Can Singles Really Buy an HDB Flat in 2025?

Yes — and it’s more accessible than ever.

More singles in Singapore are applying for HDB flats, whether for independence, long-term security, or to stop renting. And in 2025, HDB has expanded support through two key pathways:

- The Single Singapore Citizen Scheme (apply solo)

- The Joint Singles Scheme (apply with another single)

Depending on your age and income, you can buy a 2-room Flexi BTO, a larger resale flat, or even consider an Executive Condo. Updated CPF grants and the new Family Care Scheme also give singles more flexibility and ballot priority.This guide breaks down everything you need to know — eligibility, grants, flat types, and the latest rules to help you plan smart.

What Is the Single Scheme and Who Qualifies?

If you’re single and hoping to own a home in Singapore, the Single Singapore Citizen Scheme could be your key to unlocking that dream. Designed for unmarried Singaporeans aged 35 and above, this scheme allows you to buy selected HDB flats on your own — no spouse, no joint income needed.

It’s one of the most popular routes for singles looking to buy a flat today, especially with more people choosing to stay single longer or focus on financial independence.

Who is eligible under the Single Singapore Citizen Scheme?

To qualify, you must:

- Be a Singapore citizen

- Be 35 years old or above (as of application date)

- Be unmarried, divorced, or widowed

- Be applying as a sole owner

If you’re buying under this scheme, you can apply for a 2-room Flexi BTO flat in a non-mature estate, or choose from a wide range of resale HDB flats, including 3-room and larger units — a great option if you’re after more space.

Expert tip: Not ready for a long commute? Resale flats offer more location flexibility — and with the right HDB home loan or bank package, you can stretch your loan tenure while staying within budget.

What are the age, citizenship, and marital status criteria?

The scheme is strictly for citizens aged 35 and above. If you’re divorced or widowed, the same age requirement applies — unless you have legal custody of children, which may make you eligible under different family schemes.

It’s also important to note: Permanent Residents (PRs) are not eligible to buy an HDB flat on their own. If you’re a PR looking for property options, you’ll need to explore private housing or purchase jointly with a citizen spouse.

What income ceilings, EIP rules, and citizenship rules apply?

Here’s a quick overview of the key limits in 2025:

Here’s a quick overview of the key limits in 2025:

HDB Single Scheme Rules & Limits in 2025 (At a Glance)

- Income Ceiling

- BTO (2-Room Flexi): $7,000/month

- Resale: No income ceiling

- BTO (2-Room Flexi): $7,000/month

- Flat Types Allowed

- BTO: 2-room Flexi only

- Resale: 3-room and above

- BTO: 2-room Flexi only

- CPF Housing Grants

- Eligible for up to $80,000 (both BTO and resale)

- Eligible for up to $80,000 (both BTO and resale)

- Ethnic Integration Policy (EIP) / SPR Quota

- Applies to both BTO and resale

- Applies to both BTO and resale

- Age Requirement

- Must be 35 years and above (for both BTO and resale)

- Must be 35 years and above (for both BTO and resale)

💡 Tip: Resale flats offer greater flexibility — especially for singles who exceed the BTO income ceiling or want a larger flat near MRTs or parents.

What Is the Joint Singles Scheme and How Does It Work?

Not buying alone? The Joint Singles Scheme is designed exactly for that.

Under this scheme, two unmarried Singapore citizens can co-apply for an HDB flat — whether you’re friends, siblings, or simply two like-minded singles looking to own a home together.

It’s one of the best options if you’re not eligible to buy a larger flat on your own or want to split the cost of homeownership.

Can two singles apply together under this scheme?

Yes — as long as you meet the following criteria:

- Both applicants are Singapore citizens

- Both are 35 years old or above

- Both are unmarried, divorced, or widowed

- You apply jointly as co-owners under the Joint Singles Scheme

This scheme allows you to apply for:

- A 2-room Flexi BTO flat in a non-mature estate

- A larger resale flat, such as a 3-room or 4-room

- In some cases, even an Executive Condominium (EC) — though restrictions apply

Expert tip: If affordability is your main concern, co-owning can help you qualify for a higher loan amount and split monthly repayments. Use our mortgage loan repayment calculator to estimate costs.

What’s the difference between applying alone vs jointly?

Here’s a quick comparison:

Single vs Joint Singles Scheme: Key Differences at a Glance (2025)

| Feature | Single Scheme | Joint Singles Scheme |

|---|---|---|

| Number of Applicants | 1 person | 2 people |

| Minimum Age | 35 | Both must be 35+ |

| Flat Type (BTO) | 2-room Flexi only | 2-room Flexi only |

| Flat Type (Resale) | Any size | Any size |

| Grant Eligibility | Individual grants | Combined grant eligibility |

| Loan Eligibility | Based on solo income | Based on combined income |

Pro tip: Joint ownership means sharing both responsibility and risk — have a proper agreement in place before committing.

