Buying a new launch condo in Singapore? Then you’ll need to understand how the Progressive Payment Scheme (PPS) works. This payment method is used for Building-Under-Construction (BUC) properties — and it’s very different from buying a resale flat or completed unit.

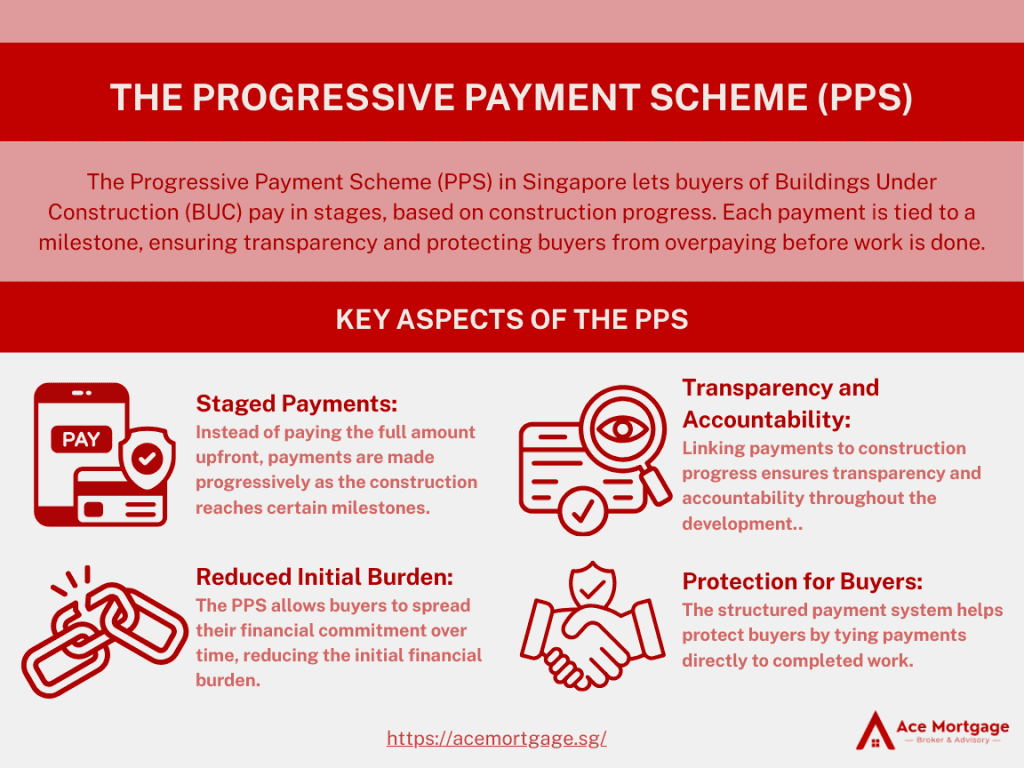

Instead of paying the full amount upfront, you’ll make payments in stages tied to construction milestones. That means lower initial costs and more time to manage your finances.

In this 2025 guide, we’ll break down the progressive payment schedule, how bank loans and CPF come into play, and tips to plan ahead — so you buy smart and avoid costly mistakes.

What Is the Progressive Payment Scheme and Who Should Use It?

If you’re planning to buy a new launch condo in Singapore, understanding the Progressive Payment Scheme (PPS) is essential. Unlike resale purchases, PPS lets you pay for your property in phases linked to construction progress, giving you better control over cash flow and financial planning. It’s the standard payment method for Building-Under-Construction (BUC) condos and Executive Condominiums (ECs).

To simplify your financing journey, platforms like Ace Mortgage offer expert help in comparing bank loan packages and navigating the PPS process with confidence.

How does the progressive payment scheme work in Singapore property purchases?

