Thinking about becoming a landlord in Singapore? With rents staying high and property demand holding steady in 2025, investing in rental property is back on the radar.

But before you dive in, it’s key to understand rental yield, ROI, loan rules, and the real costs involved. In this guide, we break down everything — from financing and tax tips to location strategies and yield benchmarks — so you can invest smart and avoid rookie mistakes.

Why Invest in Rental Property in Singapore?

Singapore’s property market has long been seen as a safe haven — and in 2025, rental property remains one of the most popular investment vehicles for locals and PRs.

- Consistent rental demand

- Strong tenant pool

- Long-term capital appreciation

Whether you’re eyeing monthly cash flow or future capital gains, owning a rental unit gives you full control — unlike stocks or REITs. And unlike CPF, it’s a hedge that can outpace inflation.

What Makes Rental Property a Popular Investment in 2025?

- Rental demand remains strong – Despite cooling measures, condo and HDB rents are still high in 2025.

- Tight housing supply – With fewer new launches and MOP flats delayed, renters have fewer options.

- Stable property prices – Unlike stocks or crypto, property in Singapore doesn’t swing wildly.

Pro tip: Always use a mortgage loan repayment calculator before committing — it gives you a clearer view of long-term costs.

How Does It Compare to REITs, Stocks, or CPF?

If you’re choosing between rental property, REITs, CPF savings, or the stock market in 2025, it helps to compare how each one performs across key investment factors. Here’s a snapshot of the pros and cons:

Investment Comparison: Rental Property vs REITs, Stocks, CPF (2025)

| Investment Type | Pros | Cons |

|---|---|---|

| Rental Property | High control, leverage potential, passive rental income | Requires high upfront capital, ongoing maintenance |

| REITs | Easy entry, diversified exposure, liquid | No control over assets, subject to market swings |

| Stocks | Potential for fast gains, high liquidity | Volatile, emotionally driven decisions common |

| CPF | Government-guaranteed returns, safe | Low interest (~2.5%), limited flexibility for investing |

If you want more control over your returns and are ready for long-term commitment, rental property still stands out — especially when financed right.

What Are the Key Benefits (Cash Flow, Appreciation, Hedge)?

- 💸 Cash Flow – Monthly rent can offset mortgage payments or become side income.

- 📈 Capital Appreciation – Well-located properties tend to rise in value over time.

- 🛡️ Inflation Hedge – As living costs go up, so do rental prices — while your loan stays fixed.

Still deciding? Start by checking Singapore home loan rates to understand your financing options.

Understanding Rental Yield and ROI in 2025

If you’re investing in Singapore real estate in 2025, two numbers should always be on your radar — rental yield and ROI. These aren’t just buzzwords — they’re the clearest indicators of whether your property is actually working for you financially.

What Is Gross vs Net Rental Yield?

Gross rental yield is the annual rental income divided by the property price — before any deductions.

Net rental yield, on the other hand, factors in all your ongoing costs: property tax, mortgage interest, maintenance, and even vacancy buffers.

Expert tip: Net yield gives a much clearer picture of your actual profit — especially in a high-cost market like Singapore.

How to Calculate Rental Yield in Singapore

The easiest way to calculate gross yield is:

(Annual Rent ÷ Purchase Price) × 100

But to really understand profitability, you’ll want to dig into net rental yield — where you subtract things like loan interest, condo MCST fees, and property tax.

📘 For a full breakdown and formulas:

👉 Rental Yield Singapore: How to Calculate Net ROI Like a Pro

What’s a Good ROI for Property Investment in 2025?

In 2025, a gross yield of 3%–4% is fairly common for condos and ECs. Net ROI — after all costs — may drop closer to 1.5%–2.5%, depending on your loan structure and vacancy rate.

That might sound low, but with the right unit and financing, property still outperforms CPF interest and gives you capital appreciation over time. Always assess ROI with your loan interest rate, tenure, and rental trends in mind.

