Planning to buy a flat this year? You’ll want to catch up on the latest HDB changes first.

In 2025, HDB introduced new rules, updated grant amounts, and stricter eligibility checks — all of which could affect your application. Whether you’re buying your first BTO, upgrading, or applying as a single, these updates matter.

Not sure where to start? Don’t worry — we’ll walk you through everything, nice and easy.

What Are the Latest HDB Rules Introduced?

If you’re planning to buy a flat this year, it’s not just about picking a good location anymore — HDB’s new rules in 2025 have completely changed how the game is played.

What were the major policy changes announced in 2025?

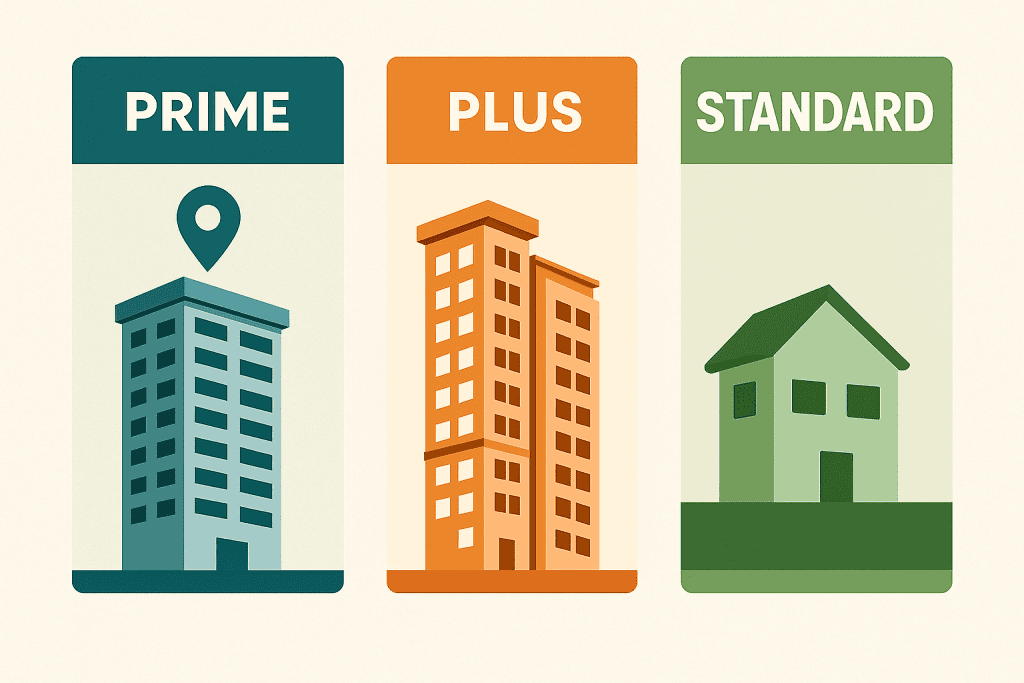

1. New Flat Categories: Prime, Plus, and Standard

To help you make sense of the changes, here’s a quick comparison of the new Prime, Plus, and Standard flat categories introduced under the 2025 HDB rules. Each type comes with different eligibility requirements, resale conditions, and grant implications.

HDB now classifies BTOs into three groups:

Comparison of Prime, Plus & Standard HDB Flats Under 2025 Rules

| Flat Type | Minimum Occupation Period (MOP) | Resale Restrictions |

|---|---|---|

| Prime | 10 years | Subsidy clawback, income ceiling for resale |

| Plus | 10 years | No renting out entire unit, eligibility filters |

| Standard | 5 years | Normal resale rules apply |

Related: Learn more about flat types on HDB’s official site.

2. HFE Letter is Now Mandatory

Before you can apply for any flat, you’ll need the new HDB Flat Eligibility (HFE) letter. It checks:

- Your eligibility to buy

- How much loan you qualify for (HDB or bank)

- What grants you can get

💡 Tip: Don’t wait till the BTO launch week — your HFE letter application can take up to 21 working days.