What are the latest income limits and grant rules in 2025?

As of 2025, here’s what you need to know:

HDB Joint Singles Scheme: Income Ceiling & CPF Housing Grants (2025)

- Combined Income Limit

- BTO (2-Room Flexi): $14,000/month

- Resale: No income ceiling

- BTO (2-Room Flexi): $14,000/month

- Enhanced CPF Housing Grant (EHG)

- BTO: Up to $20,000 per person

- Resale: Up to $20,000 per person

- BTO: Up to $20,000 per person

- Singles Grant

- BTO: Not applicable

- Resale: Up to $40,000 combined

- BTO: Not applicable

- Proximity Housing Grant (PHG)

- BTO: Not applicable

- Resale: Up to $20,000 combined (when buying near parents/children)

- BTO: Not applicable

💡 Tip: Under the Joint Singles Scheme, resale flats offer far more grant opportunities (Singles Grant + PHG) compared to BTOs, making them attractive for pairs of singles planning long-term housing.Total potential CPF support: Up to $80,000 per applicant, depending on income.

Can Singles Apply for a BTO Flat in 2025?

Yes — but not for every type of flat.

If you’re applying under the Single Singapore Citizen Scheme or Joint Singles Scheme, your BTO flat options are currently limited to 2-room Flexi units in non-mature estates. That said, these flats remain popular for their affordability, ease of ownership, and eligibility for grants like the Enhanced CPF Housing Grant.

That said, the landscape has shifted slightly with the introduction of Standard, Plus, and Prime flat classifications in 2024 — so here’s what singles need to know in 2025.

What BTO flat types are eligible for singles today?

As of now, only 2-room Flexi flats are available for singles applying through:

- The Single Scheme (1 applicant)

- The Joint Singles Scheme (2 applicants)

These flats:

- Are located in non-mature estates

- Range from 36 to 45 sqm

- Offer flexible lease lengths (from 15 to 99 years — more on that below)

Unfortunately, 3-room or larger flats are not available for singles through BTO — unless you’re applying under a family-based scheme (e.g., as a divorced single with custody of children).Tip: If you’re looking for a 3-room or bigger flat as a single, you’ll need to explore the HDB resale market, where singles have much more flexibility.

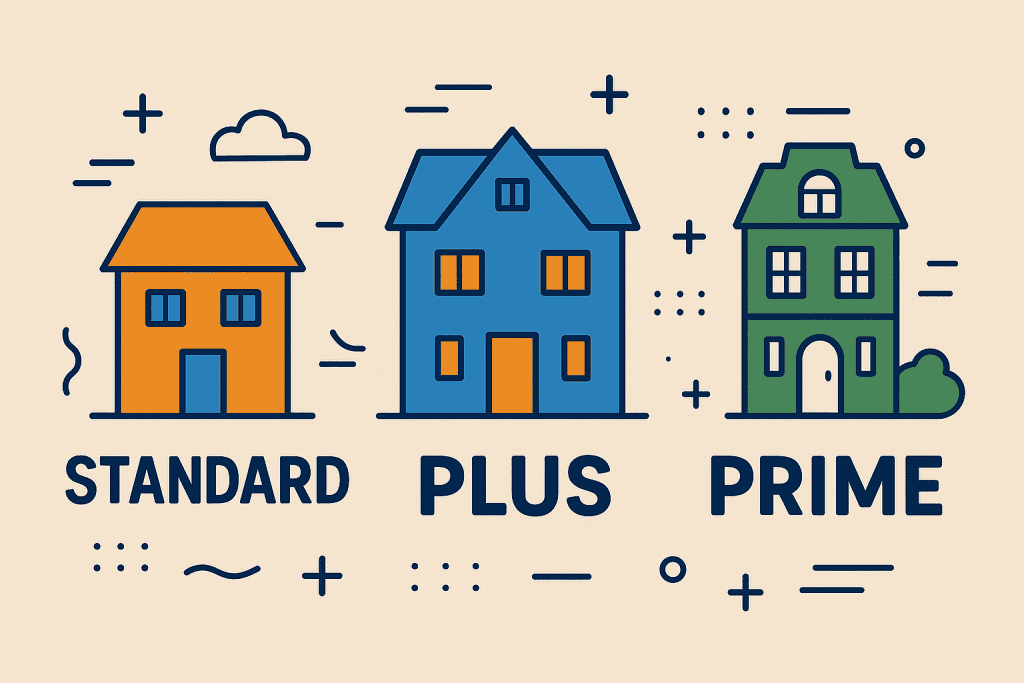

What are Standard, Plus, and Prime classifications in 2025?

