DBS has launched some of the most competitive home loan rates we’ve seen in a while — including fixed rates from just 2.50% in 2025.

If you’re planning to buy a new home or refinance your existing loan, now’s a smart time to compare options. DBS isn’t the only player — banks like UOB and OCBC are also offering aggressive promos.

In this guide, we’ll break down:

- The latest DBS fixed and floating rates

- Who qualifies and how to apply

- How DBS stacks up against other banks

Remember, a lower interest rate doesn’t always mean a better deal. Check the lock-in period, fees, and flexibility too.

Want a shortcut? A mortgage broker can help you compare everything — for free.

Let’s dive in.

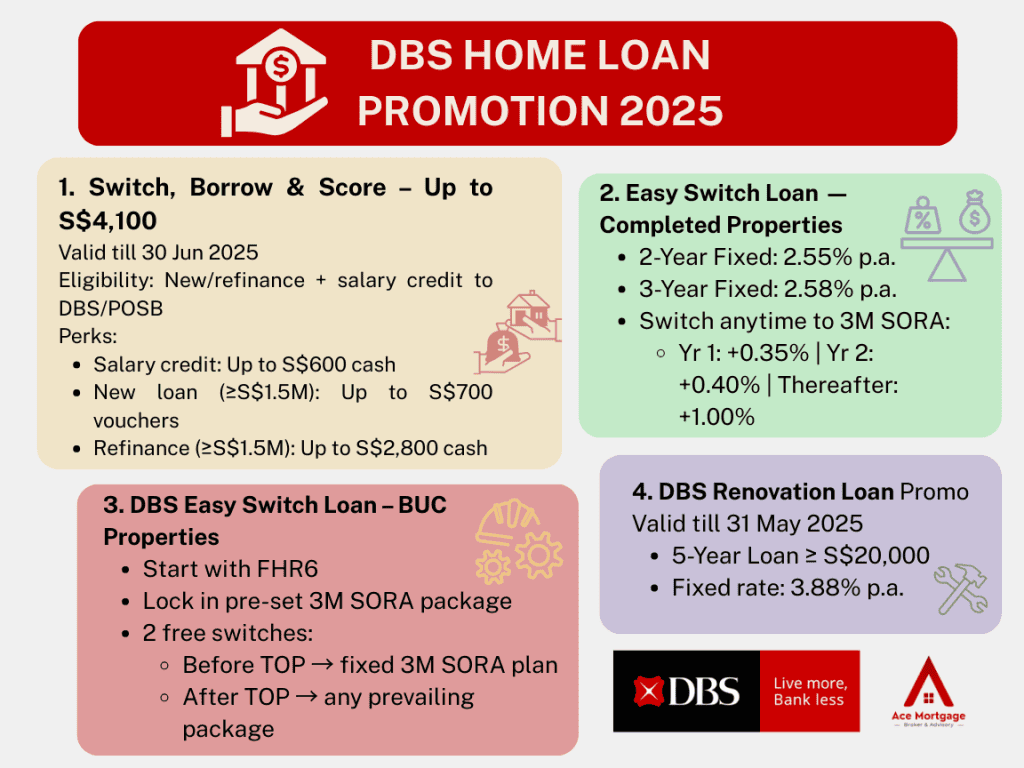

Latest DBS Home Loan Promotions in 2025

DBS is making waves in 2025 with some of the most competitive home loan packages in Singapore — including fixed rates from as low as 2.55% p.a. These promos are drawing interest from both new buyers and homeowners looking to refinance. Still, it’s worth comparing the fine print — from rewards and flexibility to how DBS stacks up against other banks in terms of total value and lock-in conditions.

If you’re unsure whether to go fixed or floating, comparing the long-term costs can make a big difference. And sometimes, a better deal lies outside your primary bank.

What are the current DBS home loan promotional rates?

DBS’s most talked-about offer right now is its 5-year fixed rate package at 2.50% p.a. This provides long-term stability — ideal if you’re locking in your first mortgage or prefer predictable repayments.

They also offer floating rate packages tied to the Fixed Deposit Home Rate (FHR), currently starting from around 2.90% p.a., depending on your loan amount and lock-in preferences.