🧮 You can also use our mortgage loan calculator to estimate your instalments before getting your HFE letter.

Who do these new HDB rules apply to — existing or future buyers?

The new rules apply mainly to:

- All BTO launches from 2025 onward

- Resale flats in Prime and Plus locations

- Anyone applying for grants under the updated structure

Already own a flat? You’re not directly affected unless you plan to sell and buy again — especially in a newly classified estate.

📌 Tip: If you’re upgrading soon, it’s best to check your HDB home loan or refinance options early to avoid last-minute surprises.

What is the goal behind the 2025 HDB policy overhaul?

In one word: fairness.

HDB’s goal is to keep housing inclusive and sustainable, especially in popular towns. The new classification model helps curb flipping and keeps public housing for real homeowners, not just profit-seekers.

The required HFE letter also adds clarity — letting you see what flat type, grant, and loan you’re eligible for upfront.

Expert note: We’ve seen many buyers surprised by how these changes impact their financing options — reviewing the latest home loan rates in Singapore early can help you plan with more confidence.

The Prime, Plus, and Standard Model Explained

With the 2025 changes, HDB no longer treats all flats the same. The new Prime, Plus, and Standard classification system affects where you can buy, how long you need to stay, and what happens when you sell.

Understanding these differences is key — especially if you’re choosing between a central launch and a non-mature estate.

What defines Prime, Plus, and Standard flats?

Here’s a simplified breakdown:

- Prime flats

- Located in central, highly desirable estates

- Heavily subsidised, but come with resale restrictions

- 10-year MOP, subsidy clawbacks on sale

- Located in central, highly desirable estates

- Plus flats

- Found in attractive areas outside the city centre

- Slightly fewer restrictions than Prime, but still more than Standard

- 10-year MOP, moderate resale controls

- Found in attractive areas outside the city centre

- Standard flats

- Typical BTOs in most estates

- Usual 5-year MOP, no extra resale conditions

- Open to all eligible buyers

- Typical BTOs in most estates

🏷️ For detailed descriptions, check HDB’s flat classification explainer.

How does this affect resale restrictions and MOP periods?

Here’s where things get serious. If you’re eyeing a Prime or Plus flat, you’ll need to be ready for a longer commitment.

Comparison of Prime, Plus & Standard HDB Flats Under 2025 Rules

| Flat Type | Minimum Occupation Period (MOP) | Resale Restrictions |

|---|---|---|

| Prime | 10 years | Subsidy clawback, income ceiling for resale |

| Plus | 10 years | No renting out entire unit, eligibility filters |

| Standard | 5 years | Normal resale rules apply |

💡 Planning to upgrade in future? Prime and Plus flats may limit your flexibility. Consider your long-term goals before committing.

Which towns and projects fall into each category?

Here’s a rough guide based on current classification trends:

- Prime: Queenstown, Bukit Merah, Kallang/Whampoa, and future Greater Southern Waterfront launches

- Plus: Areas near MRTs, popular schools or key hubs — like Bidadari, Bishan, or Tampines Central

- Standard: All other BTOs in towns like Woodlands, Yishun, Choa Chu Kang, Sembawang, etc.

This list evolves with each launch. You’ll know the classification during the BTO exercise — or you can check past examples via the HDB BTO portal.

🔍 Considering alternatives with fewer restrictions? You can also explore options like a private property loan or compare condo loan financing for long-term flexibility.

New HDB Grants in 2025: What You Can Still Claim

With property prices climbing, every dollar counts — and the good news is, HDB grants are still available in 2025. Whether you’re buying a BTO flat or going the resale route, understanding which CPF housing grants you qualify for can make a huge difference in affordability.

Let’s break it down clearly, starting with the big one: EHG.

What is the Enhanced CPF Housing Grant (EHG) in 2025?

The Enhanced CPF Housing Grant (EHG) remains the main grant for first-time buyers. It’s based on your household income — and can go up to $80,000.

