Thinking of buying an HDB flat in 2025? Whether it’s a BTO or resale, CPF Housing Grants can help you save big on your home purchase.

But here’s the catch: there are different grants, different rules, and different income ceilings — and if you don’t plan properly, you could miss out on tens of thousands of dollars in subsidies.

In this CPF Housing Grant guide, we’ll walk you through:

- The types of grants available (EHG, Family Grant, PHG)

- Who qualifies and how much you can get

- How to apply and avoid costly mistakes

We’ll also show you how to combine grants with the best home loan rates in Singapore, so you can stretch your budget even further. Tools like our mortgage loan repayment calculator will help you stay on track.

Let’s break it down — and help you make the most of every dollar.

Understanding CPF Housing Grants

Buying a flat in Singapore can feel expensive — but CPF Housing Grants can ease the load. These grants are designed to reduce the cost of your new home, whether you’re buying a BTO flat, resale flat, or exploring housing loan options in Singapore. Knowing how they work can save you thousands right from the start.

What is a CPF Housing Grant and How Does It Work?

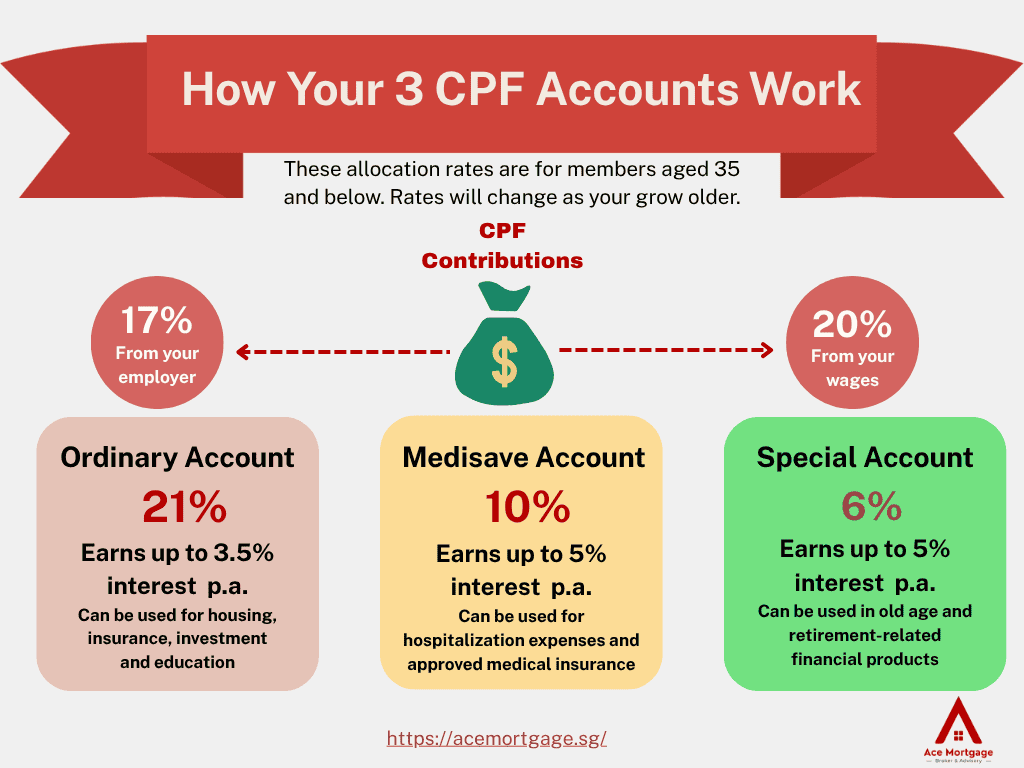

A CPF Housing Grant is a subsidy credited into your CPF Ordinary Account. It’s used to offset your flat price or reduce your home loan.

Quick facts:

- Not cash in hand — it reduces your loan amount or downpayment.

- Available for BTO, resale, and in some cases, EC purchases.

- Must meet criteria like citizenship, income ceiling, and flat type.