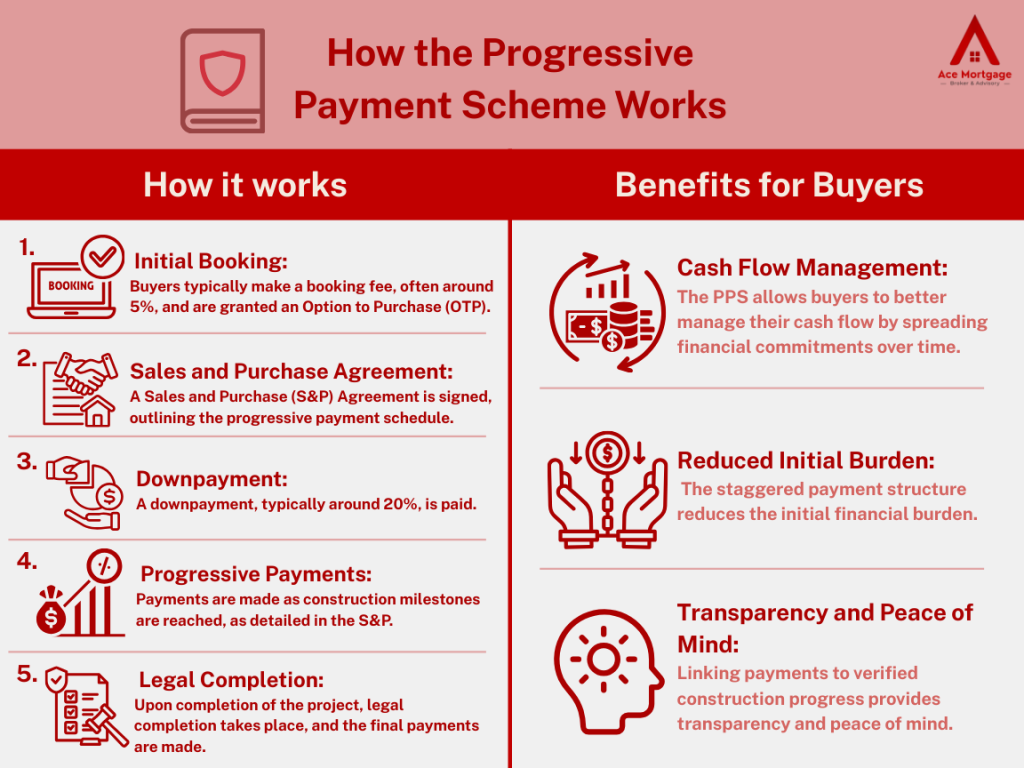

Under PPS, your payments are broken down into manageable stages. You’ll first pay 5% for the Option to Purchase (OTP), followed by 15% when signing the Sale & Purchase Agreement (S&P). After that, loan disbursements kick in only when each construction milestone is reached — and interest is charged only on what’s disbursed.

This means you don’t start repaying your full home loan from day one. Instead, your monthly repayments increase progressively, giving you breathing room to plan better.

Expert tip: Many first-time buyers underestimate how helpful this is for managing cash flow. If you’re unsure how your monthly repayments will scale up, try using a home loan repayment calculator to simulate your future costs.

Who qualifies for progressive payment and when is it applicable?

PPS applies only to uncompleted private properties and ECs. If you’re buying a resale or fully built unit, you’ll need to pay the full purchase price shortly after signing the S&P — no phased payments.

This scheme is typically used by:

- Buyers purchasing new condos directly from developers

- EC buyers during the launch phase

- Anyone using a bank loan to finance a BUC unit

To qualify, you’ll need to pass Total Debt Servicing Ratio (TDSR) checks and have an Approval-in-Principle (AIP) ready. Learn how to prepare for that in our step-by-step mortgage planning guide.

Why is it ideal for new launch condo buyers and EC purchasers?

Because PPS is designed to align with your condo’s construction timeline, it offers major benefits to buyers who need time to prepare:

- You avoid heavy mortgage payments early on

- You can time your sale of an existing home without pressure

- You get more flexibility to build savings or CPF reserves

Personally, I think PPS is one of the smartest ways for first-time buyers to enter the market. If you’re strategic, you can even refinance later using a refinancing service to lock in better rates after your full loan is disbursed.

How Much Do You Actually Pay at Each Stage of the Payment Schedule?

One of the biggest questions new launch buyers ask is: “How much do I need to fork out — and when?” That’s where the progressive payment schedule comes in. It breaks your total condo payment into smaller, timed installments, so you don’t pay everything upfront.

Understanding this timeline helps you plan your CPF use, bank loan drawdowns, and monthly cash flow. Here’s what to expect.

What percentage is paid at each construction milestone — from booking to TOP?

Progressive Payment Schedule for Private Condos & ECs in Singapore

| Stage of Construction | Payment (%) |

|---|---|

| Option to Purchase (OTP) | 5% |

| Sale & Purchase Agreement (within 8 weeks) | 15% |

| Completion of foundation | 10% |

| Completion of reinforced structure | 10% |

| Completion of partition walls | 5% |

| Completion of roofing | 5% |

| Completion of doors, windows, carpentry | 5% |

| Issuance of Temporary Occupation Permit | 25% |

| Issuance of Certificate of Statutory Completion | 15% |

Each payment is triggered when the developer hits a certified construction milestone. Don’t forget to budget for Buyer’s Stamp Duty separately — use this BSD calculator to get a quick estimate based on your purchase price.