✅ You must be employed for at least 12 months

✅ Your monthly household income must not exceed $9,000

✅ It applies to both BTO and resale flats

✅ The grant amount scales with income — the lower your income, the higher the grant

🧠 Note: Unlike older grants like AHG and SHG, the EHG is meant to be simple, needs-based, and universal.

You can find full eligibility criteria on the HDB EHG page.

How do HDB grants differ for BTO vs resale flats?

Before you decide between a BTO or resale flat, it’s important to understand how the available housing grants differ. While both options offer the Enhanced CPF Housing Grant, resale buyers can qualify for additional grants — which may offset higher resale prices.

Comparison of HDB BTO vs Resale Flat Grants Available in 2025

| Grant Type | BTO Buyers | Resale Buyers |

|---|---|---|

| Enhanced CPF Housing Grant (EHG) | ✅ Yes | ✅ Yes |

| Family Grant | ❌ Not applicable | ✅ Up to $80,000 |

| Proximity Housing Grant | ❌ Not applicable | ✅ Up to $30,000 |

The resale route gives you more stacking options, but the price per sq ft is usually higher.

If you’re still unsure which route works better for your budget, you can explore home loan options tailored to each scenario.

Can you stack or combine grants as a couple or family?

Yes — and that’s how many buyers make their flat much more affordable.

Here’s how it works:

✅ First-timer couples buying resale can combine:

- EHG (up to $80,000)

- Family Grant (up to $80,000)

- Proximity Housing Grant (up to $30,000)

That’s a potential $190,000 in total grants — straight into your CPF OA for flat payment.

✅ Married couples or fiancé/fiancée schemes also qualify

✅ Singles can get grants too (though lower amounts)

💡 Tip: Your HFE letter will include your estimated grant eligibility. Not sure how it affects your loan? Use our mortgage loan repayment calculator to test different grant scenarios.

Flat Eligibility Criteria Under the 2025 Rules

You may want a flat — but can you actually buy one? Under the updated HDB eligibility rules in 2025, it’s now tougher for some groups to qualify. From income ceilings to marital status checks, these requirements decide what type of flat you can apply for, and whether you’re eligible for housing grants or loans.

Let’s break it down clearly.

What are the income ceilings for BTO and resale?

HDB uses income ceilings to decide who qualifies for public housing and related grants.

HDB Income Ceiling Requirements for BTO & Resale Flats (2025)

| Flat Type | Income Ceiling (Monthly Household Income) |

|---|---|

| BTO (Standard/Plus) | $14,000 for families / $7,000 for singles |

| BTO (Prime) | $14,000 strictly enforced (no exceptions) |

| Resale Flat | $14,000 to qualify for grants, but no cap if no grants used |

Before you start planning, make sure your household income falls within the required range. This affects grant eligibility, HFE letter approval, and loan limits.

🔎 Not sure where you stand? Read more about the HFE letter here to understand your eligibility before applying.

How does citizenship, marital status, and age affect eligibility?

Your personal profile matters more than ever in 2026. Here’s how:

- Singaporean Citizens can buy BTO flats. PRs can only buy resale flats — and only with another PR or a citizen spouse.

- Unmarried individuals under 35 generally can’t buy BTOs (unless applying under special schemes like Orphans or Joint Singles).

- Married couples and fiancé/fiancée pairs can apply together — but must register their marriage by key collection for BTO flats.

- Singles aged 35 and above can buy 2-room Flexi flats (BTO or resale) on their own.

🧠 Tip: If your profile is borderline, get your HDB Flat Eligibility (HFE) letter early — it confirms what you can (and can’t) apply for.*

What are the current rules for singles and divorced applicants?

2026 rules continue to give singles and divorcees access to flats — but with caveats.

