Buying a flat with your parents or siblings isn’t just about splitting the cost — it’s about building a life together. Whether you’re supporting ageing parents, co-investing with your sibling, or securing a family home, it’s a big commitment. But here’s something many families overlook: what happens if something unexpected happens to one of you?

Even though home loan rates have stabilised in 2025, they’re still not low. If something happens to you, your family might struggle with repayments. That’s why having mortgage insurance — like HDB’s HPS or a private plan — is more important than ever.

This guide walks you through how to protect every co-owner properly, so your family home stays safe, no matter what life brings.

Why Insurance Is a Must When Buying a Flat with Family

Buying a flat with your parents or siblings might feel safe — you trust each other, you’re sharing the load. But life happens. And in 2025, with rising mortgage interest rates in Singapore, the risk is bigger than many realise. One illness, accident, or sudden passing — and the full weight of the home loan in Singapore could fall on just one person.

That’s where mortgage insurance (like HDB’s HPS or private MRTA) becomes essential. It’s not about being dramatic — it’s about making sure your loved ones aren’t left scrambling to repay the loan on their own.

What if one co-owner passes away — who pays the remaining loan?

Let’s say you and your sibling take a mortgage loan in Singapore together. You split the payments — everything’s fine. But if one of you passes away unexpectedly, the other doesn’t just pay “their half.” They’re now responsible for the full monthly home loan repayment.

Even worse, the bank won’t care if that surviving co-owner earns less or wasn’t the main borrower.

💡 Tip: If you’re using a bank loan instead of HDB, be sure to consider a private mortgage insurance plan — something not everyone realises they need.

👉 Check your repayment amount using this mortgage loan repayment calculator.

How a sudden disability can put your family flat at risk

It’s not just death — disability is another major risk. If one co-owner suffers a stroke, accident, or long-term illness, they may no longer be able to earn. But the monthly mortgage repayments still need to be made.

With no insurance in place, the remaining family member has to cover the entire housing loan in Singapore — while also managing medical bills or caregiving.

This is especially risky if you’re co-owning with elderly parents or someone with irregular income.

Why CPF and legal ownership alone don’t fully protect your loved ones

A common myth: “I used CPF, so I’m covered.” Not true.

- CPF helps you pay the loan, but doesn’t waive anything if you pass away or become disabled.

- Being listed as a legal co-owner means you share the asset — but also the liability.

Without proper coverage, your family could be left holding the bag.

What CPF, Legal Ownership, and Mortgage Insurance Actually Cover

Before you rely on CPF or your name on the title deed — here’s how each component stacks up.

Comparison of Protection Tools When Co-Owning a Flat in Singapore

| Tool | What It Helps With | What It Doesn’t Cover |

|---|---|---|

| CPF Housing Usage | Pays your share of monthly instalments | Doesn’t clear loan if you pass away or become disabled |

| Legal Co-Ownership | Grants ownership rights to multiple people | Doesn’t protect others from taking on your loan portion |

| Mortgage Insurance (HPS/private) | Pays off outstanding home loan if you die or become disabled | Doesn’t apply if coverage is lapsed or insufficient |

🧠 Bottom line? Only proper mortgage insurance actually protects the co-owners from financial fallout.

If you’re unsure whether your current plan is enough, speak to a Singapore mortgage broker for personalised advice. It’s the easiest way to protect your family’s peace of mind.

HDB Home Protection Scheme (HPS) — What It Covers and Misses

Many Singaporeans think they’re automatically protected just because they’re using CPF for their HDB home loan. But that’s not always true.

The Home Protection Scheme (HPS) is a mortgage-reducing insurance plan by CPF Board that’s only compulsory if you’re using CPF savings to repay your HDB loan. It covers the outstanding loan if the insured owner dies, becomes terminally ill, or permanently disabled. Sounds solid, right?

But here’s the catch — HPS doesn’t apply to everyone, and it’s easy to be under-covered without realising.