Since October 2024, HDB has reorganised its flat launches into three categories:

HDB Flat Categories Explained (Standard, Plus & Prime) — Key Rules for Singles in 2025

| Flat Type | Who It’s For | Typical Location | Key Restrictions |

|---|---|---|---|

| Standard | Most general BTO buyers | Non-mature estates | Standard 5-year MOP |

| Plus | Buyers who want central-ish homes | City-fringe / near MRTs | 10-year MOP, income ceiling applies |

| Prime | Highly-subsidised central flats | Central areas (e.g., Queenstown) | 10-year MOP, strict resale & subsidy clawbacks |

Note: Singles can currently only apply for Standard flats — and only for 2-room Flexi units in non-mature estates. Plus and Prime units are off-limits for singles under current BTO rules.

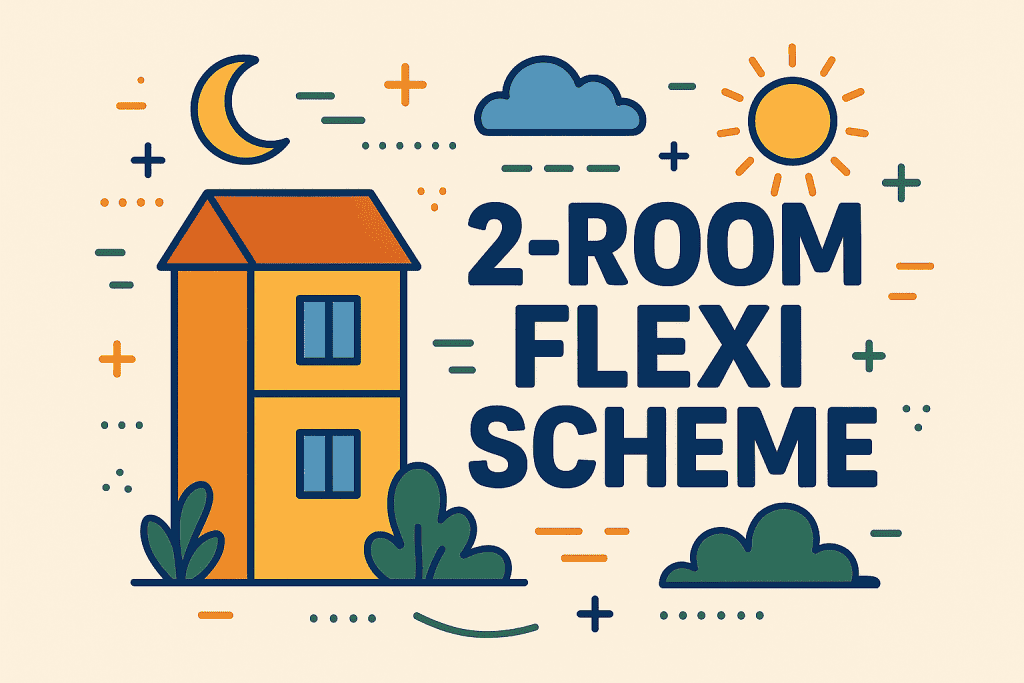

How does the 2-Room Flexi Scheme work for singles?

The 2-room Flexi Scheme is specially designed to meet the needs of:

- Elderly homeowners (shorter leases allowed)

- Singles aged 35 and above (full 99-year lease required)

Here’s how it works for singles:

Key Features of the 2-Room Flexi BTO Scheme for Singles (2025)

- Flat Sizes → Choose between 36 sqm or 45 sqm, designed for compact yet functional living.

- Lease Duration → Comes with a full 99-year lease (if applying under age 65), giving long-term security.

- Income Ceiling → Monthly income must be $7,000 or below to qualify under the Singles Scheme.

- Grant Eligibility → Singles can tap into the Enhanced CPF Housing Grant (EHG) of up to $40,000, plus an additional Proximity Housing Grant if buying near parents.

- Location Restrictions → Only available in non-mature estates, so options in central or city-fringe areas are off the table.

✅ Pro Tip: The 2-Room Flexi BTO is the most affordable entry point for singles, but if you want a bigger flat, better location, or no income ceiling, resale may be a better fit.