CPF Housing Grant Eligiblity Criteria

| Criteria | CPF Housing Grant Applies If... |

|---|---|

| Citizenship | At least one applicant is a Singaporean |

| Age | Minimum 21 (singles: 35) |

| Income ceiling | Varies by grant, up to $14,000/month |

| Employment duration | Typically ≥ 12 months for EHG |

Expert tip: Always check your CPF OA balance and credit before applying — it affects how the grant is used and whether you need a higher loan.

Why CPF Grants Are Crucial for HDB Affordability

CPF grants make your property more affordable by reducing what you need to borrow.

Here’s how they help:

- Lower loan quantum = lower monthly repayment

- Reduce the amount you need for downpayment

- Allow you to pick better loan terms or even a fixed-rate mortgage

- Help you qualify for loans without stretching your Total Debt Servicing Ratio (TDSR)

Overview of the Main CPF Housing Grants Available

CPF Housing Grant Comparison (EHG, Family Grant, PHG)

| Grant Type | Who It’s For | Max Amount | Conditions |

|---|---|---|---|

| Enhanced Housing Grant (EHG) | First-time buyers | Up to $80,000 | Income ≤ $9,000, 12 months of employment |

| Family Grant | Buying resale flat as a couple | Up to $80,000 | Income ≤ $14,000, SC/SC or SC/PR household |

| Proximity Housing Grant (PHG) | Living near family | Up to $30,000 | Flat within 4km of parents/children |

Did you know? You can combine multiple grants when buying a resale flat — making it one of the most cost-effective housing options if done right.

Types of CPF Housing Grants Explained

The Ultimate HDB Grants – Summary Table

| Grant Type | BTO/SBF/Open Booking | Resale | Income Ceiling | Grant Amount |

|---|---|---|---|---|

| Enhanced CPF Housing Grants (Families) | Yes | Yes | $9,000 | Up to $80,000 |

| Enhanced CPF Housing Grants (Singles) | Yes | Yes | $4,500 | Up to $40,000 |

| CPF Housing Grants for Rental Flats | No | Yes | $14,000 | Up to $80,000 |

| Proximity Housing Grant | No | Yes | None | Up to $30,000 |

Not all CPF Housing Grants are the same. Some are designed for first-time BTO buyers, others for resale flat applicants. The key differences come down to income level, flat type, and family profile. Knowing which grants you’re eligible for — and how much you can get — helps you plan your home loan more effectively.

What is the Enhanced CPF Housing Grant (EHG) and Who Can Apply?

The Enhanced CPF Housing Grant (EHG) is meant for first-time buyers of BTO or resale flats. It’s based mainly on your household income and employment stability.

Eligibility Criteria:

- First-time applicant or household

- Monthly household income ≤ $9,000

- At least 1 applicant must be employed continuously for 12 months

- Buying a BTO or resale flat with at least 20 years of lease left

Enhanced CPF Housing Grant (EHG) Amount by Monthly Income

| Average Monthly Income | EHG Amount |

|---|---|

| ≤ $1,500 | $80,000 |

| $2,000 | $70,000 |

| $4,000 | $50,000 |

| $6,000 | $30,000 |

| $9,000 | $5,000 |

Expert tip: If you’re planning to use an HDB loan, the EHG will directly reduce your loan amount. For bank loans, use the mortgage repayment calculator to check how the EHG changes your monthly repayments.

What Are the Family Grant and Singles Grant for Resale Flats?

These grants are for resale flat buyers and are based on your marital status, citizenship, and income.

Family Grant (for couples):

- Up to $80,000 if buying a resale flat

- Income ceiling: $14,000

- At least one SC applicant

Singles Grant:

- Up to $40,000 for singles aged 35+ buying a resale flat alone

- Income ceiling: $7,000

- Must be a first-timer

Summary of Family and Singles Grants for Resale Flats

| Grant Type | Max Amount | Conditions |

|---|---|---|

| Family Grant | $40k–$80k | Based on flat type & income |

| Singles Grant | Up to $40k | Must be SC, 35+, buying resale flat |

Planning tip: If you’re buying a resale flat, these grants can be combined with EHG and PHG for maximum impact. Use them together to reduce your need for a high-interest mortgage loan in Singapore — especially if you’re applying through a mortgage broker to compare rates.

