If you’re single and thinking about buying a flat in Singapore, here’s something you should know: you could be leaving tens of thousands of dollars on the table.

In 2025, singles can qualify for CPF housing grants like EHG, Singles Grant, and PHG — and yes, they’re real money. Whether you’re eyeing a BTO or a resale flat, these grants can shave off a huge chunk of your cost — up to $115,000 or more if you plan it right.

The best part? You don’t need to be coupled up to qualify. So if you’re buying solo, this is your chance to make homeownership a lot more affordable

Enhanced CPF Housing Grant (EHG) – The Core Grant for Singles

If you’re buying a home solo for the first time, the Enhanced CPF Housing Grant (EHG) is likely the main CPF grant you’ll qualify for.

It’s available whether you’re going for a BTO flat or a resale flat, and in 2025, it remains one of the most generous subsidies offered to singles in Singapore.

It’s also the only housing grant that applies across both flat types — making it a key factor in your budgeting and home loan planning.

How Much EHG Can a Single Get in 2025?

As of 2025, eligible singles can receive up to $40,000 in EHG. The exact amount you’ll get depends on your average monthly income over the past 12 months. The lower your income, the higher your grant.

Here’s a rough breakdown:

Enhanced CPF Housing Grant (EHG) Amounts for Singles Based on Monthly Income (2025)

| Monthly Income (Single) | EHG Grant Amount |

|---|---|

| ≤ $1,500 | $40,000 |

| $1,501 – $2,000 | $35,000 |

| $2,001 – $2,500 | $30,000 |

| $2,501 – $3,000 | $25,000 |

| $3,001 – $3,500 | $20,000 |

| $3,501 – $4,000 | $15,000 |

| $4,001 – $4,500 | $10,000 |

This grant is credited to your CPF Ordinary Account and goes toward your flat purchase, reducing the loan amount you need — and that means smaller monthly repayments. You can use our mortgage loan repayment calculator to estimate your actual monthly costs.

Expert tip: If your income is just above a threshold, it could be worth holding off a month or two if it means qualifying for a higher grant tier. Even a $200 difference in average income can mean thousands more in grant support.

What Income, Employment and Lease Criteria Apply?

To qualify for the EHG in 2025, you must meet all of the following conditions:

- Income ceiling: Your average gross monthly income must be $4,500 or less

- Employment requirement: You must have worked continuously for the past 12 months, with CPF contributions

- Lease requirement: The flat must have a remaining lease that can last you to at least age 95

These criteria apply to both BTO and resale flats, and yes — HDB checks all three carefully. If you’re buying an older resale unit, the lease rule is especially important. If the lease doesn’t meet the minimum, your grant amount may be reduced or denied.

Real talk: Always check the lease balance of your shortlisted units before locking in an Option to Purchase (OTP). A great location doesn’t mean much if it disqualifies you from the grant.

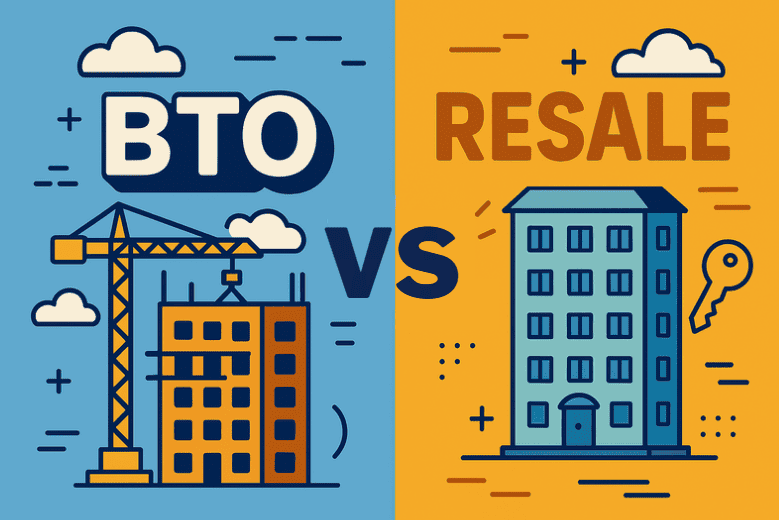

Does EHG Apply Differently for BTO vs Resale?