👤 Singles:

- Must be Singaporean and at least 35 years old

- Can buy 2-room Flexi BTOs in non-mature estates

- Can also buy resale flats of any size (subject to income and grant criteria)

💔 Divorced Applicants:

- Must wait 3 years after divorce to apply for another BTO (unless they’re awarded full care of children)

- May retain their matrimonial flat if eligible

- Grant eligibility is re-assessed from scratch

📌 If you’re unsure about your options, it’s worth checking housing loan comparison tools or speaking to a mortgage advisor who understands complex cases.

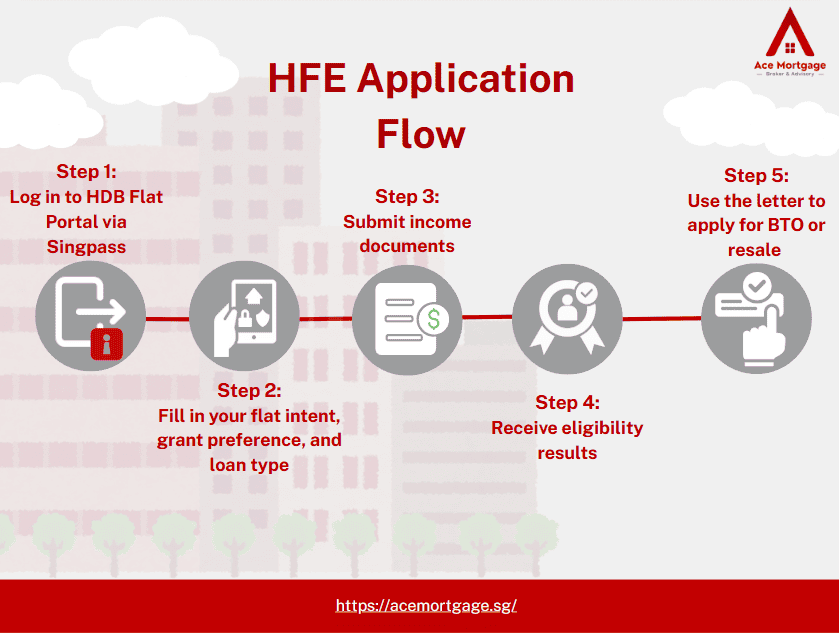

The HFE Letter: Now Mandatory for Every Flat Buyer

Starting from May 2023, the HDB Flat Eligibility (HFE) letter is a must-have before you can apply for a flat. Think of it as your all-in-one checkpoint — it tells you upfront if you’re eligible for a flat, a loan, and any CPF housing grants.

In 2026, it’s not optional — you won’t even be allowed to book a flat without it.

What does the HFE letter cover?

The HFE letter replaces the old HLE (Home Loan Eligibility) letter and streamlines three checks into one:

✅ Flat eligibility (e.g. citizenship, age, income ceiling)

✅ Grant eligibility (e.g. Enhanced CPF Housing Grant, Family Grant)

✅ Loan eligibility — including both HDB loan and bank loan options

📌 In short: it tells you what type of flat you can buy, what grants you qualify for, and how much loan you’re allowed to take.

How to apply for your HFE and what documents to prepare

You’ll need to apply through the HDB Flat Portal. Here’s what to have ready:

- Singpass login

- Latest payslips or CPF contribution history

- IRAS Notice of Assessment

- Supporting documents for bonus income (e.g. commissions, part-time work)

If you’re applying with a co-applicant (e.g. spouse or fiancé), both parties must submit their income and ID documents.

📝 Tip: The more complete your documents, the faster the HFE processing.

How long is the HFE letter valid — and when should you apply?

The HFE letter is valid for 6 months from the date of issue. But don’t wait till the BTO or SBF exercise is announced — apply early so you don’t miss out.

Apply at least 3–4 weeks in advance, especially if you have variable income or complex financials. Processing times vary, and incomplete submissions can delay your eligibility.

🔍 Already applied? Use this time to check your estimated home loan repayment amount and plan your flat budget confidently.