Why it matters: The 2-room Flexi gives singles an affordable entry into homeownership — and if you don’t mind a smaller space, it’s often the cheapest path to buying a flat with CPF and grants.

What About Buying a Resale Flat as a Single?

If you’re a single buyer looking for more space, a better location, or faster keys — resale flats might be your best bet. Unlike BTOs, resale HDB flats come with fewer restrictions, and yes — singles can absolutely buy larger units, even in mature estates.

And while resale prices are higher, the flexibility, availability, and access to CPF housing grants can often make this a smarter long-term choice.

Can singles buy 3-room or larger resale flats?

Yes — and that’s one of the biggest advantages of going resale.

As a single applicant (or under the Joint Singles Scheme), you can buy:

- Any flat size — from 3-room to even executive flats

- In any location — including mature estates and city-fringe areas

- Without a long waiting time — no ballot, no years of construction

There are no restrictions on resale flat size or estate classification for singles. That means if you’ve outgrown the 2-room BTO limit, resale opens up a world of options.

Pro tip: Need to move quickly? Resale flats are ideal if you want to own a home within months — not wait 3–5 years for BTO completion.

What CPF housing grants can singles get for resale?

Contrary to what many think — grants aren’t just for BTO buyers. In fact, single buyers can qualify for multiple CPF housing grants when buying resale flats in 2025.

Here’s a quick summary:

CPF Housing Grants for Singles Buying Resale Flats (2025)

| Grant Type | Amount (Single Applicant) | Key Conditions |

|---|---|---|

| Enhanced CPF Housing Grant (EHG) | Up to $40,000 | Based on income (must be ≤ $4,500/month) |

| Singles Grant | Up to $25,000 | If buying a 2–4 room flat |

| Proximity Housing Grant (PHG) | Up to $15,000 | If living with/near parents |

That’s up to $80,000 in grants — even for a single buyer. Just make sure your monthly income and flat type qualify. We’ll link to a full breakdown of CPF grants for singles soon.

What’s the process for financing and buying resale?

Buying a resale flat as a single works similarly to any standard HDB resale purchase — but here’s what to keep in mind:

- Get your HFE Letter early

This is your all-in-one approval for HDB eligibility, grants, and loan options. You’ll need this before issuing an Option to Purchase (OTP). - Compare home loan options

You can choose between an HDB loan or a bank loan from providers like DBS, UOB, or OCBC. Consider factors like interest rate, tenure, and monthly repayments. Use our mortgage loan repayment calculator to compare. - Lock in your unit and pay option fees

Once you find a flat, you’ll pay an option fee ($1,000 max), exercise your OTP, and proceed to submit the resale application to HDB. - Prepare your downpayment and legal fees

Singles must pay at least 5% in cash if taking a bank loan. Stamp duties, legal costs, and other fees will apply too — check our BSD calculator to estimate.

Expert tip: Not sure how much loan you can get as a single? A mortgage broker in Singapore can help you compare packages and get pre-approval before you commit.

Are Executive Condominiums (ECs) an Option for Singles?

Short answer: Yes — but only under the Joint Singles Scheme.

If you’re a single Singaporean hoping to buy an Executive Condominium (EC), you’re not eligible to apply alone. However, if you’re applying with another single under the Joint Singles Scheme, you may be able to buy a new EC directly from the developer — as long as you meet all the standard eligibility rules.

This is a great alternative for singles who:

- Exceed the income cap for BTO or resale grants

- Want condo-style living with subsidised pricing

- Plan to hold the property long term and enjoy future capital gains

Can singles buy ECs under the Joint Singles Scheme?

Yes, but there are conditions.

To apply for a new EC launch, both applicants must:

- Be Singapore citizens

- Be 35 or older

- Apply jointly under the Joint Singles Scheme

- Have a combined gross monthly income not exceeding $16,000

Also, at least one applicant must not own other property, and both must not have exceeded two prior HDB subsidies.

Note: Singles cannot buy a new EC on their own — only jointly under this scheme. If you’re applying solo, your only EC option is the resale market (after the 10-year MOP).

New Executive Condo Eligibility Limits for Singles (2025)

| Criteria | Joint Singles Scheme (EC Purchase) |

|---|---|

| Age Requirement | Both applicants must be 35+ |

| Citizenship | Both must be Singapore citizens |

| Income Ceiling | $16,000/month combined |

| Ownership History | Max 2 subsidised flats in lifetime |

| Eligible EC Type | Only new launch ECs (not resale ECs) |

ECs are ideal for joint applicants who earn too much for BTO but still want an affordable entry into private property.

What are the price, grant, and eligibility limitations?

