed price during the option period

If they do, you may have grounds to escalate the issue through HDB. That’s why it’s so important to understand your buyer rights and follow through with proper submission steps on the HDB Resale Portal.

Verbal promises ≠ legal protection — get it in writing

One of the most common mistakes? Trusting verbal promises.

We’ve heard stories like:

- “The seller said they’d leave the built-ins behind.”

- “Agent told me I could delay the OTP exercise.”

- “I was promised a valuation top-up later.”

Here’s the truth: If it’s not written in the OTP or resale documents, it doesn’t count.

Verbal agreements are not legally enforceable under HDB regulations — and if disputes arise, you’ll have nothing to fall back on. Always request that any special terms be included in writing or through your agent’s formal communication.

💡 Pro tip: If the seller agrees to include furniture or delay submission, make sure it’s reflected in writing on the resale application or supplementary agreements.

4. Paying More Than the Legal Option Fee Limit

When emotions run high and the flat seems perfect, some sellers (or agents) may “suggest” you put down more than the usual to secure the deal.

🚫 Don’t fall for it.

For HDB resale flats, the option fee is strictly capped at $1,000. Paying more — even if it’s “under the table” — is not only against HDB rules, but also puts you at legal and financial risk.

Here’s what every buyer in Singapore needs to know before handing over any cash.

Why the $1,000 limit matters (and what’s illegal)

The HDB Option to Purchase (OTP) is a government-regulated contract. Under current HDB policy, the option fee must be between $1 and $1,000 — nothing more.

If you pay anything above that, here’s what can happen:

- The resale application may be rejected

- HDB may investigate for unauthorised side payments

- You may have no legal way to recover the excess amount

📌 Reminder: Any amount paid beyond $1,000 is not protected by HDB and could be considered illegal consideration.

If you’re unsure whether the fee you’re being asked for is correct, check out the exact fee caps when using the HDB home loan or compare against what private properties require — where 1% of the purchase price is standard.

What to do if a seller pressures you for more

It’s surprisingly common for sellers to say:

- “Pay an extra $2,000 cash — off record — to reserve the flat.”

- “If you really want this unit, give me more upfront.”

This is where you need to stay firm.

Here’s how to respond:

- Politely decline and refer to HDB’s official $1,000 cap

- Insist that all payments go through official channels

- If pressured, walk away — there are always other units

💡 Don’t worry about losing the flat — any seller who breaks the rules could jeopardise their own transaction.

And if you’re unsure what’s fair, a mortgage advisor can guide you on what’s legally allowed before you proceed.

Always request receipts and written confirmation

Even if the option fee is within the legal range, always ask for written proof. This protects you in case anything goes sideways later on.

✅ Always collect:

- A signed OTP form

- A receipt for the option fee with date and amount

- Any communication with the seller or agent about payment terms

📌 Keep digital and physical copies of everything — especially if you’re using CPF or applying for a refinance HDB loan down the road.

🧠 Pro tip: If the seller refuses to provide a receipt, treat that as a red flag and consider reporting the issue to HDB.

5. Rushing Into It Without Agent or Legal Advice

We get it — buying property in Singapore is already expensive. So it might feel “smarter” to go DIY and save on agent or legal fees.

But here’s the truth: rushing into the Option to Purchase (OTP) without proper advice is how small errors turn into big regrets. And in real estate, mistakes aren’t cheap — they often cost thousands.

Whether you’re buying your first HDB flat or refinancing a condo, having a professional in your corner can protect your money, your rights, and your peace of mind.

Why DIY buyers make more OTP mistakes

Without professional help, buyers often:

- Overlook important clauses in the OTP

- Miss submission deadlines

- Get tripped up by valuation shortfalls or mortgage loan limits

You might think you’ve read everything carefully — but unless you’ve been through the process before, it’s easy to miss one small step that delays or derails your purchase.

💡 Think of it like assembling IKEA furniture — you can do it without the manual… but it’ll probably wobble.

What agents or brokers catch that you don’t

Property agents and mortgage advisors look at OTP documents and loan structures every single day. What takes you hours to research, they spot in minutes.

An experienced agent or broker can:

- Flag OTP terms that are risky or one-sided

- Advise on submission timelines, loan timing, and CPF planning

- Compare home loan rates in Singapore to get you the best deal before you commit

More importantly, they know what not to do — and can help you avoid getting penalised over technicalities like late exercise or overpayment of the option fee.

How a mortgage broker can help at zero cost

Here’s the best part: working with a mortgage broker in Singapore doesn’t cost you anything.

Unlike property agents, mortgage brokers are typically paid by the banks — not by you. That means:

- No extra cost

- No pressure to pick one loan over another

- Just honest, expert help to match you with the right financing

They’ll guide you through everything from loan comparison, to IPA approval, to refinancing down the road. And if you’re feeling overwhelmed by OTP documents, they can even link you up with legal support.