Who is covered under HPS — and when you might be excluded

You’re only covered under HPS if:

- You’re repaying an HDB loan using CPF Ordinary Account (OA) funds

- You’ve applied and been medically accepted for HPS

- You maintain your premiums through CPF deductions

If you’re using cash, bank loans, or private property loans, HPS won’t apply at all.

Even for HDB buyers, exclusions can happen. If you:

- Failed HPS medical underwriting

- Forgot to accept coverage terms

- Lapsed on premiums without topping up CPF

…you might think you’re covered when you’re not.

💡 Tip: Always double-check your HPS status via My CPF or consult a Singapore mortgage broker to be sure.

What happens if HPS coverage lapses or isn’t enough

HPS premiums are auto-deducted from your CPF OA. But if you switch jobs, take a CPF break, or your OA balance runs low — coverage can lapse without warning.

Also, HPS only covers your declared share of the loan. So if you and your sibling each cover 50%, and one of you passes away, only half the loan is cleared. The rest is still payable by the surviving co-owner.

Even if you think you’re insured under HPS, these gaps could leave your family vulnerable.

Top Reasons Why HPS May Fail to Fully Protect Your Family

| HPS Gap | What It Means for Co-Owners |

|---|---|

| Coverage lapse due to low CPF OA | Insurance quietly ends — without alerting other owners |

| Coverage only matches your loan share | Surviving co-owner pays the rest if you pass away |

| Medical rejection or non-activation | You’re not covered at all, even with CPF repayments |

🧠 Always check your HPS coverage percentage and tenure — it should match your loan terms and ownership share. If not, you could be underinsured without realising it.

Should you opt out of HPS and get private coverage instead?

You can apply to be exempted from HPS — but only if you have approved private insurance that matches or exceeds HPS standards.

This is a smart move if:

- You want better control over payout structure (e.g. payouts to family, not HDB)

- You’re buying a flat with older parents or siblings who aren’t CPF-contributing

- You want consistent coverage even after age 65 (HPS coverage ends there)

Some people prefer mortgage reducing term assurance (MRTA) from insurers or level term life insurance — especially if they’re using bank loans instead of HDB loans.

👉 Learn more about the pros and cons in our guide to refinance HDB loan or explore a DBS home loan with flexible insurance pairings.

Private Mortgage Insurance — A Better Fit for Some Families

Using a bank home loan or paying cash for your HDB flat? Then HDB’s Home Protection Scheme (HPS) may not apply — or may not be enough. That’s where private mortgage insurance in Singapore comes in.

In 2025, more families are co-owning flats, and with mortgage loan rates rising, protecting everyone involved is a must. Private plans give you more control, better flexibility, and a safety net beyond CPF.

MRTA vs Level Term: which makes more sense for shared flats?

If you’re co-owning a flat with family, choosing between MRTA and level term insurance comes down to your priorities:

- MRTA (Mortgage Reducing Term Assurance): Cheaper, and the payout reduces over time — tracking your loan balance.

- Level Term Insurance: Slightly higher premium, but payout stays fixed. Great if you want flexibility to support surviving family, not just repay the bank.

Comparing MRTA vs Level Term Insurance for Co-Owners

Here’s a breakdown of how each option works — and when each makes sense for families co-owning a flat.

Comparison of MRTA vs Level Term Insurance for Singapore Co-Owners

| Feature | MRTA (Mortgage Reducing Term) | Level Term Insurance |

|---|---|---|

| Payout size | Decreases over time (matches loan) | Stays the same throughout |

| Premium | Usually lower | Slightly higher |

| Best for | Covering the loan balance | Supporting dependents or sharing among co-owners |

| Payout recipient | Usually goes to the lender | Goes to your named beneficiaries |

| Portability | Tied to the loan (non-transferable) | Independent of loan (can cover multiple assets) |

💡 Expert tip: If you co-own with siblings or ageing parents, a level term plan may give your family more flexibility during a crisis.

Can you get one policy to cover both parent and child?

Yes — some insurers offer joint-life insurance plans, which insure two people under one policy (e.g. parent and child). The payout is triggered on the first death or disability, helping the surviving co-owner avoid full loan responsibility.