- Purchase Price: ECs are typically priced 20–25% lower than private condos, but can still range from $1 million to $1.4 million depending on location and size.

- Grants: While ECs are subsidised, there are no CPF housing grants for singles under this scheme.

- Loan Rules: You’ll likely need to apply for a bank loan, as HDB loans are not available for ECs. A mortgage broker can help you compare fixed vs floating rate packages across major lenders.

Tip: ECs may seem more expensive upfront — but with the right mortgage plan, they can be more manageable than resale condos.

What are the resale and MOP restrictions for ECs?

Executive Condominiums come with strict ownership and resale rules that all buyers — including joint singles — must follow:

EC Resale Restrictions & MOP Rules for Singles Buying Under Joint Scheme (2025)

| Period | Restriction |

|---|---|

| Years 1–5 | Must be owner-occupied; cannot sell or rent out entire unit |

| Year 6–10 | Can sell to Singaporeans and PRs only |

| After Year 10 | EC becomes fully privatised — can sell to anyone, including foreigners |

This Minimum Occupation Period (MOP) applies even if both joint owners eventually go their separate ways — so it’s important to plan long term.

If you’re unsure about buying jointly, consider drawing up a private agreement or legal advice to manage future resale or ownership splits.

What CPF Housing Grants Are Available for Singles in 2025?

Good news: even if you’re applying for a flat on your own, you’re still eligible for multiple CPF housing grants. Whether you’re buying a BTO or resale flat, these grants can shave off tens of thousands from your purchase price — especially if your income is moderate.

In 2025, there are three main CPF grants that singles can tap into:

- Enhanced CPF Housing Grant (EHG)

- Singles Grant (for resale only)

- Proximity Housing Grant (PHG) (for resale only)

Want a full breakdown of CPF housing grants? Explore all the 2025 grant options for singles here.

How does the Enhanced CPF Housing Grant (EHG) work for singles?

The EHG for Singles is available for both BTO and resale flat buyers — as long as you meet the income and employment criteria.

To qualify:

- You must be employed continuously for 12 months before applying

- Your monthly income must not exceed $4,500

- You must be a first-time applicant

The grant amount is tiered based on income — the lower your income, the more you receive.

If you’re eligible, here’s what you can expect:

Enhanced CPF Housing Grant (EHG) Amounts for Singles Based on Monthly Income (2025)

| Monthly Income (Single) | EHG Grant Amount |

|---|---|

| ≤ $1,500 | $40,000 |

| $1,501 – $2,000 | $35,000 |

| $2,001 – $2,500 | $30,000 |

| $2,501 – $3,000 | $25,000 |

| $3,001 – $3,500 | $20,000 |

| $3,501 – $4,000 | $15,000 |

| $4,001 – $4,500 | $10,000 |

The EHG is credited to your CPF Ordinary Account and used to offset your housing loan — not given in cash.

How much can you get under the Singles Grant?

The Singles Grant is exclusive to resale flat buyers, and it’s a great way to reduce upfront costs if you’re not going the BTO route.

To qualify, you must:

- Be buying a 2-room to 4-room resale flat

- Not have taken any housing subsidy before

- Meet the income ceiling of $7,000/month (Single) or $14,000/month (Joint Singles Scheme)

Singles Grant Amount in 2025 (Based on Flat Size)

- 2- to 4-room resale flat → Eligible for $25,000 Singles Grant

- 5-room or larger flat → Not eligible for Singles Grant

💡 Tip: The Singles Grant can be stacked with the Enhanced CPF Housing Grant (EHG) and Proximity Housing Grant (PHG), giving resale buyers a strong financial advantage over BTO options.

This grant is stackable with EHG and PHG — giving resale buyers a real financial edge.

Can you combine multiple grants like EHG + Proximity Housing Grant?

Yes — and most singles do.

If you’re buying a resale flat near your parents (or living with them), you can qualify for the Proximity Housing Grant (PHG) on top of EHG and the Singles Grant.

Here’s what the full combination might look like for a qualified single buyer in 2025:

Maximum CPF Housing Grants for Singles (2025)

| Grant Type | Maximum Amount |

|---|---|

| Enhanced CPF Housing Grant (EHG) | $40,000 |

| Singles Grant | $25,000 |

| Proximity Housing Grant (PHG) | $15,000 |

| Total | Up to $80,000 |

These are credited into your CPF OA, which reduces your housing loan amount — and in turn, your monthly repayments. Great if you’re looking to keep your mortgage loan manageable as a single.

What Home Loan Options Do Singles Have?

