If you’re eyeing a resale flat this year, keeping up with the latest HDB Prices Index is non-negotiable. With 2025 already showing signs of a shift from the sharp highs of 2023, many buyers and sellers are wondering — are prices finally stabilising, or is there more volatility ahead?

In this article, we break down how the HDB Resale Price Index has moved since 2023, what’s driving the changes, and how it affects your home buying strategy. Whether you’re a first-time buyer or planning to upgrade, knowing where the market is headed can help you make smarter, more confident moves.

Tip: Want to know what your monthly loan repayment could look like in 2025? Try this handy mortgage loan repayment calculator to get a quick estimate.

Understanding the HDB Resale Price Index (RPI)

If you’re buying or selling an HDB flat in 2025, the Resale Price Index (RPI) is a key number to watch. It gives you a snapshot of how HDB resale flat prices are moving across the entire market — and helps you decide when to act and how much to budget. Let’s unpack what it means, why it matters, and how it has evolved over the years.

What is the HDB Resale Price Index and how is it calculated?

The HDB Resale Price Index (RPI) is a quarterly indicator that tracks overall price movements of HDB resale flats. It’s calculated based on resale transactions across flat types and towns, adjusted for seasonality and market movements.

In simpler terms? It tells us whether prices are generally going up or down — and by how much.

It doesn’t reflect individual flat prices, but rather the overall market trend.You can find the latest RPI updates published directly on HDB’s official site. Most property watchers use it as a barometer for whether it’s a good time to buy or wait.

Historical trends: How has the RPI evolved over the years?

Let’s take a quick look at how the index has moved over the past few years:

HDB Resale Price Index (RPI) Trends and Percentage Change

| Region | RPI (Start of Year) | RPI (End of Year) | % Change |

|---|---|---|---|

| 2020 | 131.5 | 138.1 | +5.0% |

| 2021 | 138.1 | 155.7 | +12.8% |

| 2022 | 155.7 | 171.9 | +10.4% |

| 2023 | 171.9 | 174.9 | +1.7% |

| 2024 (est.) | 174.9 | ~175.2 | ~0.2% |

Prices surged during COVID-19 and peaked in 2022, but signs of stabilisation began to show in late 2023. By early 2025, the RPI has been moving sideways — neither dropping drastically nor climbing sharply.

Significance of RPI for buyers and sellers in 2025

In 2025, a flat RPI means the resale market is more predictable — great news if you’re planning your finances.

For buyers, this could mean fewer bidding wars and more realistic prices. If you’re looking to enter the market this year, it’s a good time to compare HDB loan vs bank loan options carefully. Start by checking out HDB home loan packages and see how they stack up against private bank rates.

For sellers, a stable RPI means your flat may not fetch windfall profits — but it also means the pool of eligible buyers is wider, especially with CPF grants still in play.

Expert tip: Instead of timing the market, focus on affordability. Use a mortgage calculator to figure out what monthly repayments look like before making a move.

HDB Resale Price Trends: 2023 vs 2025

HDB resale prices have come a long way since their pandemic-era peak. While 2021 and 2022 saw double-digit jumps, 2023 marked a turning point. Fast forward to 2025, and the market has clearly cooled — but not collapsed.

Let’s break down what’s changed, what’s driving the shift, and what it all means if you’re planning to buy or sell soon.

Comparative analysis of resale prices between 2023 and 2025

In 2023, prices rose modestly by 1.7% compared to the previous year’s spike. This slowdown signaled the start of a stabilisation phase. By 2025, the HDB Resale Price Index has largely plateaued, with minor quarter-on-quarter fluctuations.

Here’s a simple breakdown:

HDB Resale Price Trends and % Change for 4-Room Flats

| Year | Avg. 4-Room Resale Price (Islandwide) | % Change |

|---|---|---|

| 2023 | ~$550,000 | +1.7% |

| 2024 | ~$553,000 (est.) | +0.5% |

| 2025 | ~$555,000 (stable trend) | +0.3% |

Source: HDB quarterly data (2023–2024), estimated trend (2025)

In short: price momentum has slowed, but resale flats are still holding their value — especially in mature estates like Queenstown, Bishan, and Toa Payoh.

Factors contributing to price changes over the two years

Several factors have contributed to the tapering growth:

- Rising interest rates: Monthly mortgage payments went up, reducing borrowing power.

- Stricter HFE checks: The new HFE letter made financial assessment stricter upfront.

- Increased BTO supply: With more BTOs launched, some buyers held off on resale.

In fact, many buyers in 2025 are turning to brokers to better understand their loan eligibility and approval odds. Engaging a Singapore mortgage broker can help you make sense of different financing scenarios — especially if you’re deciding between bank and HDB loans.