However, be aware:

- Both lives must be insurable (some insurers set age limits)

- The policy ends after the first claim (you’ll need to re-insure after)

- For tenancy-in-common, ownership shares must be considered when deciding how much coverage each person needs

If you’re unsure what works best for your family, a mortgage broker in Singapore can help compare joint plans vs individual coverage.

How private insurance payouts can help your surviving family directly

Here’s one of the biggest advantages of private plans: you choose who gets the money.

Unlike HPS, which pays directly to HDB to settle the loan, a private mortgage insurance payout goes to your beneficiary. That means your family can choose to:

- Pay off the loan entirely

- Cover a portion and keep the rest for living expenses

- Hold the flat while working out the best next steps

This is especially helpful if you:

- Co-own with someone not working (e.g. elderly parent)

- Want flexibility on whether to sell or keep the home

- Have dependents relying on you beyond just housing

👉 If you’re using a DBS home loan or UOB mortgage with family, ask about pairing it with a suitable insurance plan. You can explore your bank options here:

Choosing the Right Insurance Setup for Parents & Siblings

When you’re co-owning a flat with family, there’s no one-size-fits-all insurance plan. Your coverage setup should reflect your loan structure, ownership shares, and the financial responsibilities of each co-owner.

In Singapore, it’s common to see siblings sharing a flat equally — or adult children co-signing with ageing parents. The right insurance setup depends on who’s contributing to the home loan repayment, and who needs the protection most if something unexpected happens.

One joint policy vs separate policies — what protects who?

Some insurers allow joint-life mortgage insurance, which covers two owners under one policy. It pays out once — on the first death or permanent disability — then the policy ends.

Joint policies work well when:

- Both owners are equally responsible for the loan

- You want a simple, shared coverage solution

- You’re co-owning under joint tenancy

Separate policies may be better when:

- Co-owners have different financial stakes or ages

- You want coverage to match ownership shares

- You’re under tenancy-in-common, with distinct shares

💡 Tip: If your parents are retired or not contributing to the mortgage, a joint policy may leave the working owner under-protected. In this case, separate coverage is usually safer.

Should insurance match the loan amount or each person’s share?

This is a common question — and an important one.

- If you and your sibling are splitting the mortgage loan in Singapore 50/50, it’s fair to each insure half.

- But if one person is shouldering more of the repayment, their coverage should reflect that.

Here’s a guide to help:

Recommended Mortgage Insurance Coverage Based on Ownership and Repayment Setup

| Ownership & Repayment Setup | Recommended Coverage |

|---|---|

| Equal ownership + equal repayment | 50% each |

| Unequal ownership + unequal repayment | Match each party’s repayment share |

| One person pays 100%, other is passive owner | One person insures full loan |

✅ Use this mortgage loan repayment calculator to figure out how much each co-owner is liable for — then match your insurance accordingly.

How to split premiums fairly across co-owners

Whether you go with a level term plan or MRTA, someone’s got to pay the premiums — and it should reflect the benefit each person receives.

- For joint policies, premiums are shared equally — unless otherwise agreed.

- For separate plans, each co-owner pays for their own policy (or reimburses whoever covers it upfront).

If one party is gifting their share (e.g. a parent helping a child buy a home), they may choose not to be covered at all — or let the working owner pay full coverage to protect their investment.

💡 Pro tip: Always document informal agreements about premium payments — especially if ownership is split under tenancy-in-common.

The key takeaway? Insurance should reflect reality — not just what’s on the title deed.

If you need help figuring out how to structure your policy setup, a Singapore mortgage broker can break it down clearly, and help match it to your home loan in Singapore.

Coordinating Ownership with Insurance to Avoid Gaps

You might already have insurance — but if your ownership or CPF setup isn’t structured correctly, your family could still lose the flat. This is where many Singapore buyers get caught off guard.

It’s not just having a policy. It’s making sure your ownership type, CPF usage, and insurance coverage all work together. Because in real-life situations — like a death or dispute — poor coordination can unravel even the best intentions.