Whether you’re eyeing a BTO or resale flat, one of the biggest questions you’ll face is:

“How much can I actually borrow as a single?”

In Singapore, singles can choose between an HDB concessionary loan or a bank loan — but each comes with its pros, cons, and income-related limits. Plus, since 2023, you’ll need to apply for something called the HFE Letter before you even start.

Here’s how to navigate all of it as a solo buyer.

Should you use an HDB loan or a bank loan as a single buyer?

Let’s break it down simply:

HDB Loan vs Bank Loan for Single Buyers in Singapore (2025 Comparison)

| Feature | HDB Loan | Bank Loan |

|---|---|---|

| Max Loan-to-Value | Up to 80% of flat price | Up to 75% of property value |

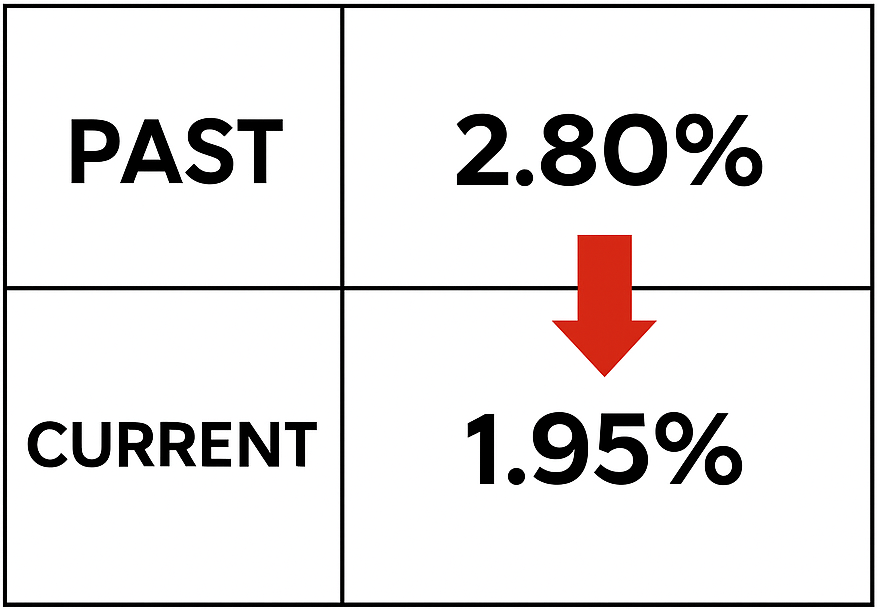

| Interest Rate | Fixed at 2.6% | Floating or fixed (as low as ~3.1%) |

| Downpayment | 20% (fully payable by CPF) | 5% cash + 20% CPF/cash |

| Early Repayment Penalty | None | Usually 1.5% during lock-in period |

| Loan Flexibility | More forgiving if income fluctuates | Stricter TDSR enforcement |

If you’re planning to use more CPF and want a longer loan tenure, an HDB home loan may work better. But if you want lower interest rates and more package choices, check out bank mortgage options

How much can you borrow based on income and TDSR?

Your borrowing capacity as a single depends mainly on:

- Your gross monthly income

- The Total Debt Servicing Ratio (TDSR) limit (currently 55%)

- Your loan type and tenure

Here’s an approximate guide:

How Much Can Singles Borrow Based on Income in Singapore (2025 Guide)

- Monthly Income: $2,500

- Max Monthly Mortgage (TDSR 55%): $1,375

- Approx. Max Loan (25-Year Tenure): ~$300,000

- Max Monthly Mortgage (TDSR 55%): $1,375

- Monthly Income: $3,500

- Max Monthly Mortgage: $1,925

- Approx. Max Loan: ~$420,000

- Max Monthly Mortgage: $1,925

- Monthly Income: $4,500

- Max Monthly Mortgage: $2,475

- Approx. Max Loan: ~$550,000

- Max Monthly Mortgage: $2,475

- Monthly Income: $6,000

- Max Monthly Mortgage: $3,300

- Approx. Max Loan: ~$720,000

- Max Monthly Mortgage: $3,300

💡 Tip: Use a mortgage loan repayment calculator to test your own income and tenure scenarios before committing.

These numbers are estimates. Use our mortgage loan repayment calculator to plug in your actual income and loan term.

Why is the HFE Letter important before applying?

Since May 2023, all flat buyers — including singles — must apply for an HDB Flat Eligibility (HFE) Letter before they:

- Apply for a BTO or resale flat

- Get an HDB or bank home loan

- Use any CPF housing grants

The HFE Letter combines everything into one approval:

✅ Grant eligibility

✅ Loan eligibility

✅ Flat eligibility

It takes about 21 working days to process and is valid for 9 months. Without it, you won’t even be able to book a flat or get an Option to Purchase (OTP) for a resale unit.

