Looking to secure a prime BTO flat in Singapore’s city-fringe? The 2025 launches of MacPherson Weave BTO and Geylang BTO projects present an exciting opportunity for homeowners and investors alike. Located in well-connected and amenity-rich districts, these BTO launches offer a rare blend of convenience, accessibility, and long-term value.

In this in-depth guide, we cover everything you need to know — from MacPherson BTO project details and Geylang BTO launch updates, to application tips, price comparisons, and the investment potential of these mature estates. Whether you’re a first-time buyer or planning to right-size, this article will help you make an informed decision for your future home in Geylang or MacPherson.

With BTO prices starting from under $100,000 for 2-room Flexi flats, affordability is a key draw — but it’s just as important to explore your home loan options here to ensure long-term financial comfort.

Overview of MacPherson Weave BTO

MacPherson Weave is one of the most exciting projects in the 2025 BTO launch, especially for buyers seeking affordable city-fringe living. Nestled in a mature estate with strong transport links and community amenities, this development blends urban convenience with everyday comfort — ideal for both first-time homeowners and right-sizers.

Project Details and Specifications

This upcoming MacPherson BTO project is expected to feature several modern residential blocks, offering 2-room Flexi, 3-room, and 4-room flats. The design prioritises sustainability and community living, with green roofs, sheltered walkways, and communal gardens woven throughout the estate.

Units are built with long-term liveability in mind — barrier-free access, energy-efficient fittings, and thoughtful layouts make daily life easier and more comfortable for residents of all ages.

For first-time buyers eyeing a 3-room or 4-room unit, understanding your HDB home loan options is essential to making a confident and informed decision.

Location and Accessibility

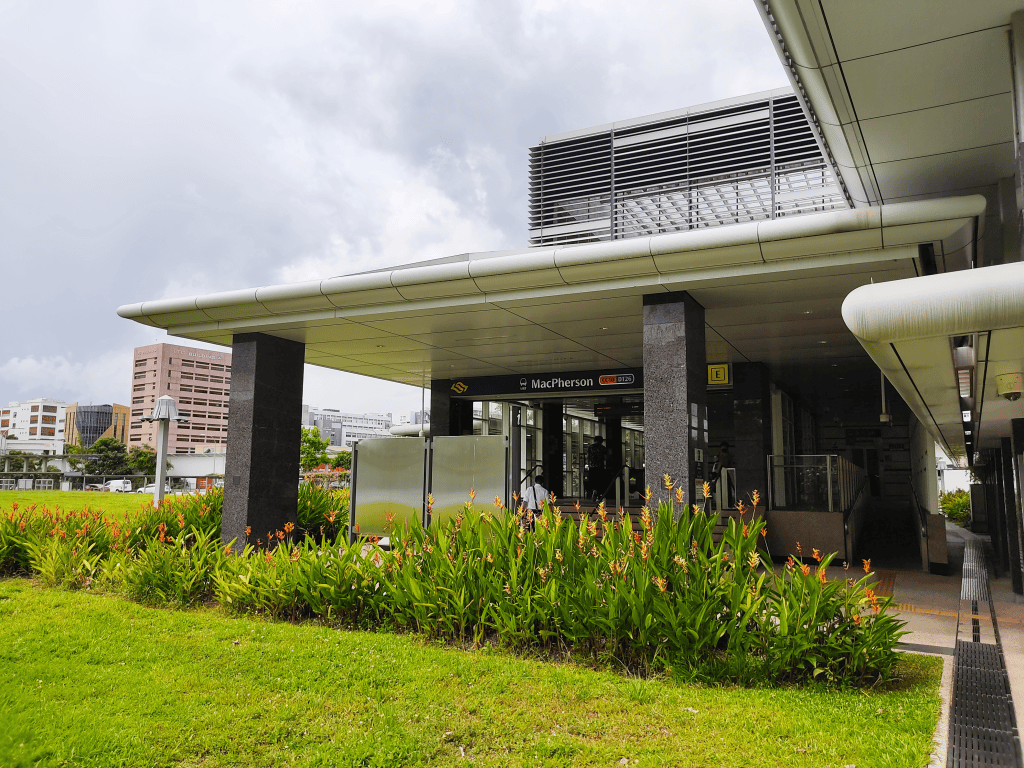

Location is one of MacPherson Weave’s strongest selling points. Situated at the junction of Paya Lebar Road and Circuit Road, the project offers excellent connectivity.

Residents will enjoy:

- A short walk to MacPherson MRT Interchange, which connects the Circle and Downtown lines

- Direct access to major expressways like PIE and KPE

- A thriving neighbourhood filled with food centres, clinics, parks, and heartland malls

This level of accessibility is rare for BTOs, especially in central regions — making MacPherson a strategic pick for buyers prioritising convenience.

In my opinion, living here means you can reach the city in under 20 minutes without giving up the everyday comforts of a mature estate.

Unit Types and Layouts

Whether you’re planning for the future or looking to downsize, MacPherson Weave offers a unit for every need.

The 2-room Flexi flats suit singles or elderly residents who want to stay close to central amenities. For couples and smaller families, the 3-room and 4-room flats offer practical, open-concept layouts with well-ventilated kitchens and flexible living areas.

Design-wise, you can expect modern interiors that make efficient use of space — ideal for those who appreciate both functionality and comfort.

Why MacPherson Is a Top Choice for BTO Buyers

MacPherson continues to stand out as one of the most attractive locations for BTO applicants in 2025 — and for good reason. Its unique blend of seamless connectivity, mature estate amenities, and access to essential services makes it an ideal place to live, especially for young couples and multigenerational families looking for long-term convenience.

Proximity to MacPherson MRT and Other Transport Options

Few BTO projects enjoy the luxury of a true interchange MRT station just minutes away. MacPherson Weave is within walking distance of MacPherson MRT Interchange, serving both the Circle Line and Downtown Line. This means faster commutes to areas like Paya Lebar, Bugis, and Marina Bay — all without the need to transfer multiple times.

On top of that:

- Major expressways like PIE and KPE are nearby, offering convenient driving access to the city and east coast.

- Multiple bus services along Circuit Road and Paya Lebar Road make daily commuting even more flexible.

In my opinion, the dual-line MRT access is a huge advantage for working professionals who value a short and reliable commute.

Nearby Amenities like Malls, Parks, and Hawker Centres

Living in a mature estate means having everything you need just a few steps from home — and MacPherson BTO buyers get exactly that. Residents can easily access:

- Heartland malls like Paya Lebar Square, PLQ Mall, and SingPost Centre

- Well-loved hawker centres at Circuit Road and MacPherson Market

- Community spaces and neighbourhood parks for outdoor activities and exercise

Whether you’re running errands, enjoying weekend meals, or relaxing with family, the area delivers both convenience and charm — something newer towns often lack.

Reputable Schools and Healthcare Facilities in the Area

For families planning ahead, MacPherson offers access to several established schools and medical centres — a major factor for long-term living. Within close proximity, you’ll find:

- Canossa Catholic Primary School and Geylang Methodist School

- Preschools and childcare centres conveniently located within the estate

- Kwong Wai Shiu Hospital, Geylang Polyclinic, and various private clinics

These institutions provide essential support for families with young children and elderly members, adding another layer of practicality to choosing MacPherson as your home base.

What You Should Know About Geylang BTO Launches

Geylang may be one of Singapore’s oldest districts, but don’t let its age fool you — it’s fast becoming a hot spot for BTO launches. With its excellent connectivity, vibrant food culture, and growing demand among young homeowners, the area has seen a fresh wave of interest. If you’re considering a BTO in Geylang, here’s what you need to know to make an informed decision.

Geylang BTO Projects in 2023 & 2024

Recent years have seen a resurgence of Geylang BTO launches, including projects like Dakota Crest and Pine Vista, which received strong interest due to their proximity to MRT stations and central location. These projects offered mainly 3-room and 4-room flats and were oversubscribed — a clear signal of buyer confidence.

What’s driving this interest?

- Mature estate appeal with ready infrastructure

- City-fringe location just 10–15 minutes from the CBD

- Strong demand from young couples and right-sizers

With higher prices driven by proximity to town and Dakota MRT, it’s wise to compare DBS, UOB, and OCBC home loan packages before committing to a flat — especially if you’re stretching your budget.

(Follow this with additional inline links:)

Accessibility and Lifestyle in Geylang

Geylang offers one of the best lifestyle-transport combos for BTO buyers. Multiple MRT stations — including Dakota, Aljunied, and Mountbatten — serve the area, ensuring residents enjoy quick access to town, the east, and even the airport.

More than that, the neighbourhood is known for:

- A legendary food scene featuring both traditional hawkers and trendy cafes

- Walkable streets and community spaces

- Easy access to recreational spots like Singapore Sports Hub and East Coast Park

Geylang strikes a rare balance — urban living with heartland familiarity.

Is Geylang a Good Area to Live or Invest In?

Despite outdated perceptions, Geylang has grown into a practical, well-connected district that’s attracting a younger generation of buyers. With the government’s ongoing efforts to revitalise the area and its mature estate status, residents benefit from ready-built amenities and increasing long-term value.

From an investment standpoint:

- Flats here have shown steady appreciation, especially those near MRTs

- Proximity to Paya Lebar commercial hub adds rental appeal

- Ongoing transformation plans further boost potential

In my opinion, Geylang is no longer just an underrated gem — it’s a strategic pick for those who value location, heritage, and future value in one package.

How Does MacPherson Weave Compare to Geylang BTOs?

If you’re deciding between MacPherson Weave and Geylang BTO projects, you’re already on the right track — both are city-fringe, mature estate launches with strong appeal. But there are key differences worth considering before you apply. From pricing and unit mix to the overall living environment, here’s how these two BTO options stack up.

Price Differences and Unit Availability

While both MacPherson and Geylang are located in mature estates, MacPherson BTOs tend to offer slightly lower entry prices due to their location being just a touch farther from the CBD. In contrast, Geylang’s proximity to the Paya Lebar commercial hub and the East-West MRT line often results in higher pricing, especially for 4-room flats.

In terms of unit types:

- MacPherson Weave is expected to offer a mix of 2-room Flexi, 3-room, and 4-room units — with decent availability across types.

Recent Geylang BTO launches like Dakota Crest had mostly 3-room and 4-room flats, with fewer smaller units.

Surrounding Environment and Estate Maturity

Both estates are mature, but their surrounding environments feel quite different.

- MacPherson leans more residential and community-focused. It has wide streets, older but stable HDB blocks, and a strong heartland feel.

- Geylang, on the other hand, is more mixed-use — combining housing, shophouses, eateries, and some pockets of nightlife.

The infrastructure in both areas is established, but MacPherson tends to be quieter and more family-oriented, while Geylang offers a denser, livelier setting with a unique cultural charm.

Demographic and Community Differences

In terms of demographics, MacPherson traditionally attracts:

- Multi-generational families

- Elderly residents

- Young couples seeking long-term stability

Meanwhile, Geylang sees:

- More young professionals

- Singles or couples prioritising urban accessibility

- A diverse mix of long-time residents and new homeowners

This affects the vibe — MacPherson tends to have a tight-knit, neighbourly atmosphere, while Geylang offers more diversity and fast-paced energy.

Both appeal to different lifestyles, so your choice depends on what kind of community you’re hoping to be part of.

Application Guide for MacPherson and Geylang BTOs

Applying for a BTO flat in MacPherson or Geylang requires more than just timing — understanding eligibility, income limits, and application strategies can make a real difference in your chances. This section breaks down what you need to know before submitting your BTO application for these mature estate launches.

Before applying, take a moment to calculate your mortgage repayments — knowing your numbers helps you stay realistic during the flat selection stage.

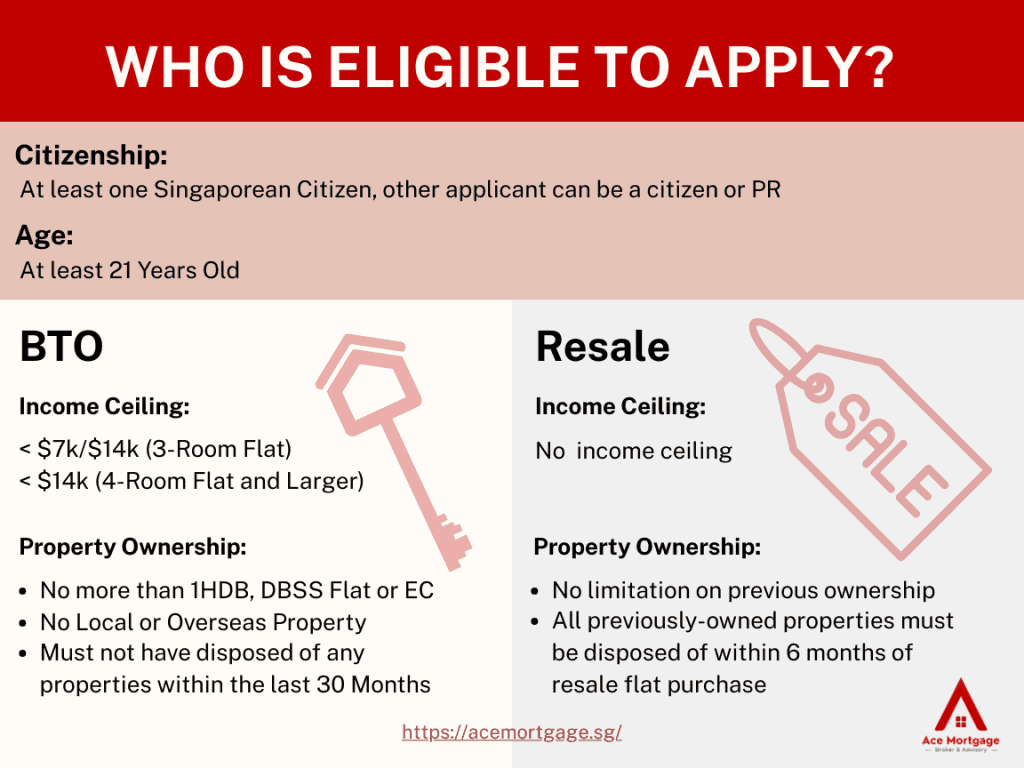

Eligibility Requirements & Income Ceiling

Whether you’re applying for MacPherson Weave or a Geylang BTO, the basic HDB eligibility criteria still apply:

- At least one applicant must be a Singapore Citizen

- Household income must not exceed the relevant income ceiling

- $7,000 for 2-room Flexi (short lease)

- $14,000 for 3-room or 4-room flats (may go up to $21,000 for extended families)

- $7,000 for 2-room Flexi (short lease)

- Must apply as a family nucleus, fiancé-fiancée, or singles scheme (for 2-room Flexi only)

Expert tip: If you’re applying as a first-timer couple, you’ll have priority chances and possibly higher ballot odds, especially under the Family and Parenthood Priority Scheme (FPPS).

Application Timeline and Balloting Tips

BTO applications typically open during HDB’s quarterly launches — MacPherson Weave and future Geylang BTOs are part of this sales cycle.

Here’s how the timeline usually works:

- Application opens: You have one week to apply online

- Results released: Usually within 2–3 months

- Flat selection: If you get a queue number, selection begins based on ballot order

To improve your chances:

- Apply under priority schemes (FPPS, MCPS, etc.)

- Focus on less oversubscribed flat types (e.g., 3-room)

- Be flexible with location preferences if you’re open to alternatives

Alternatives if You Don’t Get a Queue Number

Didn’t get a number? Don’t worry — you still have options.

- Consider applying in the next BTO sales exercise; mature estate launches happen multiple times a year

- Look into Sale of Balance Flats (SBF) or Open Booking of Flats, where leftover units from past launches are offered

- Explore the resale market, especially for MacPherson and Geylang — both areas have strong supply of well-located flats with existing infrastructure

Missed out on a queue number? You can still explore the resale market or consider refinancing options to improve affordability over time — especially if you’re planning for a bigger home.

Those who already own a flat may benefit from a refinanced HDB loan to unlock better rates.

Future Value & Investment Potential

Beyond location and lifestyle, one of the biggest reasons buyers are eyeing MacPherson Weave and Geylang BTOs is the long-term value they offer. As mature city-fringe estates, both locations enjoy strong market fundamentals — from healthy price appreciation to growing rental demand. If you’re wondering whether your BTO purchase will pay off in the future, here’s what the data and experts say.

For those eyeing future rental income or asset growth, Singapore private property loans may be worth exploring as a next step — especially for investors looking beyond the BTO market. Alternatively, commercial buyers may consider a commercial property loan for more diversified portfolios.

Past Appreciation Trends in MacPherson & Geylang

MacPherson vs Geylang HDB Resale Price Trends & MRT Impact

| Estate | Avg 4-Room Resale Price | Appreciation Trend | MRT Proximity Impact |

|---|---|---|---|

| MacPherson | ~$620,000 | Slow & Steady | High Impact (Dual-line Access) |

| Geylang | ~$670,000 | Moderate to Strong | Very High near Dakota MRT |

Rental Demand in City-Fringe Estates

Rental demand is another key factor driving long-term value, especially in city-fringe BTO locations like Geylang and MacPherson.

Why demand remains strong:

- Proximity to commercial hubs like Paya Lebar Quarter and the CBD

- Good MRT access, which appeals to professionals and expatriates

- Wide selection of amenities that make daily life convenient for tenants

In particular, Geylang sees higher short- to mid-term rental turnover due to its vibrant setting and appeal to younger renters, while MacPherson attracts long-term tenants who prioritise peace and connectivity.

What Analysts Say About Long-Term Value

Property analysts generally agree that BTOs in mature estates like these are among the safest entry points into the market — offering both strong owner-occupier appeal and investment upside.

Key insights include:

- BTO flats in MacPherson and Geylang often outperform newer towns in terms of resale demand

- City-fringe locations are expected to retain value well amid policy shifts or economic slowdowns

- Upcoming developments around Paya Lebar and Geylang East may drive further appreciation

Choosing a BTO in a mature estate isn’t just about comfort — it’s a strategic decision that offers long-term financial resilience and flexibility.

Ready to Buy? Let’s Get You Home

Ready to make your move on a city-fringe BTO flat? Whether you’re drawn to the connectivity of MacPherson Weave or the vibrant charm of Geylang BTOs, securing the right home starts with making informed financial decisions. Don’t leave your mortgage planning to chance — speak to a licensed mortgage broker or contact us today for a personalised consultation. Let us help you unlock the best loan rates and step confidently into your new home journey.