💡 Want to see how it works in real life? We’ve broken it down in a real case study here.

Cost Breakdown of Owning Rental Property in Singapore

Rental income may sound attractive — but don’t forget the real costs of owning a rental property in Singapore. Between upfront payments, monthly commitments, and surprise expenses, it’s easy to underestimate how much you’ll actually spend.

Let’s break it all down.

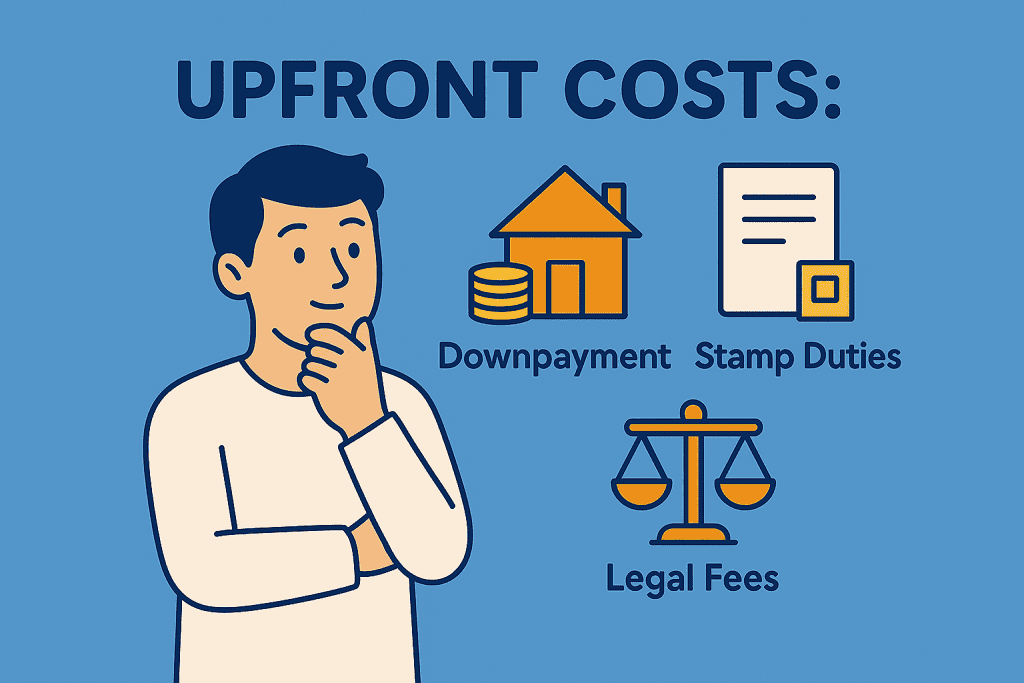

Upfront Costs: Downpayment, Stamp Duties, Legal Fees

Before you collect rent, you’ll need to fork out a sizable amount upfront:

- Minimum Downpayment: 25% if using a bank loan (5% cash, 20% CPF/cash)

- Buyer’s Stamp Duty (BSD): Based on property price or market value, whichever is higher

- Legal Fees & Valuation Costs: Typically $2,000–$3,000

- Renovation & Furnishing: Especially for condos, budget $20K–$50K to attract tenants

Need help crunching the numbers? Use our BSD Calculator

Ongoing Costs: Loan Repayments, Maintenance, Property Tax

Every month, landlords shoulder recurring costs that eat into ROI:

- Mortgage Repayments: Bank loans usually span 25–30 years

- Condo MCST Fees: $200–$400/month depending on facilities

- Property Tax: Based on Annual Value (AV), adjusted yearly

- Insurance: Landlord coverage for fire, contents, liability

These are non-negotiables — so calculate them before you invest.

