If you’re living in or buying an HDB flat, you’ve probably heard about fire insurance. But do you really need it? The truth is, fire insurance protects your flat’s structure — like walls and floors — from costly fire damage. Even though fires are rare, repairs can get expensive fast.

In this article, we’ll break down what HDB fire insurance covers, who must have it, and why it’s important to keep it up to date. No jargon, just simple facts so you can make smart decisions about protecting your home.

Let’s dive in!

Why HDB Fire Insurance Still Matters in 2025

If you’re living in an HDB flat, especially while repaying a home loan in Singapore, fire insurance might seem like an afterthought — until you actually need it.

In 2023 alone, over 900 residential fires were reported across Singapore. Most were small, but a single electrical spark or unattended kitchen flame can still cause serious structural damage — which HDB requires you to repair before you can sell or hand over your flat.

For something so affordable, fire insurance continues to be one of the most underrated forms of financial protection in 2025.

H3: Rebuilding your flat after a fire could cost up to $70,000

Let’s say a fire damages your kitchen and spreads smoke through the house. You’d be looking at:

- Tiling, plastering, repainting

- Replacing HDB windows, doors, fittings

- Rewiring and plumbing reinstatement

All that? Easily $40,000 to $70,000 in reinstatement costs — on top of your monthly mortgage repayments.

Expert tip: “Many flat owners assume their renovation insurance will cover structural damage, but it won’t. HDB fire insurance is the only thing standing between you and a massive restoration bill.” — Elaine Goh, licensed mortgage broker in Singapore

H3: Most HDB owners assume they’re covered — but they’re not

One of the most common misconceptions we hear is:

“I already bought home insurance from my bank, so should be fully covered, right?”

Actually… no.

Home contents insurance covers your renovation and belongings. But it won’t pay to fix your walls, floors, or wiring — all of which are required if you plan to sell, refinance, or return your unit to HDB.

If you’re still on an HDB home loan, missing this coverage is a real financial blind spot — especially with fluctuating housing loan interest rates already affecting your monthly budget.

H3: For less than $2, you get essential structural protection

Here’s the part that still surprises people: fire insurance premiums start at just $1.11 for a five-year policy.

That’s less than 25 cents a year to protect up to $176,700 in structural value (depending on flat type). You don’t even pay monthly — it’s a one-off sum that keeps your flat in compliance with HDB’s reinstatement policies.

Personal tip: Set a yearly reminder in your phone to check the expiry date on your Certificate of Insurance. It’s a small habit that could save you tens of thousands later.

What Is HDB Fire Insurance and Why It’s Mandatory

HDB fire insurance isn’t optional if you’re using an HDB loan — it’s a condition tied directly to your mortgage agreement. The policy is designed to cover the original structure of your flat in the event of a fire, ensuring that you’re not left financially stranded if disaster strikes.

It’s not about covering your lifestyle or renovation — it’s about protecting HDB’s baseline handover condition, which you’re contractually responsible for maintaining.

HDB fire insurance is compulsory for all HDB loan holders

If you’re borrowing directly from HDB, the fire insurance policy is mandatory. HDB won’t release your loan disbursement without a valid Certificate of Insurance (COI) in place — and you’ll need to renew this coverage throughout the entire loan period.

📌 Planning to refinance or sell? You’ll also need to show this certificate to your bank or conveyancing lawyer.

It only covers your flat’s original structure — nothing you’ve added

Fire insurance does not cover renovations, built-ins, or furniture. It only protects:

- Walls, flooring, ceiling finishes

- HDB-installed sanitary fittings, pipes, and electrical wiring

- Windows and doors originally provided by HDB

So if you’ve added feature walls, built-in wardrobes, or kitchen cabinets — those aren’t covered.

To protect those, you’ll need separate enhanced home insurance from a private provider.

The policy helps meet HDB reinstatement conditions after a fire

If your flat suffers fire damage, HDB expects you to reinstate it to its original condition — even if you’re planning to move out or sell.

The fire insurance payout gives you the financial means to do that, covering essential works that can otherwise cost tens of thousands. Without it, you’ll be footing the bill yourself — which could be a major setback if you’re already managing rising home loan interest rates in Singapore.

When You’re Required to Buy Fire Insurance

Not everyone needs fire insurance by law — but if you’re holding an HDB loan, it’s non-negotiable. For everyone else? It’s not required, but skipping it leaves you financially exposed if something goes wrong.