When exactly are payments due during the building process?

Each time a stage is completed, your bank will be notified and disburse the next portion of your loan. You’ll only start paying interest on that amount — which keeps your early repayments low.

For example:

- After foundation, you start servicing 10% of your loan.

- When roofing is completed, you’re up to about 50% drawn.

- Your full mortgage only kicks in after TOP.

If you want to estimate your monthly payments across each phase, try our mortgage loan repayment calculator.

What should you do if your project is delayed or the schedule shifts?

Delays aren’t common, but they can happen. When they do, your next payment is simply postponed until that milestone is reached.

But here’s the catch: you might still be paying rent or bridging costs in the meantime.

Expert insight: Always keep a 3–6 month buffer in your cash reserves. Don’t commit every cent upfront — and avoid overusing your CPF OA early. It’s better to stay flexible in case the timeline shifts.

If you’re unsure how to structure your financing buffer, a mortgage broker can help you build a repayment timeline around real-life uncertainties.

How Do Bank Loans and CPF Work With Progressive Payment?

When you buy a new launch condo under the Progressive Payment Scheme, your financing doesn’t get disbursed all at once. Instead, both your bank loan and CPF funds are released gradually, depending on the construction stage.

This means you’ll need to plan for how loan interest, CPF savings, and debt servicing limits all interact — especially during the early phase of your homeownership journey.

How is your home loan disbursed in stages, and how does interest apply?

With BUC (Building-Under-Construction) properties, the bank only disburses funds when a certified construction milestone is completed. That’s why it’s called “progressive.”

You’ll start with 20% (cash/CPF) for the OTP and S&P stages. Then, your bank starts funding the rest in chunks — and you only pay interest on the amount disbursed, not the full loan.

Here’s how it plays out:

- Stage 1: Foundation completed → 10% disbursed → pay interest on that 10%

- Stage 2: Roofing done → another 5% disbursed → interest increases slightly

Expert tip: This staged model helps reduce financial pressure during the early years. But it also means your monthly repayments will climb over time. Plan your cash flow to absorb this rise gradually.

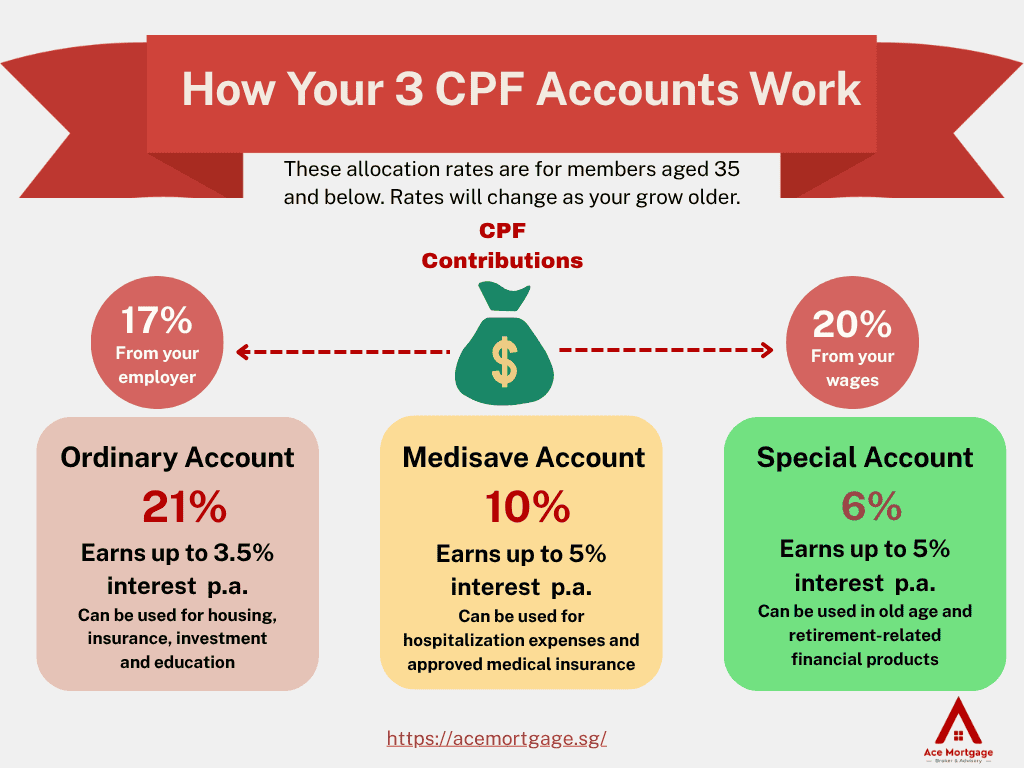

What should you consider about TDSR, MSR, and CPF usage for each stage?