What Is the Proximity Housing Grant (PHG) and How Much Can You Get?

The Proximity Housing Grant (PHG) encourages families to live near or with each other.

Eligibility:

- Buying a resale flat within 4km of parents or children, or living with them

- At least 1 Singapore Citizen in the household

- No income ceiling

Grant Amounts:

- $30,000 if moving in with parents/children

- $20,000 if living within 4km

Proximity Housing Grant (PHG) Summary Table

| Living Arrangement | PHG Amount |

|---|---|

| Living with parents/children | $30,000 |

| Living within 4km | $20,000 |

Good to know: The PHG is stackable with the Family Grant and EHG, making resale flats an attractive option if you’re planning to live near family. Just make sure the distance is within the approved zone — HDB uses geolocation to verify.

Which CPF Grant Applies to You?

Not all buyers fit into a simple category — and CPF Housing Grants are structured to reflect that.

Whether you’re buying as a single, with your spouse, or under a unique family arrangement, understanding which grant applies can help you plan smarter and avoid missing out on financial support.

What Grants Apply to First-Time and Second-Timer Buyers?

If you’re a first-time buyer, you’ll have the most access to CPF Housing Grants. You can stack the Enhanced CPF Housing Grant (EHG) with the Family Grant and Proximity Housing Grant (PHG) — especially if you’re buying a resale flat.

For second-timers, options are more limited. You typically won’t be eligible for the EHG or Family Grant again. However, you may still qualify for PHG or special schemes like the Assistance Scheme for Second-Timers (ASSIST).

Expert tip: If you’re no longer eligible for grants, you might consider reducing monthly costs through a home loan refinance — especially if you’re still paying off an HDB loan at a higher rate.

What CPF Housing Grants Can Singles or Joint Singles Apply For?

If you’re aged 35 and above, buying a flat as a single Singapore Citizen, you may be eligible for:

- EHG (Singles) — up to $40,000 based on income

- Singles Grant — up to $40,000 for resale flats

- PHG — up to $15,000 if living near or with your parents

For singles buying a resale flat together under the Joint Singles Scheme, these grants are still applicable — with eligibility assessed individually and combined.

Important note: You’ll need to buy a 2-room flexi or resale flat to qualify for most singles-related grants. BTO restrictions may apply depending on the project and location.

What If You Have a Non-Citizen Spouse or Unusual Family Setup?

Singaporeans married to non-citizens can still receive CPF housing grant support under the Non-Citizen Spouse Scheme. Here’s how it typically works:

- You can receive half of the EHG (up to $40,000)

- The flat application is submitted under your name alone (as the Singapore citizen), with your non-citizen spouse listed as an essential occupier

- This scheme applies to both BTO and resale flats

Note: This is not the same as the Single Singapore Citizen Scheme, which is used by individuals applying without a spouse.

Other family setups — such as buying with parents, siblings, or extended family — may still qualify for CPF housing grants, as long as HDB’s eligibility conditions are met. These include factors like citizenship, income ceiling, age, and whether you’re a first-time applicant.

Planning tip: These situations are trickier — and this is where speaking with a qualified mortgage advisor can help you strategise CPF usage and optimise your home loan application.

CPF Housing Grants by Property Type

Different CPF housing grants apply depending on whether you’re buying a BTO flat, resale flat, or even an executive condominium (EC). Choosing the right flat type affects not just your grant eligibility, but also how much you’ll need to borrow — and how much interest you’ll pay over time.

What Grants Are Available for BTO Flat Buyers?

If you’re buying a Build-To-Order (BTO) flat, your main grant option is the Enhanced CPF Housing Grant (EHG). It’s income-tested and meant to help first-timer households.

Key criteria:

- Monthly household income ≤ $9,000

- At least one applicant working for the past 12 months

- Flat must have ≥ 20 years of lease remaining

- Must not have previously received a housing subsidy

Unlike resale buyers, BTO buyers can’t stack grants like the Family Grant or PHG. But with flat prices generally lower and the EHG offering up to $80,000, it’s still one of the most cost-effective paths to homeownership.

Expert note: Even with CPF support, always check your affordability before booking a flat. Use our mortgage loan calculator to estimate monthly repayments — especially if you’re comparing bank vs HDB loan options.