You must buy fire insurance if you’re taking an HDB loan

Fire insurance is mandatory if you’re using HDB’s financing to buy your flat. Without proof of an active policy — issued by HDB’s appointed insurer, Etiqa Insurance as of 2025 — your loan disbursement won’t go through.

Even after you move in, you’ll need to keep it active until your HDB loan is fully repaid.

This policy ensures HDB’s interest in the flat is protected — and so is yours.

Not required for bank loans — but still strongly recommended

If you’re financing your flat with a bank loan for HDB or private property, fire insurance isn’t compulsory — but banks often expect you to have some form of structural protection in place.

And let’s be real: if a fire causes $50,000 in damage, having a mortgage in Singapore with no insurance puts the full financial burden on you.

Some banks also bundle fire or home insurance into your loan package — but coverage levels vary, so check the fine print.

Forgetting to renew could void your protection completely

HDB fire insurance isn’t a one-time payment — it needs to be renewed at the end of each 5-year term (unless stated otherwise). If you forget to renew:

- Your structural protection lapses

- You may be non-compliant with your HDB loan

- You might face issues during resale or refinancing

⏰ Tip: Set a phone reminder to check your renewal on MyHDBPage before expiry — no one’s going to chase you if you forget.

What HDB Fire Insurance Actually Covers (And Doesn’t)

Here’s the truth: HDB fire insurance only covers the basic structure of your flat, nothing more. If you’ve renovated your home or filled it with personal items, this policy won’t help you replace them after a fire.

Covers only walls, floors, windows, and HDB-provided fixtures

The policy is designed to restore your flat to its original condition — the way HDB handed it to you. That includes:

- Internal walls, ceilings, floor tiles

- HDB-issued doors and windows

- Sanitary fittings (original toilet bowls, sinks, etc.)

- Electrical wiring and water piping installed by HDB

🔎 This matters because HDB requires you to reinstate the flat to original condition after a fire — even if you’re moving out or selling.

Does not cover renovations, furniture, or your electronics

Any work done beyond the basic HDB fittings is not covered. That means:

- Renovated kitchens or bathrooms

- Built-in wardrobes or feature walls

- Sofas, beds, TVs, laptops, fridges, and personal items

If you’ve upgraded your space or invested in custom carpentry, you’ll need separate home contents insurance to protect those.

🧠 Tip: Many homeowners assume their mortgage in Singapore comes with full insurance — but most bank-linked policies only offer limited structural cover.

No compensation for smoke, flooding, theft, or alternate housing

Fire insurance is specific. It does not pay for:

- Smoke or soot damage

- Burst pipes or flood-related issues

- Stolen items or break-ins

- Hotel stays or temporary accommodation

If you’re worried about these risks, you’ll want to combine your fire insurance with an enhanced home insurance policy.

💡 The best coverage often comes from bundling both — especially if you’re already managing a fluctuating housing loan interest rate.

How Much Does HDB Fire Insurance Cost in 2025?

One of the best things about HDB fire insurance? It’s incredibly affordable, even with rising costs everywhere else. Whether you’re still repaying a home loan in Singapore or just bought your first resale flat, the cost of 5-year coverage is less than most people spend on Grab rides in a week.

Better still — you pay it once every five years, not annually or monthly.

Premiums start at $1.11 for 1-room flats — here’s the full range

HDB fire insurance premiums are fixed based on your flat type. As of 2025, here’s what you’ll pay for a 5-year policy (including GST):

- 1-room flat: $1.11

- 2-room flat: $1.99

- 3-room flat: $3.27

- 4-room flat: $4.59

- 5-room flat / 3Gen flat: $5.43

- Executive / Multi-Gen flat: $6.68

No income tiering, no extras — just simple, fixed prices from Etiqa Insurance, HDB’s current insurer.

Maximum coverage goes up to $176,700 for executive flats

The sum insured (i.e. how much the policy will pay out after a fire) increases with your flat size. Executive flats get the highest protection, capped at $176,700.

This payout is intended to cover reinstatement of your flat’s original HDB finish — a must if you’re selling or returning the flat.

🧠 Tip: You can estimate the potential out-of-pocket cost after a fire using a mortgage loan repayment calculator and comparing it against your insured amount.