Technically, the EHG amount is calculated the same way for both BTO and resale flats — based on income and lease. But the context differs:

- For BTO flats, EHG is the only CPF housing grant that singles can access

- For resale flats, EHG can be stacked with the Singles Grant and the Proximity Housing Grant (PHG)

That’s why resale buyers often walk away with more total grant money — even though resale prices are usually higher. The ability to combine grants can offset a big chunk of your housing loan in Singapore.

If you’re income-eligible and okay with a resale flat, don’t overlook the stacking potential — it’s how many singles end up with $90K+ in total CPF grants.

Singles Grant – Boost for Resale Flat Buyers

Thinking of buying a resale flat on your own? Then don’t overlook the Singles Grant — it’s one of the few CPF housing grants created just for unmarried Singaporean first-time buyers.

Unlike BTO buyers, who can only tap into the EHG, resale buyers can stack multiple grants, and the Singles Grant plays a massive role in making homeownership more affordable for singles in 2025.

What Is the Singles Grant Amount for Resale in 2025?

As of 2025, the Singles Grant gives you:

- $40,000 when buying a 2-room to 4-room resale flat

- $25,000 for a 5-room resale flat

It’s a one-time CPF housing grant credited to your CPF Ordinary Account, directly reducing the amount of mortgage you’ll need to borrow — which means lower monthly repayments and less total interest paid over the years.

When combined with the Enhanced CPF Housing Grant (EHG) and Proximity Housing Grant (PHG), your total grant amount as a single buyer could reach $95,000 or more — that’s more than what some couples get.

Pro tip: This is one of the rare grants only available for resale flats. If you’re leaning resale, it’s a major financial plus.

Who Qualifies and What Income Thresholds Apply?

To be eligible for the Singles Grant in 2025, you must meet the following criteria:

- Be a Singapore Citizen

- Be 35 years old and above (or 21 if widowed/orphaned)

- Be a first-time applicant (never received any housing subsidy)

- Earn a gross monthly income of $7,000 or less

- Purchase a resale flat under the Single Scheme or Joint Singles Scheme

If you’re applying under the Joint Singles Scheme, both applicants must meet the eligibility conditions. The grant will be split equally between your CPF accounts.

Also important: the flat must meet HDB’s minimum lease rules — so always check that it lasts you to at least age 95 if you want the full grant.

Why Singles Should Prioritise This Grant

Let’s be real — buying a flat solo in Singapore isn’t cheap. Without a second income or co-owner, you’ll feel every dollar of that mortgage. That’s why the Singles Grant is a game-changer.

Here’s why it deserves serious attention:

- It’s stackable with EHG and PHG, boosting your total CPF support

- It offers more flexibility in choosing location, size, and timeline

- It helps you reduce your housing loan interest rate by shrinking your loan amount upfront

In many cases, choosing a resale flat — and getting this grant — could save you years of waiting for a BTO and tens of thousands in mortgage interest. If you pair that with the right mortgage loan in Singapore, you’re looking at real long-term savings.

If you qualify, don’t hesitate — the Singles Grant is one of the best tools to make solo homeownership possible in 2025.

Proximity Housing Grant (PHG) – Stay Close to Family

If you’re buying a resale flat as a single, there’s one more grant that often flies under the radar — the Proximity Housing Grant (PHG). It’s not income-based, and it doesn’t require you to live with anyone. All you need to do is live near your parents or children.

For many singles, this is the easiest CPF housing grant to qualify for — and when stacked with the Enhanced CPF Housing Grant and Singles Grant, it can push your total grant support well above $100,000.

What PHG Amounts Do Singles Get in 2025?

The PHG gives singles up to:

- $15,000 if you move in with your parents or children

- $10,000 if you live within 4km of them

This grant is credited to your CPF OA, just like the others, and directly reduces your property loan amount — giving you a better chance at more manageable monthly repayments or lower interest costs.

And the best part? There’s no income ceiling. It’s purely based on location and relationship.

Even if your income disqualifies you from EHG, PHG may still be available — and worth it.