DBS Home Loan Rates 2025 – Fixed vs Floating Packages

| Package Type | Interest Rate (Year 1–5) | Lock-in Period | Best For |

|---|---|---|---|

| Fixed Rate (5-Year) | From 2.50% | 5 years | Buyers who value repayment stability |

| FHR Floating Rate | ~2.90% | 2–3 years | Buyers expecting rates to drop |

Expert Tip: Fixed rates shield you from rate hikes, while floating rates may save you more if the market dips — it really depends on your outlook.

How do these promotions compare to other banks?

Compared to banks like UOB and OCBC, DBS is strong in branding and long-term fixed packages. But that doesn’t automatically make it the best choice for everyone.

- UOB sometimes offers shorter lock-ins and quicker processing.

- OCBC has attractive floating rates with no lock-in periods.

- Other banks may offer promotional cashback or lower legal fees.

From our view, DBS works best for those seeking peace of mind over 5 years, while UOB and OCBC may appeal to those who want more flexibility or expect to refinance early. Want the full picture? Use a mortgage broker to compare real offers across all banks — not just DBS.

Who is eligible for DBS home loan promotions?

To qualify for a DBS housing loan in 2025, you’ll need:

- A minimum gross income of $2,500/month

- Singaporean/PR status (foreigners may apply with stricter conditions)

- A clean credit record and TDSR below 55%

For self-employed borrowers, DBS typically requests:

- 2 years of NOA or CPF contribution history

- Company financials if applying under a business entity

Refinancing an existing HDB loan? DBS is also a great option — and you can explore your eligibility further on their refinance loan page. Use our repayment calculator to check your monthly commitment before applying.

Understanding DBS Fixed and Floating Rate Packages

Fixed Rate Home Loan Comparison (Singapore – May 2025)

| Bank | Rate | Tenure | Min Loan |

|---|---|---|---|

| DBS | 2.55% | 2 / 3 / 5 Years | $100,000 |

| OCBC | 2.60% | 2 / 3 Years | $100,000 |

| UOB | 2.58% | 3 Years | $100,000 |

| HSBC | 2.68% | 2 / 3 / 5 Years | $200,000 |

| MayBank | 2.50% | 5 Years | $100,000 |

Floating Rate Home Loan Comparison (Singapore – May 2025)

| Bank | Rate | Tenure | Min Loan |

|---|---|---|---|

| DBS | 2.90% | No Lock-in / 2 Years | $100,000 |

| OCBC | 2.85% | 2 Years | $100,000 |

| UOB | 2.95% | 2 Years | $100,000 |

| HSBC | 2.80% | No Lock-in | $200,000 |

| MayBank | 2.80% | 2 Years | $100,000 |

Choosing between a fixed or floating rate is one of the biggest decisions you’ll make when applying for a DBS housing loan.

Each option suits different needs, and DBS offers both — including their well-known Fixed Deposit Home Rate (FHR) packages. Let’s break down how these two work, and which might be a better fit depending on your goals.

What is the difference between fixed and floating rates at DBS?

A fixed rate home loan from DBS offers interest that remains the same for a set number of years — typically 2 to 5. Your monthly repayments won’t change during this lock-in period, which provides peace of mind.

A floating rate loan, on the other hand, is tied to the FHR. It fluctuates based on DBS’s own fixed deposit interest rates. That means your repayment amount can rise or fall depending on market movements.

If you need certainty and hate surprises, fixed rates are a safer pick. But floating rates could help you save more — especially if interest rates trend downward.

How does the Fixed Deposit Home Rate (FHR) work?

DBS pioneered the FHR model, which is unique in Singapore. Unlike traditional board rates that banks can adjust without much transparency, the FHR is pegged to specific tenures of DBS’s fixed deposit rates (e.g., FHR6 or FHR8 for 6 or 8-month deposit rates).

Here’s a simplified view:

DBS FHR Rate Comparison: FHR6 vs FHR8

| FHR Tier | Pegged To | Typical Rate (2025) | Transparency |

|---|---|---|---|

| FHR6 | 6-month fixed deposit rate | ~2.65% | High |

| FHR8 | 8-month fixed deposit rate | ~2.70% | High |

Expert tip: Since DBS publishes FHR rates publicly, there’s less chance of sudden interest rate hikes out of nowhere — unlike with board rates from some other banks.