Unexpected Costs: Vacancy, Repairs, Agent Commissions

Even the best properties come with curveballs:

- Vacancy Periods: Always factor in 1–2 months of no rent between tenants

- Repairs: Aircon issues, plumbing, appliance replacements — they add up

- Agent Fees: Up to 1 month’s rent for each successful tenancy

Expert Tip: Always build a “vacancy buffer” into your yield calculations — it protects your cash flow.

Top Locations to Invest in Singapore Rental Property (2025)

When it comes to rental property, location isn’t just important — it’s everything. In 2025, tenant preferences are shifting, and some districts are performing better than others.

Whether you’re eyeing a condo in the East or a resale HDB in a mature estate, your rental yield will heavily depend on where you buy.

Which Districts Offer Strong Rental Demand in 2025?

Here are some hot picks based on URA and 99.co rental trend data:

- District 15 (East Coast, Katong) – High expat appeal, near good schools and lifestyle amenities

- District 3 (Queenstown, Tiong Bahru) – Central fringe location, strong demand from professionals

- District 19 (Serangoon, Hougang, Punggol) – More affordable condos, solid yield potential

- District 27 (Yishun, Sembawang) – Budget-friendly HDB rentals with good accessibility

Tip: Use portals like EdgeProp or URA Rental Statistics to check rental transactions by project and district.

HDB vs Condo vs EC: Which Has Better Yield?

Choosing the right property type can make or break your rental returns. Here’s a quick comparison of average rental yield by property type in Singapore (2025) — so you can pick based on your investment goals and target tenant market.

Singapore Rental Yield Comparison by Property Type (2025)

| Property Type | Average Rental Yield (2025) | Typical Tenant Profile |

|---|---|---|

| HDB (3–4 Room Flats) | 4% – 5.5% | Couples, budget renters, local workers |

| Executive Condo (EC) | 3.5% – 4.2% | Young families, upgraders, value-seekers |

| Private Condo | 3% – 4% | Expats, singles, PMETs |

| Luxury Condo (CCR) | 2% – 3% | High-net-worth expats, senior execs |

Investor Tip: Yield isn’t everything — don’t forget to factor in appreciation potential, entry price, and tenant demand.

Key Factors That Make a Location Tenant-Friendly

- Proximity to MRT stations

- Schools and childcare nearby

- Food, shopping and amenities within walking distance

- Low noise but easy access to city fringe areas

- Strong employment hubs (e.g. Paya Lebar, One-North, Jurong)

We’ll soon be publishing a deep dive into the top rental areas in Singapore — stay tuned for insider picks based on 2025 data.

How to Finance a Rental Property in Singapore

Unless you’re buying in full cash (rare), understanding your financing options for rental property in Singapore is key to getting the best returns. Your mortgage terms — from LTV limits to ABSD and loan tenure — directly affect your rental yield and ROI.

Can You Use a Housing Loan to Buy Investment Property?

Yes — you can use a private housing loan from a bank to finance rental property in Singapore. However, it’s treated as an investment property, which means:

- No HDB loans allowed (even for resale flats)

- Higher downpayment required (at least 25%)

- ABSD applies if this is your second or subsequent property

Learn more: Private Property Loan in Singapore

What Is the Minimum Downpayment & LTV Rule?

Here’s how it works in 2025:

- Bank Loan (1st Property): Up to 75% LTV, 5% cash minimum

- Bank Loan (2nd Property): LTV capped at 45%, minimum 25% downpayment

- Cash Component: 5%–25%, depending on your profile and loan count

This means your upfront capital needs are much higher for investment properties — and you’ll need to factor in Buyer’s Stamp Duty (BSD) and Additional Buyer’s Stamp Duty (ABSD) too.

How ABSD, TDSR, and MSR Affect Your Loan Eligibility

- ABSD (Additional Buyer’s Stamp Duty): 20% for Singaporeans buying their second property; 30% for foreigners

- TDSR (Total Debt Servicing Ratio): Capped at 55% of gross monthly income — includes all your existing loans

- MSR (Mortgage Servicing Ratio): Only applies to HDB/EC purchases; capped at 30% of income

Tip: Use a mortgage loan repayment calculator to estimate how much you can borrow while staying within TDSR limits.