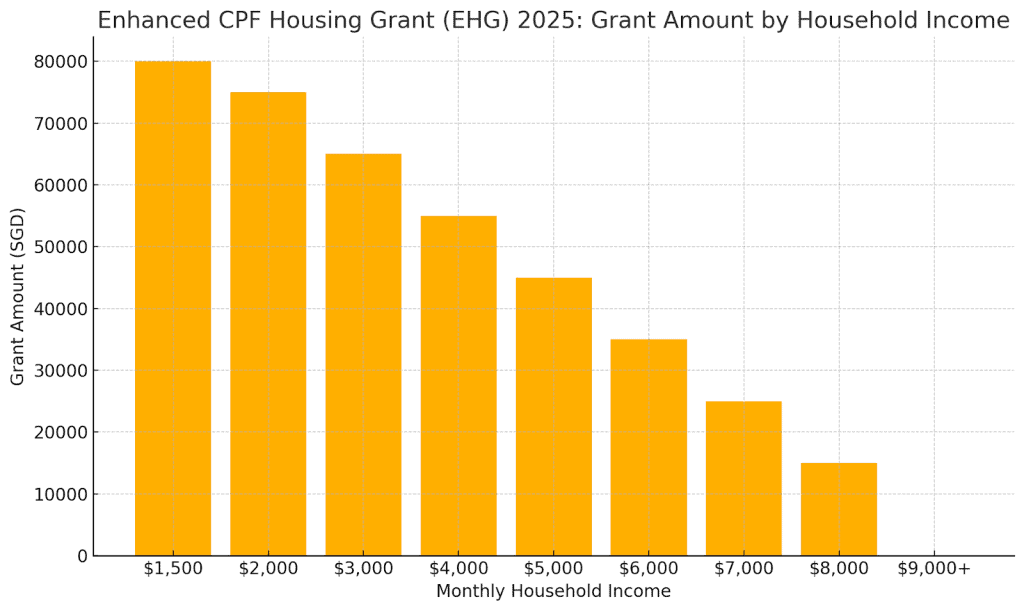

Grants vs Income: How Much Can You Really Get?

In 2026, your income isn’t just a number on your payslip— it determines how much grant support you receive and how much loan you’re eligible for. The more you earn, the less CPF housing grant you’ll receive — and the stricter your loan caps will be under MSR and TDSR rules.

Let’s look at how it all ties together.

What income range qualifies for maximum grant amounts?

The Enhanced CPF Housing Grant (EHG) is the key grant that adjusts based on income. Here’s how it scales:

Before the table, here’s a short explainer:

The lower your household income, the higher your grant — up to a maximum of $80,000. Once you cross $9,000, you no longer qualify for EHG.

EHG Grant Amounts Based on Monthly Household Income (2025)

| Monthly Household Income | EHG Grant Amount |

|---|---|

| $1,500 and below | $80,000 |

| $2,001 – $3,000 | $65,000 |

| $3,001 – $4,000 | $50,000 |

| $4,001 – $5,000 | $35,000 |

| $5,001 – $6,000 | $20,000 |

| $6,001 – $7,000 | $10,000 |

| $7,001 – $9,000 | $5,000 |

| Above $9,000 | Not eligible |

🧮 Not sure where you fall? Run a quick estimate using our mortgage loan repayment calculator to check your affordability after applying your potential grant.

How does MSR and TDSR limit your loan eligibility?

Even if your income is grant-eligible, your monthly loan repayment limits are controlled by:

- MSR (Mortgage Servicing Ratio): Max 30% of gross monthly income (for HDB flats)

- TDSR (Total Debt Servicing Ratio): Max 55% of income, including all debts (for private or ECs)

This means if you earn $6,000/month:

- Max $1,800/month can go to an HDB mortgage (MSR)

- But if you have a car loan or student loan, TDSR could cut this further

📌 Tip: These limits affect how much loan you can take — even if you’re eligible for a flat. Plan your budget around both grant AND MSR/TDSR limits.

When should you speak to a mortgage broker for better clarity?

Before you apply for a flat — not after.

