Trying to figure out the difference between a bridging loan and a top-up loan in Singapore? You’re not alone — these two sound similar but serve very different purposes. And if your HDB loan isn’t enough or you’re in the middle of buying a new flat before selling your current one, choosing the right option could save you thousands.

In 2025, with rising flat prices and tighter loan limits, more buyers are turning to these alternative housing loan options to close funding gaps. But how do you know which one fits your situation better?

In this quick guide, we’ll break down:

- What each loan is used for

- When to use a bridging loan vs a top-up loan

- How CPF usage, interest rates, and loan terms differ

- And how to decide smartly without overstretching yourself

Let’s make this simple — so you can move forward with confidence (and without hidden surprises).

What’s the Key Difference Between Bridging Loans and Top-Up Loans?

Before choosing between a bridging loan or a top-up loan, it’s important to know what they’re each built for. Both help with financing gaps during your property journey — but how they work, when to use them, and what you can use them for in Singapore are very different.

Let’s break it down.

Purpose and Use Cases — What Each Loan Is Designed For

Here’s the gist:

A bridging loan is a short-term loan used when you’re buying a new home before selling your current one. It’s ideal when you need fast cash to cover your downpayment or Option Fee — especially for upgraders moving from HDB to private property.

A top-up loan, on the other hand, lets you increase your current mortgage amount. You’re essentially tapping on the built-up value (equity) of your home to fund things like:

- Renovation

- Investments

- Medical or education expenses

🔍 Expert tip: If you haven’t sold your current flat and need quick funds, a top-up loan won’t help. But a bridging loan might be exactly what you need — just make sure you’re confident your sale will go through soon.

Loan Mechanics — Tenure, Repayment, CPF & Collateral

Now let’s get into the key technical differences between a bridging loan and a top-up loan — especially how they’re structured, repaid, and whether you can use CPF for your home loan repayments.

These mechanics matter more than they seem. Choosing the wrong structure can result in cash flow stress, ineligibility for CPF usage, or even loan rejection. So here’s a side-by-side breakdown to help you see things clearly.

Comparison of Bridging Loan vs Top-Up Loan in Singapore (2025)

| Feature | Bridging Loan | Top-Up Loan |

|---|---|---|

| Tenure | 3–6 months | Follows your mortgage (up to 25–30 years) |

| Repayment | Lump sum or capitalised | Monthly instalments |

| CPF Usage | ❌ Not allowed | ✅ Allowed (CPF OA) |

| Collateral | Existing property | Existing mortgaged property |

Quick tip: Always check if your bank allows CPF usage for top-ups before committing. And use a mortgage loan repayment calculator to model monthly costs before you sign.

Which Banks Offer These Loans in 2025?

Most major banks in Singapore offer both loan types — but terms and rates vary depending on whether you’re financing an HDB flat, condo, or private property.

🏦 DBS

- Offers both bridging loans and top-up options

- Uses the FHR6 rate or SORA-linked packages

- Explore DBS home loan packages →

🏦 UOB

- Known for flexible top-up loans for private properties

- Fixed rate and floating SORA-based plans

- Check UOB home loan options →

🏦 OCBC

- Offers competitive bridging loan interest rates

- Supports top-up loans with CPF repayment flexibility

- View OCBC home loan rates →

💬 Pro tip: Instead of comparing every bank yourself, speak to a mortgage broker in Singapore who can guide you through the fine print, approval timelines, and hidden fees — for free.

📚 Want to dig deeper into bridging loans? Read this SingSaver guide on how they work in Singapore’s housing market.

When Should You Use a Bridging Loan in 2025?

In Singapore’s current housing market, bridging loans are becoming a go-to solution for buyers who need short-term funds to move forward before their current flat is sold. With high resale demand, tight timelines, and strict HDB rules, waiting around for cash flow can cause you to lose your ideal unit.

So when does a bridging loan actually make sense? Let’s break it down.

Buying a New Home Before Selling the Old One

This is the classic scenario where a bridging loan shines. Let’s say you’re upgrading from your HDB flat to a condo or resale executive apartment, but your existing flat hasn’t been sold yet. You still need to:

- Pay the option fee

- Put down 5–25% in cash or CPF

- Exercise the OTP within 3 weeks

If your sale proceeds aren’t in yet, a bridging loan covers that temporary shortfall — so you don’t have to walk away from the deal.