Before loan approval, banks will assess your eligibility using the Total Debt Servicing Ratio (TDSR) — currently capped at 55% of your gross monthly income.

If you’re buying an EC, the Mortgage Servicing Ratio (MSR) also applies (capped at 30%).

Key CPF usage points:

- You can use CPF OA for the downpayment (up to 20%) and monthly loan repayments.

- Always keep at least $20,000 in your CPF to remain eligible for future purchases or safety buffers.

Tip: Overusing your CPF early can hurt your retirement and limit flexibility. A useful read: How CPF affects your property plan.

Which banks offer the most competitive rates for BUC financing?

Interest rates for BUC loans differ from completed property loans. Most packages are floating rates tied to SORA, with fewer fixed-rate options.

As of 2025, here’s what buyers often compare:

- DBS Home Loan: Trusted for stability, but limited lock-in choices

- UOB Home Loan: Often offers early bird rates for new launches

- OCBC Home Loan: Competitive for EC buyers with strong CPF usage

Instead of checking each bank manually, you can save time with a mortgage broker who compares all BUC loan packages at once — and negotiates on your behalf.

What Are the Real Pros and Cons of Progressive Payment?

The Progressive Payment Scheme (PPS) sounds great on paper — and for most new launch buyers in Singapore, it really is. But like any financing method, it comes with both upsides and downsides you’ll want to plan for.

Let’s break down the real-world pros and cons — beyond what’s printed in brochures.

What financial advantages does progressive payment give first-time buyers?

If you’re new to property, PPS is one of the most cashflow-friendly options out there. Here’s why many first-timers prefer it:

- Staggered repayments = smaller monthly outflows in the early years

- No need for full loan disbursement upfront, which buys you planning time

- CPF and cash balances can be preserved longer, helping with flexibility

- You can still live in your current place while the new one is being built

Our take: For young couples or buyers planning a future family, PPS makes it easier to avoid being financially stretched in the short term.

What risks and hidden costs should you be prepared for?

It’s not all upside. These are some real risks to watch for with progressive payment:

- Floating rates: Most BUC loans are floating, so rising rates = rising monthly costs

- Delays in construction could mean extended rent payments

- Interest still accrues on each disbursed portion of the loan

- Buyer’s Stamp Duty (BSD) is paid early — not delayed with the payment schedule

Make sure you calculate all upfront fees using a tool like the BSD calculator, so you’re not caught off guard.

Expert insight: One common mistake is assuming low early payments = low total cost. In reality, the true cost depends on how you manage loan structure, CPF, and refinancing later on.

How does progressive payment compare to paying upfront in full?

Some buyers — especially seasoned investors — prefer to just pay everything in cash. But that’s not always the wisest move.

Here’s how they stack up:

Progressive vs Full Payment for Condo Buyers in Singapore

| Factor | Progressive Payment | Full Upfront Payment |

|---|---|---|

| Cash Outlay | Lower at the start | Very high immediately |

| Loan Interest Exposure | Gradual build-up | Full loan starts from Day 1 |

| Liquidity Retention | Higher (more buffer for emergencies) | Lower (funds tied up immediately) |

| Flexibility to Refinance | High (can optimize post-TOP) | Lower (early lock-ins) |

Pro tip: Many buyers opt for progressive payment and then refinance after TOP to lock in a better deal. Learn how with our refinance home loan guide.

Is the Deferred Payment Scheme Better for You Than Progressive Payment?