A trusted mortgage advisor can:

- Analyse your CPF and income profile

- Recommend the best loan options (HDB vs bank)

- Maximise your grant and loan pairing strategy

🔍 Want to compare rates across multiple banks? Check the latest home loan rates in Singapore before you commit to a fixed or floating package.

Common Mistakes to Avoid With the New Rules

With tighter restrictions under the New HDB framework, one wrong assumption could cost you a grant, your dream flat — or even your eligibility. The rules have changed, and what used to work may no longer apply.

Here are some common pitfalls you’ll want to sidestep.

Assuming old rules still apply to your application

Too many buyers assume that if their cousin got a BTO in 2021, they can follow the same path.

But with Prime, Plus, and Standard flat classifications, 10-year MOPs, new income ceilings, and the required HFE letter, most of the rules have shifted.

✅ What to do instead: Always refer to the most updated flat eligibility criteria before applying — even if you’ve applied in the past.

Skipping the HFE process or applying too late

Many applicants wait till the BTO launch is announced before rushing to apply for their HFE letter — only to find out it’s not processed in time.

The result? You miss the launch window entirely.

🕒 HFE processing can take up to 21 working days — longer if documents are incomplete or if you’re self-employed.

💡 Avoid the crunch: Apply for your HFE early, and run your numbers with a home loan calculator to budget ahead.

Overlooking the MOP and resale restrictions of Prime/Plus flats

That swanky Prime flat in Queenstown might look amazing now, but remember — with a 10-year MOP, you’re locked in for a decade.

Plus, you can’t rent out the whole unit during that time, and resale comes with strict eligibility conditions for future buyers.

📌 Make sure the flat fits your life stage and future plans — not just your wishlist.

🔍 Need flexibility? You might want to compare housing loan options for resale flats in Standard estates with fewer restrictions.

Visual Recap: HDB New Rules and Eligibility at a Glance

Need a quick summary? Whether you’re comparing rules, planning your grant strategy, or trying to figure out how to get that all-important HFE letter, this section gives you a visual snapshot of the most important things to remember — no long paragraphs needed.

Table: Comparison of pre-2025 vs 2026 rules

To see just how much things have changed, here’s a side-by-side view of what the HDB landscape looked like before 2025 versus what it looks like now.

HDB Rules Before vs After 2025 — Key Differences at a Glance

| Feature | Pre-2025 | Post-2025 (Current Rules) |

|---|---|---|

| Flat Categories | All BTOs treated the same | Prime, Plus, Standard model introduced |

| MOP Period | 5 years (standard for all) | 10 years for Prime/Plus, 5 for Standard |

| Grant System | Multiple grants (EHG, AHG, SHG) | Streamlined grants; EHG is primary |

| Loan & Grant Eligibility | Separate applications (HLE, grant checks) | Combined via HFE letter |

| Resale Conditions | Standard across board | Prime/Plus flats face stricter resale rules |

💡 Want to plan based on the latest figures? Try our mortgage calculator for current rates and monthly breakdowns.

Chart: Income ceilings and grant tiers breakdown

Your grant eligibility scales with income. Here’s a visual breakdown of how the Enhanced CPF Housing Grant (EHG) tiers compare based on household earnings:

Here’s the visual chart showing how the Enhanced CPF Housing Grant (EHG) scales down as household income increases — from $80,000 for lower-income families to $0 above $9,000/month

Flowchart: Steps to secure eligibility with the HFE letter

Here’s a quick guide to what you need to do before you can even apply for a BTO or resale flat under the new system:

🔄 Step-by-Step: HFE Letter Application Flow

- Log in to HDB Flat Portal via Singpass

- Fill in your flat intent, grant preference, and loan type

- Submit income documents (IRAS, CPF, payslips)

- Receive eligibility results for:

- Flat type

- Grant amount

- Loan limits

- Flat type

- Use the letter to apply for BTO or resale during launch

📌 Don’t wait — HFE processing can take weeks. Apply early to avoid disappointment.