📌 Tip: You’ll still need proof of sale, such as the Option to Purchase from your buyer, before the bank approves your bridging loan. If you’re not sure how to structure this, a mortgage broker in Singapore can advise you based on your timeline.

CPF or Cash Shortfall During an Upgrade

Upgrading your flat often means coughing up more upfront CPF or cash than expected. Especially since HDB only lends up to 80% LTV, and private banks typically cap at 75%, the rest has to come from your CPF Ordinary Account or savings.

If your CPF isn’t liquid yet — or you’re still waiting for your old flat’s sale proceeds to flow back — a bridging loan can help cover:

- Cash shortfall from downpayment

- Option fees

- Legal or stamp duty costs

🔗 Don’t forget to check your OA balance via myCPF before you commit to any property purchase. And if needed, estimate your monthly CPF deduction using our mortgage loan repayment calculator.

Urgent Purchases — BTO, Launches, Auctions

Some property opportunities won’t wait for your bank account to catch up.

- You’re selected for a BTO or Sale of Balance Flat (SBF) and have to exercise your option quickly

- A promising new launch or EC project opens balloting

- You win a property auction that requires 10% cash within days

In these high-pressure situations, waiting for your flat to sell or CPF to be refunded just isn’t realistic. A bridging loan buys you speed and flexibility — and could be the difference between securing a dream home or losing it to a faster buyer.

📌 Pro tip: Banks often process bridging loans within 1–2 weeks. But approval depends on whether your existing flat is already sold or at least under Option. If unsure, consult a Singapore mortgage advisor to map your timeline.

When Is a Top-Up Loan the Better Option?

Unlike bridging loans — which are fast, temporary, and best for timing gaps — top-up loans are better suited for homeowners who already have a mortgage and want to unlock extra funds for longer-term needs.

Top-up loans are also more CPF-friendly, come with structured monthly repayments, and don’t require you to sell your property. So if you’re settled in your home but need cash, this could be the right fit.

Let’s look at the most common use cases in 2025.

Renovating Your Existing Flat or Condo

Just collected your BTO or resale keys, but running short on renovation funds? A top-up loan lets you borrow against the value of your new flat to finance that renovation — without switching banks or refinancing the whole loan.

It’s a popular option for:

- BTO buyers who used up most of their CPF

- Resale flat owners needing immediate renovation cash

- Condo buyers upgrading their interiors before moving in

💡 Bonus: Since this is still a housing-related loan, some banks allow CPF OA to be used for monthly repayment. Always check the bank’s terms, or speak to a mortgage consultant before signing.

Need Extra Cash Without Changing Banks

If you’re happy with your current mortgage lender but need funds urgently — maybe for education, investment, or medical reasons — a top-up loan is often the simplest solution.

You don’t need to refinance or go through the full approval process again. Instead, your bank will:

- Revalue your property

- Assess your repayment ability

- Offer a loan based on your unused equity

It’s especially useful for borrowers who locked in a low fixed rate mortgage and don’t want to lose it just to get extra cash.

📌 Tip: You can check your property’s current valuation and loan balance using the bank’s portal or through a mortgage broker. If you’re with DBS, UOB, or OCBC, you may already qualify for a top-up without extra paperwork.

Explore:

Supplement Your Loan After Resale Purchase

Let’s say you bought a resale flat or private property and used up most of your CPF for the initial downpayment. A top-up loan can help you:

- Replenish cash reserves

- Pay for furnishings or renovation

- Consolidate debts (e.g. personal or renovation loans)

This is especially relevant in 2025, as many resale flat prices in mature estates are pushing buyers to stretch their CPF and savings upfront.

🔍 If you’ve already started your mortgage with the bank, check whether a top-up loan can give you better rates than a renovation loan. Need help comparing? A refinance home loan expert can help you check all available packages.

Real-Life Example: Bridging Loan vs Top-Up Loan

Sometimes, the clearest way to understand your loan options is to see what someone else went through. Meet James — a typical Singaporean upgrader navigating the jump from HDB to private property.

