Thinking of getting your own HDB flat before turning 35? You’re not alone. Many singles in Singapore start planning early — only to realise the rules aren’t exactly straightforward.

Can you buy solo before 35? Are there any exceptions? And what can you actually do while waiting?

Don’t worry — we’re here to clear things up. This guide breaks down what’s allowed, what’s not, and the smart moves you can make right now to get one step closer to your own home.

Let’s dive in and make your flat journey a little less confusing — and a lot more doable.

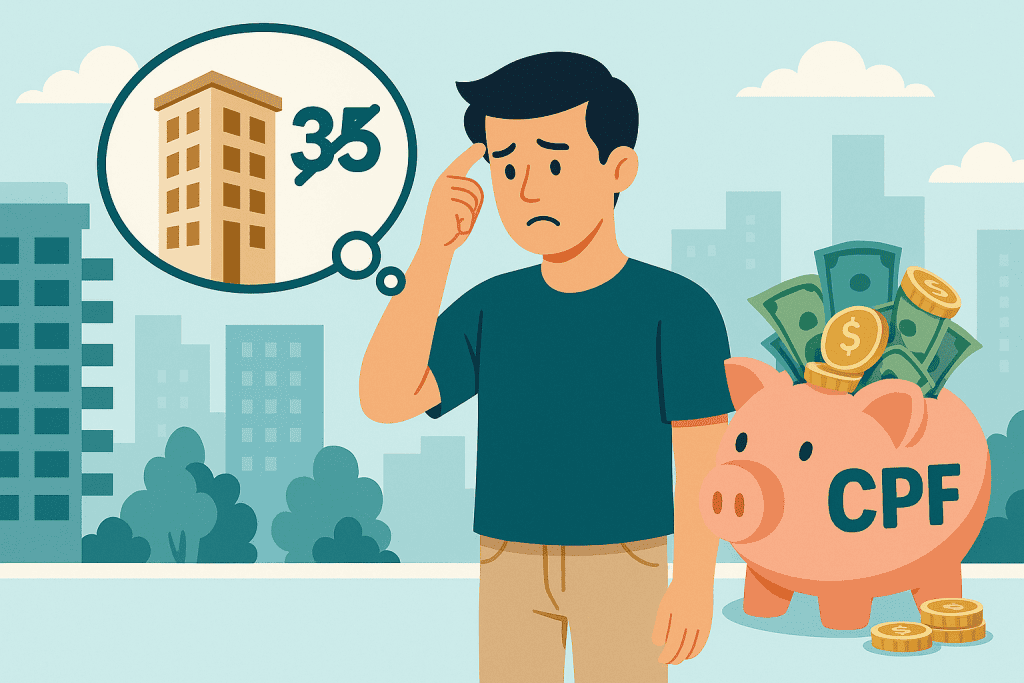

Can Singles Buy HDB Flats Before Age 35?

So… you’re single, not 35 yet, and wondering if you can finally buy your own HDB flat.

You’re earning decently, your CPF OA’s looking healthy — and maybe you’re just done with sharing a room. But here’s the truth:

If you’re below 35 and planning to buy a flat alone — HDB says no.

At least not under the Single Singapore Citizen Scheme, which kicks in only at age 35.

And yes, it applies whether you’re eyeing a 2-room BTO, a resale unit, or a cozy studio apartment. Let’s break it down.

What the rules say about buying solo before 35

Unless you’re widowed, orphaned, or buying with family, HDB does not allow singles under 35 to buy a flat alone.

This is baked into their eligibility criteria — and no, it doesn’t matter if you’ve got enough for a downpayment, have zero loans, or are using a mortgage loan repayment calculator daily to plan your budget.

To buy on your own under HDB’s rules, you must:

✅ Be a Singapore Citizen

✅ Be at least 35 years old

✅ Be applying under the Single Scheme

Anything else — and your application won’t even get past Step 1.

🧠 Expert tip: Want to buy earlier? You’ll need to apply with someone — we’ll show you legal workarounds in the next section.

Flat types that are restricted until you hit 35

Here’s where it gets real:

🎯 There is no “small flat” exception for singles below 35.

Whether it’s:

- A 2-room Flexi BTO in Yishun

- A 4-room resale in Toa Payoh

- An ageing resale unit going cheap…

👉 You can’t buy it solo before 35.

Only exception? You’re applying under a different scheme (e.g. Joint Singles, Family Nucleus), which we’ll cover next.

Why the Single Scheme officially starts at 35

It’s not random. HDB designed the age rule to balance public housing priorities — giving families and couples earlier access, while still supporting independence for singles, just a little later.

