Not sure what a HDB essential occupier is or why it matters when buying a flat in Singapore? You’re not alone. Many first-time buyers get confused between “owner” and “occupier” — but understanding the difference can affect your HDB eligibility, grants, and future housing options.

In this guide, we’ll explain how a HDB essential occupier affects your flat application, CPF housing grants, HDB loan eligibility, and whether you can buy another property later.

What Is a HDB Essential Occupier and Why It Matters

When applying for a flat in Singapore, HDB doesn’t just look at who’s buying — it also looks at who’s living there. That’s where the HDB essential occupier comes in. Simply put, an essential occupier is someone who isn’t an owner of the flat but is officially listed to meet HDB eligibility, especially under family-based schemes.

For a deeper look into your financing options, check out our guide on HDB home loans and how they differ from bank loans.

Who qualifies as an essential occupier under HDB rules?

To qualify as an essential occupier, you must be:

- A Singapore Citizen or PR

- Listed in the HDB flat application from the beginning

- Intending to live in the flat for the full Minimum Occupation Period (MOP)

You cannot add someone casually after the application — HDB only recognises occupiers declared at the point of flat purchase. According to HDB’s official eligibility guidelines, the occupier must also reside in the unit to qualify.

How does being an occupier help you qualify for a flat?

Under most schemes — such as BTO and SBF — applicants must form a valid family nucleus. If you’re applying alone under the Single Singapore Citizen Scheme, you must be at least 35. But if you’re 25 and applying with your parent as an occupier, you could qualify under the Fiancé/Fiancée Scheme or Multi-Generation Scheme.

In short: listing the right occupier can make or break your flat eligibility.

💡 Expert tip: Don’t assume every family member qualifies. Always refer to HDB’s scheme requirements and get guidance from a mortgage broker in Singapore if you’re unsure.

Is an essential occupier the same as a family nucleus?

Not exactly — but they’re closely linked. A family nucleus refers to the combination of applicant(s) and occupier(s) used to meet HDB’s criteria (e.g. you and your spouse or you and your parent). The essential occupier is the non-owner individual within that nucleus who legally supports the application.

So while all essential occupiers are part of the family nucleus, not every family nucleus member is necessarily designated as an essential occupier.Bottom line: An essential occupier is often legally required for HDB flat approval. Without one, your application — even with financing and CPF ready — could get rejected.

Essential Occupier vs Owner: What’s the Real Difference?

Many first-time buyers assume that once someone is listed in an HDB flat application, they have equal rights — but that’s not the case. There’s a big legal and financial gap between being a flat owner and being listed as an essential occupier. Let’s break it down.

Can occupiers use CPF or get grants?

No — essential occupiers cannot use CPF savings for the flat purchase, nor are they entitled to CPF housing grants. Grants like the Enhanced Housing Grant (EHG) or Proximity Housing Grant (PHG) are strictly disbursed to flat owners only.

Even if you’re part of the family nucleus as an occupier, HDB considers your role non-financial, which means:

- No CPF deductions from your account

- No access to any housing subsidy or grant

- No responsibility for HDB or bank loan repayments

If you’re planning to contribute financially, it might make more sense to be listed as a co-owner instead.

Tip: Before structuring your flat purchase, use our mortgage loan repayment calculator to see what your CPF and cash contributions would look like as an owner.

Are occupiers listed on the property title?

No, they’re not. Only flat owners appear on the official title deed. Essential occupiers are listed in the HDB system, but they do not have ownership stake in the property. This means:

- They cannot sell, rent out, or pledge the property

- They have no claim on sale proceeds

- Their name will not appear in legal documents like the Option to Purchase (OTP)

HDB views the occupier as someone who fulfils the eligibility requirement, not someone who holds legal interest in the property.

Do occupiers have any legal rights to the flat?

In short — very limited. Occupiers have a right to reside in the flat during the Minimum Occupation Period (MOP), but they don’t have ownership or decision-making power.

If the owner chooses to sell the flat or transfer ownership, the occupier’s consent is not legally required (although in family situations, HDB may review on a case-by-case basis). In cases of death or disputes, occupiers do not automatically inherit the flat unless a will or succession plan is in place.

If you’re thinking long-term — e.g. legacy planning or shared investments — it may be wiser to consider joint ownership. Learn more about structuring ownership smartly by speaking with a trusted mortgage broker in Singapore.

When Must You Include an Occupier in HDB Applications?

Listing a HDB essential occupier isn’t optional in every case — it depends on the HDB scheme you’re applying under. In many situations, especially for younger buyers or singles, adding an occupier is the only way to meet HDB flat eligibility requirements.

Which HDB schemes require essential occupiers?

If you’re applying under a family-based scheme, HDB usually requires you to form a valid family nucleus, which may include a non-owner occupier. Common schemes where this applies include:

- Fiancé/Fiancée Scheme

- Multi-Generation Family Scheme

- Orphan Scheme

- Single Singapore Citizen Scheme (for singles above 35)

In these cases, an essential occupier (e.g. a parent or fiancé) may be necessary to satisfy the eligibility criteria even if they’re not a co-owner.

📚 For full scheme details, check HDB’s eligibility schemes overview.

Can singles or PRs use an occupier to meet eligibility?

Yes, but with conditions.

- A single Singapore Citizen under 35 typically cannot apply for a BTO flat unless they do so under special schemes (e.g. with a parent as an essential occupier under the Orphan Scheme).

- A Singapore PR cannot buy a flat alone — they must form a valid family nucleus with a Singapore Citizen, often as an essential occupier.

In both cases, listing the right occupier can help you unlock flat eligibility that would otherwise be out of reach.

💡 Pro tip: If you’re unsure whether you qualify on your own, consult a Singapore mortgage broker to explore scheme-based financing and CPF strategies.

Are occupiers required for resale flats?

It depends — but yes, in many resale flat cases, an occupier is still required to meet the family nucleus requirement, especially if you’re applying under family-based or priority schemes.

However, resale flats do offer more flexibility. For instance:

- Singles aged 35+ can apply without needing an occupier.

- Married couples or families typically apply as joint owners instead.

- If you’re applying with a parent or sibling, you may still need to list one as an essential occupier to fulfil eligibility — even if they’re not contributing financially.

🏠 Considering a resale purchase? Compare HDB loan options and bank loan rates before applying.

How to Add or Remove an Occupier in Your Flat

Essential occupiers may not own the flat, but their role in your HDB application is critical. Whether you’re applying for a new flat or already living in one, it’s important to know how to add, remove, or update an occupier correctly — especially if you’re planning for future grants, loans, or inheritance.

Steps to add an occupier during flat purchase

You can only add an essential occupier at the point of flat application — not after your flat has been legally secured. Here’s how it works:

- During application, include the occupier’s details (NRIC, relationship, citizenship) under the “occupant” section.

- HDB will assess the occupier’s role as part of your eligibility scheme (e.g. Fiancé/Fiancée, Orphan Scheme).

- Once approved, the occupier’s name will be tied to the flat throughout the Minimum Occupation Period (MOP).

You won’t be able to add someone later just for convenience or future planning. Once the application is locked in, the occupier list becomes part of your legal flat profile.

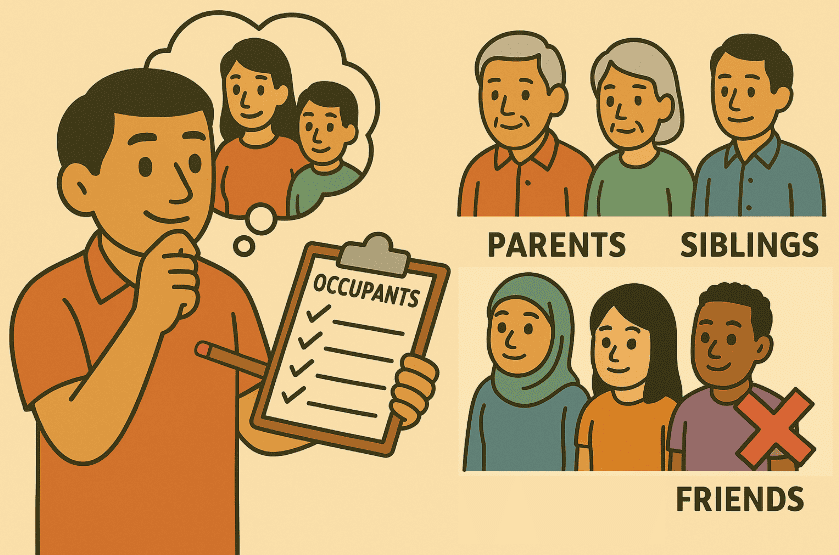

Can you add parents, siblings or friends?

Yes — but with limits.

✅ You can add:

- Parents or grandparents (for Multi-Generation or Orphan schemes)

- Siblings, under certain family-based criteria

- Fiancé or fiancée, with a valid declaration form

❌ You generally cannot add friends or unrelated individuals unless they’re forming a valid family nucleus with you.

If you’re unsure whether your intended occupier qualifies, it’s worth checking with a mortgage consultant before submission.

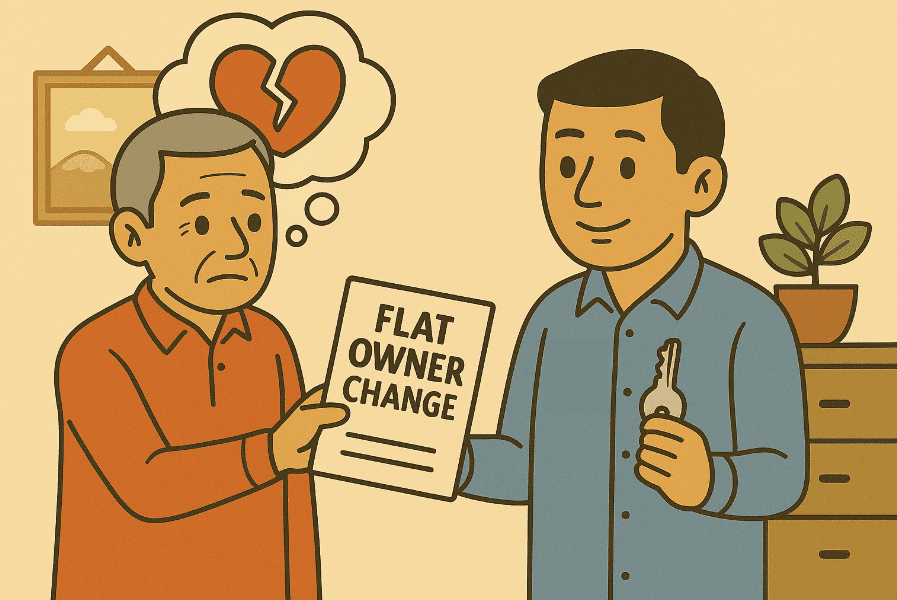

How to remove or update occupier info later on

Removing or updating an essential occupier after the flat has been purchased is not automatic. You’ll need to submit a request to HDB under their Change in Flat Ownership process, and approvals are given only under valid reasons such as:

- Death of occupier

- Divorce or separation

- Change in family structure (e.g. child reaching legal age)

You’ll be required to submit supporting documents and meet the eligibility criteria laid out by HDB. Full details and application forms can be found here:

🔗 HDB: Change in Flat Ownership Eligibility

Need clarity on how to add or remove an HDB occupier?

Our step-by-step guide breaks down who qualifies, how to apply via MyHDBPage, and what happens to your CPF, grants, and loan eligibility — so you can avoid costly mistakes when updating your flat’s occupancy.👉 Read: Can I Add or Remove an Occupier from My HDB Flat?

Can Occupiers Buy Their Own Flat Later?

If you’re listed as an essential occupier today, you might be wondering: “Will this affect my chances of owning a home in the future?” The short answer is — yes, it can. While being an occupier doesn’t make you a legal owner, it still impacts your HDB eligibility, loan options, and even CPF housing grant usage down the line.

Does occupier status count as home ownership?

Technically, no. HDB does not consider occupiers as property owners because they don’t appear on the title deed and cannot sell, rent out, or finance the flat.

However — and this is key — if you’re an essential occupier of an HDB flat, HDB still tracks your occupancy history. This means:

- You’re subject to the same Minimum Occupation Period (MOP) rules as owners.

- You may be restricted from applying for another HDB flat or EC until the MOP ends.

- Being an occupier may delay your ability to buy private property with CPF.

⚠️ For instance, if you’re an occupier of your parent’s flat, you’ll need to wait out the full 5-year MOP before applying for your own BTO.

Can occupiers apply for a BTO or EC in future?

Yes — but only after meeting certain conditions.

If you’re an essential occupier in a flat that’s still within its MOP, you usually cannot apply for another subsidised flat (like a BTO or EC), even if you weren’t the owner. HDB treats your occupancy as part of a previous housing subsidy.

Once the MOP is over, you can:

- Apply for a new flat or EC (subject to eligibility)

- Buy a resale flat without subsidy restrictions

- Consider a private property purchase, depending on your timeline

🧠 Pro tip: If you’re planning a property purchase after being an occupier, review your financing path early. Explore options for private property loans to avoid delays.

Will grants or loan eligibility be affected?

Yes — in several ways:

- If you were an essential occupier in a subsidised flat, you may be considered a second-time applicant — which could reduce your CPF housing grant amounts or disqualify you from certain schemes.

- You might face a wait-out period (currently up to 30 months) before you can apply for subsidised housing again, especially for BTOs.

- For financing, some banks may assess your history as part of their risk and eligibility checks.

Before making plans to buy a second home or switch roles, it’s smart to speak to a mortgage advisor who can walk you through available loan products and structuring options.

✅ Need clarity on what type of loan you can get as a former occupier? Use our loan eligibility calculator to estimate your next step.

What Happens to the Flat if the Owner Dies?

This is a sensitive but important topic — especially for families where only one person is listed as the legal flat owner. Many assume that essential occupiers will automatically inherit the flat if the owner passes away, but that’s not how it works in Singapore.

Do occupiers have inheritance rights?

No. An essential occupier does not have legal rights to inherit the flat unless explicitly named in a valid will or they qualify under HDB’s inheritance framework.

Even if the occupier has been living in the flat for years or contributed informally to household expenses, HDB considers only the legal owner in determining succession.

This is why it’s crucial for owners to have proper estate planning, especially if they want a spouse, parent, or child (listed only as an occupier) to retain the flat after their passing.

Can the flat be transferred to the occupier?

Yes — but only if the occupier qualifies under HDB’s rules and submits a formal change in flat ownership application.

Here’s what’s typically required:

- The occupier must be a Singapore Citizen or PR

- They must have been living in the flat at the time of the owner’s death

- They must meet eligibility criteria to own an HDB flat (income ceiling, ownership status, etc.)

If the occupier doesn’t meet these requirements, the flat may have to be returned to HDB or sold.

What if no will is left behind?

If the flat owner passes away without a will, the property is distributed under Singapore’s Intestate Succession Act. This usually means:

- The flat goes to the next-of-kin in a fixed order (spouse, children, parents, etc.)

- The Public Trustee’s Office may step in to manage the distribution

- If no eligible inheritor is found, the flat may be taken back by HDB

Occupiers not legally related or not listed in the succession order will have no claim to the flat.

If you’re an occupier in such a scenario, it’s wise to get legal advice early and explore financing options in case a refinance or purchase transfer becomes necessary. Learn more about your options on our page about refinancing HDB loans.

FAQs on HDB Essential Occupiers in 2025

Still unsure about the finer details? These are some of the most common (and confusing) questions Singaporeans ask about HDB essential occupiers — updated with the latest HDB policy guidance.

Can I be an occupier for two flats?

No — HDB does not allow you to be listed as an essential occupier in more than one flat at the same time. You must fully commit to residing in the flat during its Minimum Occupation Period (MOP), and HDB treats this as a serious housing arrangement, not a loophole for eligibility stacking.

If you’re already listed as an occupier in one flat, you’ll need to be officially removed before applying or being included in another HDB flat purchase.

Can I change from owner to occupier?

Yes, but only through HDB’s Change in Flat Ownership process — and it’s subject to approval. Owners may request to be removed from the title deed and listed as occupiers instead (for instance, during a divorce or when transferring the flat to children), but:

- You must still meet eligibility criteria as an occupier

- Supporting documents (e.g. legal separation, death certificate) are often required

- Both parties (owner and proposed owner) must agree

If you’re considering changing roles for estate or financial planning reasons, explore whether a refinance home loan or ownership restructure makes more sense for your goals.

Can I check my occupier status online?

Yes. You can check your status via My HDBPage using your Singpass:

- Log in to My HDBPage

- Navigate to “My Flat” → “Flat Details”

- Look for the list of registered owners and occupiers

This lets you confirm whether you’re legally registered in the HDB system — helpful if you’re applying for another flat, a CPF grant, or need to verify your residential history.

Planning to upgrade or switch flats? Before making a move, use our BSD calculator to estimate your Buyer’s Stamp Duty based on your property value.

Final Thoughts on HDB Essential Occupiers and What to Do Next

Understanding the role of a HDB essential occupier is more than just ticking a box on your flat application — it can impact your eligibility, grant access, loan planning, and even future property decisions. Whether you’re applying for a BTO, planning to include a parent in your application, or navigating ownership changes, getting these details right can save you a lot of time (and money) down the road.

If you’re still unsure whether you or someone else should be listed as an occupier or co-owner, you’re not alone — it’s one of the most common areas of confusion for buyers in Singapore.

Need Help With HDB Ownership Planning?

Whether you’re buying your first home or restructuring ownership, we’re here to guide you.

- Compare the best HDB home loan options from top banks

- Use our handy mortgage loan calculator to plan monthly instalments

- Speak with a trusted mortgage broker in Singapore for tailored advice on flat structuring and CPF usage

Don’t make costly mistakes — get expert help early.

Contact us today and let us simplify your HDB journey.