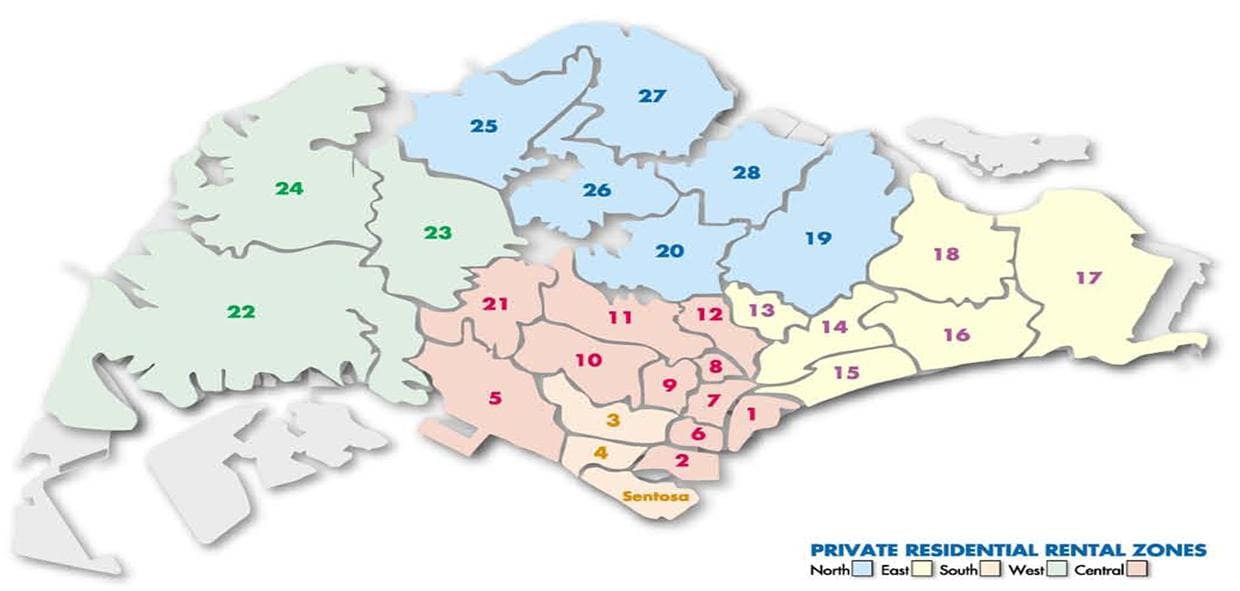

Singapore may be small, but when it comes to real estate, knowing your district and postal code can make a huge difference. Whether you’re house-hunting, investing, or comparing neighborhoods, understanding how Singapore’s 28 districts and 5 regions are mapped out is essential.

In this updated 2025 guide, we break down the Singapore district map, postal code system, and regional planning zones — all in a simple, visual format. You’ll also learn how this knowledge ties into property prices, loan options, and long-term investment value.

Here’s a tip for you. District and postal code affect your home loan eligibility, grant options, and even school access. If you’re unsure where to start, a Singapore mortgage broker can help you compare bank loans based on your preferred district.

Let’s dive in.

Understanding Singapore’s Districts and Regions

When navigating the Singapore property market, it’s crucial to understand how the island is divided — not just physically, but strategically.

From district numbers used by agents and banks to urban planning regions defined by the URA, these boundaries affect everything from pricing and home loan approvals to long-term investment value.

Let’s break down what these divisions mean — and how they can work in your favour.

What’s the difference between districts and regions — and which matters more when buying property?

In Singapore, districts and regions aren’t just planning jargon — they shape how properties are marketed, priced, and even financed.

- Districts (like District 9 or District 15) are part of a legacy 28-district system originally used by URA and real estate agents.

- Regions (like the Central Region or East Region) are URA-defined planning zones used for development and urban policy.

So which matters more? If you’re a buyer or investor, districts help you compare price trends and prestige, while regions give you insight into infrastructure growth and future upside.

Properties in the Core Central Region (CCR) often come with a premium due to their District 9, 10, and 11 tags — but savvy buyers can find better value in the Rest of Central Region (RCR) if they study URA’s planning maps closely.

Why understanding your district can affect your resale value and rental returns

Not all districts are created equal — and this affects both capital appreciation and rental yield.

Here’s why your district choice matters:

- District prestige: Prime districts like 10 and 15 enjoy higher resale value due to demand and reputation.

- Tenant appeal: Expats often prefer districts near MRT lines, schools, and business hubs.

- Loan flexibility: Your district may impact loan approval amounts, especially with private property loan options or HDB flat mortgages.

From our experience helping homebuyers across all 28 districts, we’ve seen stronger long-term returns in well-located RCR zones, especially those with upcoming MRT lines or nearby lifestyle hubs.

How to check your district and region using postal codes and online maps

It’s easier than you think.

Check your postal code — The first two digits link to a specific district. For example, 09 = District 9.

Use official maps — URA’s Master Plan or OneMap can show your planning region.

