You’ve found an HDB flat in a great location — but it only has 55 years left on the lease. Cheaper than newer units, but… is it risky?

Short-lease HDB flats can seem like a steal, especially in mature estates. But with all the talk about lease decay, CPF limits, and resale value, it’s hard to know if it’s a smart buy or a ticking time bomb.

In this guide, we’ll break down what it really means to buy a flat with less than 60 years left — so you can decide with confidence.

What Is Considered a Short-Lease Flat?

Not all HDB flats are created equal — especially when it comes to how many years are left on the lease. While most buyers aim for units with a full 99-year tenure, some flats on the resale market are nearing the second half of their lease lifespan.

These are known as short-lease HDB flats, and while they come with more restrictions, they also tend to be much more affordable. The key is knowing what you’re getting into — and how it might impact your CPF usage, housing loan options, and resale value down the line.

How many years left is considered “short”?

In general, once an HDB leasehold dips below 60 years of remaining lease, it’s considered short by CPF and most banks. Below this point, buyers may face CPF usage limits and stricter loan eligibility criteria.

According to CPF Board guidelines, at least 20 years of lease must be left to use CPF at all — and full CPF usage is only allowed if the lease can last the youngest buyer to age 95. You can check the full CPF property usage rules here.

I advice you to always verify the flat’s lease balance before committing. You can then use our mortgage loan repayment calculator to see how much monthly installment fits your budget based on age and tenure.

<H3>Which flats are most affected today?

You’ll often find short-lease flats in older towns like Toa Payoh, Queenstown, Bukit Merah, and Ang Mo Kio — areas where many HDB blocks were built in the 70s and 80s.

If you’re planning to use an HDB home loan or bank financing, keep in mind that your loan amount and tenure will depend on how many years are left. This is why it’s helpful to work with a Singapore mortgage broker who can help you compare options across DBS, UOB, OCBC and more.

📌 For current lease information, HDB’s resale flat portal provides block-level data on remaining lease.

<H3>Why some short-lease flats are still in demand

Despite tighter rules, short-lease HDB flats are still popular — especially with:

- Older buyers or retirees who don’t need a full 99-year term

- Budget-conscious families who want to stay in central or mature estates

- Buyers who prioritise space, location, or amenities over long-term resale

These flats often come at a discount, which can help offset the restrictions. If your plan isn’t to resell in the short term — or if you’re looking for a well-located home at a lower entry price — this could be a strategic move.

Personal take: If you’re financially secure and not planning to upgrade later, buying a short-lease flat could make a lot of sense as long as you’ve run the numbers.

Start with a clear comparison using our mortgage calculator and speak to an advisor about your financing limits.

What Happens When the Lease Runs Out?

This is the big question everyone’s asking: what happens to your HDB flat after the 99-year lease is up? Does the government extend it? Do you get money back? Can you still live there?

The short answer? HDB flats are sold on a 99-year leasehold — and when that lease expires, the land technically returns to the state. That means there’s no automatic extension, and the flat has no residual value. It’s why so many Singaporeans worry about buying units with 40–50 years left.

Can you still stay in the flat at year 99?

No — once the 99-year lease expires, the flat returns to the state.

It doesn’t matter if you’re the original owner or bought it at year 80. When the lease ends:

- You must vacate the property

- You don’t receive compensation (unless SERS applies — more on that below)

- The flat has no market value

Buying a 40-year-old flat? Use our mortgage loan repayment calculator to make sure your loan doesn’t outlive your flat.

Will HDB renew or extend the lease?

Nope — HDB does not renew leases.

Even if you’re a first-time buyer, and even if you really love your flat. Once it hits 99 years, that’s it.

The only known exception is:

- SERS (Selective En Bloc Redevelopment Scheme) — but only less than 5% of flats have been selected for this since it began.

HDB reaffirmed this in Parliament replies.

As for VERS (Voluntary Early Redevelopment Scheme)?

It’s still a concept — not active, no details, and definitely not guaranteed.

If long-term ownership matters to you, it’s safer to explore options like:

- A newer resale with more lease

- Or refinancing your HDB loan while your current flat still holds good value

Is compensation ever given at lease expiry?

Only if your flat is selected for SERS. And that’s rare.

Otherwise:

- No payout

- No refund

- Just hand the keys back at year 99

And let’s be honest — most older flats won’t be selected for SERS, especially in areas where newer developments already exist nearby.