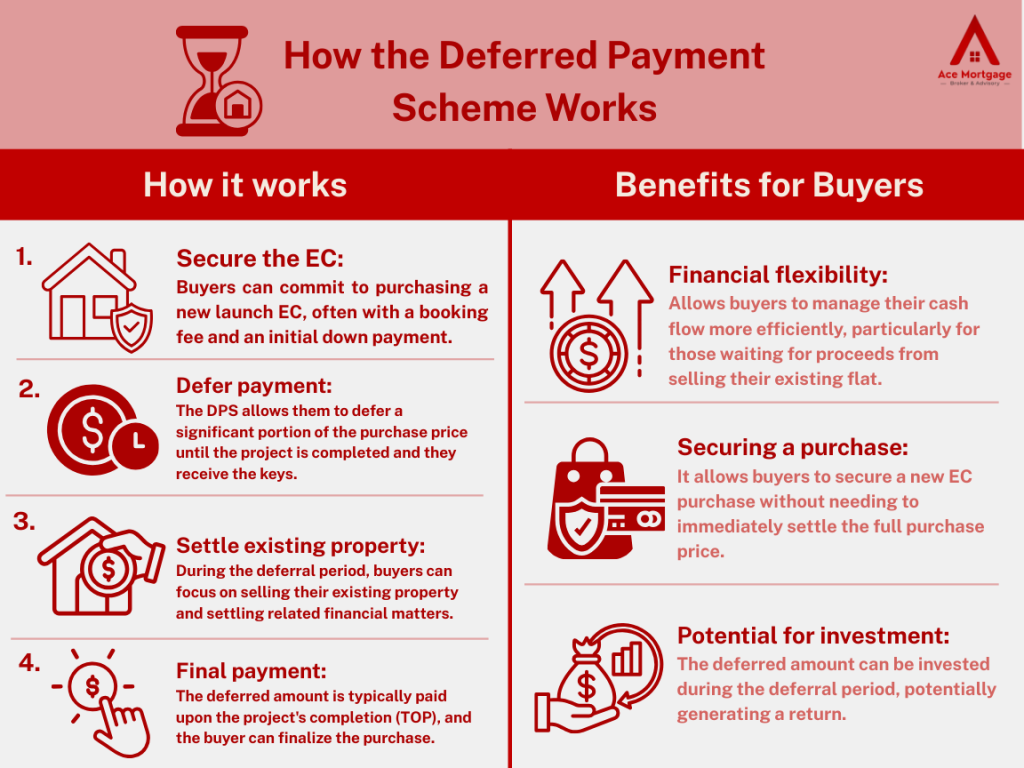

While most new launch condos use the Progressive Payment Scheme, some developers offer an alternative — the Deferred Payment Scheme (DPS). DPS lets you delay the bulk of your payment until the property is nearly or fully completed.

It sounds attractive, especially if you need time to sell another property or secure funds. But is it better than PPS? Let’s compare.

How does deferred payment differ in structure and timeline?

Under DPS, you typically pay 20% upfront and postpone the remaining 80% until the condo obtains its Temporary Occupation Permit (TOP). That means you don’t start your mortgage until you’re almost ready to move in.

In contrast, PPS spreads your payments over years, tied to construction milestones — starting from the foundation all the way to CSC.

Comparison: Progressive Payment Scheme vs Deferred Payment Scheme (Singapore)

| Aspect | Progressive Payment Scheme | Deferred Payment Scheme |

|---|---|---|

| Loan Drawdown | Gradual (based on construction) | One-time (near or after TOP) |

| Early Interest Payments | Low at first, then increases | None until loan kicks in fully |

| Immediate Ownership | Starts from signing S&P | Delayed until final payment |

| Developer Availability | Standard for most BUC condos | Limited to selected developments |

Which type of buyer benefits more from each scheme?

PPS is ideal for:

- First-time buyers managing cash flow

- Owners planning to sell an HDB before TOP

- Buyers who prefer gradual payment and loan flexibility

DPS suits:

- Investors needing more time to arrange financing

- Buyers with cash tied up in other assets

- Those upgrading and still waiting for funds from a sale

In my opinion, PPS offers more long-term control. Unless you really need that deferral, going with PPS lets you pace your financing and even refinance strategically after completion. (Here’s how: Refinance home loan)

How do both schemes affect your loan approval and CPF planning?

With PPS, your loan gets assessed and drawn progressively — which may give you some breathing room under Total Debt Servicing Ratio (TDSR) calculations. You can also start using your CPF Ordinary Account funds right away.

With DPS, everything happens later — which might sound convenient but can make loan approval harder if your income situation changes before TOP.

Expert tip: If you expect your income to rise, DPS could work. But if you’re unsure about future employment or need to use CPF early, PPS is the safer, more flexible route.

What Additional Costs Do Buyers Overlook in New Launch Purchases?

