Thinking of buying a property but not ready to start paying the loan just yet? That’s where the Deferred Payment Scheme in Singapore comes in.

It lets you secure your dream home now and delay your mortgage repayments till later — sounds great, right? But before you jump in, it’s worth knowing both the upsides and the fine print.

In this quick guide, we’ll break down the real pros and cons of the Deferred Payment Scheme, so you can decide if it’s the right move for your 2025 property journey.

Should You Use the Deferred Payment Scheme in 2025?

The Deferred Payment Scheme (DPS) isn’t a one-size-fits-all deal. In 2025, it’s mainly offered for new ECs or fully completed private properties — and while it can ease your cash flow short-term, it’s not without trade-offs.

Before you dive in, let’s break down who benefits most… and who should think twice.

When DPS makes sense for HDB upgraders or EC buyers

If you’re upgrading from your HDB flat to an Executive Condo, DPS can give you time to sell first — before you start paying for the new place.

Why it works:

- 🕒 No immediate mortgage required — loan only kicks in at TOP

- 💸 Helps avoid double repayments (HDB + new property)

- 🔁 Buys you time to shift CPF funds and cash from your HDB sale

Tip from a Singapore mortgage broker: Many upgraders use DPS to avoid bridging loans and stretch their sale timeline without panic.

Plus, with mortgage rates in Singapore still hovering above 3%, locking in your unit now but delaying loan repayments can be a tactical move.

Who should avoid DPS due to risk or loan limitations

DPS can backfire if:

- You’re close to your TDSR limit

- Your income is unstable or heavily commission-based

- You may struggle to get loan approval 12–18 months later

Also, most DPS units are priced slightly higher — developers often add a 3–5% premium to offset the deferred cash flow. That means you’re paying more for short-term flexibility.

And if interest rates climb further in 2025, your eventual mortgage loan in Singapore could cost you more over time.

Key questions to ask before choosing this route

Before jumping into the Deferred Payment Scheme, ask yourself:

🧾 1. Can I still get the home loan I need later on?

Your current eligibility doesn’t guarantee future approval. If interest rates go up or your income drops, your loan may be reduced — or rejected entirely.

💵 2. Will I have enough CPF and cash at TOP?

You may be buying time now, but the big 80% payment comes later. Make sure your finances — especially CPF OA and proceeds from any property sale — will be ready.

📈 3. Am I okay paying a higher price for short-term flexibility?

DPS units often come with a markup (3–5%). Consider if the convenience is worth the extra cost, or if going with a normal payment scheme might save you more overall.

🧠 4. What’s my backup plan if things don’t go smoothly?

What if you can’t get the loan? Will you have to sell something, switch loan types, or back out entirely? Always plan for the “what ifs.”

💡 Pro tip: DPS works best when it’s part of a clear upgrade plan — not a way to delay decisions. If you’re unsure, speak to a mortgage advisor before locking anything in.

Top 3 Benefits of the Deferred Payment Scheme

The Deferred Payment Scheme (DPS) isn’t just a fancy term — it’s a real strategy that helps many buyers manage their property transition without burning out financially. If you’re buying an Executive Condo or a completed unit in 2025, here’s what makes DPS worth considering.

Delays home loan repayment and frees up cash

With DPS, your mortgage loan repayment only starts when the property receives TOP (Temporary Occupation Permit). That could be a year or more from the time you book the unit.

This means:

- No immediate bank loan = no monthly instalments yet

- You can channel your cash into reno savings, investments, or emergency funds

- CPF savings continue to grow untouched until they’re needed at TOP

💡 This delay can be especially useful if you’re still paying off your HDB home loan.

Lets you lock in today’s price and buy time to sell

Singapore’s property market moves fast. DPS lets you secure a unit now — even if your current home isn’t sold yet.

This is ideal for:

- HDB upgraders waiting out the MOP or market

- Condo owners looking for a smooth handover without bridging loans

- Anyone who doesn’t want to risk missing out on their ideal unit

And yes, you skip the stress of rushing to offload your current property at a poor price.

Helps manage temporary cashflow or investment cycles

Maybe your bonus is due next year. Maybe your business revenue is seasonal. Or you’re in between asset sales.

Whatever the reason, DPS offers breathing space. It’s especially helpful for:

- Business owners with fluctuating income

- Buyers receiving lump-sum payouts (CPF, endowment, inheritance)

- Investors waiting for current investments to mature

📊 If timed right, DPS can act like a financial buffer — allowing you to enter the market without being financially stretched upfront. Want to check how much you can afford later? Try our mortgage calculator.

3 Major Risks or Downsides You Should Know

While the Deferred Payment Scheme sounds attractive, it’s not without its drawbacks. Here are three key downsides every buyer should seriously consider before committing.

Higher unit price under DPS vs normal scheme

Here’s something most buyers overlook: units under DPS often come with a premium, usually 3% to 5% higher than units sold under the normal payment scheme.

Why? Because developers are offering you flexibility — and they price that in.

So even though you get to delay your home loan in Singapore, you’re technically paying more for the same property. Over the long term, this can eat into your capital gains or increase your total loan interest.

Possible loan rejection later (TDSR/LTV issues)

DPS doesn’t lock in your mortgage — it only locks in the property. When it’s time to take the loan (typically at TOP), the bank will reassess your profile.

If your income drops, your TDSR (Total Debt Servicing Ratio) exceeds limits, or if you’ve taken on new debts… you might not qualify for the full loan amount you initially planned for.

💥 That’s a big risk. You’ll still need to pay for the property — which could mean scrambling for cash or finding a co-borrower last minute. Always pre-check with a mortgage broker in Singapore if your long-term eligibility is stable.

Less flexibility if your plans or finances change

A lot can happen in 12 to 24 months.

Maybe you plan to upgrade, but then interest rates spike. Or you were banking on CPF inflows or a bonus that didn’t come through. With DPS, once the loan is due, you must proceed — or face penalties, legal costs, or even forfeiture of your booking fee.

This makes DPS less ideal for:

- Buyers without stable income

- Couples who might experience life changes (job switch, baby, relocation)

- Anyone not 100% certain they can complete the transaction down the line

🔍 If you need more flexibility or prefer lower upfront commitment, it might be safer to explore other options like resale with a normal payment scheme or shorter MOP transition.

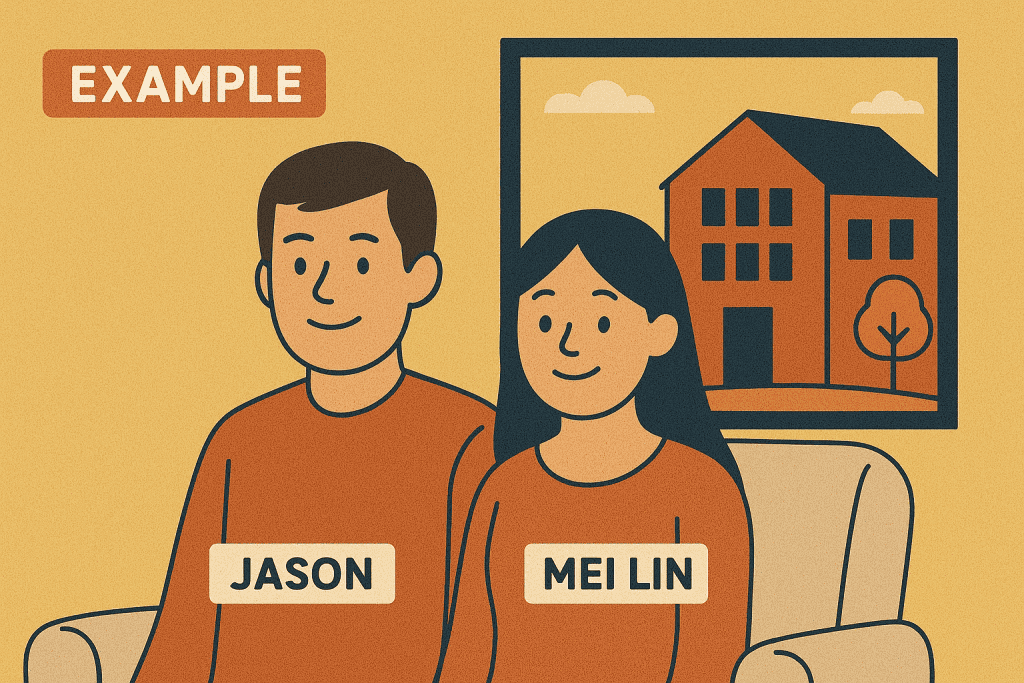

Real-Life Example: How One Couple Used DPS to Upgrade Smart

Sometimes the best way to understand the Deferred Payment Scheme is through real stories. Meet Jason and Mei Lin — both in their late 30s, living in a 4-room HDB flat in Tampines. In early 2024, they decided to upgrade to an Executive Condo in Sengkang, but their HDB wasn’t sold yet.

Why they chose DPS while selling their HDB

Jason was concerned about juggling two mortgages. Mei Lin wanted to avoid taking a bridging loan. Their property agent suggested a new EC that offered the Deferred Payment Scheme — and that changed everything.

- They only had to pay 20% upfront (using their CPF + savings)

- No immediate home loan repayment in Singapore

- More time to sell their flat without accepting a low offer out of desperation

It gave them the breathing room they didn’t know they needed.

Outcome: smoother transition and cost savings

By the time their EC hit TOP, they had already sold their HDB and fully unlocked their CPF. Because they didn’t rush the sale, they got $30K more than their initial valuation.

💡 With no need for a bridging loan and a well-timed mortgage loan in Singapore, they avoided extra bank charges — and even secured a better rate through a broker.