📉 Flats with less than 30 years left usually see sharp drops in resale value, even in mature towns. It’s not just about age — it’s about loan restrictions and CPF limits too.💬 Pro tip: Before committing to an older resale unit, speak to a mortgage broker in Singapore who can help you weigh resale risk, CPF eligibility, and long-term affordability.

Can You Use CPF or Get a Housing Loan?

Buying a flat is one thing — financing it is another. If you’re eyeing a short-lease HDB flat, two big things may get in your way:

- CPF usage limits

- Loan eligibility restrictions

Here’s how both work

How CPF usage changes with remaining lease

CPF isn’t a free pass — especially for older flats.

Basic CPF rule:

- The flat must have at least 20 years of lease left to use CPF at all.

To use the full amount of your CPF for housing:

- The lease must last until the youngest buyer turns 95.

If it doesn’t, CPF usage will be pro-rated — meaning you’ll need to fork out more cash upfront.

Check CPF’s official usage rules here

If you’re buying a resale flat with <60 years of lease, always check your CPF limit early. Our mortgage brokers in Singapore can help calculate exactly how much you can use.

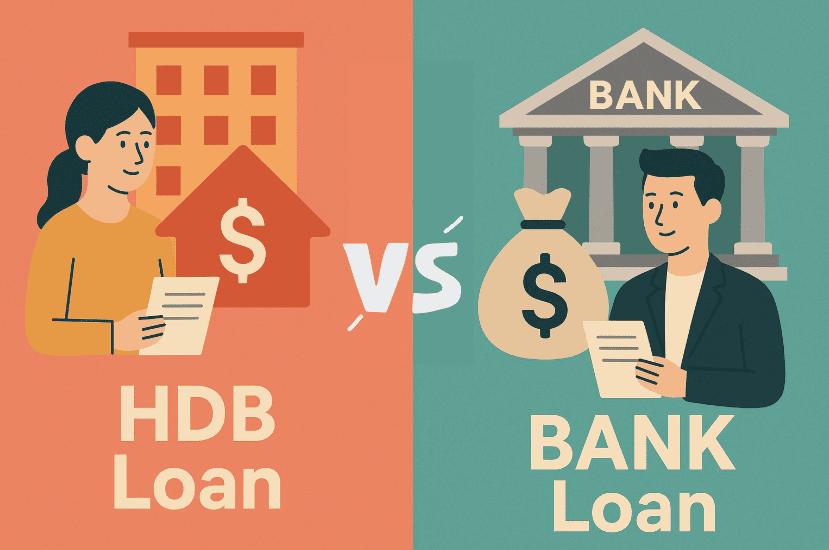

How much loan you can get — HDB vs bank

Loans get trickier when the lease is short. Here’s the key difference:

🏢 HDB Loan

- Generally more lenient, but still needs at least 20 years of lease left

- Loan amount may be adjusted if the flat won’t last the buyer till age 95

- Can’t use an HDB loan for private property or industrial flats

✅ Use this for direct applications: HDB home loan guide

🏦 Bank Loan

- Banks are stricter. The remaining lease affects both:

- Loan tenure (shorter lease = shorter loan)

- Loan amount (lower % of purchase price)

- Loan tenure (shorter lease = shorter loan)

- Some banks won’t lend at all if lease < 30 years

💬 Planning ahead? Compare DBS, UOB, or OCBC home loan options before committing.

What happens if you don’t meet both criteria?

If the flat fails both CPF + loan tests?

- You’ll need to pay a larger cash downpayment

- CPF usage may be limited or denied

- Bank loans may not be approved at all

- You might have to walk away from the unit — even if the price seems great

This is why lease matters so much.

Expert tip: Before you fall in love with an older resale flat, ask your advisor to run a CPF + loan simulation.

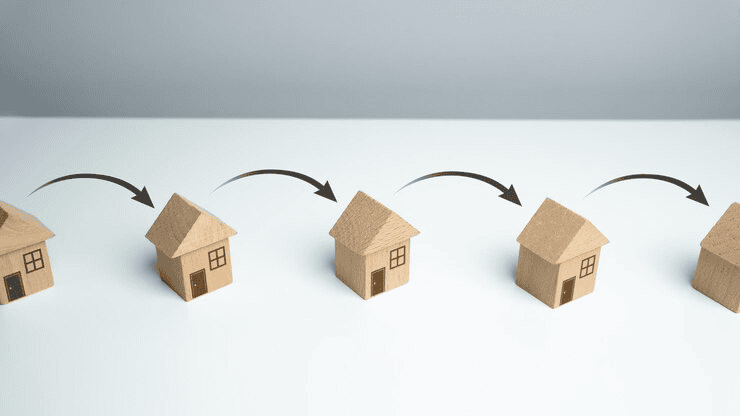

How Lease Decay Affects Resale Value Over Time

Lease decay isn’t just theory — it’s something buyers and sellers feel in their wallets. As an HDB flat gets older, its resale value doesn’t stay constant. In fact, the last few decades of the lease can make or break your eventual selling price.

