Found your dream flat, but your HDB loan can’t cover it? Don’t worry — you’re not the only one stuck in this situation in 2025.

With tighter loan limits and rising flat prices, many buyers are now realising their HDB loan isn’t enough to seal the deal. But before you give up or overstretch yourself, know this — there are smart ways to work around it.

In this guide, we’ll show you 5 practical solutions to consider when your HDB loan falls short — from appeals and CPF top-ups to exploring bank loan options and long-term refinancing tips.

Let’s dive in.

Why Your HDB Loan Might Be Too Low in 2025

Feeling shocked at how little HDB is offering you? You’re not alone. In 2025, many buyers are finding their approved HDB loan amount falls short — even when they meet the basic eligibility.

Here’s why this is happening

H3: Lower LTV Limits Mean You Can’t Borrow as Much

Since 2022, HDB has capped its Loan-to-Value (LTV) limit at 80%. That means your maximum loan is now smaller, and you’ll need more CPF or cash upfront.

HDB Maximum Loan Amount Based on LTV in 2025

| Estimated Flat Price | Max HDB Loan (80%) | Min CPF/Cash Required |

|---|---|---|

| $400,000 | $320,000 | $80,000 |

| $600,000 | $480,000 | $120,000 |

| $700,000 | $560,000 | $140,000 |

💡 Even if your income is strong, the loan cap is fixed.

🔗 Need help working this out? Try this mortgage loan repayment calculator

Income or Credit Factors Reduce Your Approved Loan

You could be earning enough — but your loan eligibility may still be reduced if:

- You’re self-employed or on commission

- You’re already paying off car, study, or credit card loans

- You exceed the MSR (30% of gross monthly income)

Tip: Use a Singapore mortgage broker to assess your eligibility before applying for your HFE letter. 🔗 Read more about the HFE Letter here

Pricier Resale or Executive Flats Push You Over Budget

Going for an executive flat or resale unit in a prime estate? You’ll likely face Cash Over Valuation (COV) — and that cannot be covered by loans or CPF.

If the flat valuation is $500,000 but seller wants $550,000,

✅ $50,000 must be paid in cash, not CPF, not HDB loan.

🔍 Use HDB’s resale flat prices portal to research past prices before making an offer.

What to Do If Your HDB Loan Is Not Enough

Realised your HDB loan amount doesn’t cover the flat price? Don’t worry — you still have options.

Here are three practical ways to make up the shortfall

Appeal for a Higher HDB Loan with Updated Documents

Yes — you can appeal.

If your financial situation has improved (e.g. pay raise, new job, fewer debts), submit updated documents to HDB and request a review of your loan amount.

✅ Documents to include:

- Latest 3 months of payslips

- Updated CPF contribution history

- IRAS Notice of Assessment

- Supporting documents for co-applicants (if any)

📌 Submit your appeal through your My HDBPage.

💬 Tip: If unsure how strong your appeal is, speak to a mortgage consultant first for free advice.

Use CPF Ordinary Account or Cash to Cover the Gap

If your HDB loan falls short, you can tap on your CPF OA savings or make a cash top-up to bridge the difference.

💡 How to Check Your CPF Balance:

- Login to myCPF using Singpass

- Check your OA balance and recent contributions

📊 Pro Tip: Always keep at least 6–12 months of CPF OA buffer for emergencies or mortgage repayments.

📌 Use this mortgage repayment calculator to check how much monthly instalment your CPF can sustain.

Explore Bank Loans or Bridging Loans as Alternatives

If HDB can’t give you the full amount, consider financing the rest through a bank home loan — or if you’re selling your current flat, a bridging loan.

✅ Bank loans allow you to borrow up to 75%

✅ May come with lower interest than HDB’s 2.6%

✅ Shorter processing time and more flexibility

🔗 Learn more:

💡 A mortgage broker can help you compare all options — and it’s free.

Should You Adjust Your Flat Budget Instead?

If your HDB loan just doesn’t cover the numbers, sometimes the smarter move isn’t to borrow more — but to spend less.

Before committing to that high-floor corner unit, here’s why relooking your budget could save you future stress

Smaller or Non-Mature Flats May Fit Within Limits

Flats in non-mature towns tend to have lower prices and better loan-to-value (LTV) coverage, making them more accessible if your HDB loan falls short.

HDB Flat Prices Comparison: Mature vs Non-Mature Estates in 2025

| Town Type | Avg 4-Room Price (2025) | Estimated Min Loan Required (80% LTV) |

|---|---|---|

| Mature Town | $580,000 | ~$464,000 |

| Non-Mature Town | $440,000 | ~$352,000 |

📌 Looking for a budget-friendly option? Use this mortgage loan repayment calculator to estimate what you can safely afford.