Implications for current and prospective homeowners

Here’s what today’s market means for you:

If you’re buying:

- Don’t expect prices to drop drastically — especially in popular mature estates.

- Use this stable period to lock in a deal without rushing or overpaying.

- Consider resale units with existing renovations to save on post-purchase costs.

If you’re selling:

- Price realistically, especially if your unit is in a non-mature or less central area.

- Units near MRT stations, good schools, or with high-floor views still command strong demand.

Honestly, in this market smart financing matters more than market timing. Getting pre-approval and comparing rates early could save you thousands over the loan tenure.

Key Factors Influencing HDB Resale Prices

Behind every price shift in the resale market is a combination of policy, economics, and buyer behaviour. In 2025, HDB resale prices are no longer riding the wild highs of the pandemic years — and here’s why.

Impact of government policies and cooling measures

Over the past few years, multiple cooling measures were rolled out to moderate price growth. These include:

- Tightened loan limits through TDSR/MSR caps

- Longer wait periods for private property downgraders

- Stricter eligibility checks via the HFE letter process

- CPF housing grant tweaks, which affected demand dynamics

All these moves were meant to reduce speculative buying and encourage long-term ownership. While they didn’t cause a crash, they did help cool enthusiasm for overbidding.

Tip: If you’re buying soon, make sure you’re clear on your loan ceiling. Try this mortgage calculator to see what you can afford after grants and cooling measures.

Economic indicators and their effect on the housing market

Apart from policies, macroeconomic trends also played a big role in softening the resale market:

- High interest rates led to lower loan quantum approval.

- Inflationary pressures impacted affordability and renovation budgets.

- Wage stagnation among younger buyers made resale less accessible without CPF help.

The broader economy tends to influence whether buyers feel confident making a big-ticket commitment like an HDB purchase. In 2025, things are slowly improving — but many are still cautious.

Supply and demand dynamics in the resale market

Finally, the classic law of supply and demand continues to shape price levels:

- More BTO launches in mature and central estates are drawing buyers away from resale.

- MOP flats entering the market in newer towns like Sengkang and Punggol increase supply.

- Delayed upgrader demand (due to tighter financing rules) also softened resale activity.

That said, certain flats — like those in city-fringe or near MRTs — remain hot picks. If you’re eyeing one of those, act fast or risk missing out.

The gap between BTO and resale prices is narrowing in some towns. If you don’t want to wait 3–4 years for a BTO, a well-located resale flat can be a smart middle-ground — especially if you’re using a refinance home loan strategy later to cut long-term costs.

Regional Analysis: Resale Price Variations Across Singapore

Not all towns grow equally. While some HDB estates saw strong price gains in recent years, others have flattened — or even slipped. If you’re serious about value, this regional lens can make or break your next property decision.

Top-performing towns in terms of resale price growth

Despite a market-wide slowdown, a few towns still posted strong price increases between 2023 and 2025 — especially mature estates with great connectivity and amenities.

Central HDB Towns With Strongest 4-Room Resale Price Growth

| Town | Avg. 4-Room Price (2023) | Avg. 4-Room Price (2025) | % Increase |

|---|---|---|---|

| Bukit Merah | ~$780,000 | ~$820,000 | +5.1% |

| Queenstown | ~$810,000 | ~$850,000 | +4.9% |

| Bishan | ~$700,000 | ~$735,000 | +5.0% |

| Kallang/Whampoa | ~$740,000 | ~$770,000 | +4.0% |

These areas are popular with both upgraders and singles looking for central access without private condo prices.

Expert tip: If you plan to sell in 5 years, a flat in these central towns may offer stronger appreciation. Just be sure your financing matches your timeline — and check out DBS home loan packages for competitive fixed rates.

Areas experiencing price stagnation or decline

Some towns have seen price fatigue, especially where a large number of flats reached MOP recently or where BTO supply has surged.

- Punggol: Prices are flat due to oversupply of newer flats

- Sengkang: Sluggish growth as more MOP flats enter the market

- Woodlands: Slow pickup due to location and upcoming supply

That doesn’t mean they’re bad buys — just that price gains may be slower. These estates could still offer value if you’re planning to stay long-term.

Emerging hotspots for potential buyers

A few sleeper towns are quietly gaining steam:

- Jurong West: Future Jurong Region Line (JRL) is a game changer

- Bukit Batok: Great for those priced out of Clementi or Tengah

- Yishun: Larger flats at reasonable prices, with good rental prospects

Some of these areas also benefit from private property spillover demand — where condo buyers turn to large resale flats as an alternative. If you’re looking for value, these regions are worth watching.

Look into private property loan options if you’re upgrading or exploring ECs in the same towns. Interest rates and approval requirements differ from HDBs, so plan ahead.