Many buyers focus so much on the downpayment and monthly loan that they forget about hidden upfront costs. If you’re buying a new launch condo in Singapore, don’t get caught off guard by the extras — some of which are payable early in the process.

Here’s what to expect and how to budget wisely.

How much should you budget for stamp duties, legal fees, and renovation?

Besides the 20% downpayment, you’ll need to plan for these:

- Buyer’s Stamp Duty (BSD):

Typically 3% to 5% depending on your purchase price

Try our BSD calculator to estimate this instantly.

- Additional Buyer’s Stamp Duty (ABSD):

Applies if you’re buying a second property or are a foreigner - Legal Fees:

Around $2,500 to $3,500 (varies by law firm and property price) - Renovation & Furnishing:

Budget $30,000 to $80,000, depending on your taste and layout

Expert tip: Many first-time buyers forget that stamp duties must be paid within 14 days of signing the S&P — not later. So keep those funds ready early on.

How can CPF be used smartly — and when should you hold back?

Your CPF Ordinary Account (OA) can be used for:

- Downpayment (after cash portion)

- Legal fees

- Monthly loan repayments

But just because you can use CPF doesn’t mean you should wipe it out.

When to hold back CPF usage:

- You want to retain $20,000 in OA for future home purchases or as a buffer

- You’re planning to invest the rest via CPFIS

- You want to earn the guaranteed 2.5% interest for longer

Insight: Some buyers who emptied their OA early later regretted it — especially when refinancing or buying a second property down the line.

What happens if you refinance midway or want to change banks later?

Good news: once your condo receives TOP and the full loan is disbursed, you’re free to explore refinancing. Many do this around year 2 or 3 when lock-ins expire.

Refinancing helps you:

- Lower your interest rate

- Switch from floating to fixed (or vice versa)

- Reset your loan tenure to improve cash flow

Use our refinance home loan guide to compare top bank offers and calculate your potential savings.

Pro tip: Some owners save thousands per year just by refinancing smartly. Don’t wait until rates spike — plan 6 months before your lock-in ends.

How to Plan Your Finances for a Smooth Progressive Payment Journey

The Progressive Payment Scheme gives you more breathing space — but only if you plan your finances strategically. With staggered loan disbursement, it’s easy to get caught off guard when monthly payments start ramping up.

Here’s how to stay financially secure throughout your BUC journey — from OTP to TOP.

What cash flow planning tips can help you avoid mortgage stress?

Your loan may start small, but it won’t stay that way. Every stage of construction triggers more disbursement — and higher monthly repayments.

Here’s how to manage that rise:

- Set aside a 6-month emergency fund for mortgage payments

- Keep track of your loan disbursement timeline so you’re never surprised

- Don’t stretch your TDSR to the max — leave a 5–10% buffer

- Delay big-ticket expenses (like cars or renovation deposits) until after loan approval

Expert advice: Use a mortgage loan calculator to simulate your future repayment schedule — based on each BUC stage. It helps you visualise the increase before it happens.

When is the best time to lock in your interest rates?

There’s no one-size-fits-all answer, but here’s a general rule:

Lock in early if:

- You’re in a rising interest rate environment

- You value stability over chasing the lowest possible rate

Don’t lock in too soon if:

- You believe rates may drop post-TOP

- You want flexibility to refinance after the loan is fully disbursed

Tip: If you’re unsure, work with a mortgage broker who tracks interest rate movements and can help you float or fix your loan at the right time.

How should you prepare for long-term affordability and market shifts?

Buying a home is a 25- to 30-year commitment — so you’ll want to stress-test your financial plans.

Ask yourself:

- Can I still afford this loan if interest rates rise by 2%?

- What if I lose my job for 3–6 months?

- Am I saving enough for retirement while repaying this mortgage?

Final tip: Don’t just think in terms of loan approval — think long-term sustainability. After all, financial peace of mind is what makes home ownership truly feel like home.

Ready to Buy a New Launch? Make Progressive Payment Work for You

The Progressive Payment Scheme in Singapore offers a practical way to own a new launch condo without financial strain upfront. But like all good tools, it works best when you understand the timeline, anticipate hidden costs, and plan for rising loan commitments.

Whether you’re buying your first home, upgrading from an HDB, or investing in a BUC property — a smart financing strategy can save you thousands over the years.

Need help comparing home loans or planning your CPF usage?

Let Ace Mortgage walk you through the best rates, step-by-step planning, and refinancing strategies tailored to your needs.

Explore our mortgage blog for more expert tips, calculators, and buyer guides.