Key Legal and Tax Requirements for Landlords

Renting out your property in Singapore doesn’t stop at collecting rent — there are strict legal and tax requirements that every landlord needs to follow. Overlooking these can lead to penalties, tenant disputes, or even a ban on renting out your unit.

Let’s break down the essentials for 2025.

IRAS Rental Income Tax: What You Need to Declare

Rental income is fully taxable in Singapore. You must declare it under “Other Income” in your annual IRAS tax filing. This includes:

- Monthly rent

- Reimbursements from tenants (e.g. utility bills, maintenance fees)

- Advance rent or forfeited deposits

The good news? You can claim deductions for allowable expenses like mortgage interest, property tax, and agent fees — reducing your taxable rental income.

Tip: Use IRAS’ pre-filled deduction option or itemise your costs if you have large expenses.

URA, HDB, and MOM Rules for Renting Your Unit

Before renting out your property, make sure it’s allowed:

- HDB Flats: Must meet the Minimum Occupation Period (MOP) of 5 years before you can rent it out

- Private Condos & ECs: Minimum 3-month tenancy period, no short-term rentals (Airbnb-style stays are illegal)

- Foreign Workers as Tenants: You must comply with MOM occupancy caps and permitted housing guidelines

⚠️ Failure to comply can lead to fines, eviction orders, or disqualification from future rentals.

Foreign Ownership, ABSD Tiers, and MOP Restrictions

- Foreigners can buy condos but cannot purchase HDB flats unless married to a Singaporean

- ABSD is higher for foreigners (currently 60% in 2025), and also applies to PRs and Singaporeans owning multiple properties

- MOP Restrictions apply to all HDB units and new ECs before they can be legally rented

What to Do After You Buy — First Steps as a Landlord

Congrats — you’ve bought your investment property! But before tenants move in, there are a few important boxes to tick. Here’s what every new landlord in Singapore should know to get started on the right foot in 2025.

Should You Hire a Property Manager or Manage It Yourself?

If you’re wondering whether to manage your rental property yourself or outsource it, this table breaks down the pros and cons. Many new landlords in Singapore compare DIY property management vs hiring a rental agent to optimise both time and rental yield.

Rental Property Management in Singapore: Comparison Table

| Management Option | Advantages | Disadvantages |

|---|---|---|

| DIY Landlord | Full control, cost savings | Time-intensive, requires legal/tenant knowledge |

| Property Agent / Manager | Hassle-free, professional tenant handling | Hassle-free, professional tenant handling |

Expert Tip: If you’re managing more than one unit or staying overseas, a professional agent can help maintain your ROI and sanity.

What to Do Before Renting: Lease Agreements, IRAS Notices

You’ll need to:

- Draft a legally binding tenancy agreement

- Collect security deposits (usually one month per year of lease)

- Submit IRAS Form T (Rental Income Declaration)

- Register with HDB or URA if renting out HDB/EC units

- Take inventory photos and do a handover checklist

This paperwork protects both you and your tenants — and avoids trouble later.

Resources to Help New Landlords Succeed

✅ IRAS: Rental Income Guidelines

✅ URA: Private Property Rental Rules

✅ HDB: Renting Out Your Flat

✅ Mortgage Broker Services: For reviewing refinancing options or bridging loans

🔗Want more help managing your unit? Check out our full guide on How to Manage Your Rental Property in Singapore.

Common Mistakes to Avoid When Investing

Even seasoned investors slip up — and when it comes to rental property investment in Singapore, small mistakes can lead to big losses. Here are the most common pitfalls to steer clear of in 2025.