If you’re thinking long-term, here’s what to watch out for

What happens to valuation as lease drops below 60

- Once your flat hits <60 years of remaining lease, buyers start pulling back.

- Fewer buyers = less demand = lower valuation.

- Valuers also factor in CPF and loan restrictions when pricing older flats.

📊 Example: Two similar 4-room flats — one with 75 years left, one with 45 — the older unit could be $80k–$120k cheaper, just because of the lease.

💡 Planning to sell in the next 5–10 years? Use our mortgage loan calculator to check how much equity you’d retain at different resale prices.

Why older flats may be harder to sell later

Here’s why flats with short leases don’t move easily:

- Buyers may not qualify for a full loan if the lease doesn’t cover them till age 95

- CPF usage may be restricted, especially for younger buyers

- Fear of “no value at the end” makes buyers cautious

📌 According to past resale trends, flats with <40 years lease often sit on the market longer, or end up selling well below valuation.

💬 Want to avoid holding a flat nobody wants? Talk to a mortgage broker in Singapore early and plan your exit timeline smartly.

Should you worry about capital loss?

Yes — if you’re banking on appreciation.

Short-lease HDB flats:

- Don’t usually appreciate

- May depreciate faster once CPF and loan eligibility tighten

- Offer lower returns if sold near or below 50 years lease

That said, if you’re buying to live comfortably, and not to flip or upgrade later — the capital loss may not matter as much.

Best tip? Always factor in your holding period and future resale plans before buying. The last thing you want is to be stuck with a flat that’s fully paid — but impossible to sell.

Can You Still Rent or Hold It Long-Term?

Not planning to sell anytime soon? You’re not alone.

Many Singaporeans buy older flats to live in or rent out while riding out the lease. But with short-lease HDB flats, holding long-term has its own pros and watch-outs.

Let’s break it down

Rental demand for old flats in mature estates

Yes — rental demand is still strong in older, central towns like:

- Queenstown

- Toa Payoh

- Bukit Merah

- Ang Mo Kio

These areas have:

- Great accessibility

- Malls, MRTs, schools

- Solid tenant pool (young couples, expats, retirees)

But here’s the catch:

- Tenants don’t care about lease length — landlords do

- Shorter lease = lower resale value = less equity build-up

- Fewer banks will finance buyers who want to buy from you later

If you’re buying to rent, factor in the holding cost vs yield. Use our mortgage loan calculator to run the numbers.

What happens after MOP?

After your Minimum Occupation Period (MOP) — typically 5 years — you can:

- Sell on the open market

- Rent out the whole unit (if it’s a 3-room or larger)

- Refinance your loan for better terms

→ Explore refinancing options to lower your monthly cost once you’re eligible

📌 Note: If your flat is already 40+ years into its lease at MOP, you’ll likely face:

- Fewer interested buyers

- Lower resale pricing

- CPF + loan eligibility concerns from potential buyers

How to plan if you’re not selling soon

If you’re buying a short-lease flat and plan to hold it long-term, here’s how to stay smart:

✅ Choose locations with strong rental demand

✅ Make sure your loan ends well before the lease does

✅ Consider fixed interest options early — see DBS, UOB, or OCBC home loans for comparisons

✅ Track remaining lease + CPF usage milestones

Your goal isn’t just “affordability today” — its livability and liquidity later.

Is It Still Safe to Buy a Flat with Less Than 60 Years Left?

Buying a short-lease flat isn’t always risky — but it definitely isn’t for everyone.

The real question is: do the numbers, lifestyle, and future plans work for you? If you’re aware of the CPF and loan rules, and you’ve run the math, it can still be a smart, practical move.

When CPF + loan + lease still align with your needs

It might still be safe — even strategic — if:

- The lease can cover the youngest buyer till age 95 → full CPF usage

- You’re okay with a shorter home loan tenure and slightly more cash upfront

- You don’t plan to sell or upgrade in the short-term

- You’re buying mainly for location, space, or community, not profit

🔍 Want to check your safe loan limits before committing? Use our BSD calculator to estimate upfront costs accurately.