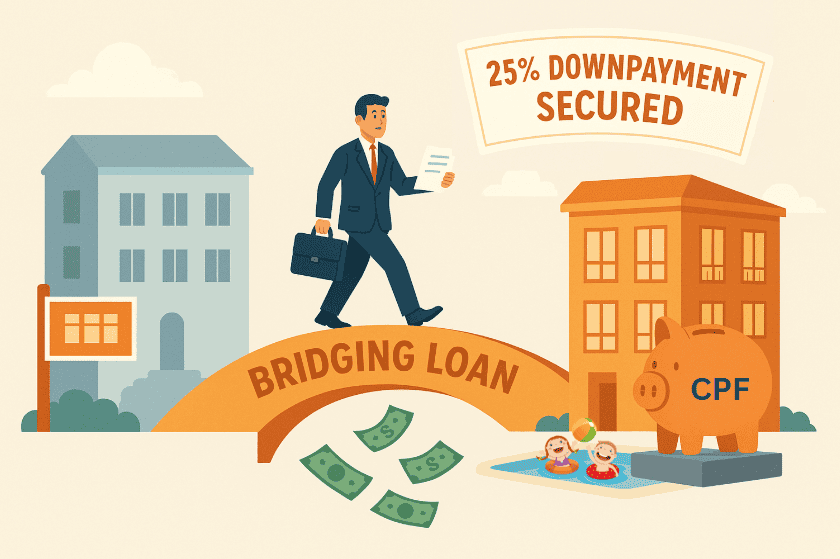

James Upgrades from HDB to Condo — and Chooses a Bridging Loan

James had just secured a great deal on a 3-bedroom condo in Jurong. The catch? He had to pay the 25% downpayment fast — but his existing HDB flat hadn’t sold yet. His CPF OA was tied up, and his cash wasn’t enough to bridge the gap.

Instead of giving up the unit, James took a bridging loan based on the expected proceeds from his flat sale. The bank gave him just enough to cover the initial payment, and once his HDB sale was completed two months later, he paid off the bridging loan in full.

✅ This gave him the flexibility to move forward without waiting for his old flat to sell.

Why a Top-Up Loan Didn’t Work for His Case

James first considered a top-up loan, thinking it might help him get extra funds without the stress of short-term repayment.

But here’s the problem: a top-up loan can only be taken after the mortgage has started — and James hadn’t even completed the purchase yet. Since there was no existing mortgage to top up, the bank couldn’t offer him that option.

Plus, top-up loans are generally used to draw equity from a property you already own — not to finance the purchase of a new one.

❌ No existing mortgage = no top-up loan.

What You Can Learn From James’ Experience

If you’re in a similar situation — buying a new home before selling your old one — a bridging loan might be your only realistic option. It works when:

- You’re confident your current home will sell soon

- You need funds before CPF or sale proceeds come in

- You don’t want to miss your new dream flat due to timing

📌 Pro tip: Always check with a mortgage broker in Singapore before making any financial move — they can map out which loan types are available to you based on your timeline and assets.

Not Sure Which Loan to Use? Follow This Quick Guide

Still stuck between a bridging loan and a top-up loan? Don’t worry — it all comes down to timing, repayment style, and CPF flexibility.

Here’s a quick breakdown to help you choose the right fit for your situation in 2025.

Based on Timing of Your Property Sale or Purchase

- 🕒 If you’re buying a new home before selling your current one — and you need cash to cover the downpayment or option fee — a bridging loan is designed exactly for that.

- 🧾 But if your new mortgage has already started and you simply want to extract more funds from it? That’s where a top-up loan comes in.

✅ Bridging = before your flat sells

✅ Top-up = after your mortgage begins

🔗 Related: Private property loan options in Singapore

Based on Whether You Need Lump Sum or Ongoing Cash

- If you need a one-time lump sum to cover short-term cash flow, like paying for a condo before your HDB sale goes through, go with a bridging loan.

- If you want access to long-term cash, such as for renovation, investments, or education, then a top-up loan gives you structured, monthly access without refinancing.

📌 Reminder: Bridging loans are typically repaid in full within 3–6 months. Top-up loans stretch over years — just like your original home loan.

Based on CPF Usage and Loan Repayment Comfort

- With a top-up loan, you can usually use your CPF Ordinary Account to service monthly repayments.

- Bridging loans, on the other hand, are cash-only — CPF usage is not allowed.

💡 If CPF cash flow is tight, or you want to avoid depleting your savings, a top-up loan gives you more breathing room.