Once you hit 35, you unlock:

- The full HDB Single Scheme

- Access to grants like the Enhanced CPF Housing Grant

- Freedom to choose between BTO or resale flats

💬 Planning ahead? Use this time to build your CPF savings and loan eligibility — so you can move fast when you qualify.

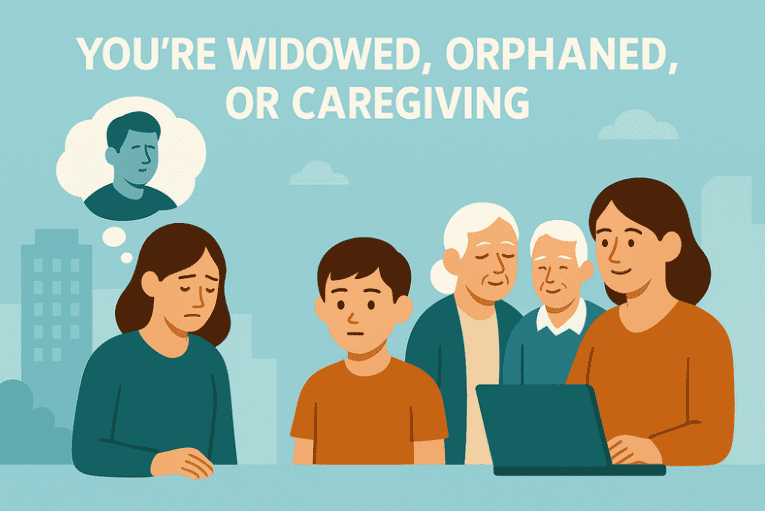

What If You’re Widowed, Orphaned, or Caregiving?

While most singles have to wait until 35 to buy a flat alone, there are rare but important exceptions.

If you’ve lost a parent, a spouse, or are caring for a dependent family member, HDB may allow you to buy a flat before age 35 — with conditions.

Let’s go over the three key scenarios where age restrictions can be lifted.

Special exceptions under HDB eligibility rules

HDB isn’t completely rigid. In fact, it offers flexibility in situations where independent housing is genuinely needed earlier. These are the three main exceptions:

1. Orphaned singles

If both your parents have passed away, and you’re at least 21 years old, you may be allowed to buy a flat with your siblings under the Orphan Scheme.

2. Widowed or divorced singles

If you were previously married and are now widowed or divorced, HDB may consider your application before 35 — provided:

- You’re a Singapore Citizen

- Your marriage was legally registered

- You meet the usual HDB loan eligibility and income criteria

3. Singles with caregiving responsibilities

This one’s less known — but if you’re caring for elderly parents, you might qualify under the Family Nucleus Scheme or receive ballot priority (see the Family Care Scheme). More on this below.

How caregiving may open BTO or resale options early

If you’re living with and supporting an elderly parent — especially one who is ill, disabled, or dependent — you may be able to apply as a family nucleus before 35.

This works if:

- You and your parent are applying together

- Both are Singapore Citizens or PRs

- You intend to live in the same flat and fulfil the MOP (Minimum Occupation Period)

While this doesn’t let you buy 100% solo, it’s a legit pathway to earlier homeownership that many younger singles overlook.

💬 Pro tip: If you plan to live within 4km of your parents, you might also qualify for the Proximity Housing Grant later on — so plan your move wisely.

Documents and declarations you’ll need to qualify

HDB takes exceptions seriously — and will need full documentation to review your case.

Here’s what you may need to prepare:

- Death certificates (for orphan/widowed cases)

- Divorce papers or deed of separation

- Caregiver support documents (e.g. medical reports, disability certificates)

- Birth certificates to prove family ties

- Proof of shared address or intent to co-reside

- CPF contribution history to show financial responsibility

Missing just one item could delay or derail your application — so it’s worth speaking to a mortgage advisor early to plan your timeline and paperwork properly.

🧠 Don’t wait until you’re desperate to start checking eligibility. Exceptions can take weeks or months to process.

Loopholes and Legal Alternatives for Singles Below 35

Can’t buy an HDB flat solo yet? You’re not totally out of luck.

There are legal ways around the age rule — if you’re open to co-owning, applying under a different scheme, or even renting as a short-term step.

Let’s explore the smart (and legit) ways singles under 35 can still get their foot in the HDB door.

Can you co-buy with a sibling, friend, or parent?

Yes — but not always.

If you’re below 35, HDB only allows co-purchase in specific pairings. Here’s what’s allowed:

✅ With your parents

You can apply as a family nucleus with your parent(s) — even before turning 35. This lets you apply for BTO or resale under the Public Scheme.

✅ With a sibling (if orphaned)

If both parents are deceased, you and your sibling (both Singapore Citizens) may apply together from age 21 under the Orphan Scheme.