🧠 Bottom line: Going solo might save a few hundred upfront — but the cost of a wrong move is way higher. Get advice early.

6. Backing Out After Signing: What You Can (and Can’t) Do

Sometimes life throws you a curveball — job changes, loan issues, or just cold feet. If you’ve already received the HDB OTP and want to back out, you’re probably wondering:

Is it still possible? And how much will I lose?

This section breaks down exactly what happens if you decide not to proceed after accepting the Option to Purchase, what’s allowed under HDB rules, and what your options are if things go sideways.

Can you cancel after receiving the OTP?

Yes — but only if you haven’t exercised the OTP yet.

Once the seller issues the HDB OTP and you’ve paid the option fee, you technically have the right to walk away anytime during the 21-day option period. The seller is obligated to hold the flat for you, but you are not obligated to complete the deal — unless you formally exercise the OTP.

⚠️ However: If you back out, your option fee is non-refundable. That’s the price of changing your mind — and it’s written clearly in the OTP terms.

If you’re unsure whether you’re ready, it’s better to delay accepting the OTP than rush in. Tools like this mortgage loan repayment calculator can help you double-check your budget before you commit.

Will HDB ever refund your option fee?

In most cases — no. Once the seller collects your option fee, it’s considered a goodwill deposit to reserve the unit for you. If you decide not to proceed, the seller keeps the money.

Even if:

- You were unaware of a legal detail

- Your bank loan got delayed

- You changed your mind the next day

…the outcome is the same: the option fee is forfeited.

📌 That’s why it’s crucial to confirm your HDB loan approval or bank IPA before you even think about accepting the OTP.

Legit exceptions (job loss, loan rejection, etc.)

In rare cases, HDB may allow the deal to be withdrawn without heavy penalties — but only if you have clear, documented reasons.

Some recognised exceptions include:

- Unexpected job loss or retrenchment

- Sudden serious medical conditions

- Death of one of the buyers before exercising the OTP

- Loan rejection, despite multiple attempts

Even then, you’ll need:

✅ Official letters (e.g. from employer, doctor, or bank)

✅ A written explanation to HDB

✅ Proof that you acted in good faith

📌 Note: This doesn’t guarantee a refund — HDB reviews each case individually.💡 If you’re facing loan rejection after getting the OTP, consider reaching out to a mortgage broker who can help you explore alternative bank approvals quickly — before the OTP expires.

Final Checklist to Avoid Costly OTP Mistakes

If there’s one thing we’ve learned from helping countless Singapore buyers — it’s that OTP mistakes are always avoidable with the right prep.

This isn’t just about paperwork. It’s about protecting your deposit, your loan eligibility, and your peace of mind. So before you sign anything (or pay anyone), run through this quick checklist to make sure you’re not missing a critical step.

Confirm loan approval before collecting OTP

Whether you’re applying for an HDB home loan or going with a bank loan, always secure your HLE or IPA before accepting the OTP.

Why it matters:

- Ensures your budget is realistic

- Prevents forfeiting your option fee due to loan rejection

- Speeds up your resale or condo transaction timeline

💡 Use a mortgage loan calculator to check how much you can safely borrow based on your monthly income and CPF.

Track all OTP deadlines and milestones

Set digital calendar alerts the moment you receive the OTP. Your 21-day countdown begins on the date of issuance, not the date you remember to act.

Track these milestones:

- Day 1: Received OTP and paid option fee

- Day 7: Financing and CPF checks completed

- Day 14–18: Ready to exercise the OTP and submit paperwork

- Day 21: Final deadline — no excuses

📌 Delays cost money. And in some cases, your dream flat.

Don’t sign until every clause is double-checked

Never assume that a standard HDB OTP form is “just boilerplate.” Double-check:

- Option fee amount and expiry date

- Flat details and address

- Any verbal agreements written into the terms

- Seller’s name and NRIC details

And if anything looks confusing? Don’t sign. Ask your property agent or get a second opinion from a mortgage advisor in Singapore who deals with OTP terms regularly.

🧠 No one ever regrets checking too carefully — but many regret rushing.

Avoiding OTP Mistakes Can Save You Thousands — Here’s Your Next Step

Buying a flat in Singapore is a huge milestone — but rushing through the Option to Purchase (OTP) process can lead to costly, stressful mistakes. From missing the 21-day deadline to paying more than the legal option fee or skipping your loan approval, these errors are easy to avoid once you know what to look out for.

So before you collect that OTP, take a deep breath and do it right.

✅ Double-check your loan approval or IPA

✅ Read every line of the OTP — not just the price

✅ Track your submission dates

✅ Never agree to shady cash top-ups

✅ And when in doubt? Get expert help

Whether you’re applying for an HDB home loan, checking out DBS mortgage rates, or exploring refinance options, our experienced mortgage advisors in Singapore are here to help — at no cost to you.