Want to compare how other banks structure their floating rates? Visit our DBS home loan guide or check out OCBC home loans for contrast.

What are the pros and cons of each rate type?

To help you decide, here’s a quick side-by-side comparison:

Fixed vs Floating Rate: DBS Home Loan Comparison

| Feature | Fixed Rate | Floating (FHR) Rate |

|---|---|---|

| Stability | Yes – locked for 2–5 years | No – varies based on FHR |

| Potential to Save | Less if rates drop | More if rates fall |

| Early Repayment Fees | Often higher | Usually lower |

| Transparency | Predictable | Tied to published deposit rates |

| Best For | Long-term planners | Flexible homeowners with higher risk tolerance |

Our take: First-time buyers usually lean fixed for security. More seasoned owners, especially those with shorter-term plans, might prefer floating rates.

Still unsure? Use our mortgage repayment calculator to model both scenarios, or speak to a mortgage expert who can help tailor your decision.

DBS Home Loan Refinancing Options

Already have a mortgage? You might be overpaying without realising it. With interest rates stabilising in 2025, now’s a smart time to review your home loan. Refinancing to a DBS housing loan can help you lock in lower interest or improve your loan structure — especially if your current lock-in period has ended.

From experience, many clients only start thinking about refinancing after seeing rising repayments. But the best time is often 6 months before your lock-in ends.

When should you consider refinancing with DBS?

You should consider refinancing when:

- Your lock-in period is ending (or already over)

- Your current interest rate is above 2.80%

- You want to change your loan tenure or switch from floating to fixed

- You’re looking to cash out for renovations or investments

DBS often attracts refinancers with limited-time fixed packages and transparent FHR floating options, which make long-term planning easier.

Here’s a tip: Even a 0.30% difference in interest can mean tens of thousands saved over your loan tenure. Don’t ignore small percentage changes.

Explore the current options with our refinance home loan page or HDB refinance guide if you’re switching from an HDB loan.

What are the steps to refinance your home loan with DBS?

Refinancing with DBS is straightforward, especially if you’re working with a broker:

- Get an In-Principle Approval (IPA) from DBS

- Review the Letter of Offer (including lock-in and legal terms)

- Appoint a lawyer to handle legal conveyancing

- DBS disburses the loan and your old bank is repaid

- Start monthly payments with DBS — usually at a lower rate

The full process usually takes about 4–6 weeks, depending on the documentation and valuation.

Want someone to handle all this for you? A mortgage broker coordinates everything with DBS and your lawyer at no cost to you.

What are the costs and benefits of refinancing?

Let’s break it down:

Typical Costs:

- Legal fees: ~$2,000 (may be subsidised by DBS)

- Valuation fees: ~$200–$500

- Admin or clawback charges (if you’re still in lock-in)

Benefits:

- Lower interest = lower monthly payments

- Option to restructure your tenure

- Better alignment with current goals (e.g. shorter term or cash-out)

DBS Refinancing Costs and Subsidies Breakdown

| Category | Cost | Offset by DBS? |

|---|---|---|

| Legal Fees | ~$2,000 | Yes (partial) |

| Valuation Fees | $200–$500 | Often subsidised |

| Early Repayment Penalty | Varies (if applicable) | No |

Use our loan calculator to compare your current and potential new payments before refinancing.

DBS Bridging Loans Explained

Need funds for your new home before selling your current one? That’s where a DBS bridging loan comes in. It helps to “bridge” the short-term gap in financing, so you don’t miss out on buying your next property while waiting for your sale proceeds.

This type of short-term loan is ideal for buyers upgrading from one home to another — especially in Singapore’s fast-moving property market.

Personally, I’ve seen many clients hesitate to buy their dream home just because their current place hasn’t sold. A bridging loan can keep the momentum going.

What is a DBS bridging loan and how does it work?

A bridging loan from DBS works by giving you temporary access to cash secured against the proceeds from your existing property sale. It typically lasts up to 6 months, with repayment expected once your old flat is sold.

There are two types of bridging loan structures:

- Capitalised interest: You repay the full sum + interest only after your sale completes.

- Simultaneous repayment: You service both your main and bridging loan at the same time.

Capitalised interest is popular because it reduces immediate cash stress — though total interest paid may be slightly higher. Need help with structuring your transition smoothly? Speak to a mortgage broker who can plan out the timeline for you.