Use this table to find your flat type’s current premium

Below is the latest summary of HDB fire insurance premiums and insured amounts by flat type. This table reflects the 5-year rates and coverage provided by Etiqa Insurance, HDB’s appointed fire insurer from August 2024.

HDB Fire Insurance Premiums and Coverage by Flat Type (2025 Table)

| Flat Type | 5-Year Premium (w/ GST) | Sum Insured |

|---|---|---|

| 1-Room | $1.11 | $37,900 |

| 2-Room | $1.99 | $57,000 |

| 3-Room | $3.27 | $83,300 |

| 4-Room / Type S1 | $4.59 | $117,000 |

| 5-Room / 3Gen / Type S2 | $5.43 | $144,800 |

| Executive / Multi-Gen | $6.68 | $176,700 |

📌 Rates are provided by Etiqa Insurance Pte. Ltd., HDB’s official fire insurance partner as of 16 August 2024.

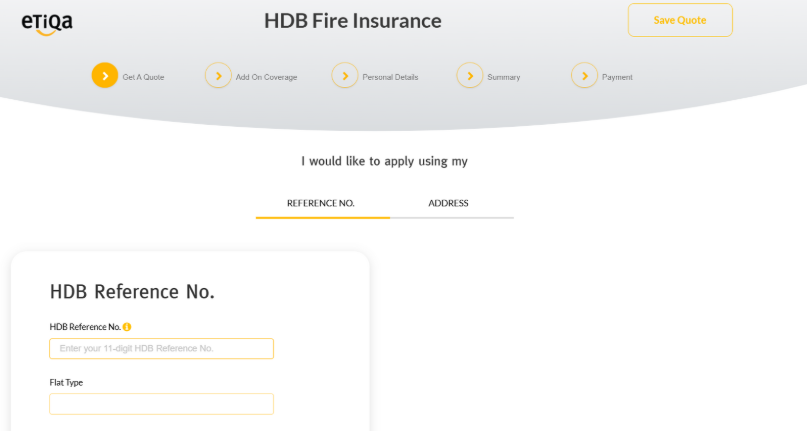

How to Buy or Renew Your HDB Fire Insurance

Whether you’re taking an HDB loan or preparing your flat for resale, keeping your fire insurance active is crucial. As of August 2024, Etiqa Insurance Pte. Ltd. is the official fire insurer appointed by HDB.

Most policies last 5 years — and if yours is nearing expiry, you’ll need to renew it manually. Here’s how to check, renew, and download your certificate.

Where and how to check your fire insurance status online

To see if your fire insurance is still valid:

- Go to MyHDBPage

- Log in using Singpass

- Under My Flat → Purchased Flat → Financial Info, check your Fire Insurance Details

You’ll see:

- Whether your policy is active

- Expiry date

- Sum insured

- Insurer (should now reflect Etiqa Insurance)

⏰ Tip: Set a calendar reminder 1 month before expiry — HDB doesn’t send automated alerts.

Steps to renew your policy and download your certificate

There are two simple ways to renew your fire insurance:

Option 1: Online via Etiqa

- Visit etiqa.com.sg

- Navigate to Fire Insurance → HDB Fire Insurance Scheme

- Enter your postal code or HDB scheme account number

- Confirm flat type and make payment

- Download your Certificate of Insurance (COI) instantly

Option 2: AXS Kiosk or AXS App

- Tap “eServices” → “Insurance” → “Etiqa Fire Insurance”

- Scan barcode from your renewal letter (or enter details manually)

- Pay via PayNow, credit card, or NETS

Why the Certificate of Insurance is crucial for loans or resale

Your COI is more than a receipt — it’s proof that your HDB flat is properly insured.

You’ll need to show your COI when:

- Getting an HDB loan disbursed

- Applying for home loan refinancing in Singapore

- Selling your flat (HDB resale checklist requires valid fire insurance)

- Using CPF for monthly instalments

🧠 Pro Tip: Save a digital copy in your email or Google Drive. It’ll save you stress when dealing with HDB or your bank.

Do You Need More Than Just HDB Fire Insurance?

Short answer: yes — in most cases.

While HDB fire insurance protects your flat’s original structure, it does not cover everything inside your home. If you’ve renovated or own furniture, electronics, or other valuables, you’ll want a second layer of protection: enhanced home insurance.

Fire insurance doesn’t protect your renovation or personal items

HDB fire insurance only covers your flat in its original HDB condition — nothing you’ve added later. That means if a fire damages your:

- Built-in cabinets

- Custom wardrobes or feature walls

- TV, fridge, laptop, or sofa

You’re on your own. These are not covered by HDB’s scheme.