Overpaying for Low-Yield Units or Poor Locations

Just because a condo is in a nice district doesn’t mean it’s a smart buy. Some properties have high price tags but generate low rental yield — especially in the Core Central Region (CCR). Always:

- Compare average yield vs psf price

- Look at rental demand in the area (not just resale trends)

- Use real data — not just agent hype

Underestimating Costs and Vacancy Risks

Many new landlords forget that the rent doesn’t always roll in perfectly every month.

Common overlooked costs:

- Agent commissions for finding new tenants

- Periods where your unit sits vacant

- Maintenance surprises (air-con repairs, leaking taps)

These expenses can eat into your net rental yield and ROI faster than you think.

Ignoring Government Cooling Measures and Rules

Policies like ABSD, TDSR, and new loan curbs can significantly impact:

- How much you can borrow

- How much tax you’ll pay

- Whether you’re even eligible to buy a second property

Make sure to check out our ABSD Singapore Guide before committing to any second home.

Always factor in policy shifts before locking in your investment — especially if you plan to refinance later.

Rental Property ROI Case Study Singapore (2025)

Sometimes, numbers speak louder than theory. In this case study, we break down the real costs, income, and ROI for a rental property in Singapore — so you can see how it all plays out before diving in.

Sample Property: 2-Bedroom Condo in District 15

Let’s take a mid-range, 2-bedroom condo in Marine Parade as our base case.

Property profile:

- 2-bedroom freehold unit, ~750 sq ft

- Purchase price: $1.4 million

- Monthly rental income: ~$4,300

- Bank loan tenure: 25 years, interest rate: 3.2%

District 15 is known for strong rental demand, especially from expats and young couples — making it a popular investment choice for those eyeing East Coast rental yields.

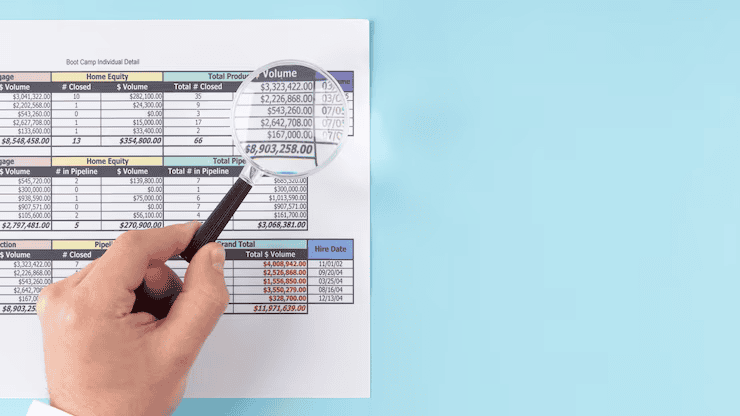

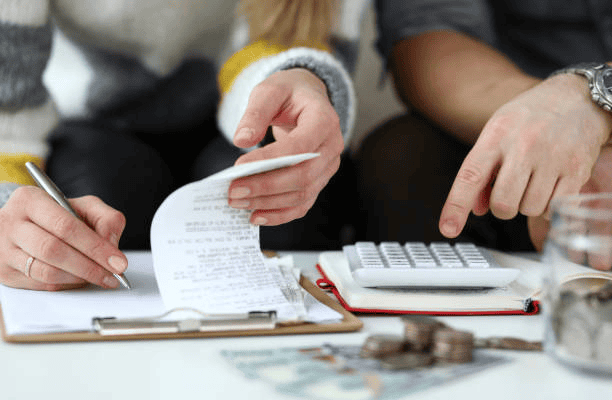

Cost Breakdown vs Monthly Rental Income

If you’re planning to invest in a 2-bedroom condo in Singapore, understanding the monthly cash flow is crucial. This table compares rental income vs ownership costs based on current market averages in 2025, helping you estimate your net rental yield with better accuracy.