Who should avoid short-lease flats

You may want to skip these if:

- You’re a first-time buyer planning to upgrade later

- You need maximum CPF and bank financing to afford your home

- You’re hoping to build equity or resale profit

- You aren’t sure how long you’ll stay in the flat

Flats with 35–45 years of lease can be affordable, but they often limit your options later. If in doubt, speak to someone who can explain the loan impact across different banks — check out UOB’s home loan plans for reference.

What questions to ask before buying

Before you commit, ask yourself:

- What’s the exact lease balance left?

- How much CPF can I actually use?

- Will I qualify for a sufficient loan — and from which bank?

- Am I planning to resell or hold long-term?

- Can I stomach the idea of zero resale value in 30 years?

❓ Still unsure? It might help to explore alternatives like a condo loan for private properties with longer leases — or look into newer resale HDBs in non-mature estates.

Should Seniors Consider the Lease Buyback Scheme?

If you’re a retiree or planning for your parents, the Lease Buyback Scheme (LBS) might sound like a lifeline — but is it really better than selling?

LBS lets you keep living in your flat while selling part of your remaining lease back to HDB. In return, you get a cash payout and a stream of CPF Life income. But it’s not for everyone.

Here’s how it works — and whether it’s worth considering in 2025

Who qualifies for LBS in 2025?

To be eligible for the Lease Buyback Scheme, you must:

- Be aged at least 65

- Own a 4-room flat or smaller (as of 2025, 5-room flats are still excluded from most estates)

- Have at least 20 years of lease remaining

- Live in the flat (it must be your primary residence)

- Have no other property ownership

💡 Friendly tip: If you’re unsure whether your current flat or estate qualifies, consider speaking to a planner or broker — our team can also help you explore alternatives like refinancing HDB loans for lower monthly costs.

How much payout you could receive

Your payout depends on:

- The market value of your flat

- The amount of lease you sell back (typically down to a 30-year tail end)

- Whether you’re a single owner or couple

The payout is split into:

- CPF top-up (used for CPF Life annuity)

- Cash bonus (up to $30,000 depending on flat type and eligibility)

For example:

A 3-room flat in Bedok could generate around $100,000+ in total proceeds — depending on the remaining lease, location, and flat type. About $60,000–$80,000 goes into CPF Life, and you could get $10,000–$30,000 in cash bonus.

📌 Want to see how the Lease Buyback works in real life?

HDB explains the process clearly here.

How it compares to selling the flat

Before deciding, it helps to compare the Lease Buyback Scheme vs selling your HDB flat side-by-side:

Lease Buyback Scheme vs Selling HDB Flat: Which Option Is Better for Seniors?

| Option | Pros | Cons |

|---|---|---|

| Lease Buyback | Keep living in your home, no need to relocate | Flat can’t be passed on, resale market value lost |

| Selling Flat | Full proceeds upfront, freedom to downgrade | Must move out, may lose community ties |

🧠 Which is better?

- If you want stability + passive income, LBS makes sense.

- If you prefer flexibility or downsizing, selling may offer more freedom.

💬 Either way, don’t rush. Seniors exploring these paths should also look at private property loans if they’re considering moving into a retirement condo or downsizing with a loan plan that works post-retirement.

Visual Reference: How Lease Affects CPF, Loans, and Value

Not sure how the lease length will affect your finances? Here’s a quick overview of what changes when your HDB flat ages — from CPF usage and loan eligibility to future resale value.

Impact of Remaining HDB Lease on CPF Use, Loan Eligibility & Resale Value

| Remaining Lease | CPF Usage | Loan Eligibility | Resale Value Trend |

|---|---|---|---|

| > 80 years | ✅ Full CPF allowed | ✅ Full HDB or bank loan | 🔵 Strong resale value; widely acceptable |

| 60 – 79 years | ✅ Full CPF if lease covers youngest buyer till age 95 | ✅ Full loan if lease covers buyer till loan maturity | ⚠️ Slight buyer caution, especially for younger buyers |

| 40 – 59 years | ⚠️ CPF usage pro-rated | ⚠️ Loan tenure and amount reduced (especially by banks) | 🔽 Lower resale value; fewer eligible buyers |

| < 40 years | ❌ Limited CPF use or none if lease < 30 years | ❌ Most banks decline loans; HDB loan unlikely | ⛔ Hard to sell; very limited market appeal |

Expert tip: Use our mortgage loan repayment calculator to plan your affordability based on the flat’s lease and your age.

Final Decision: Should You Buy a Short-Lease Flat?</H2>

After all the rules, numbers, and scenarios — it comes down to this: Does buying a short-lease HDB flat match your life stage, goals, and risk appetite?

Let’s help you make that call

When it’s a smart financial move

You’re likely making a smart decision if:

- You’re older and don’t need a full 99-year lease

- You’ve done the math — CPF, loan, resale — and it fits your budget

- You plan to live in the flat long-term, not flip it

- You value space, convenience, or location over investment returns

💡 These flats can be great for retirees, downsizers, or buyers looking for a lower entry price in mature estates.

When it may cause regret down the road

Be cautious if:

- You’re in your 20s or 30s and hoping to upgrade or sell in 5–10 years

- You need full CPF and max loan support to afford the flat

- You’re relying on future appreciation or en bloc hope

- You haven’t considered exit strategy, financing limits, or retirement impact

💬 In short? If you’re buying for flexibility, liquidity, or future wealth — a short-lease flat may hold you back.

Speak to a mortgage advisor to evaluate your options

Still unsure? That’s completely normal.

Your situation is unique — and that’s where a good mortgage advisor makes all the difference. A trusted expert can help you:

- Break down CPF and loan rules based on your age and flat choice

- Compare lenders offering flexible packages for older flats

- Assess if alternatives (like refinancing to a better package or exploring private property loans) may suit you better

✅ Buying a home — short lease or not — should feel right, not rushed.

👋 Reach out for a no-obligation chat and get clarity before you commit.

FAQs About Short-Lease HDB Flats

Still got questions? You’re not alone — here are some of the most common concerns Singaporeans have when considering an older flat:

Can I use CPF if the flat has only 55 years left?

Yes, but with conditions.

- CPF can still be used if the remaining lease covers the youngest buyer to at least age 95.

- If it doesn’t, CPF usage will be pro-rated — meaning you’ll need to top up more cash.

❗Important: If the flat has less than 30 years of lease, CPF cannot be used at all.

📌 You can read CPF’s rules in detail here.

What if my lease ends before I pass on?

If the HDB lease expires in your lifetime, the flat reverts to the state. You will not receive compensation unless the flat was selected for SERS (very rare).

There’s also no legal right to remain in the unit after lease expiry — even if it’s your only home.

💡 If you’re older and buying a resale flat, it’s worth checking lease balance vs your expected lifespan. You may also want to explore private housing loans if downsizing is an option.

How is Lease Buyback different from selling?

Before you decide, here’s a side-by-side look at how the two options compare in terms of flexibility, payout, and long-term implications:

Lease Buyback Scheme vs Selling Your HDB Flat: Key Differences for Senior Homeowners

| Criteria | Lease Buyback Scheme | Selling the Flat |

|---|---|---|

| Stay in the flat | ✅ Yes – you continue living in your home | ❌ No – you must vacate the property |

| Payout | ✅ Monthly CPF Life income + potential cash bonus | ✅ Full cash proceeds (minus any outstanding loan) |

| Future value | ❌ Flat can't be resold or passed on | ✅ Buyer can resell if lease allows |

| Flexibility | Moderate – locked into CPF annuity | High – you can downgrade, rent, or reinvest freely |

💬 Not sure which option suits your retirement goals? Learn more about how Lease Buyback works or speak to a property advisor who can compare both for you.

Final Thoughts on Buying a Short-Lease HDB Flat in Singapore

Buying a short-lease HDB flat isn’t for everyone — but for the right buyer, it can be a practical, value-driven choice. The key is knowing your numbers, your timeline, and your long-term plans.

✅ If you’re clear about staying long-term, don’t need full loan or CPF support, and care more about comfort than resale — a short-lease flat could work in your favour.

❌ But if you’re buying for flexibility, appreciation, or future upgrades, it may be better to look for a longer lease or alternative financing paths.

Ready to Plan Your Next Step?

Whether you’re buying your first flat or weighing a retirement move, it’s worth getting expert clarity on:

- CPF + loan eligibility

- Bank vs HDB financing

- Resale timelines and risk

- Alternatives like refinancing or private property loans

👋 Speak to an experienced mortgage broker in Singapore for a personalised, no-pressure consult — and make your next property move with confidence.