Pro tip: Apply for the HFE Letter before you browse — it’ll tell you exactly what you can afford, what grants you qualify for, and whether you can go with an HDB or bank loan. Need help comparing loans? Speak with a trusted mortgage broker in Singapore for personalised guidance.

What If You’re an Orphan, Divorced, or Caregiver Single?

HDB schemes aren’t just built around married couples and nuclear families. If you’re an orphan, divorced, widowed, or a single caring for elderly parents, there are still clear paths to buying an HDB flat in Singapore.

In fact, 2025 policies like the Family Care Scheme are giving more ballot priority to singles with caregiving responsibilities — or those hoping to live close to loved ones.

Let’s walk through how the rules apply based on your situation.

What is the Orphans Scheme and who qualifies?

The Orphans Scheme allows Singaporean siblings who have lost both parents to buy an HDB flat together.

To qualify:

- Both applicants must be Singapore citizens and orphans

- They must be unmarried, divorced, or widowed

- At least one applicant must be 35 years old or above

- The siblings must not already own other property

Eligible orphans can buy:

- A 2-room Flexi BTO flat in non-mature estates

- Any resale flat, regardless of location or size

- In some cases, even Executive Condominiums (ECs) under the Joint Singles Scheme

Note: If there are more than two siblings, only one group can buy under the Orphans Scheme — the rest must be listed as occupiers or apply separately.

Want to dive deeper into this?

We’ll be publishing a full guide on the HDB Orphans Scheme in Singapore — including special conditions, flat options, and planning tips.

Are divorced or widowed singles eligible for flat purchase?

Yes — with a few added conditions.

If you’re divorced or widowed, you can still apply under the Single Scheme or Joint Singles Scheme, provided you’re:

- 35 years or older

- A Singapore citizen

- Not co-owning another HDB or private property

If you have legal custody of children, you may be eligible to apply under a family-based scheme instead — which opens the door to larger BTO flats and additional grant support.

Flat Eligibility for Divorced and Widowed Singles (2025 Overview)

| Status | Eligible Scheme | Flat Type Options |

|---|---|---|

| Divorced with custody | Public Scheme (Family-based) | BTOs (2-room and larger) |

| Divorced without custody | Single Scheme (35+) | 2-room BTO / resale flats |

| Widowed (no children) | Single Scheme (35+) | 2-room BTO / resale flats |

Pro tip: If you’ve owned an HDB before with your ex-spouse, it may affect your subsidy count or resale levy — check your HDB records early.

How does the new Family Care Scheme affect ballot priority?

Introduced in late 2024 and expanded in 2025, the Family Care Scheme gives ballot priority to first-time singles who are:

- Buying a BTO flat near their parents, or

- Planning to live with ageing parents

Key benefits include:

- Additional ballot chances in selected BTO projects

- Applies even if you’re applying under the Single Scheme

- Can be used with other priority schemes (e.g. Senior Priority Scheme for parents)

Why it matters: If you’re a caregiver or simply want to live near family, this scheme can significantly improve your chances in competitive BTO launches — even for 2-room units in popular non-mature towns.

What Happens After You Apply for a Flat?

So you’ve submitted your BTO or resale application — now what?

Whether you’re applying solo or under the Joint Singles Scheme, knowing what happens next can help you prepare financially and emotionally for one of life’s biggest milestones. Here’s a breakdown of the post-application journey, from ballot results to key collection.

How to improve your BTO ballot chances as a single

Let’s be honest — getting a BTO flat as a single can feel like a lottery. But there are a few strategic ways to boost your odds:

Best Strategies to Improve BTO Ballot Chances for Singles in Singapore (2025)

| Tip | Why It Works |

|---|---|

| Apply under the Family Care Scheme | Gives priority to singles buying near/with parents |

| Choose non-mature estates | Less demand = higher ballot success |

| Opt for 2-room Flexi units | More units reserved for singles in this flat type |

| Apply during lower-demand launches | Avoid oversubscribed areas like Bidadari or Queenstown |

What to expect during booking, signing and downpayment

If you’re shortlisted in the ballot, you’ll receive an invitation to book your flat. Here’s what happens next:

- Flat Booking Appointment

- You’ll select your preferred unit

- Pay the option fee ($500–$2,000 depending on flat type)

- You’ll select your preferred unit

- Sign Agreement for Lease

- Happens a few months later

- You’ll make your downpayment (5–20%, depending on loan type)

- Legal documents and stamp duty fees are due here too

- Happens a few months later

- Secure your home loan

- Finalise your HDB loan or bank loan

- Compare packages from DBS, UOB, or OCBC

- Use our mortgage calculator to estimate monthly payments

- Finalise your HDB loan or bank loan

Note: If you’re using CPF for downpayment or stamp duty, ensure you have sufficient OA funds before lease signing.