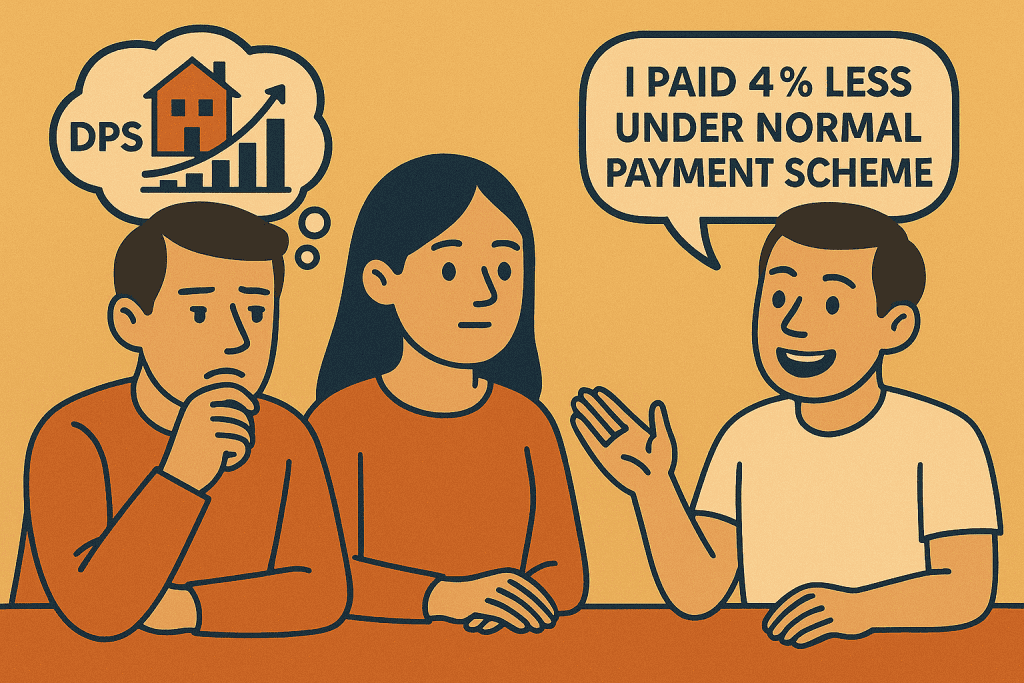

What they’d do differently if buying again

While the experience was mostly smooth, Jason admitted they underestimated how fast EC prices could climb under DPS. Their neighbour who opted for normal payment paid 4% less.

If they had known, they might’ve negotiated harder or considered refinancing their home loan after TOP to reduce long-term interest.

🔍 Lesson learned: Always compare the real costs — not just the payment timeline.

DPS vs Normal Payment Scheme (2025 Comparison Table)

Wondering which route fits your situation better? Here’s a quick side-by-side of the Deferred Payment Scheme vs Normal Payment Scheme, updated for Singapore’s 2025 property market.

HDB Grants You Can Get at Age 35: BTO vs Resale Comparison for Singles

| Flat Type | Grants You Can Get at 35 |

|---|---|

| BTO | EHG only |

| Resale | EHG + Singles Grant + PHG |

💡 Pro tip: Use this table together with a mortgage loan calculator to simulate repayments under both schemes.

Final Thoughts – Should You Use DPS for Your Next Property?

The Deferred Payment Scheme in Singapore can be a smart tool — but only when used intentionally. It’s not about buying time just for the sake of it. It’s about strategic timing, smart cashflow planning, and knowing your long-term numbers.

It’s ideal for transitional buyers or cashflow planners

If you’re selling your HDB soon or waiting on CPF refunds, DPS gives you that helpful buffer. You get to lock in your next home without stressing about monthly mortgage repayments right away.

It’s also popular among business owners or commission-based earners who prefer to delay big financial commitments until their income stabilises.

Not for everyone — assess risks and affordability first

This isn’t a “buy now, think later” kind of scheme. There’s still risk involved — from higher property prices to loan rejection if your TDSR or LTV ratios shift before TOP.

Before committing, check:

- How stable is your income?

- Can you pay more upfront if your loan is reduced?

- What’s your exit plan if things don’t go to plan?

It’s worth using a mortgage loan repayment calculator to stress-test your numbers — now and at TOP.

Book a free consult to compare EC home loan options

Still unsure if DPS is right for you? Or want to compare the best EC loan packages from DBS, UOB, OCBC, and more?

Speak to a licensed mortgage broker in Singapore. Our team can help you:

- Check your loan eligibility early

- Compare home loan interest rates in Singapore

- Plan your timeline around MOP, TOP, and CPF cashflow

No pressure, just clarity — and options that make sense for you.

Conclusion: Is the Deferred Payment Scheme Worth It in 2025?

The Deferred Payment Scheme in Singapore can be a smart move — but only if it fits your situation. It’s best for transitional buyers who need time to sell, shift CPF funds, or manage short-term cashflow. But it’s not a magic solution. You’ll still need a solid plan, loan approval, and the discipline to follow through when the time comes.

Ready to Make a Confident Move? Let Us Help You Compare EC Home Loans Today

Whether you’re considering DPS, normal payment, or something in between — the right financing makes all the difference. Speak to a licensed mortgage advisor in Singapore who can:

- Break down your monthly costs

- Find the best EC loan rates from DBS, UOB, OCBC, and more

- Help you avoid common loan rejection mistakes at TOP

At the end of the day, DPS isn’t about delaying payment — it’s about buying time to plan smart.

If it fits your journey, use it to your advantage. If not, walk away knowing you’ve thought it through.

Your next home move should feel right — not rushed.