❌ With a friend or unrelated person

Unfortunately, you can’t co-buy with a friend below 35, unless both of you are over 35 and applying under the Joint Singles Scheme.

🧠 Important: Even when allowed, the flat must meet HDB eligibility and lease requirements, especially if using CPF housing grants.

Family nucleus and non-single schemes explained

If you don’t qualify as a single buyer, your next best option is applying as part of a family unit — real or constructed.

Here’s what to know:

- Public Scheme: Buy with your parents, children, or spouse (legal or fiancé/fiancée). This is the most flexible and common.

- Fiancé/Fiancée Scheme: Engaged couples can apply before marriage, with a proof of ROM timeline.

- Single Parent Scheme: Unmarried parents aged 21+ with legal custody may apply solo.

- Orphan Scheme: As mentioned, orphaned siblings can apply together from age 21.

Each scheme has unique grant eligibility and income ceiling rules — so if you’re unsure which one you fit under, it’s worth chatting with a mortgage consultant to make sense of your options.

What about interim rental or family transfer options?

If you’re not eligible to buy yet, you still have ways to live independently — or prep for ownership.

Here are three alternatives:

1. Rent under the Parenthood Provisional Housing Scheme (PPHS)

While usually for couples, some family-based applications may qualify — especially if waiting for a BTO.

2. Live in a family-owned flat with future transfer

Some singles move in with parents and plan for future ownership transfer. This isn’t the same as buying — but may work as an interim step if planned carefully with legal support.

3. Rent a room or flat while saving

Not glamorous, but practical. Renting privately gives you independence while you build up your CPF OA savings, boost your income, and prepare your home loan eligibility for age 35.

💬 Pro tip: Use this “waiting period” to clean up your credit, repay debts, and boost your CPF — it’ll all affect your future loan size and grant amount.

What You Can Do Now to Prepare Before 35

You might not be able to buy a flat solo yet — but that doesn’t mean you can’t start laying the groundwork.

In fact, the smartest single homeowners we’ve seen? They start prepping well before 35. That way, once they’re eligible, they can move fast — with enough CPF, strong loan approval, and full access to grants.

Here’s what you can start doing right now.

H3: Grow your CPF OA and build loan eligibility

If you’re under 35, your CPF Ordinary Account (OA) is your best friend.

Every dollar you build now = future downpayment or mortgage buffer. It also shows banks or HDB that you’re financially stable — which improves your mortgage loan eligibility later on.

What you can do:

- Top up voluntarily if you have extra savings

- Avoid withdrawing CPF early for non-housing uses

- Check how much CPF you’ll need for your desired flat type

💡 Planning for a resale flat? You’ll need enough CPF to cover the valuation shortfall plus any Cash Over Valuation (COV).

Understand BTO vs resale pros and CPF grants

At 35, you’ll finally qualify for HDB’s Single Scheme, and with it, housing grants for singles like:

- Enhanced CPF Housing Grant (EHG) – up to $40,000

- Singles Grant – up to $40,000

- Proximity Housing Grant (PHG) – up to $15,000

But your grant eligibility depends on what you buy:

HDB Grants You Can Get at Age 35: BTO vs Resale Comparison for Singles

| Flat Type | Grants You Can Get at 35 |

|---|---|

| BTO | EHG only |

| Resale | EHG + Singles Grant + PHG |

So use your wait time to think: Would I prefer to wait for a BTO… or go resale and unlock more grants? Knowing this now helps you prep your CPF, budget, and expectations.

Run affordability checks with a mortgage calculator

Want to know how much flat you can afford the moment you turn 35?

Don’t guess — run the numbers now with a proper mortgage loan repayment calculator. It shows your estimated:

- Loan size based on income

- Monthly instalments

- CPF vs cash needed

- Impact of grants on loan quantum

Even if you’re just planning, it’s worth checking early — especially if you’re saving towards a specific goal like a $450K resale flat or planning to apply for a DBS home loan or UOB housing loan when eligible.🧠 The earlier you understand your numbers, the better your shot at a smooth, confident purchase later on.

Case Study — Wei Jie, Age 29, Wants to Buy Early

Wei Jie’s like many young professionals in Singapore — independent, financially stable, and ready to move out. At 29, he earns a steady income, has built up a solid CPF balance, and thought he was ready to buy a flat.

Then reality hit: he couldn’t buy a flat solo until 35.

Here’s what happened — and how he’s now planning smarter than ever.

Why he considered co-buying with his sister

Initially, Wei Jie explored co-buying a resale flat with his older sister. Both were single, working, and tired of squeezing into the family flat.