When can you collect keys and move in?

The timeline depends on whether you’re buying BTO or resale:

How Long It Takes to Get Your HDB Keys: BTO vs Resale (2025)

- BTO Flats → Expect a wait of 3–5 years from application to key collection.

- Resale Flats → Keys are ready in just 8–12 weeks after option acceptance (about 2–3 months).

✅ Fastest Route: If you’re in a hurry, resale flats are the quickest way to homeownership. Keys can be collected in under 3 months, provided all paperwork is in order.

💡 Tip: Even after key collection, budget time and money for renovation, moving logistics, and loan repayment planning.

Once keys are collected, you’re officially a homeowner — but you’ll still need to plan for renovation, move-in logistics, and loan repayment.

Final Thoughts: Is It Worth Buying a Flat as a Single in 2025?

If you’ve read this far, you already know — buying a flat as a single in Singapore is not only possible, it’s increasingly practical. Whether you’re eyeing a 2-room BTO, a resale upgrade, or co-buying an EC, there are real, long-term advantages to taking that leap.

That said, it’s not for everyone. Here’s what to weigh before making your decision.

What are the long-term benefits for single homeowners?

Owning a home as a single comes with serious upside — especially in Singapore’s rising property market.

Long-Term Benefits of Buying a Flat as a Single in Singapore (2025)

- Stability → Lock in your own home before prices rise further or rental costs spike.

- Asset Building → Grow long-term wealth through capital appreciation of your property.

- Independence & Control → Full say over how, where, and with whom you live — no landlord restrictions.

- CPF Growth → Monthly repayments build your CPF balance with accrued interest, instead of going to rent.

💡 Tip: Buying earlier as a single not only secures today’s prices but also allows you to maximise CPF compounding growth over decades.

For many singles, buying early is one of the smartest personal finance moves they make in their 30s

What potential challenges should you consider?

Homeownership also means responsibility — and when you’re doing it solo, it pays to plan ahead.

- You’ll bear the full monthly repayment

No joint income means tighter loan limits and a bigger financial commitment - Unexpected life changes

Job changes, health issues, or caregiving responsibilities can affect affordability - Resale & mobility

Minimum Occupation Period (MOP) means you can’t just sell or upgrade immediately

Tip: Make sure you leave enough room in your budget for renovation, emergencies, and future lifestyle shifts.

When should you talk to a mortgage advisor for help?

If you’re even thinking about buying a flat — it’s time to speak with one.

A mortgage advisor or licensed mortgage broker in Singapore can help long before you’re ready to sign anything. Whether you’re unsure about how much loan you qualify for, which banks offer the lowest interest rates, or what grants you’re eligible for as a single — having an expert in your corner can save you both time and money.

Here’s when it’s especially worth reaching out:

- 🧮 You’re not sure how much you can borrow based on your income

- 💸 You want to compare HDB loan vs bank loan packages

- 📝 You’re confused about the HFE Letter or grant paperwork

- 🔄 You’re buying a resale flat and want to coordinate loan approval with OTP deadlines

- 📉 You want help lowering monthly repayments by finding the best rate or loan structure

Pro tip: Mortgage advisors don’t charge you — they’re paid by the banks. So if you’re buying as a single and want to optimise your budget, getting professional guidance is basically a free upgrade to your home-buying journey.

Ready to Buy a Flat as a Single in 2025? Let’s Make It Happen

Buying a flat as a single in Singapore might feel overwhelming — but with the right knowledge and support, it’s absolutely doable. Whether you’re applying for a 2-room Flexi BTO, buying a resale flat with CPF grants, or exploring options under the Joint Singles Scheme, there are more pathways open than ever before.

Before you decide on your flat or financing, take time to:

- Confirm your eligibility under the Single or Joint Singles Scheme

- Compare HDB loan vs bank mortgage rates for singles

- Use our home loan calculator to plan smart

- Reach out to a trusted mortgage advisor for personalised help

Have questions about loan approvals, CPF grants, or choosing the right lender?

We’re here to guide you through every step — from HFE Letter to key collection.

Speak to a licensed mortgage broker now — and take the next step toward your first home, your way.