🛠️ If you’ve upgraded your unit significantly while still paying a mortgage in Singapore, this gap could be financially painful.

Enhanced home insurance covers what fire insurance doesn’t

Enhanced home insurance (also called home contents insurance) steps in where fire insurance stops. It covers:

- Renovation works and fittings

- Household electronics and appliances

- Furniture and personal belongings

- Alternative accommodation if your flat becomes unlivable

Some plans even include theft, burst pipes, and accidental damage.

💡 Look for a plan that complements — not overlaps — your HDB fire insurance.

You might need both if you’ve spent on interiors or valuables

If you’ve invested in your home — even a $10,000 kitchen reno or a few big-ticket gadgets — it makes sense to layer both policies.

Think of it like this:

Comparison of HDB Fire Insurance vs Enhanced Home Insurance Coverage in Singapore (2025)

| Insurance Type | Protects | Covers Up To |

|---|---|---|

| HDB Fire Insurance | Walls, floors, HDB fixtures (structure) | Up to $176,700 (by flat type) |

| Enhanced Home Insurance | Renovations, electronics, furniture | Depends on policy chosen |

Tip: Review your total home value — if it’s above your fire insurance coverage, it’s time to consider an upgrade.

Quick Checklist: Is HDB Fire Insurance Enough for You?

Not sure if basic fire insurance is sufficient? Use this quick checklist to assess your situation.

If you answer ✅ to any of the points below, it might be time to top up with enhanced home insurance for fuller protection.

✅ Still paying an HDB loan? You’re required to have it

You’re required to maintain valid fire insurance throughout your loan period — no exceptions.

✅ Renovated or upgraded your home? Consider added protection

Your built-ins, carpentry, and fittings aren’t protected by fire insurance. You’ll need separate contents coverage.

✅ Own furniture, gadgets, or valuables? Basic cover won’t be enough

TVs, laptops, designer bags, or even your fridge — all excluded from HDB’s basic policy.

Pro Tip: Pair HDB fire insurance with enhanced home contents insurance for full coverage — especially if you’re already repaying a mortgage in Singapore.

Frequently Asked Questions About HDB Fire Insurance

H3: Can I use CPF to pay for fire insurance premiums? (No — only cash or AXS/GIRO)

No — you must use cash, GIRO, or pay via AXS (kiosk, e-station, or mobile app). CPF cannot be used to pay for HDB fire insurance premiums.

Who provides HDB fire insurance in 2025? (Etiqa Insurance Pte. Ltd.)

As of 16 August 2024, HDB appointed Etiqa Insurance Pte. Ltd. as the official fire insurer under the HDB Fire Insurance Scheme. NTUC Income is no longer the provider.

Policies now run for a 5-year term and are purchased or renewed via Etiqa or AXS channels.

What happens if I miss the renewal? (You risk going uninsured)

If your 5-year fire insurance policy expires and you don’t renew it:

- You’ll have no coverage for structural damage

- You may be non-compliant with your HDB loan terms

- Resale or refinancing transactions could be delayed

🔔 Tip: Set a phone reminder before expiry — HDB does not send automated notifications.

Does it cover water leaks, burst pipes, or theft? (No — only fire to structure)

No, it doesn’t. HDB fire insurance is strictly limited to fire-related damage affecting:

- Structural walls

- Flooring

- HDB-provided fixtures and wiring

It does not cover water damage, flooding, pipe issues, theft, or vandalism. For those, you’ll need enhanced home insurance.

Conclusion: A Small Policy with Big Protection

Fire insurance might not be flashy — but if you’re a flat owner in Singapore, it’s one of the smartest and most affordable protections you can have. For just a few dollars every five years, you get peace of mind that your flat’s structure is covered — and your loan obligations are protected.

✅ Still paying off your HDB loan? It’s mandatory.

✅ Renovated your space or filled it with expensive items? It’s time to consider more.

✅ Want full protection? Pair fire insurance with enhanced home contents cover.

Not Sure If You’re Fully Covered?

If you’re unsure whether your current plan is enough — or you’re planning to refinance your home loan or switch lenders — it’s worth speaking with a trusted mortgage broker in Singapore.

We’ll help you sort out your loan, protection, and compliance — so your home is safe, inside and out.