What Are the Grant Options for Resale Flat Buyers?

Resale flat buyers enjoy the widest range of CPF housing grants. This is where combining multiple schemes can lead to significant savings — especially if you’re buying near family or fall within a lower income tier.

Grants you can combine:

- Enhanced CPF Housing Grant (EHG) – up to $80,000

- Family Grant – up to $80,000

- Proximity Housing Grant (PHG) – up to $30,000

Stackable CPF Housing Grants for Resale Flat Buyers

| Buyer Profile | Max Grant Amount | Stackable Grants |

|---|---|---|

| Couple (first-timers) | Up to $160,000 | EHG + Family Grant + PHG |

| Single (35+) | Up to $95,000 | EHG (Singles) + Singles Grant + PHG |

Planning tip: If you’re stretching your budget for a larger resale flat, make sure to consult a mortgage broker to find the best financing package.

Can You Use CPF Housing Grants for Executive Condominiums (ECs)?

CPF Housing Grants are available for new ECs bought directly from the developer — but the options are more limited compared to HDB flats.

Grant available:

- Family Grant only (up to $30,000–$40,000 depending on income and flat type)

Conditions:

- Household income must not exceed $16,000/month

- Applicant must be a first-timer

- EC must be bought during the launch from the developer (not resale)

Important: EHG is not applicable for ECs. You also won’t get PHG even if the EC is near your parents. But you can still use CPF savings and apply for a private property loan to finance the balance.

CPF Grant Eligibility Requirements You Must Know

Before applying for any CPF housing grant, it’s critical to understand the eligibility rules. These aren’t just technical checkboxes — they determine how much you’ll receive, and in some cases, whether you qualify at all. The main factors that HDB checks include income, citizenship, employment status, and your housing history.

What Are the Income Ceilings and Age Rules?

Each grant comes with its own income ceiling, and exceeding it — even slightly — can disqualify you from receiving the full amount.

2025 income ceilings (by grant type):

- Enhanced CPF Housing Grant (EHG): ≤ $9,000/month (combined household income)

- Family Grant: ≤ $14,000/month

- Singles Grant: ≤ $7,000/month

- Executive Condo (Family Grant only): ≤ $16,000/month

Age matters too — especially for singles:

- You must be at least 35 years old to apply under the Singles Scheme

- No minimum age if applying as a couple or family unit (21+)

Tip: If your income is borderline, consider applying earlier in the year when your 12-month average may be lower. It could bump you into a higher grant tier.

What Are the Citizenship, Employment and Family Criteria?

Your household makeup and employment history affect your eligibility:

Citizenship:

- At least one Singapore Citizen (SC) required for all grants

- For maximum Family Grant, both applicants should be SCs (SC/PR households receive less)

Employment:

- At least one applicant must have worked continuously for 12 months prior to application (EHG only)

- Income must be consistent and supported by CPF contribution history

Family Composition:

- Married couples, joint singles, single applicants, and SCs with non-citizen spouses all fall under different schemes

- Grant amounts are adjusted accordingly

Not sure which applies to your case? Speaking with a mortgage consultant can help you assess your profile before applying.

How Does Property Ownership or Past Grant Use Affect Eligibility?

If you’ve previously owned a property or received a housing grant, your options are more limited.

Here’s what you need to know:

- If you’ve taken a housing subsidy before, you’re not eligible for EHG or the full Family Grant again

- You must dispose of any private property at least 30 months before applying for a BTO flat

- If applying as a second-timer, you may still qualify for the Proximity Housing Grant (PHG)

Grant Eligibility for Buyers with Property History or Past Grants

| Scenario | Grant Eligibility |

|---|---|

| First-time buyer, no private property | Full grant access |

| Own(ed) private property in last 30 months | Not eligible for BTO/EHG |

| Took a grant previously | PHG only or limited options |

Planning tip: If you’ve maxed out your CPF grants, consider reducing your loan burden instead. Use a mortgage calculator to explore how refinancing or switching to a lower-rate loan could help.

What’s New with CPF Housing Grants in 2025?