Who Qualifies Based on Proximity Rules?

To qualify for the PHG as a single:

- You must be buying a resale flat (PHG doesn’t apply to BTOs)

- Your parents or children must either:

- Live with you in the new flat

- Live within 4km of the flat you’re buying

- Live with you in the new flat

- The family member you’re staying near must be a Singapore Citizen or PR

- You must remain within proximity throughout the Minimum Occupation Period (MOP)

The distance is calculated using the shortest walking route — so it’s based on HDB’s internal mapping, not driving distance.

Pro tip: Use HDB’s distance e-service before applying. Some buyers have been caught off guard thinking 4km “by car” counts — it doesn’t.

Common PHG Pitfalls to Avoid

- Buying too far without checking: Don’t assume a nearby condo or block qualifies. Even a 4.1km distance can disqualify you.

- Parents moving away after you apply: You must maintain the proximity or co-residence during your MOP. If they relocate, you may have to refund the grant.

- Buying ineligible flat types: PHG is for resale only — not BTO or EC purchases.

Also, remember — if you’ve used the PHG once before, you can’t claim it again. It’s a one-time grant per buyer.

Stacked correctly, PHG might be the final push that lets you afford a better flat in a better location — while staying close to the people who matter.

Stacking Grants – Maximise Your Grant Take-Up

If you’re buying a resale flat as a single, you’re in a unique position — you can stack multiple CPF housing grants. Unlike BTO buyers who only qualify for EHG, resale buyers can combine EHG, the Singles Grant, and the Proximity Housing Grant (PHG) for serious savings.

In 2025, this stacking strategy is one of the most effective ways for single buyers to reduce their housing loan in Singapore and lower their long-term interest burden.

Can You Combine EHG + Singles Grant + PHG?

Yes — and that’s exactly how many single buyers reduce their upfront costs by $90,000 to $115,000 or more.

Here’s how the grants stack:

- EHG: Up to $40,000 (based on income)

- Singles Grant: $25,000–$40,000 (flat type dependent)

- PHG: $10,000–$15,000 (based on proximity)

All three grants are credited to your CPF Ordinary Account and used to offset the property price — which means smaller loan amounts, less interest, and better mortgage terms.

Pro tip: Grant stacking only applies to resale flats. If you’re buying BTO, you’ll only get EHG — no Singles Grant, no PHG.

Sample Grant Outcomes by Income Levels

Let’s break it down with simple examples. If you’re buying a 4-room resale flat under the Single Scheme:

Total CPF Housing Grants for Singles in 2025 (EHG + Singles Grant + PHG)

| Monthly Income | EHG | Singles Grant | PHG | Total CPF Grants |

|---|---|---|---|---|

| $1,800 | $35,000 | $40,000 | $15,000 | $90,000 |

| $2,500 | $25,000 | $40,000 | $10,000 | $75,000 |

| $4,000 | $10,000 | $40,000 | $10,000 | $60,000 |

Want to see how this impacts your monthly repayment? Use our mortgage loan repayment calculator to estimate the savings based on your grant stack and loan amount.

Where Resale Outshines BTO for Grant Value

Let’s be honest — BTOs are great if you’re okay with waiting and have a tight budget. But when it comes to maximising CPF housing grants, resale flats win hands down.

Here’s why:

- Only EHG is available for BTO flats

- Resale lets you stack EHG + Singles Grant + PHG

- The combined grants can offset 20–30% of a typical resale flat price

Even if resale prices are higher, the extra grant support and flexibility — from choosing location to skipping long BTO waits — can be worth it.

If you want more flat choices, earlier keys, and better grant value, resale is the smarter path for many singles — especially in 2025’s tight market.

Eligibility Essentials and Avoiding Grant Rejection

Getting CPF housing grants as a single buyer in Singapore is definitely doable — but it’s not automatic. Many first-time applicants get tripped up by small eligibility details that lead to delays, lower grant amounts, or outright rejection.

To help you avoid that, here’s what you need to know before applying for the Enhanced CPF Housing Grant (EHG), Singles Grant, and Proximity Housing Grant (PHG) in 2025.