How joint tenancy and tenancy-in-common affect your protection

These legal structures might sound technical, but they carry big implications when something goes wrong.

- Joint Tenancy: All co-owners own the entire flat equally. If one passes away, their share automatically goes to the surviving owner(s) — no need for a will.

- Tenancy-in-Common: Each co-owner holds a fixed percentage. Their share becomes part of their estate if they pass — and doesn’t automatically go to the others.

Now, why does this matter for insurance?

If you’re under joint tenancy, a joint-life mortgage insurance policy makes sense — the surviving owner receives the benefit and keeps the flat.

But with tenancy-in-common, you must ensure:

- Each person’s insurance matches their loan share

- Estate planning (like a will or nomination) is done — or the deceased’s share could go to unintended heirs

💡 Tip: If you’re not sure what structure you’re under, you can check your flat’s title deed via HDB or your law firm.

Why your CPF usage must align with your insurance plan

Many owners use CPF to repay their HDB loan or bank loan in Singapore — but forget how it affects insurance.

If you’re using CPF:

- You’re usually auto-enrolled into HDB’s Home Protection Scheme (HPS)

- But if you opt out of HPS and use a private mortgage insurance, you must apply for exemption

And if you’re using cash only, you’re not automatically insured at all.

The biggest danger? You think you’re covered, but you’re not — or your HPS coverage doesn’t fully match your loan.

👉 Use this mortgage loan repayment calculator to find out how much of the loan is still at risk — then review if your current insurance is sufficient.

What happens to your share if you didn’t nominate anyone?

If you’re using tenancy-in-common and pass away without a will or nomination:

- Your share goes into your estate

- Surviving co-owners may need to buy it over or sell the flat

- If CPF was used, your share of the flat may be sold to refund your CPF account

In contrast, under joint tenancy, your share auto-transfers — but only if it hasn’t been severed.

CPF Nomination also matters. If there’s no CPF nomination, the payout goes through the Public Trustee, which delays funds and causes stress for loved ones.

Common Ownership Mistakes That Risk Flat Loss in Co-Owned Homes

| Mistake | What Could Happen |

|---|---|

| Tenancy-in-common + no will | Share may go to unintended beneficiaries |

| CPF used + no HPS or private cover | Surviving owner left with full loan liability |

| Private insurance but no nomination | Payout delays, legal disputes, or frozen funds |

🧠 Moral of the story? Your legal setup, CPF usage, and insurance must work hand-in-hand — or someone you love could end up paying the price.

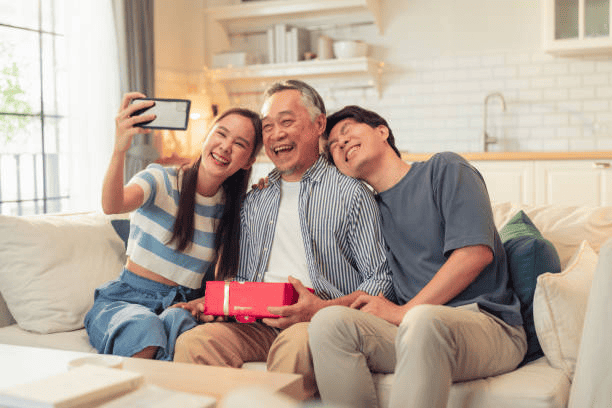

Family Scenario: Protecting a 3-Owner Flat the Smart Way

Let’s bring everything together with a real-life scenario many Singaporean families can relate to: a flat co-owned by a parent and two adult children.

Co-owning with family sounds simple — but if insurance and ownership aren’t aligned, things can get messy fast. This case study shows how one family nearly got it wrong… and how they turned it around.

How this family split their insurance based on loan share

Meet the Tans — a single-family household with:

- Mr Tan (retired father)

- Alicia (eldest daughter, 35)

- Ben (younger son, 32)

They bought a 5-room resale flat as tenants-in-common, splitting loan ownership:

- Alicia: 50%

- Ben: 40%

- Mr Tan: 10% (added for eligibility, didn’t contribute financially)

Initially, they assumed HDB’s Home Protection Scheme (HPS) had them covered. But after reading up on how HPS works, Alicia realised two major issues:

- Mr Tan was excluded from HPS due to health reasons

- The siblings’ coverage didn’t total 100% of the loan

This meant that if something happened to Ben, Alicia would suddenly shoulder 60% of the loan on her own.