Frequently Asked Questions About HDB New Rules (2025)

Singaporeans are still adjusting to this year’s changes — and honestly, some parts are confusing. Below are answers to the most common questions buyers have been asking about the latest HDB policy updates.

Can I still buy a 3-room flat as a single under the new rules?

Yes — but only under certain conditions.

If you’re 35 or older and a Singapore Citizen, you can buy:

- A 2-room Flexi flat (BTO) in non-mature estates

- A resale flat of any size (yes, including 3-room and up)

But under the new Prime and Plus model, even resale flats may come with extra eligibility checks, especially in more central areas.

💡 Check your HFE letter early to see what flat types and sizes you’re eligible for.

📌 Not sure where to start? Try our home loan calculator to plan your budget first.

Do the changes affect private property downgrades?

Yes — and here’s how:

If you own a private property and plan to buy an HDB flat, you must:

- Wait 30 months after selling your private property

- Apply only for Standard resale flats (you are not eligible for Prime or Plus flats)

This rule remains unchanged in 2026, but the new classification means fewer options for downgraders in city-fringe or high-demand areas.

📎 If you’re planning to switch from private to HDB, you may want to explore private property loan options first and delay your downgrade strategically.

Are resale levies or MOP periods different now?

Yes, depending on the flat type.

- MOP (Minimum Occupation Period) is now:

- 10 years for Prime and Plus flats

- 5 years for Standard flats

- 10 years for Prime and Plus flats

- Resale levy still applies to second-timer buyers who previously received a housing subsidy (e.g. grants or a first BTO). The amount hasn’t changed — but it now matters more due to longer MOPs.

📌 Planning to sell and buy again? Factor in the MOP and resale levy early, especially if you’re considering a second subsidised flat.

📊 You can also compare HDB vs bank loan options if you’re buying a resale unit after meeting your MOP.

Final Thoughts: Plan Smart Around HDB Rule Changes

The HDB landscape in 2026 may feel stricter, but it’s still very possible to make a smart, affordable housing move — if you go in prepared.

Here’s what to keep in mind before your next application.

Why you should recheck your eligibility even if you’ve applied before

Assuming you’re still eligible because you applied last year? That could backfire.

With new income ceilings, grant criteria, and the introduction of the HFE letter, your eligibility can shift — especially if your income, household size, or marital status has changed.

✅ Reapply for your HFE letter each time you’re planning to buy — it reflects your latest financial profile.

How the new rules help — not just restrict — homeownership

At first glance, rules like 10-year MOPs, resale conditions, and stricter income checks seem like barriers.

But they’re designed to:

- Keep hot locations accessible to genuine buyers

- Prevent flipping and speculative profits

- Support lower- and middle-income families with targeted grants

💡 Think of it as a reset — one that rewards long-term homeownership over short-term gains.

Where to get personalised advice for your flat journey

HDB grants, loan eligibility, MOP, and loan types can be hard to juggle — especially if you’re buying with a partner or navigating a complex profile (like being self-employed or applying after a divorce).

A good next step? Speak to a neutral mortgage advisor who can:

- Help you compare rates across banks

- Structure your CPF usage smartly

- Maximise your home loan and grant pairing based on your timeline

📌 You can also explore best home loan rates in Singapore and use a mortgage calculator to get clarity on your numbers — before applying.

Conclusion: Navigate the New HDB Rules with Confidence

The new HDB rules in 2025-6 may feel overwhelming at first — but once you understand how grants, eligibility, and flat types work together, the process becomes much more manageable.

Whether you’re eyeing a Prime flat in Queenstown, a resale in a mature estate, or a first BTO as a couple, everything starts with clarity: your budget, your eligibility, and your financing plan.

Don’t let uncertainty hold you back from your next move.

💬 Ready to make a confident, well-informed flat decision?

✅ Check your loan affordability with our mortgage loan repayment calculator

✅ Learn more about home loan options in Singapore tailored to your needs

✅ Or speak to a trusted mortgage advisor for free, no-pressure guidance

Your flat journey starts with the right information — and a plan that works for you.