Need help working out what your CPF can support? Try our mortgage loan repayment calculator to model your monthly instalments.

FAQs About Bridging and Top-Up Loans in Singapore

Still have questions? You’re not alone. Here are some of the most common queries from homebuyers in Singapore comparing bridging loans vs top-up loans in today’s market.

Which loan is better for upgrading from HDB to private property?

If you’re in the middle of upgrading from an HDB flat to a condo or landed home, a bridging loan is often the better choice — especially when you need funds before your HDB sale is completed.

Why? Because bridging loans:

- Let you pay the downpayment or OTP early

- Don’t require you to refinance your mortgage first

- Are faster to disburse (often within 1–2 weeks)

However, if your new property is already under mortgage and you’re looking to fund renovations or other personal costs, a top-up loan may be more suitable. You can also use CPF with top-ups, which adds repayment flexibility.

🔗 Learn more: HDB home loan vs bank loan

Can I use both bridging and top-up loans together?

Yes, but only under very specific circumstances.

Here’s how it might work:

- You use a bridging loan to purchase your new home before your old one sells

- After the purchase completes and you have a mortgage in place, you then apply for a top-up loan to fund renovations or other costs

📌 Important: You can’t use a top-up loan before your mortgage starts. It only works after you’ve drawn down on your home loan.

Need help planning both loans as part of your upgrade? Speak with a Singapore mortgage broker who can coordinate the sequence for you.

Is CPF usable for bridging loans?

No — you cannot use CPF to pay for bridging loans. These are short-term, interest-bearing loans that must be repaid in cash only.

On the flip side, top-up loans do allow repayment using your CPF Ordinary Account (OA), as long as the loan is used for housing-related purposes and meets CPF’s guidelines.

✅ If CPF flexibility matters to your budget, a top-up loan may be more manageable in the long run.

🔗 Tip: Use this mortgage loan repayment calculator to see how CPF usage can offset your monthly costs.

Final Advice — Talk to a Broker Before You Decide

Now that you understand the key differences between bridging loans and top-up loans, the next step is to make a choice based on your own timeline, finances, and risk comfort.

Before jumping into any housing loan in Singapore, pause and reflect. A quick check now can save you from years of repayment stress.

Ask Yourself These Key Questions First

- Am I buying my new property before selling my current one?

- Do I need a lump sum now, or do I want structured monthly access to funds?

- Can I afford cash-only repayment, or do I need CPF to help cover the loan?

- Do I have an exit plan for the bridging loan (e.g. upcoming sale proceeds)?

- Is it worth refinancing my mortgage just to access a top-up?

📌 If you’re unsure about any of the above, don’t guess. The wrong loan structure can affect your long-term financial flexibility.

Use a Loan Calculator to Check Repayment Affordability

Don’t just go by feel — always run the numbers.

Our mortgage loan repayment calculator can help you estimate:

- Monthly instalments for both bridging and top-up loans

- CPF usage vs cash outlay

- Impact of interest rate changes over time

💡 Even a 0.5% interest difference can cost you thousands over the life of a loan.

Get a Free Consult With a Trusted Mortgage Broker

Still unsure which loan is right for you?

That’s exactly what a mortgage broker in Singapore is here for. They can:

- Compare bridging and top-up loan options across DBS, UOB, OCBC, and more

- Check your CPF, income, and timeline to suggest the best-fit solution

- Help with paperwork, approval timelines, and avoid common loan mistakes

- Charge you nothing — because banks pay them, not you

🎯 Whether you’re upgrading, renovating, or refinancing, having a broker on your side gives you clarity — without the overwhelm.

Final Thoughts — Choosing the Right Home Loan Solution

No two buyers are the same — and when it comes to choosing between a bridging loan or a top-up loan, the best choice really depends on your timeline, cash flow, and future plans.

The good news? You don’t have to figure it all out alone.

Whether you’re upgrading, renovating, or just need some breathing space in between homes, the right loan structure can make your journey smoother — and far less stressful.

💬 So take a breath, explore your options, and if you’re still unsure, speak to someone who’s done this a thousand times before.

A quick, honest chat with a trusted mortgage advisor could be the difference between “I hope this works” and “I’ve got this sorted.”

You’ve got more options than you think — let’s find the one that fits.