Are You Age‑Eligible & a First‑Timer?

First, you must meet age and first-time buyer rules, which are non-negotiable.

To qualify for any CPF housing grant as a single:

- You must be at least 35 years old

- Or 21 years old if widowed, orphaned, or under special exceptions

- You must also be a first-time applicant, meaning you haven’t received previous HDB subsidies (like SHG or AHG)

This applies whether you’re applying under the Single Scheme or Joint Singles Scheme.

Miss this, and your application will be rejected outright — age and first-timer status are deal-breakers.

Income, Employment, Lease and Citizenship Issues

Every CPF housing grant has specific technical eligibility checks that often catch buyers off guard.

Eligibility Criteria for CPF Housing Grants for Singles in 2025

| Grant Type | Income Cap | Employment Requirement | Lease Requirement | Citizenship Requirement |

|---|---|---|---|---|

| EHG | ≤ $4,500/month | 12 months continuous employment | Flat lease must cover you to age 95 | Singapore Citizen |

| Singles Grant | ≤ $7,000/month | None specified | Standard HDB lease eligibility | Singapore Citizen |

| PHG | No income ceiling | Not applicable | Must meet HDB resale lease criteria | Applicant + relative must be SC or PR |

Run the numbers using a mortgage loan repayment calculator before you commit — it helps align your grant eligibility with your budget and loan size.

Family Care Scheme & Joint Singles Impact

As of mid-2025, HDB introduced the Family Care Scheme (FCS) — a new ballot priority scheme designed to help singles who plan to live near their aging parents.

If you’re buying a BTO flat and indicate you’ll live within 4km of your parents, you may get a higher chance in the HDB ballot — even if PHG itself doesn’t apply to BTOs. This doesn’t increase your grant, but it boosts your chances of getting a flat.

Separately, if you’re applying with a friend or sibling under the Joint Singles Scheme:

- Both applicants must meet all income, age, and citizenship rules

- The grant amounts are split 50/50 into your respective CPF accounts

- Your combined income is used for loan eligibility calculations, which can affect TDSR/MSR

Pro tip: If one applicant has significantly higher income or CPF savings, consider whether applying solo or jointly gives you a better overall deal.

Resale vs BTO – Which Grants Work Better in 2025?

Trying to decide between a BTO or resale flat as a single? When it comes to CPF housing grants, resale flats unlock more money — but they also come with higher upfront prices. The right choice depends on your budget, timeline, and how much you want to maximise your grants in 2025.

Example Scenarios: Resale Single vs BTO Single

Let’s say you’re a single buyer earning $2,500/month and comparing both options.

If you choose a BTO flat, the only grant you’re eligible for is the Enhanced CPF Housing Grant (EHG), which could give you around $25,000.

But if you go for a resale flat, you could qualify for:

- EHG ($25,000)

- Singles Grant ($40,000)

- Proximity Housing Grant (PHG) ($10,000–15,000)

That’s up to $80,000+ in CPF housing grants — a massive difference in support just by switching flat types.

Resale may cost more upfront, but it gives you more grants and flexibility — especially if you want to move in faster or choose your ideal location.

Total Grant Table for Quick Comparison

Wondering which flat type gives you the most CPF support as a single buyer? Here’s a side-by-side look at the housing grants you can get for BTO vs resale flats in 2025, so you can decide which option gives you the best value.

Which CPF Housing Grants Apply to BTO vs Resale Flats (2025)

| Grant Type | BTO Flat (Single) | Resale Flat (Single) |

|---|---|---|

| EHG | ✅ Yes | ✅ Yes |

| Singles Grant | ❌ No | ✅ Yes |

| PHG | ❌ No | ✅ Yes |

| Total CPF Grant Potential | Up to $40,000 | Up to $115,000+ |

If your goal is to reduce your mortgage burden, resale flats offer significantly more CPF support — even if the selling price is higher.

Grant Disbursement and Using CPF

All CPF housing grants — whether EHG, Singles Grant or PHG — are:

- Credited to your CPF Ordinary Account

- Used to offset your flat purchase price, lowering the loan amount you need

- Not given in cash (you won’t see the money, but you’ll feel it when your mortgage is smaller)

You can estimate how much you’ll save using a mortgage loan repayment calculator, which factors in your grant stack, loan amount, and interest rate.

If you’re comparing home loan interest rates in Singapore, remember: the lower your loan amount, the easier it is to qualify for better bank rates.

BTO or resale — you’ll still need a loan. But grant stacking lets resale buyers borrow less, pay less interest, and gain more CPF flexibility down the road.

FAQs About CPF Housing Grants for Singles

Got questions? You’re not alone. Here are the most common ones we hear from single buyers navigating CPF housing grants in Singapore — especially with all the new 2025 changes.

Can Singles Under 35 Get CPF Housing Grants in Any Situation?

In most cases, no — you must be at least 35 years old to qualify under the Single Scheme. However, there are exceptions:

- If you’re widowed or orphaned, you may apply from age 21

- If you’re applying under a different scheme (e.g. public rental or family nucleus), other rules may apply — but not for CPF grants under the Single Scheme

If you’re under 35 and planning ahead, use the time to build up your CPF savings and understand the grant landscape before applying.

Do You Need to Repay Grants If You Sell or Upgrade Later?

Not exactly — but grants are not “free money” either.

When you sell your flat, you’ll need to refund the grant amount (plus accrued CPF interest) back into your CPF Ordinary Account. This refunded amount becomes part of your CPF, and you can reuse it for your next property — but you can’t cash it out.

So while you don’t repay it out-of-pocket, the CPF grant reduces your net cash proceeds from the sale.

Planning to upgrade in 5–10 years? Consider how grant refunds will impact your affordability for your next private property loan or condo purchase.

How Do Grants Affect Your Loan Amount and Monthly Instalment?

Grants help by reducing the loan quantum you need to borrow — which means:

- Lower monthly instalments

- Shorter or more manageable loan tenure

- Better chance at qualifying under TDSR/MSR limits

For example, if your flat costs $450,000 and you get $80,000 in CPF housing grants, your bank loan only needs to cover $370,000 (or less, depending on your CPF balance and downpayment).

Use our mortgage loan repayment calculator to see exactly how CPF grants affect your monthly payments based on different loan sizes.

Even a $20,000 grant difference can shave years off your mortgage — or give you breathing room in your monthly budget.

Conclusion: How to Make the Most of CPF Grants as a Single in 2025

Grants can make or break your homeownership journey — especially if you’re buying solo in Singapore’s competitive 2025 market. With schemes like the Enhanced CPF Housing Grant (EHG), Singles Grant, and Proximity Housing Grant (PHG), there’s more support than ever — but only if you plan right.

Here’s how to make every dollar work harder for you.

Which Grant Combination Offers You the Best Value?

The “best” grant stack depends on your flat type and monthly income:

- If you’re buying a resale flat, you could stack EHG + Singles Grant + PHG — up to $115,000 in CPF housing grants

- If you’re buying a BTO, you’ll only get the EHG, maxing out around $40,000

For many singles, resale offers more upfront help. But if you’re tight on cash and not in a rush, BTO still gives great long-term value — especially when paired with a solid HDB home loan or bank rate.

When to Choose Resale Over BTO to Maximise Grant Support

If grant support is your top priority, resale flats win in 2025. You’ll not only get larger grant amounts, but you also:

- Avoid long BTO waiting times

- Can buy larger flat types

- Qualify for PHG if living near parents

But resale comes with higher pricing — so be sure to check your loan eligibility with a mortgage broker and use tools like the BSD calculator to assess affordability.

Why You Should Speak to a Mortgage Advisor Before Applying

Grants are just one part of the equation. You’ll also need to:

- Pick the right home loan (bank vs HDB)

- Ensure your TDSR/MSR qualifies you for enough financing

- Time your application to match income eligibility windows

Working with a trusted mortgage advisor in Singapore ensures you don’t miss out on thousands in grants or pick a loan package that doesn’t fit your long-term plan.

At Ace Mortgage, we help singles like you maximise CPF support, avoid grant pitfalls, and get the best home loan for your needs — so you can buy confidently, not cautiously.