HDB and CPF policies are updated regularly to reflect changing market conditions and affordability goals. In 2025, several key changes have been made to CPF housing grants — especially around income ceilings, grant amounts, and applicant eligibility. If you’re planning to buy soon, it’s critical to understand what’s different this year.

What Policy Changes Have Taken Effect This Year?

Here’s a snapshot of the 2025 policy updates:

- EHG income ceiling remains at $9,000, but more applicants now qualify due to higher median income adjustments

- Family Grant criteria for Executive Condos (ECs) updated to support households earning up to $16,000/month

- Greater flexibility introduced for blended households (e.g. SC + PR, non-citizen spouse)

- HDB has enhanced proximity verification methods for the Proximity Housing Grant (PHG) — now using exact geolocation to confirm distance

These changes aim to make grants more targeted, especially for younger households and middle-income buyers.

How Have Income Ceilings and Grant Amounts Been Updated?

While grant caps remain largely unchanged from 2023–2024, adjusted income tiers mean more people now qualify for higher payouts — especially under EHG.

EHG Income-to-Grant Table:

| Avg Household Income | EHG Amount |

|---|---|

| ≤ $1,500 | $80,000 |

| $2,500 | $65,000 |

| $4,000 | $50,000 |

| $6,000 | $30,000 |

| $9,000 | $5,000 |

Income ceilings for other grants:

- Family Grant: Up to $14,000/month (unchanged)

- Singles Grant: Up to $7,000/month

- EC Grant (Family Grant only): Increased to $16,000/month

Note: While the absolute amounts haven’t increased, more households fall into higher grant bands due to broader income calculations — such as allowing variable income and bonus averaging.

What Do These Changes Mean for You as a Homebuyer?

If you’re buying in 2025, here’s how these updates may benefit you:

- More inclusive eligibility: Households earning close to the ceiling may now qualify for partial EHG, where they previously missed out

- Higher support for EC buyers: With income ceiling raised to $16,000, more middle-income families can now access CPF grants for ECs — while still using a private property loan if needed

- Improved proximity validation: PHG abuse has been curbed, but genuine applicants now get faster approvals

Expert insight: Don’t assume you no longer qualify based on past rules. Grant mechanics evolve — and even if CPF grants don’t fully cover your shortfall, refinancing with a lower mortgage interest rate in Singapore could help you close the gap.

Tips to Maximise Your CPF Housing Grants

Getting a CPF Housing Grant is great — but getting the most out of it requires a bit of strategy. From choosing the right flat to timing your application well, here are smart ways to stretch every dollar and reduce your mortgage burden long-term.

Can You Combine Multiple Grants for Bigger Savings?

Yes — especially if you’re buying a resale flat. This is where CPF grants are the most stackable.

You can combine:

- Enhanced CPF Housing Grant (EHG) – up to $80,000

- Family Grant / Singles Grant – up to $80,000

- Proximity Housing Grant (PHG) – up to $30,000

In total, some buyers have received over $160,000 in CPF housing grants — dramatically lowering their loan amount.

Important: Stacking is only available for resale flats, not BTOs or ECs. And each grant has separate eligibility criteria, so you’ll need to meet all three to qualify fully.

Does Flat Type, Location or Timing Affect Your Grant Amount?

Absolutely. CPF grant amounts and eligibility can shift depending on:

- Flat Type:

- BTO buyers can only use EHG

- Resale buyers can stack EHG + Family/Singles Grant + PHG

- EC buyers are limited to Family Grant only

- BTO buyers can only use EHG

- Location:

- If your resale flat is within 4km of your parents/children, you may qualify for PHG

- Otherwise, you’ll miss out on up to $30,000 in grants

- If your resale flat is within 4km of your parents/children, you may qualify for PHG

- Timing:

- CPF considers your last 12 months of income

- Applying during a period of lower income (e.g. after a bonus payout cycle) may help you qualify for a higher grant tier

- CPF considers your last 12 months of income

Expert tip: Always use a mortgage calculator to see how your chosen grant combo affects your actual monthly payments. That way, you’re not just chasing max grant — you’re making sure it improves real affordability.

How to Plan Your Flat Purchase to Get the Most CPF Support

Here’s a strategic approach to maximise CPF grant value:

- Profile yourself first

Are you a first-time buyer? Single? Buying near family? Identify all grant types you might qualify for. - Use grants to reduce loan quantum, not stretch your budget

The goal isn’t to “afford more” — it’s to borrow less and save on interest. Grants should help you stay within your means. - Get your financing plan ready before applying

Compare home loan rates in Singapore or explore refinancing if you’re upgrading from a past flat. A lower interest loan + CPF grant combo = maximum savings. - Check distance eligibility early

If you’re counting on PHG, use HDB’s distance e-service to confirm proximity before committing to a unit.

Pro tip: If you’re buying as a single or with a non-citizen spouse, your grant situation will be more complex — but there are still ways to optimise. Don’t rule yourself out without doing the math or speaking to a loan specialist.

How to Apply for CPF Housing Grants

Applying for a CPF Housing Grant isn’t difficult — but missing a step or document can delay your approval or even cost you the grant altogether. Here’s a quick guide on how to apply smoothly and avoid common pitfalls.

What’s the Step-by-Step Grant Application Process?

The grant application is submitted together with your HDB or resale flat application. You don’t need to submit it separately — but it must be done at the right stage.

Step-by-step process:

- Check eligibility for grants like EHG, Family Grant, or PHG via HDB’s portal

- Submit flat application through HDB (BTO) or resale portal

- Select CPF Housing Grant option when prompted during the online application

- Upload required documents (proof of income, CPF history, etc.)

- Wait for approval – grant will be credited into your CPF OA upon approval

- Use the credited amount to offset your flat purchase or reduce your loan

If you’re applying for a resale flat, you may also want to compare mortgage packages ahead of time — your final loan amount will depend on how much grant you’re awarded.

What Documents Do You Need to Submit?

Most of the required documents relate to income verification and household composition.

Here’s what you typically need:

- NRIC copies of all applicants

- Latest 3 months’ payslips or 12-month income history (for EHG)

- CPF contribution history for employed applicants

- IRAS Notice of Assessment (for self-employed)

- Marriage certificate (for Family Grant)

- Birth certificates (if applying with children or for PHG eligibility)

- Employment letters (if newly employed)

Reminder: Self-employed, gig workers, and freelancers must provide more extensive income history. If you’re unsure, speak to a mortgage advisor to double-check what applies to your situation.

What Are Common Application Mistakes to Avoid?

Many grant rejections or delays come from simple avoidable errors. Here are the top mistakes:

- Submitting incorrect or outdated documents

- Missing out on uploading supporting documents for dependents or spouse

- Not meeting the 12-month employment requirement for EHG

- Forgetting to declare past grant usage or previous property ownership

- Assuming PHG applies without verifying actual distance

Remember to apply with complete documents from the start. This not only speeds up your HDB approval but also helps you lock in your loan faster — especially if you plan to refinance or reprice later.

Grant Amounts and How They Affect Your Housing Budget

CPF housing grants aren’t just a bonus — they can directly reduce your cash outlay, downpayment, and loan amount. But the actual grant amount you receive depends on your income, flat type, and buyer profile.

How Much Grant Can You Get Based on Income and Flat Choice?

Grant amounts scale based on your income — the lower your household income, the higher the CPF grant you’re likely to receive.

CPF Housing Grants Comparison Table (EHG, Family, Singles, PHG) – Amounts & Eligibility

| Grant Type | Max Amount | Key Criteria |

|---|---|---|

| EHG | $5k–$80k | Income ≤ $9,000/month, employed 12 months |

| Family Grant | $40k–$80k | For resale flat buyers, income ≤ $14,000/month |

| Singles Grant | Up to $40k | Single SC aged 35+, income ≤ $7,000 |

| PHG | $20k–$30k | If living within 4km or with parents/children |

Tip: Only resale flat buyers can combine multiple grants — which is why some end up with over $160,000 in total CPF support.

How to Calculate Your Total Grant Eligibility (With Example)

Let’s say you’re a first-time couple buying a resale 4-room flat near your parents. Your combined monthly income is $5,000.

Here’s how the grant calculation may look:

- EHG: $50,000 (based on income tier)

- Family Grant: $50,000 (for 4-room resale flat)

- PHG: $20,000 (within 4km of parents)

Total CPF grant = $120,000

That $120,000 will be credited into your CPF OA and directly deducted from the flat purchase price. You’ll borrow less and pay less interest long-term.

Want to see what your mortgage might look like after grant deductions? Use this repayment calculator to test different loan sizes.

How Do CPF Grants Lower Your Downpayment and Monthly Loan?

CPF housing grants reduce the net purchase price of your flat, which in turn affects:

- Downpayment:

Since your loan quantum is lower, the 10–25% downpayment (depending on loan type) becomes more affordable. - Monthly Instalments:

Less to borrow = lower interest = smaller monthly payments. This is especially helpful if you’re using bank loans or planning to refinance later on. - Loan Tenure Flexibility:

A reduced loan gives you room to either shorten your loan tenure or stay within MSR/TDSR limits for better financial health.

Bottom line? CPF grants don’t just save you money upfront — they also give you long-term breathing room on your mortgage.

Frequently Asked Questions About CPF Housing Grants

Still have doubts about how CPF housing grants work? Here are clear answers to some of the most common questions from homebuyers in Singapore.

Can I Get More Than One CPF Housing Grant?

Yes — if you’re buying a resale flat, you can qualify for multiple CPF grants. In fact, that’s how most people maximise their savings.

You may combine:

- EHG (based on income & employment)

- Family or Singles Grant (based on household type)

- Proximity Housing Grant (if you live near or with your family)

However, you can only receive each grant once, and they are subject to your income and flat type.

Reminder: BTO buyers can only apply for the EHG — other grants apply to resale flats.

How Does the Proximity Grant Work If My Parents Move?

The Proximity Housing Grant (PHG) is based on your distance from your parents or children at the time of application — not afterward.

So if your parents move away after you’ve received the grant, you won’t need to return it. HDB does not claw back the PHG once it’s disbursed.

That said, the flat you buy must be within 4km of their registered address when applying. HDB now uses GPS mapping to verify this, so be sure to confirm before committing.

What Happens If I Sell My Flat After Using CPF Grants?

When you sell a flat that was purchased with CPF grants, the grant amount (plus accrued interest) must be refunded back into your CPF OA.

This includes:

- The full grant amount used

- Accrued CPF interest over the years (currently 2.5% annually)

Important: If your resale proceeds aren’t enough to cover the refund, you’re not required to top up the shortfall in cash — as long as you sell at market value.

Before selling, it’s wise to speak with a mortgage advisor or use a CPF refund calculator to understand how much you’ll need to return.

Final Thoughts – Are You Making Full Use of Your CPF Grants?

CPF housing grants are one of the most powerful tools for making homeownership affordable in Singapore. But they’re often misunderstood, underutilised, or applied for too late — costing buyers thousands in missed savings.

Quick Recap of What You Need to Know

- First-time buyers can qualify for multiple CPF grants, including EHG, Family/Singles Grant, and PHG (for resale flats)

- Grant eligibility depends on income, citizenship, flat type, employment history, and proximity to family

- BTO buyers get only EHG, while resale buyers can stack grants for much higher savings

- All CPF grants reduce your loan amount and downpayment, improving long-term affordability

Who to Contact If You’re Unsure About Grant Eligibility

Not every case fits neatly into HDB’s default options — especially if:

- You’re buying with a non-citizen spouse

- You’ve used a grant before

- You’re self-employed or applying with multiple family members

In these situations, it’s best to speak with a mortgage broker in Singapore who can guide you through your grant eligibility, financing limits, and the best way to structure your loan.

Planning Your HDB Journey? Compare Loan Options and Get Advice

CPF grants are just one side of the affordability equation — the other is choosing the right mortgage. A lower interest rate, better loan structure, or timely refinancing plan could save you even more than the grant itself over 20–30 years.

Before committing to any flat, make sure you:

- Compare home loan rates in Singapore

- Understand your borrowing limits, monthly instalments, and long-term costs

- Have a clear grant strategy in place so you don’t leave money on the table

Smart buyers use both CPF grants and the right mortgage plan — and that’s what makes the difference.