They looked into the Joint Singles Scheme, but quickly realised it’s only available if both co-buyers are 35 or older. At 29, Wei Jie didn’t meet the minimum age.

His sister could have bought solo — but they wanted to split costs and ownership.

💬 “We thought, if we can afford it together, why not just do it now? Turns out, HDB doesn’t allow that if you’re not 35 yet,” Wei Jie shared.

What changed after a CPF housing grant consult

Frustrated but curious, Wei Jie booked a free CPF housing grant consult with a mortgage advisor — just to see what was actually possible.

That session gave him clarity he didn’t expect:

- He couldn’t buy now, but could start building CPF grant eligibility

- If he waited till 35 and went for a resale flat, he could qualify for:

- $40K Singles Grant

- Up to $40K EHG

- $10K–$15K PHG

- $40K Singles Grant

- These CPF housing grants could shave up to $95K off his purchase price

Instead of feeling stuck, Wei Jie now had a timeline and a strategy.

What he’s doing now to prepare for buying solo at 35

Today, Wei Jie’s focused on positioning himself for the best home loan deal when the time comes. Here’s his 3-step plan:

- Maximising CPF OA: He makes small voluntary top-ups to boost his future downpayment.

- Keeping income stable: He avoids job-hopping or commission-based work for now — so he’ll meet the mortgage loan eligibility criteria easily.

- Running price scenarios: He uses a home loan calculator to estimate what he can afford in different estates — and whether resale or BTO makes more sense.

🧠 “I used to think not being able to buy now was the problem. Turns out, not planning properly would’ve been worse.”

Common Myths About Buying HDB Before 35

Still hoping there’s a secret hack? You’re not alone.

Let’s clear the air on some of the most common misconceptions singles have when trying to buy an HDB flat before age 35.

“I can co-buy with anyone, right?”

Not quite.

Unless you’re both aged 35 and above, you can’t co-buy under the Joint Singles Scheme. And if you’re hoping to apply with a friend, partner, or cousin before then — HDB will reject the application.

The only valid co-buying options before 35 are:

- With your parents (under the Public Scheme)

- With siblings (under the Orphan Scheme, if both parents are deceased)

- With a spouse or fiancé(e)

🧠 Under 35? Don’t assume — always check HDB’s scheme-specific eligibility before applying.

“If I have CPF, I can buy at any age.”

This one trips up a lot of younger Singaporeans.

Even if your CPF OA is well-stocked, you can’t use it to buy a flat alone if you haven’t met the minimum age requirement under the Single Scheme.

HDB doesn’t just look at your CPF — they look at your age, household type, citizenship, income, and lease eligibility too.

💬 Want to make the most of your CPF when the time comes? Use a mortgage loan repayment calculator to plan how much to save.

“Grants only matter if I’m 35 or older.”

Partly true — but not the full story.

Most CPF housing grants for singles do unlock only at age 35, such as:

- Enhanced CPF Housing Grant (EHG)

- Singles Grant

- Proximity Housing Grant

But if you’re planning to buy with parents, a spouse, or under a different scheme, you may still qualify for some grants earlier — just not as a solo buyer.

And by planning ahead, you can maximise your grant amount when you finally do qualify.✅ Earning less now? That could mean a higher EHG later — so timing your application right matters.

Final Thoughts — Plan Early, Buy Smart

Can’t buy an HDB flat before 35? Frustrating — we get it.

But here’s the upside: if you use this time wisely, you can hit the ground running the moment you’re eligible. Think of it as the planning stage before the real home journey begins.

Start saving CPF early, even if you can’t buy yet

Every bit you contribute to your CPF Ordinary Account now builds your home-buying power later.

Even small top-ups or avoiding premature CPF use (e.g. education loans) can make a big difference. That money goes directly into your flat — helping you borrow less, repay faster, and qualify for stronger loan packages.

🧠 Pro tip: Track your CPF OA monthly, and set a realistic savings goal by age 35.

Use this time to compare future grant scenarios

You’ll only get one shot at some CPF housing grants — and the amount depends on income, flat type, and who you’re buying with.

Use your wait time to:

- Explore resale vs BTO grant differences

- Understand what affects your EHG tier

- Strategise with tools like a mortgage loan calculator

Planning ahead could be the difference between getting $25,000… or $95,000 in total CPF grant support.

Speak to a mortgage advisor before making any big move

Still unsure what’s possible — or when you should actually start applying?

Don’t wait till you’re 35 to figure everything out. A trusted mortgage advisor in Singapore can help you:

- Forecast your loan eligibility

- Estimate CPF use and downpayment needs

- Compare rates across DBS, UOB, OCBC, and more — when you’re ready

💬 One free chat now could save you months of confusion later.