Who should consider taking a bridging loan?

Bridging loans are ideal for:

- Upgraders moving from HDB to condo or landed

- Buyers who’ve secured their next property before selling

- Anyone needing temporary funds to cover downpayment or stamp duties

Not sure if it’s for you? Here’s a quick checklist:

- You’ve already sold your current home (or sale is pending)

- You have an Option to Purchase (OTP) on a new property

- You need extra cash for booking fees, stamp duty, or bridging top-up

Tip: DBS bridging loans are useful but time-sensitive. Avoid last-minute scrambling — get pre-approved once you secure your new home.

What are the interest rates and repayment terms?

Bridging loan interest rates in 2025 are typically around 4.50%–5.25% p.a., slightly higher than standard home loans due to their short-term nature. Repayment is due in full once your current home’s sale completes — usually within 6 months.

DBS Bridging Loan Interest Rates and Terms (Singapore - May 2025)

| Feature | DBS Bridging Loan |

|---|---|

| Interest Rate | ~4.50%–5.25% p.a. |

| Tenure | Up to 6 months |

| Early Repayment Penalty | None |

| Collateral Required | Sales proceeds from your property |

Explore more bridging loan options in our private property loan guide — especially if you’re upgrading to a condo or landed property.

Eligibility Criteria for DBS Home Loans

Before jumping into any DBS home loan package, you’ll need to check if you qualify. While DBS offers one of the widest home loan selections in Singapore, they also follow strict lending criteria based on your income, credit health, and debt ratios. Missing one requirement could delay your approval — or cost you a better rate.

In my experience, many rejections happen not because of low income, but because buyers didn’t realise how much their existing loans affected TDSR.

What income and credit requirements must be met?

To qualify for a DBS housing loan in 2025, most applicants must meet the following:

For salaried employees:

- Minimum gross monthly income: $2,500

- Consistent CPF contributions

- Clean credit history

For self-employed / commission earners:

- At least 2 years of income history

- Latest Notice of Assessment (NOA)

- Business registration proof (if applicable)

If your profile is more complex — say you’re buying under a Pte Ltd or holding company — check out our breakdown on Singapore commercial property loans.

Pro tip: Avoid major purchases (like cars or furniture) before applying — big loans can reduce your approval odds.

How does the Total Debt Servicing Ratio (TDSR) affect eligibility?

TDSR is one of the key checks that can make or break your home loan approval. It limits your total monthly debt obligations to 55% of your gross income — including:

- Home loan instalments

- Car loans

- Credit card balances

- Student loans

Here’s how it works in simple terms:

TDSR Breakdown: How Much Home Loan You Can Qualify For (2025)

| Monthly Gross Income | Max Allowable Total Debt (55%) | Home Loan Must Fit Within |

|---|---|---|

| $4,000 | $2,200 | After accounting for other loans |

| $6,000 | $3,300 | - |

Don’t know your TDSR status? Use a mortgage calculator or consult a broker to avoid missteps.

What documents are needed for application?

Applying for a DBS home loan requires a few standard documents, depending on your income source.

Salaried employees:

- NRIC (front and back)

- Latest 3 months’ payslips

- CPF contribution history (last 12 months)

- Option to Purchase (OTP) for the property

Self-employed / business owners:

- 2 years of NOA

- ACRA BizFile or business registration

- Latest 6 months of bank statements

- CPF contribution (if any)

Planning to refinance? You’ll also need:

- Existing loan statement

- Title deed or mortgage document

- Valuation report (may be ordered by DBS)

Getting these ready early makes the process smoother — especially if you’re working with a mortgage broker who can help submit on your behalf.

Comparing DBS Home Loans with Other Banks

DBS might be one of the most recognised names in Singapore — but that doesn’t mean it’s automatically the best fit for everyone. In 2025, banks like UOB, OCBC, and even smaller lenders are stepping up with aggressive loan packages that compete closely with DBS’s offerings.

Let’s see how DBS stacks up, and whether it’s the best choice for your needs.

From what we’ve seen, DBS wins on fixed-rate stability — but loses out slightly on flexibility and early exit terms compared to others.

How do DBS home loan rates compare to competitors?