Rental Property Monthly Income & Expense Table (District 15, 2-Bedroom Condo)

| Cost / Income Item | Monthly Amount (Estimated) |

|---|---|

| Gross Rent | $4,300 |

| Bank Loan Repayment (P&I) | $3,200 |

| Property Tax + MCST Fees | $400 |

| Annualised Agent Commission | $100 |

| Maintenance & Miscellaneous | $100 |

Net Monthly Income: ~$500

Net Rental Yield: ~2.8%

Gross Rental Yield: ~3.7%

What the ROI Looks Like — and How to Improve It

With all holding costs considered, this investment sees a 2.8% net rental yield, which is respectable in today’s market. But you can potentially push that higher by:

- Choosing a unit with better layout or dual-key potential

- Renovating strategically to justify higher rent

- Refinancing to reduce your loan interest over time

💡 If this unit appreciates by just 2% annually, your total ROI (rental + capital gains) could exceed 5% yearly — not bad for a leveraged investment!

Final Thoughts — Is Rental Property Right for You?

Rental property in Singapore isn’t just about buying a unit and collecting rent. It’s about strategic thinking, long-term planning, and knowing when the numbers make sense. If you’ve made it this far, you’re already ahead of most.

Let’s wrap things up with a quick readiness check.

Investor Readiness Checklist (2025 Edition)

Ask yourself these 5 key questions:

- Do I have enough funds for upfront costs like BSD, legal fees, and renovations?

- Am I clear on my target rental yield and ROI expectations?

- Do I have a plan to handle vacancies or unexpected repairs?

- Am I aware of cooling measures, ABSD, and income tax obligations?

- Do I have time to manage the property — or will I hire help?

If you’re not sure about any of these, it’s a sign to go back and revisit specific sections of this guide — or speak to a mortgage professional.

When to Speak to a Mortgage Broker for Loan Advice

Before you commit to a purchase, it’s crucial to get your loan eligibility, bank offers, and total borrowing costs sorted out. A good broker will:

- Compare packages across all major banks

- Help you understand TDSR, MSR, and LTV limits

- Advise if you qualify for better rates or tenure options

🔗 Need guidance? Talk to an expert today — visit our Mortgage Broker Singapore page.

Frequently Asked Questions (FAQs)

Still have questions about rental property investment in Singapore? You’re not alone. Here are some of the most commonly asked questions — with straight-to-the-point answers to help you move forward confidently.

Can foreigners buy rental property in Singapore?

Yes — foreigners can buy private properties like condos and apartments in Singapore. However, landed homes (like bungalows or terrace houses) are restricted unless you get special approval from the Land Dealings Approval Unit (LDAU).

Also note: Foreigners are subject to higher ABSD rates — 60% as of 2025 — which can significantly affect ROI.

How is rental income taxed in Singapore?

Rental income is taxable under personal income tax. You’ll need to declare your gross rental income, and you can deduct allowable expenses like:

- Property tax

- Interest on your mortgage

- Agent commissions

- Maintenance and repairs

Learn more from IRAS’s rental income tax guide.

What’s the minimum rental period for private property?

The minimum lease period for private residential properties is 3 months. Short-term rentals (under 3 months) — including Airbnb — are not allowed under URA regulations.

Planning to rent out your unit? Review URA’s rental regulations to stay compliant.

Conclusion: Ready to Invest in Your First Rental Property?

Investing in rental property in Singapore can be one of the most powerful ways to grow your wealth — if you do it right. From calculating rental yield to managing loan repayments, there’s a lot to consider. But with the right strategy and tools, you can turn your property into a steady income stream and long-term asset.

The key? Don’t rush it. Run the numbers. Understand your costs. Choose the right location. And speak to someone who knows the market inside out.

Need Help Getting Started?

Whether you’re buying your first rental unit or planning your next move, Ace Mortgage can help you compare bank loans, optimise your financing, and avoid costly mistakes.

Get unbiased advice from a licensed mortgage broker today.

Start here 👉 Singapore Mortgage Broker

Or try these free tools to plan your next step: