So you’re ready to buy a home in Singapore — exciting! But here comes the big question: do you need a mortgage broker, a property agent… or both?

They may sound similar, but they do very different things. One helps you find the right home, the other helps you finance it smartly. If you’re not sure who does what (or when to call who), don’t worry — you’re not alone.

In this guide, we’ll break it all down clearly:

👉 What each professional actually does

👉 When you should engage them

👉 How to avoid overpaying on your home loan in Singapore

Let’s clear up the confusion — and help you make the best move.

Mortgage Broker vs Property Agent: At a Glance

If you’re buying a home in Singapore, chances are you’ll hear both these terms thrown around: mortgage broker and property agent. They often work side by side, but they serve very different roles in your property journey.

Comparison table of services, fees, and who they represent

Here’s a quick breakdown to help you see the difference at a glance:

Comparison table of services, fees, and who they represent

| Role | What They Do | Who They Represent | Fees/Commission |

|---|---|---|---|

| Mortgage Broker | Shops around for the best home loan rates in Singapore across banks, advises on loan types, helps with paperwork | You (the buyer/borrower) | Usually free — paid by the bank |

| Property Agent | Helps you buy, sell, or rent property; arranges viewings, negotiates offers | The buyer, seller or landlord (depends on contract) | Typically 1–2% commission on sale price |

Quick tip: If you’re hunting for the best mortgage loan in Singapore, a mortgage broker is your shortcut. They compare multiple banks like DBS, OCBC, and UOB in one go — often with exclusive rates you don’t get by walking into a branch.

Key regulations: MAS for brokers, CEA for agents

This part surprises most people — mortgage brokers and agents are licensed by different authorities.

- Mortgage brokers in Singapore are regulated by the Monetary Authority of Singapore (MAS). They must be accredited, follow fair lending rules, and disclose commissions from banks.

- Property agents, on the other hand, are regulated by the Council for Estate Agencies (CEA). This ensures ethical conduct when marketing or negotiating property deals.

👉 What this means for you: a property agent cannot legally give mortgage advice or recommend which home loan to take. Only a licensed broker can do that.

Which one fits different home buying situations best?

- Buying a BTO? You may only need a property agent if you’re applying for a loan. But don’t limit yourself to an HDB housing loan — a mortgage broker can also help you structure a bank loan that may offer more flexibility and competitive rates to better suit your needs.

- Going for a resale condo or private property? You’ll want both — an agent to help negotiate, and a mortgage broker to secure the lowest mortgage interest rates in Singapore.

- Upgrading or refinancing? A broker is a must — especially if you want to compare fixed vs floating rates or consider refinance home loan options.

Expert insight: Always speak to a mortgage broker Singapore early — even before you start viewing units. Why? Because knowing your approved loan amount helps narrow your budget and gives you more confidence during negotiations.

What Does a Mortgage Broker Do in Singapore?

Let’s be real — shopping for a home loan in Singapore can be a headache. Every bank has different rates, packages, lock-ins, terms… and by the time you compare them all, you’ve probably aged a year.

That’s where a mortgage broker comes in.

Instead of going bank to bank, a mortgage broker in Singapore does all the homework for you — and often with zero fees.

How mortgage brokers simplify your home loan journey

Think of a mortgage broker as your personal loan concierge. They:

- Assess your income, age, CPF usage, and eligibility

- Shortlist the most suitable loan packages (fixed, floating, hybrid)

- Handle the paperwork from application to approval

- Liaise directly with the bank so you don’t have to chase updates

They’re especially helpful if you’re a first-time buyer or upgrading from an HDB to private — when the paperwork gets a bit more sian. If you’re self-employed or have irregular income, their guidance can also make or break your approval.

👉 Pro tip: The earlier you engage a broker, the more confident you’ll be when viewing homes — you’ll know your budget down to the dollar.

Do they offer better access to bank loan options?

Yes — and here’s the best part: a good mortgage broker isn’t tied to just one bank.

They can compare home loan rates across multiple banks like:

So instead of meeting three different bank officers (and repeating yourself three times), your broker consolidates all that info in one place — tailored to your financial profile.

Some brokers even have exclusive rates you won’t find online, especially if you’re taking a bigger loan or refinancing.

Can a broker help you secure better interest rates in 2025?

In short? Yes — especially in 2025, where fixed and floating rates are fluctuating like MRT breakdown news.

Banks are adjusting to SORA-based loan packages, and new promo rates pop up every few weeks. A mortgage broker keeps track of these shifts and can help you lock in the best mortgage rates in Singapore based on:

- Your risk tolerance (fixed vs floating)

- Loan tenure and property type

- Whether you’re buying, refinancing, or repricing

💬 Expert insight: In 2025, we’re seeing more homeowners combine fixed + floating hybrid loans to hedge against volatility. A broker can help you build that custom structure — something a single bank rep may not offer.

What Does a Property Agent Do in Singapore?

While a mortgage broker helps you sort out your home loan, a property agent is the one helping you find — or sell — the actual home. From HDB flats to condos and landed properties, they’re your go-to when it comes to the physical side of the transaction.

But don’t blur the lines: agents are not loan advisors. Their job is different — and just as important.

What services do agents provide for buyers and sellers?

A licensed property agent in Singapore wears many hats. They:

- Schedule and conduct property viewings

- Advise on valuation, offer prices, and negotiation strategy

- Handle paperwork like the Option to Purchase (OTP) and liaise with lawyers

- For sellers, they manage listings, photos, and buyer leads

For buyers, they’re especially helpful if you’re trying to shortlist units in a specific location (e.g. near your kid’s school or MRT), or if you’re unfamiliar with BTO vs resale processes.

🔍 Tip: If you’re planning to buy a resale HDB flat, your agent can assist with submission timelines and CPF grant applications. But before locking in a unit, it’s wise to compare the HDB loan rate versus a bank loan to see which gives you the best deal.

Can agents give financial advice or recommend home loans?

Short answer: No — and they’re not allowed to.

Under CEA regulations, property agents cannot provide financial advice, nor can they recommend specific home loan packages. This includes suggesting which bank to go to, comparing rates, or helping you choose between fixed vs floating.

Why? Because that’s regulated under MAS, and only licensed mortgage brokers in Singapore or bank officers can give that kind of advice.

That is why agents usually just give you some banker’s contact. The problem here is that bankers can only advice you for their bank, which means their advice is biased towards their own bank.

If you want to get the best rates & unbiased advice, it’s always best to verify that you’re working with an independent mortgage advisor who isn’t tied to one bank, such as Ace Mortgage.

Personal tip: Even if your agent “has someone,” it’s smart to do your own comparison. You can also check your estimated loan repayment using a mortgage loan repayment calculator before committing.

What’s the typical commission rate for agents in 2025?

Here’s what you can expect to pay this year:

- For buyers: Typically no commission if you’re purchasing from a seller who pays the full commission.

- For sellers: Usually 2% of the sale price (negotiable, especially for higher-value properties).

- Rental transactions: Commonly half a month to one month’s rent per year signed.

Do note: property agent commission in Singapore isn’t regulated by law, so it’s always worth having a conversation about fees — especially if you’re transacting on multiple units or handling a private property loan alongside the sale.

Mortgage Broker vs Property Agent: What’s the Difference?

They might both help you buy a home, but a mortgage broker and a property agent are not the same. The difference isn’t just in job scope — it’s in who they work for, how they’re licensed, and how they get paid.

Here’s what you need to know.

Licensing: MAS vs CEA — and what that means for you

In Singapore, mortgage brokers and property agents are regulated by different authorities:

Licensing: MAS vs CEA — Who Regulates Them?

| Role | Regulatory Body | What It Means for You |

|---|---|---|

| Mortgage Broker | Monetary Authority of Singapore (MAS) | Licensed to advise on home loans, compare bank offers, and handle financing advice |

| Property Agent | Council for Estate Agencies (CEA) | Licensed to handle property transactions, listings, and buyer-seller negotiations |

Why this matters: If you need help with interest rates or choosing between fixed vs floating packages, only a mortgage broker Singapore can legally provide advice.

Representation: Do they work for you, the bank, or the seller?

One of the biggest differences? Who they’re actually working for.

Who Do They Represent in a Property Transaction?

| Role | Who They Represent | Typical Use Case |

|---|---|---|

| Mortgage Broker | You — the buyer/borrower | They work solely in your interest to find the best mortgage loan in Singapore |

| Property Agent | Buyer, seller, or landlord (varies) | May represent buyer or seller; clarify upfront, especially in resale or condo deals |

💡 Tip: When taking on a private property loan, make sure your agent’s interests are aligned with yours — especially during negotiations.

Incentives & commissions: How each gets paid

This one’s important — especially if you’re wondering whether advice is truly unbiased.

How Mortgage Brokers and Agents Get Paid

| Role | Who They Represent | Cost to You |

|---|---|---|

| Mortgage Broker | Commission from banks after successful loan approval | Usually free for borrowers |

| Property Agent | Commission (1–2% of sale price, or rental commission for landlords) | Buyer may not pay unless exclusive engaged |

📊 Pro tip: Always confirm the commission structure upfront. And before making any big decision, use a mortgage loan repayment calculator to assess your affordability.

How to Choose Between a Mortgage Broker and Property Agent

Trying to decide whether to speak to a mortgage broker or a property agent first? It really depends on where you are in your home buying journey — and what kind of help you need.

Let’s break it down so you don’t waste time (or money).

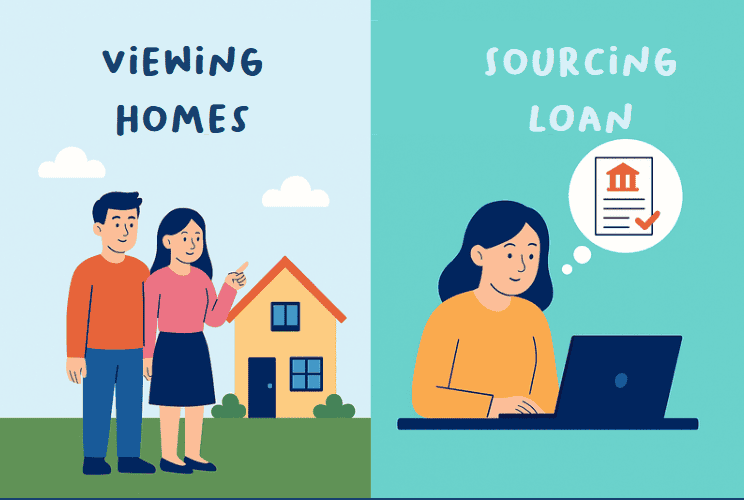

What stage are you at — viewing homes or sourcing loans?

The first step is to identify what part of the process you’re currently in. Are you still budgeting, already browsing listings, or ready to buy? Here’s who to talk to based on your current stage:

Who to Contact Based on Your Home Buying Stage (Mortgage Broker vs Property Agent)

| Your Current Stage | Who to Talk to First |

|---|---|

| Just starting out / budgeting | ✅ Mortgage broker Singapore — they’ll assess your loan eligibility and give you a clear budget |

| Actively viewing properties | ✅ Property agent — to schedule viewings and shortlist suitable homes |

| About to make an offer | ✅ Talk to both — you’ll need financing advice and transaction support |

Do you have straightforward or complex loan needs?

Not all buyers have the same financial profile. If your case is a little more complex than average, here’s why a broker might be your best ally:

If your situation is clear-cut — e.g. salaried, no debts, buying your first HDB flat — you might be okay working directly with a bank.

But if any of these apply:

- Self-employed or commission-based income

- Buying a private property or condo

- Using a mix of CPF and cash

- Looking to refinance home loan

… then a mortgage broker is a game changer.

They’ll guide you through bank comparisons, paperwork, and even help with refinance HDB loan if needed.

⚡ Expert insight: In 2025, banks are tightening approval criteria — so if your profile isn’t textbook, a broker can help package your loan to increase chances of approval.

Quick checklist: Who should you contact first?

Still unsure? Here’s a simple cheat sheet that tells you exactly who to call first, based on your situation:

Quick Decision Guide: Mortgage Broker or Property Agent First?

| Scenario | First Call? |

|---|---|

| “I just started looking, no idea what I can afford” | ✅ Mortgage broker |

| “I found a resale unit and want to make an offer” | ✅ Property agent |

| “I’m comparing home loan rates” | ✅ Mortgage broker |

| “I need help submitting an Option to Purchase” | ✅ Property agent |

| “I want to refinance my existing loan” | ✅ Mortgage refinance Singapore broker |

No matter which path you’re on, just remember:You can always book a free consultation with a mortgage advisor to get clarity before making big moves.

When Should You Use a Mortgage Broker?

The truth is, almost every homebuyer can benefit from speaking to a mortgage broker — but some people will gain a lot more than others.

If you’re navigating a tricky financial profile, comparing banks, or simply want to save time, a mortgage broker in Singapore can be your best shortcut to better interest rates and less stress.

First-time buyers, resale flat buyers, or refinancing — who benefits most

Wondering if it’s worth getting a broker involved? Let’s break it down:

Should You Use a Mortgage Broker? (Based on Buyer Profile in Singapore 2025)

| Buyer Profile | Should You Use a Broker? |

|---|---|

| First-time BTO buyer | ✅ Optional — if using HDB loan, less critical. But helpful for comparisons Recommended if going for bank loans (we can help you get better rates, flexibility and loan tenure) |

| Resale flat buyer | ✅ Highly recommended — especially for comparing bank loan vs HDB loan |

| Upgrading to condo/private property | ✅ Yes — brokers can structure complex loans and compare rates across banks |

| Looking to refinance | ✅ Absolutely — use a broker to find the best refinance home loan rates in 2025 |

Pro tip: Even if you already have a bank in mind, a broker may have access to exclusive mortgage packages — or know when to wait a week for an upcoming promo.

Are brokers helpful if you’re self-employed or have CPF limitations?

Yes — and arguably, that’s when you need them the most.

If you’re:

- Self-employed

- On variable income

- Have a short CPF contribution history

- Juggling CPF OA, cash, and maybe even a private property loan

…then applying for a housing loan can get complicated fast. Some banks have stricter income documents or require higher cash downpayment.

This is where a mortgage advisor becomes incredibly valuable. They know which banks are more lenient, how to present your income best, and which packages suit CPF-heavy payments.

Tip: Don’t guess your loan approval chance. Instead, let a broker assess your CPF situation early and advise if you should top up cash, wait, or switch banks.

Will a broker help with loan paperwork and approval tracking?

Definitely. A good mortgage broker doesn’t just compare rates and disappear.

They’ll help with:

- Filling up bank loan application forms correctly

- Submitting supporting documents (IRAS, CPF, payslips, NOAs, etc.)

- Communicating with bank officers on your behalf

- Tracking approval progress and updating you at every step

Many also advise you on what to avoid — such as topping up CPF right before application, or switching jobs during the approval window.

It’s like having a personal assistant for your home loan in Singapore — at no cost to you.

When Should You Rely on a Property Agent Instead?

While a mortgage broker helps with financing, a property agent in Singapore handles the physical property — and everything that comes with it. There are some situations where an agent isn’t just helpful — they’re essential.

Here’s when to loop them in.

Are they essential for resale HDBs, condos, or landed homes?

Yes — especially when you’re not buying directly from HDB.

If you’re:

- Purchasing a resale flat

- Buying a private condo or landed property

- Selling your current home and upgrading

…then a licensed property agent is incredibly useful. They’ll shortlist units, arrange viewings, advise on market value, and handle the back-and-forth with sellers or co-broke agents.

💡 Tip: For HDB resale buyers, an agent can guide you through eligibility checks, HDB home loan requirements, and how to apply for CPF grants without missing deadlines.

How agents assist with negotiation and option-to-purchase paperwork

Property agents aren’t just there to open doors at viewings — they’re trained to negotiate on your behalf.

Here’s how they help:

- Advise on offer price based on past transaction data

- Handle negotiation with the seller or seller’s agent

- Prepare and explain the Option to Purchase (OTP) documents

- Walk you through timelines: exercise deadline, HDB appointments, etc.

📄 If you’re unfamiliar with the option-to-purchase process in Singapore, your agent will keep you on track with key dates and legal steps.

Can they help after the sale with renovation, legal matters, or key collection?

Many agents go the extra mile — especially in Singapore’s service-driven property market.

A good agent can:

- Recommend trusted lawyers, contractors, or ID firms

- Coordinate with the seller or landlord for smooth key handover

- Help you prepare for HDB appointments or private property completion

- Even advise on timing your sale/purchase with your private property loan disbursement

Pro tip: If you’re juggling both a sale and a purchase (e.g. selling your HDB while buying a condo), a property agent can help you structure timelines to avoid a rushed move or unnecessary bridging loan.

Can You Work with Both a Broker and Agent Together?

Short answer? Yes — and you probably should.

A mortgage broker and a property agent each bring something unique to the table. In fact, working with both often gives you a more well-rounded, stress-free home buying experience — especially in Singapore’s fast-paced market.

Do their services overlap or complement each other?

They complement each other. While their timelines may cross paths, their roles are clearly distinct:

Key Differences Between Mortgage Broker and Property Agent Services in Singapore

| Role | What They Handle |

|---|---|

| Mortgage Broker | Home loan comparisons, interest rate advice, bank paperwork, loan approval |

| Property Agent | Property listings, price negotiation, legal paperwork, OTP handling |

In other words: your broker helps you secure the best home loan in Singapore, while your agent helps you secure the actual property.

They don’t compete — they complete.

How to manage both professionals without confusion

If you’re working with both, here’s how to stay organised:

- Loop them in early: Let your agent know you’re already working with a broker, and vice versa.

- Use your broker for financing questions (e.g. loan amount, CPF limits, SORA vs fixed rates).

- Use your agent for transactional steps (e.g. property search, OTP submission, seller communication).

💬 Pro tip: When you receive a bank’s Letter of Offer, your broker can check the fine print — while your agent prepares you for the next milestone, such as HDB appointments or legal conveyancing.

Tips to ensure you’re getting unbiased advice

Both brokers and agents in Singapore work on commission — but that doesn’t mean they can’t be trusted. It just means you need to know how they’re being paid.

- Ask your broker: “Are you tied to any bank, or do you represent multiple lenders?”

- Ask your agent: “Are you also acting for the seller, or only me?”

- Always verify that your mortgage advisor is MAS-licensed and not pushing one bank’s product.

A transparent broker will show you loan options across multiple banks like DBS, OCBC, and UOB — helping you choose the best fit for your goals.

What Are the Costs of Hiring a Broker or Agent in Singapore?

Let’s talk money — because while both mortgage brokers and property agents provide valuable services, it’s fair to ask: how much will it cost you?

The good news? In many cases, it might cost you… nothing. But it depends on who you hire and what you’re buying.

Do mortgage brokers charge a fee in 2025?

In 2025, most mortgage brokers in Singapore do not charge borrowers a fee.

They’re typically paid by the banks through a referral commission — which means you get their help, rate comparisons, and paperwork support at zero cost.

That said, it’s still wise to ask upfront:

- Are there any processing or advisory charges?

- Are you tied to just one bank or truly independent?

A transparent mortgage broker Singapore will disclose how they’re compensated and show you multiple loan packages — including from major banks like DBS, OCBC, and UOB.

What’s the typical agent commission — and who pays it?

Here’s a quick overview of property agent commission rates in Singapore as of 2025:

Property Agent Commission Rates in Singapore 2025

| Transaction Type | Typical Commission | Who Pays |

|---|---|---|

| Buying a property | Usually 0% (seller pays agent) | Seller |

| Selling a property | ~2% of sale price | Seller |

| Renting (1–2 year lease) | Half to one month’s rent | Tenant or Landlord, depending on contract |

💬 Tip: If you’re engaging an agent exclusively (e.g. for a rare or high-value unit), you may need to pay even as a buyer. Always confirm before proceeding.

Can you negotiate fees or commissions legally?

Yes, you can — and should.

In Singapore, property agent commissions are not fixed by law. CEA only requires transparency and a signed agreement — it doesn’t cap what can be charged.

Here’s what you can negotiate:

- Lower commission for high-value sales

- Fixed-rate commission instead of a percentage

- Bonus only if they hit a certain price

As for mortgage brokers, there’s usually no fee to negotiate — but you can ask them to explain if a particular loan earns them more commission, just to keep things transparent.

📌 Pro insight: If you’re handling a sale and purchase at the same time (e.g. selling HDB to buy a condo), some agents will give a discount if you let them handle both deals.

Real-Life Example: Using Both a Broker and Agent for a Smooth Purchase

Sometimes the best way to understand how a mortgage broker and property agent can work together — is to see it in action. Here’s a real-life story of a Singapore couple who upgraded from an HDB flat to a resale condo in 2025, and how working with both professionals helped them save time, money, and plenty of stress.

Case study: Upgrader using both for a resale condo

Meet Daniel and Sheryl — a couple in their late 30s, upgrading from their 4-room HDB in Yishun to a resale condo in Bishan. They wanted a bigger space near good schools for their two kids.

Daniel engaged a mortgage broker in Singapore early on to understand how much loan they could take, especially since they were planning to use both CPF and cash for the downpayment.

At the same time, they worked with a property agent who helped shortlist family-friendly condos with nearby MRT access and guided them through the resale process.

What went right: approval time, savings, and clarity

Here’s what made the process smooth:

Benefits of Using a Mortgage Broker and Property Agent Together (Singapore Case Study 2025)

| Advantage | Result |

|---|---|

| Broker compared UOB, DBS, and OCBC loan rates | They locked in a rate that was 0.35% lower than going direct |

| Agent negotiated price | Saved $18,000 off the listed price through data-backed offer |

| Broker handled paperwork | Approval-in-principle done within 48 hours, avoiding delays |

| Agent explained timeline | They timed HDB sale, OTP, and condo key collection seamlessly |

Daniel later shared that without the broker’s help, they might have committed to a higher interest rate. And without the agent, they’d likely have missed the seller’s deadline.

Lessons for future buyers planning to do the same

If you’re planning to upgrade, here’s what you can learn from Daniel and Sheryl’s experience:

✅ Engage a mortgage broker first — before you even start viewing. It helps you focus on what’s truly within budget.

✅ Use a property agent who knows resale timelines — they’ll keep you aligned on HDB discharge, OTP dates, and bridging loan risks.

✅ Work with both in parallel — especially when you’re juggling a sale and purchase at once. Coordination is everything.

Want a similar experience? Start by getting pre-approved with a mortgage broker Singapore — and let the process flow from there.

Frequently Asked Questions (2025 Edition)

Still unsure about how brokers and agents work in Singapore’s property market? Here are quick answers to some of the most common questions buyers ask — updated for 2025.

Can a property agent recommend a mortgage broker?

Yes, they can — but it’s important to clarify a few things.

Your property agent in Singapore may refer you to a mortgage broker, but that doesn’t mean the broker is your only option. Always ask:

- Is the broker independent or tied to one bank?

- Are they MAS-licensed mortgage advisors?

- Will they show you rates from multiple banks?

Tip: Just like how you compare listings before buying, you should compare brokers too — especially if you’re serious about getting the best mortgage rate in Singapore.

Is it legal for agents to earn referral fees from banks?

It depends. Property agents are not allowed to receive referral fees directly from banks or financial institutions unless they’re separately licensed under MAS.

However, some agents may partner with mortgage brokers, who in turn receive bank commissions. As long as the arrangement is disclosed and ethical, it’s legal — but always ask for transparency.

✅ The best way to avoid conflicts of interest? Go straight to a mortgage broker in Singapore who compares across DBS, UOB, and OCBC without bias.

Do mortgage brokers offer HDB loan advice too?

Yes — but with a caveat.

Mortgage brokers in Singapore are experts at comparing bank loans for both HDB and private property buyers. They can help you evaluate whether to go with an HDB home loan (fixed 2.6% interest) or a bank loan (which may be lower depending on the market).

They’ll also:

- Check if you’re eligible to refinance your existing HDB loan

- Explain CPF usage, MSR/TDSR, and loan tenure options

- Guide you through refinance HDB loan opportunities if you want to switch to a cheaper package

Bottom line: If you’re unsure whether to stick with HDB or switch to a bank, a broker can walk you through both options objectively — without pressure.

Final Thoughts: Who Should You Reach Out to First?

Whether you’re buying your first flat, upgrading to a condo, or refinancing your current home loan — knowing who to contact first can make a huge difference in how smooth (or messy) your property journey turns out.

Here’s how to make that call.

Quick decision guide: Broker, agent, or both?

Not sure where to start? Here’s a simple breakdown to help:

Who Should You Contact First: Mortgage Broker or Property Agent? (Singapore 2025 Guide)

| Your Situation | Start With... |

|---|---|

| Budgeting and checking loan eligibility | ✅ Mortgage broker |

| Actively viewing homes or ready to offer | ✅ Property agent |

| Doing both at the same time | ✅ Use both — in parallel |

Rule of thumb: If financing is unclear, start with a broker. If property search is your priority, get an agent involved. If you’re serious about buying — talk to both.

Common mistakes buyers make when skipping one

Too many homebuyers in Singapore make these mistakes:

- Only talking to their bank instead of using a mortgage broker to compare multiple rates

- Assuming the seller’s agent will help them — not realising the agent represents the seller, not the buyer

- Skipping pre-approval and ending up with last-minute loan rejections or lower-than-expected financing

Real talk: It’s not about spending more. In most cases, you’re not even paying extra. It’s about getting the right support, so you don’t fumble at the finish line.

Why pre-approval with a broker saves time and stress

Getting pre-approved with a mortgage broker Singapore is like getting a green light before the race.

✅ You’ll know your exact loan amount

✅ You’ll negotiate with confidence

✅ You’ll move faster than other buyers who are still scrambling for documents

And if you’re refinancing? A broker can help you run the numbers, use a mortgage loan repayment calculator, and decide if switching banks is worth it.

Speak to a Singapore Mortgage Expert Today

If you’ve made it this far, you already know how important it is to have the right people supporting your home journey. Whether you’re buying, refinancing, or just exploring your options — don’t do it alone.

A quick chat with a mortgage expert can save you tens of thousands over your loan tenure. And best of all? It’s free.

Book a free consultation with a licensed mortgage broker

Start by connecting with a trusted, Singapore mortgage broker who understands your goals, compares across banks, and handles all the paperwork — so you don’t have to.

Whether you’re a first-time buyer or planning to refinance your HDB loan, early advice makes all the difference.

Compare DBS, OCBC, UOB and more in one place

There’s no need to visit multiple banks one by one.

A good broker will help you compare popular options like:

Plus, they’ll explain the fine print — from lock-ins to SORA rates — so you can choose confidently.

Avoid costly mistakes and unlock better home loan deals

Mortgage terms can be confusing. Rates change monthly. And sometimes the “lowest rate” isn’t the best package for your situation.

Your broker will guide you through:

- Choosing between fixed, floating, or hybrid rates

- Avoiding hidden fees and poor-fit loans

- Structuring your loan for CPF, cash flow, and long-term plans

Ready to take the next step?

Book your consultation today and make your next property move with total peace of mind.