Here’s a quick side-by-side of common fixed and floating home loan rates as of early 2025:

DBS vs UOB vs OCBC: Home Loan Rates & Lock-in Periods (Singapore 2025)

| Bank | Fixed Rate (5Y) | Floating Rate (FHR / Board) | Lock-in Period |

|---|---|---|---|

| DBS | From 2.50% | ~2.65%–2.80% (FHR-based) | 2–5 years |

| UOB | ~2.45% | ~2.70% (3M SORA) | 2–3 years |

| OCBC | ~2.48% | ~2.68% (Board Rate) | 2–3 years |

As you can see, DBS is slightly higher on fixed rates, but often provides longer lock-ins and more stability.

Want a deeper dive into OCBC’s packages? Check out our OCBC home loan guide.

What unique features does DBS offer?

Here’s where DBS stands out:

- FHR pegging: Transparent floating rate benchmark published on DBS’s website

- Stable fixed-rate packages: Great for long-term planning

- Strong customer service and digital support via the DBS digibank app

Plus, DBS is known for its wider range of refinancing tools and loan structuring options, especially for buyers upgrading to condos. You can explore these further in our condo loan guide.

Personal tip: DBS is ideal if you’re risk-averse or planning to hold the property for 5 years or more. Otherwise, a bank with a shorter lock-in might save you more.

Are there any exclusive perks or rebates?

Yes — though they change from time to time. In 2025, DBS has offered:

- Legal subsidies (up to $2,000) for refinancing clients

- Valuation fee waivers for select packages

- Cashback for early sign-ups (limited promos)

Many of these perks aren’t listed publicly. Working with a mortgage broker ensures you don’t miss out on time-limited rebates or negotiated rates.

Also, DBS occasionally provides bundled deals for customers with:

- DBS Multiplier accounts

- Investments or insurance purchased together

Check our home loan blog for updates on the latest promotions across all banks — not just DBS.

Applying for a DBS Home Loan

Ready to take the next step? Whether you’re buying your first home, upgrading to a condo, or refinancing — applying for a DBS housing loan is a fairly smooth process in 2025. With online portals and mobile banking, it’s never been easier to get started.

We always recommend getting pre-approval (IPA) early. It puts you in a stronger position when negotiating or placing an offer.

What is the application process for a DBS home loan?

Here’s a simple step-by-step overview of how it works:

- Get an In-Principle Approval (IPA) – DBS assesses your income, credit history, and TDSR.

- Submit your Option to Purchase (OTP) – once your property is secured.

- Receive and review your Loan Letter of Offer – detailing rates, lock-in period, and terms.

- Appoint a law firm – to handle conveyancing and liaise with DBS.

- Loan disbursement – DBS releases the funds to seller or previous lender.

- Monthly repayments begin – based on your chosen fixed or floating package.

You can also read our full HDB home loan guide if you’re applying for a BTO or resale flat.

How long does approval typically take?

Timelines vary, but here’s a general estimate:

DBS Home Loan Approval Timeline – From IPA to Disbursement

| Stage | Typical Timeframe |

|---|---|

| IPA Assessment | 1–3 working days |

| Final Approval (post-OTP) | 3–5 working days |

| Legal & Disbursement | ~4–6 weeks total |

Factors that can delay approval include missing documents, CPF usage issues, or discrepancies in your credit history.

Tip: Avoid delays by preparing your income docs and CPF history early — or let a mortgage broker handle the paperwork for you.

Can you apply for a DBS home loan online?

Yes — DBS allows full online application through its DBS digibank portal and mobile app. You’ll need Singpass to log in and upload your documents digitally.

But take note:

- DBS only shows its own packages, not what other banks offer

- You won’t know if there’s a better deal elsewhere

- Promotions may not be reflected if you go direct

That’s why many buyers now choose to go through a mortgage comparison service — which helps you apply with DBS and compare it against UOB, OCBC, and others with one submission.

Applying directly is easy, but not always the most cost-effective. Always compare first.

Managing Your DBS Home Loan

Securing a home loan is just the first step — knowing how to manage it well over the next 20–30 years is where smart savings come in. From monthly repayments to interest tracking, DBS offers several tools to help homeowners stay on top of things. Here’s what you need to know.

Many borrowers focus so much on getting a loan, they forget to plan how to manage it. Don’t be one of them — small decisions here can save thousands.