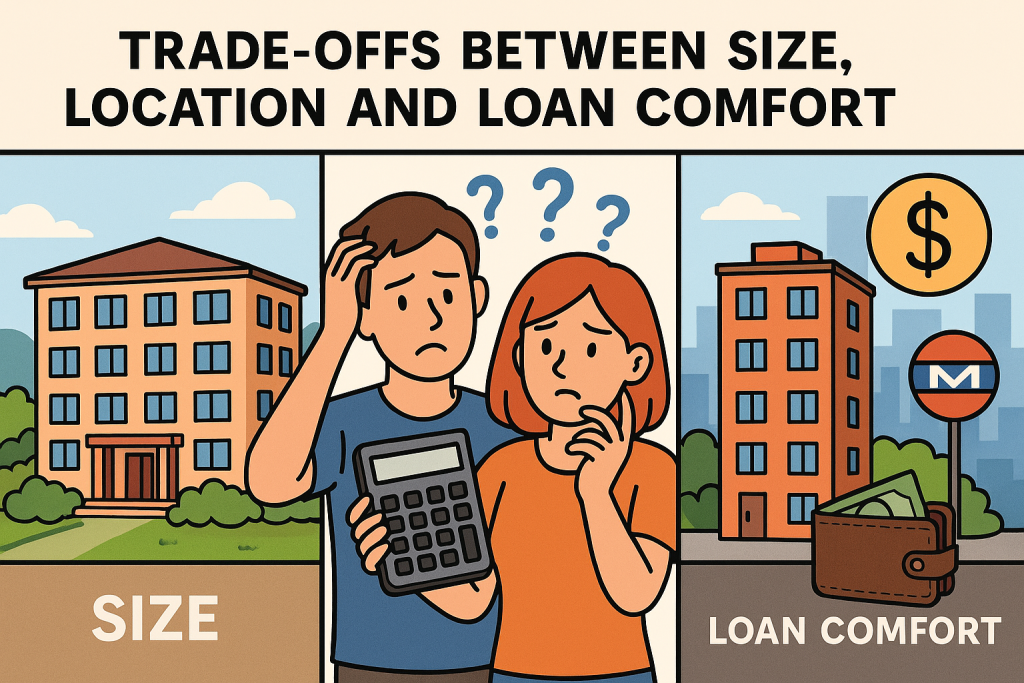

Trade-Offs Between Size, Location and Loan Comfort

Everyone wants a spacious unit in a central area — but what if it means sleepless nights over repayments?

Ask yourself:

- Do you really need 5 rooms, or will 4 suffice?

- Will a slightly longer commute save you $100k?

- Are you sacrificing cash flow for prestige?

💭 A right-sized flat helps you stay within your mortgage loan eligibility and gives you room for savings, renovations, or life emergencies.

Are You Overstretching Your Budget Prematurely?

If your HDB loan feels too tight, that’s a red flag — not a challenge to “find more money.” A flat is a 20–30 year commitment. If you’re already maxed out at purchase, what happens if:

- Interest rates go up?

- Your income drops?

- You need cash for renovation or family?

📌 Use the home loan repayment calculator to check if your monthly payment leaves breathing room.

Can You Refinance Later to a Better Loan Option?

Just because your HDB loan isn’t enough now doesn’t mean you’re stuck with it forever. Once you’ve fulfilled your Minimum Occupation Period (MOP), you can refinance to a bank loan — and possibly save thousands in interest.

Here’s how

Refinance to a Bank Loan After Reaching Your MOP

After your flat hits the 5-year MOP, you’re free to refinance your existing HDB loan to a bank loan. This opens the door to:

- Lower interest rates

- Flexible loan tenures

- Potential long-term savings

📌 Read more: Refinance your HDB loan with guidance from experts who handle the paperwork for you.

Compare Interest Rates and Break-Even Savings

In 2025, HDB’s interest rate remains at 2.6%, while bank rates may hover around 2.4% or lower depending on fixed or floating packages.

HDB Loan vs Bank Loan Interest Rates (2025)

| Loan Type | Typical Interest Rate (2025) | Lock-In Period | Flexibility |

|---|---|---|---|

| HDB Loan | 2.6% (fixed) | None | High |

| Bank Loan (Fixed) | ~2.40% for 2–3 years | Yes (1–3 yrs) | Medium |

| Bank Loan (SORA) | ~2.35% (floating) | Yes | Low–Medium |

📌 Use our home loan rate comparison tool to see if it’s worth switching.

Get Help from a Mortgage Broker for Better Deals

Refinancing involves comparing multiple banks — and it can get confusing.

That’s where a mortgage broker in Singapore comes in. They’ll:

- Shortlist the best refinance packages

- Calculate your real savings

- Handle paperwork and bank coordination

- Charge you $0 — their service is free to you

✅ Ideal if you want a better rate without the stress

Final Thoughts — Don’t Panic, Plan Smart

Realising your HDB loan isn’t enough can feel stressful, but it doesn’t have to derail your homeownership dreams. The key? Stay calm, plan ahead, and make informed moves.

Here’s how to wrap up your flat-buying journey with clarity:

You Have Options — Stay Calm and Strategic

From CPF top-ups to refinancing later, there’s always a solution. The most important thing is to understand your numbers and avoid rushing into a deal that strains your future.

📌 Use a mortgage loan repayment calculator to test different loan and payment scenarios before committing.

Don’t Force the Purchase if It Hurts Your Finances

If the numbers don’t work, don’t bend your budget to fit the flat — adjust the flat to fit your budget.

⚠️ Warning signs you’re overstretching:

- Monthly repayments > 30% of income

- No emergency CPF or cash buffer

- Relying heavily on future income increases

Sometimes, waiting or resizing your plans is the braver, smarter move.

Speak to a Mortgage Advisor Before You Commit

Before locking in a flat or loan package, talk to a Singapore mortgage broker. They’ll:

- Help you find the most suitable loan structure

- Compare rates across banks (like DBS, UOB, OCBC)

- Give you clarity, not pressure

🎯 A 15-minute chat now could save you thousands later.

HDB Loan Not Enough? Plan Smart, Not Stress Hard.

You’re not alone in this — and you’re not stuck either. Whether it’s appealing for more, adjusting your budget, or exploring other loan options, there’s always a way forward.

🏠 Your first home should feel like a fresh start, not a financial squeeze.

Before making a big decision, take a step back, breathe, and speak to someone who understands the system.

💬 Let’s Make It Work — Together.

Book a free, no-pressure consult with a trusted mortgage broker in Singapore — someone who’s helped thousands navigate HDB loan issues just like yours. You’ve got options. Let’s find the one that fits you best.