What went wrong before they added a joint-life rider

The Tans had no clear strategy — just assumptions. That changed when Ben was retrenched.

Realising the financial risk, Alicia consulted Ace Mortgage’s blog on mortgage insurance in Singapore and discovered the benefit of using level term insurance with joint-life riders for family co-owners.

They switched out of HPS and:

- Bought private level term plans matched to their loan shares

- Added a joint-life rider between Alicia and Ben for added flexibility

- Confirmed the new coverage exceeded the loan balance so they could apply for HPS exemption properly

They also referred to the HPS opt-out process article to ensure their exemption was approved smoothly.

Key takeaways: policy setup, costs, and lessons learned

Here’s what the Tans learned — and what every multi-owner flat should review.

Lessons from a 3-Owner Family Flat: What to Watch When Setting Up Insurance

| Problem | Fix They Applied | Lesson Learned |

|---|---|---|

| HPS didn’t cover all owners | Switched to level term + joint rider | Check coverage gaps, especially for parents |

| Unequal loan responsibilities | Matched policy sum to each person’s loan share | Fair doesn’t mean equal — match liability |

| Flat share not protected in estate | Set up CPF nominations + tenancy-in-common will | Don’t leave ownership transfers to chance |

💬 “We almost left a 30% gap uncovered — thinking CPF and HPS took care of everything,” Alicia shared. “Thank goodness we double-checked.”

💡 Planning tip: If your parents are only on the flat for eligibility, consider covering the full loan between siblings. You’ll avoid awkward payout complications later.

Final Steps to Protect All Co-Owners in 2025

If you’ve made it this far — well done. Co-owning a home with your parents or siblings is a big responsibility, and protecting everyone with the right mortgage insurance in Singapore is how you turn good intentions into actual security.

Here’s a simple, no-fluff checklist to get your flat — and your family — fully covered.

Confirm your loan, CPF, and insurance are all in sync

Start by checking:

- Who’s actually paying the home loan in Singapore (via CPF or cash)

- How much of the loan is still outstanding (you can use this calculator)

- Whether HPS or private coverage matches each co-owner’s loan share

Many people assume CPF usage = automatic protection. That’s not always true.

Refer to this guide: Maximise Your HDB Budget with the Right CPF Housing Grants — it breaks down how CPF works with housing, grants, and protection schemes like HPS.

Apply for HPS or get a private plan that fits your structure

If you’re using CPF and have no health issues, HPS may be the simplest route. But if:

- You’re using a bank loan for HDB or private property loan

- One co-owner is much older or retired

- You want payout flexibility for surviving family

…then a private plan (e.g. MRTA or level term with a joint rider) might be better.

Ace has a full article on how to opt out of HPS if you’re going the private route.

💡 And if you’re still choosing a bank, compare options across:

Each may pair better with different types of insurance or repayment terms.

Review your ownership and insurance yearly — before it’s too late

Life changes — someone changes jobs, gets married, or stops contributing to the loan. That’s why you should review your setup at least once a year:

- Is everyone’s ownership share still accurate?

- Are you still using CPF — or has someone switched to cash?

- Does your insurance still match your loan?

If your flat is under tenancy-in-common, make sure you also have a valid will or CPF nomination in place.

Protecting your flat is one thing. Protecting your family from hard decisions — that’s next-level planning.

Why Mortgage Insurance Is the Key to Protecting Shared Homeownership in Singapore

Mortgage insurance isn’t just a formality. It’s your safety net — and the only thing standing between your family and a forced sale, should something go wrong.

Need a clear next step? Start by speaking with someone who understands family co-ownership. Get advice that covers home loans, insurance, and estate planning all in one place — with no guesswork.

👉 Explore more tips on the Ace Mortgage blog or reach out for personalised guidance.