How can you make repayments on your DBS home loan?

DBS offers several easy repayment methods, and you can set them up as soon as your loan is disbursed:

- GIRO deduction from your DBS/POSB account (most common)

- CPF monthly instalments from your OA (for HDB and eligible private loans)

- Manual payments via internet banking (less common)

Want to estimate your monthly commitment? Use our mortgage loan repayment calculator to see how different loan amounts and tenures affect your cash flow.

Set a reminder a few days before GIRO deductions — especially if you’re managing multiple accounts.

What options are available if you face payment difficulties?

Life happens — and banks understand that. If you’re facing temporary hardship (e.g. job loss or medical issues), DBS offers the following support options:

- Loan tenure extension to lower your monthly repayment

- Temporary deferment plans (case-by-case basis)

- Partial repayments to reduce interest while staying flexible

Contact DBS early if you anticipate payment trouble. Avoiding the problem could lead to penalties or late interest that compound quickly.

Tip: If you’re unsure how to approach the bank, a mortgage broker can help you negotiate a solution discreetly.

How can you monitor your loan balance and interest rates?

You can track everything easily via:

- DBS digibank (online or app) – shows outstanding loan, next due date, and interest rate

- Annual loan statements – mailed or emailed by DBS

- Loan servicing hotline – for specific queries

Want to check if your rate is still competitive? Many homeowners forget to review their loan after the lock-in period ends, which can result in higher repayments.

After your lock-in ends, it’s often smart to explore refinancing options — or at least check if DBS offers a better internal repricing deal.

Frequently Asked Questions About DBS Home Loans

Still have questions about how DBS home loans work in 2025? You’re not alone. Here are answers to some of the most common queries we hear from homeowners, upgraders, and expats.

Can foreigners apply for a DBS home loan?

Yes, foreigners can apply — but approval criteria are stricter. Generally, DBS only lends to foreigners for:

- Private property purchases (condos or landed)

- Properties with higher valuations (e.g. $1 million+)

- Applicants with stable, documented income in Singapore

Note: HDB flats are not eligible for foreign buyer financing under DBS.

We recommend speaking with a mortgage broker to assess eligibility before you apply — especially if you’re holding an EP or S Pass.

What is the minimum loan amount offered by DBS?

As of 2025, DBS requires a minimum loan size of $100,000 for most property types. Anything below this threshold might not be accepted or could be redirected to a personal loan instead.

Minimum Loan Amounts for DBS Home Loans (Singapore 2025)

| Property Type | Minimum Loan Amount |

|---|---|

| HDB / Resale Flat | $100,000 |

| Condo / Private Property | $100,000 |

| Commercial / Investment | Higher (case-by-case) |

Looking at a smaller loan or hybrid scenario? Try our condo loan guide or speak with us to explore alternatives.

Are there penalties for early repayment?

Yes — early repayment penalties can apply, especially if you’re still within your lock-in period. Here’s what to expect:

- Within lock-in period: Penalty of ~1.5% of the outstanding loan amount

- After lock-in: No penalty, but some admin fees may apply

- Partial repayment: Allowed in most packages, but may require 1-month notice

Tip: Always check your loan letter before making early payments. Or better — let a broker help you review the terms before refinancing or selling.

Want to avoid these fees? Check out DBS’s internal repricing packages or explore our refinance loan options for better deals without penalties.

Final Thoughts – Is a DBS Home Loan Right for You in 2025?

DBS continues to be a solid choice in 2025 — especially for homeowners who value stability, trusted service, and long-term fixed packages. With competitive fixed and FHR floating rates, a wide refinancing network, and transparent processes, DBS checks many boxes.

But that doesn’t mean you should skip the comparison. Every borrower has a different profile, and the “best” loan often depends on your income, property type, lock-in preferences, and long-term goals.

From our view, DBS suits first-timers, risk-averse buyers, and upgraders who want peace of mind. If you’re flexible or want ultra-low rates, other banks may edge ahead.

What’s the next step?

- Use our repayment calculator to estimate your monthly cost

- Speak to a mortgage broker — we compare DBS, UOB, OCBC, and more in one go

- Or explore our latest tips and insights via the Ace Mortgage blog

Still unsure? Drop us a message via our contact page — no pressure, no sales pitch. Just real advice tailored to your home buying goals.