Financial Considerations for HDB Resale Buyers

Buying a resale flat isn’t just about the listing price. From option fees to stamp duties, the costs can quickly add up — especially in a tight budget. Whether you’re a first-time buyer or upgrading, knowing what you’re paying for (and what help you can get) is key.

Breakdown of upfront costs and fees associated with resale purchases

Here’s a breakdown of the typical upfront costs you’ll need to budget for:

Estimated Upfront Costs for HDB Resale Flat Buyers in Singapore

| Cost Item | Estimated Range |

|---|---|

| Option Fee (1% of flat price) | ~$4,000–$9,000 |

| Exercise Fee (within 3 weeks) | ~$1,000–$4,000 |

| Stamp Duty (BSD) | 1–4% tiered (based on price) |

| Legal & Conveyancing Fees | ~$2,500–$3,000 |

| Renovation Budget (if needed) | ~$10,000–$40,000+ |

Want to calculate stamp duty fast? Use this BSD calculator to get an exact figure based on your flat price.

Personal tip: Always keep at least 10% of your purchase budget liquid — some fees can’t be paid using CPF.

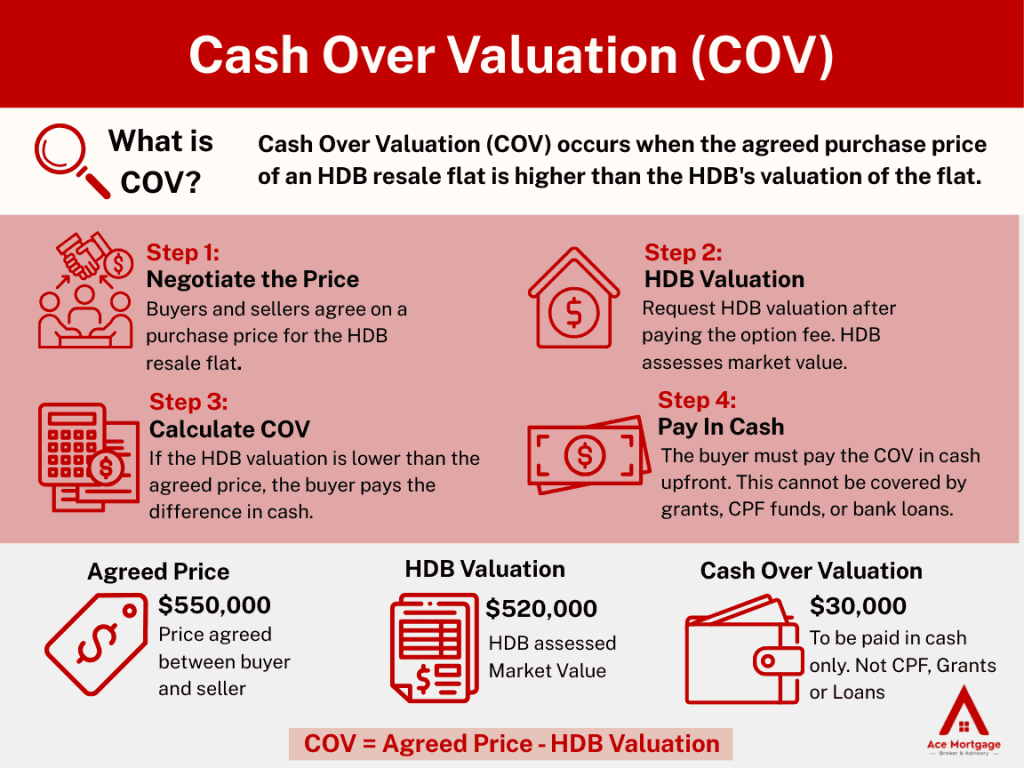

Understanding Cash Over Valuation (COV) and its implications

Cash Over Valuation (COV) is the amount you pay above the official HDB valuation — and yes, it must be paid in cash, upfront.

COV is back in 2025, especially in high-demand areas. It typically applies to:

- High-floor or unblocked units

- Flats near MRT or elite schools

- Rare layouts or well-renovated homes

But here’s the catch — COV isn’t covered by loans or CPF. That’s why pre-approval (HFE) and knowing your cash buffer are crucial.

Use a mortgage repayment calculator early to set a max limit — so your finances don’t get squeezed after paying COV.

Available housing grants and eligibility criteria

Grants can shave tens of thousands off your resale flat cost — but only if you qualify.

Here’s a quick look:

- Enhanced CPF Housing Grant (EHG)

Up to $80,000

- Income ceiling: $9,000

- Must live near workplace or family

- Income ceiling: $9,000

- Family Grant

Up to $50,000

- First-timer applicants

- Must buy 2-room or larger resale flat

- First-timer applicants

- Proximity Housing Grant (PHG)

Up to $30,000

- Living within 4km of parents/children

- Living within 4km of parents/children

Tip: Grants differ depending on whether you use an HDB or bank loan. If you’re unsure which suits you, check out this guide to HDB home loan options to compare eligibility and flexibility.

Navigating the HDB Resale Process

Buying an HDB resale flat in 2025 is more streamlined than ever — but still full of paperwork and key deadlines. Whether you’re a first-timer or upgrading from a BTO, understanding the full process helps you avoid stress, delays, and costly mistakes.

Step-by-step guide to purchasing a resale flat

Here’s a simplified breakdown of what the typical resale timeline looks like:

- Get your HFE letter

This is now a must before you can even get a flat valuation or Option to Purchase (OTP). - Secure In-Principle Approval (IPA)

Compare bank and HDB loan packages to see what you qualify for. Sites like Ace Mortgage can help you compare options in one place. - Start your flat search

Browse listings and visit units — check for defects, sun direction, and potential COV. - Negotiate and sign OTP

You’ll pay an option fee (usually 1%) to the seller. - Submit resale application via HDB portal

Both buyer and seller must submit within a set timeline. - Wait for HDB’s approval and appointment date

Once approved, you’ll make your remaining payments and complete the sale.

Pro tip: The whole resale process takes about 8–12 weeks from OTP to key collection — so don’t commit to renovations or movers too early

Common pitfalls and how to avoid them

Many buyers stumble over the same few issues. Here’s how to dodge them:

- Not securing loan approval early

→ Always get HFE + In-Principle Approval before committing to any flat. - Ignoring COV risks

→ If valuation comes in lower than expected, you’ll pay the difference in cash. - Overlooking renovation costs

→ Budget an extra $10k–$30k even for “move-in” units.

Not checking eligibility for grants

→ Missed documentation or misreading income ceilings can cost you thousands.

Tips for a smooth transaction

A smooth resale experience comes down to preparation. Here are some quick wins:

- Compare home loan rates early (don’t just rely on your bank)

- Set alerts for resale flats in your ideal towns and budget

- Double check key deadlines (especially OTP expiry and resale application windows)

- Engage an experienced mortgage consultant if you’re juggling complex loans or timelines

Expert tip: Planning to upgrade in future? Consider how refinancing could play into your 5-year plan. You can explore refinance HDB loan options even before MOP ends to estimate long-term cost savings.

Future Outlook: What to Expect in the HDB Resale Market

As we look beyond 2025, the resale market appears to be heading into a more stable — but still active — phase. While the days of sharp price jumps may be behind us, new trends, policies, and economic shifts will continue shaping the landscape.

Predicted trends for the next few years

Market watchers and analysts expect resale prices to stay relatively flat, with pockets of growth in select towns.

Key predictions:

- Resale prices to rise 1–3% annually, driven by mature estate demand

- High-floor, well-renovated flats will continue to command premiums

- BTO and PLH supply will shape buyer decisions and price competition

One thing’s clear: Singaporeans still value home ownership, and resale flats remain a practical option for those who don’t want to wait 4–5 years for a BTO.

If your goal is long-term stability and not quick profits — resale remains one of the safest bets in Singapore’s property market.

Potential policy changes and their anticipated impact

HDB policies can shift quickly depending on housing demand and affordability goals. Here are some likely areas of focus:

- Further tightening of resale grants to ensure fairness across income groups

- Expanded BTO supply in mature estates, reducing resale pressure

- Stricter eligibility for bank loans if interest rates stay high

Stay updated via reliable sources like CNA Housing Reports or the HDB newsroom. These can help you plan ahead for policy shifts.

Advice for buyers and sellers moving forward

For Buyers:

- Get pre-approved and set a firm budget ceiling

- Don’t stretch your finances — prioritise location and future value

- Lock in stable interest rates if you’re planning to stay for 10+ years

For Sellers:

- Focus on renovation quality, cleanliness, and staging

- Know your town’s average prices and be realistic

- Engage a mortgage broker if your next move involves upgrading

Thinking of upgrading to a condo or private property later? Use this condo loan guide to compare options before listing your current flat.

Is Now the Right Time to Buy or Sell an HDB Resale Flat?

The HDB Prices Index in 2025 tells a story of moderation. While resale flat prices have largely stabilised, key factors like town location, unit condition, and financing options still play a huge role in determining value.

For buyers, this is a great time to enter the market with less pressure and more choices. For sellers, realistic pricing and proper preparation will go a long way in securing the right offer.

One last tip: Whether you’re buying your first flat, upgrading, or planning to refinance — work with a trusted Singapore mortgage broker to explore the best loan solutions tailored to your goals. Need help comparing loan options, grant eligibility or next steps?

Check out more insights on the Ace Mortgage blog, or speak to a consultant directly via our contact page. It’s free, fast, and always tailored to your situation.