Use tools — Mortgage platforms like Ace Mortgage’s loan calculator often auto-fill this info when you input your address.

How Postal Code Prefixes Help You Identify Singapore Property Districts

| Postal Code Prefix | District | Region |

|---|---|---|

| 01 – 06 | District 1 & 2 | Central Region |

| 15 – 16 | District 15 & 16 | East Region |

| 22 – 24 | District 22–24 | West Region |

Knowing your exact district and region not only improves your search — it helps with smarter financial planning and choosing the right home loan package from the get-go.

Singapore District Map Overview

Whether you’re looking at a resale condo or waiting for the next BTO launch, the Singapore district map is your best friend.

These 28 districts don’t just describe geography — they reveal property price tiers, buyer demand, and even how banks assess your home loan eligibility. If you understand how the map works, you’ll start to spot patterns others miss.

What the 28-district map tells us about price tiers across the island

Not all districts are priced the same — and the map explains why.

Broadly, the 28 districts fall into three categories:

Singapore Property Price Tiers by District Zone (CCR, RCR, OCR Breakdown)

| Zone | Districts | Typical Price Range (PSF) |

|---|---|---|

| CCR (Core Central) | 1, 2, 9, 10, 11 | $2,400 – $4,000+ |

| RCR (Rest of Central) | 3, 4, 5, 7, 8, 12, 13, 14 | $1,900 – $2,800 |

| OCR (Outside Central) | 16 – 28 | $1,500 – $2,200 |

My advice for you is don’t assume CCR always means better investment. In slower markets, RCR projects tend to hold value better thanks to lower entry prices and strong rental demand.

Want to run affordability checks across different districts? Try our mortgage loan repayment calculator to plan your budget before you fall in love with that D10 unit.

Why some districts outperform others — and how to spot undervalued zones

High-performing districts share some common traits:

- Proximity to MRT interchanges

- Established schools and lifestyle amenities

- Government-backed transformation plans (e.g., Greater Southern Waterfront)

But savvy buyers are now eyeing “under-the-radar” districts with high upside, like:

- District 17 (Loyang/Changi) – future airport growth

- District 20 (Bishan/Thomson) – strong school cluster + central location

- District 23 (Hillview/Bukit Panjang) – improving transport links, lower PSF

Keep a watch out for districts near new MRT lines — these often see a spike in interest even before completion. Sites like Ace Mortgage often highlight market trends in their blog to keep you ahead of the curve.

How to use the district map to filter new launches or BTOs smartly

A simple scroll through PropertyGuru or HDB’s portal can feel overwhelming — but knowing your districts helps you filter smarter.

Here’s how:

- Looking for affordable BTOs? Start with districts in the OCR — like 18, 19, or 27.

- Want a balance of price and location? RCR districts like 13 (Potong Pasir) or 14 (Paya Lebar) are solid picks.

Chasing capital gains? CCR launches in Districts 9 and 10 still lead the pack — but require deeper pockets.

Decoding Singapore’s Postal Code System

Singapore’s postal code system is more than just for mail — it’s a quick way to identify property location, district, and even loan-related eligibility. Whether you’re eyeing a resale flat or a private condo, knowing how to decode postal codes helps you make better property decisions.

What the first two digits of your postal code reveal about your estate

In Singapore, every postal code is 6 digits long — but the first two digits are the most important. They correspond directly to your district.

For example:

- 01 to 06 = Districts 1 & 2 (CBD, Chinatown)

- 09 to 10 = District 9 & 10 (Orchard, Bukit Timah)

- 23 to 24 = District 23 & 24 (Bukit Panjang, Lim Chu Kang)

You can use this to instantly identify whether a property falls into CCR, RCR, or OCR zones — which in turn affects pricing, loan limits, and growth potential.

Tip: When comparing listings, just check the postal prefix to see if you’re getting city-fringe value at heartland prices.

Why postal sectors matter in HDB applications, school registration, and more

Here’s where it gets practical — postal codes affect:

- Primary school registration (priority given to homes within 1km radius)

- CPF housing grant eligibility, especially for resale flats near family

- Loan servicing restrictions, based on HDB loan or bank financing types

- Resale levy calculations if you’re buying a second subsidised flat

This is why agents often highlight postal sectors in listings — it’s not just marketing; it can change your application odds or financial outcome.

How to use postal codes to shortlist homes and check loan eligibility zones

Postal codes are a great starting point to narrow your search — especially when you’ve got a specific budget or school zone in mind.

Here’s how to use them:

- Cross-reference the postal prefix with your preferred school, then check if it falls within the 1km zone.

- Match the postal code with URA’s planning district to understand potential appreciation.

- Plug it into tools like our loan calculator to see how much you can afford in that area.

Postal Code Districts and Nearby School Zones in Singapore

| Postal Prefix | District | School Zone Nearby |

|---|---|---|

| 27xxx | District 27 | Sembawang Primary, Canberra |

| 16xxx | District 16 | Temasek Primary, Anglican High |

| 19xxx | District 19 | Rosyth, Nan Chiau |

If you’re unsure how your postal code affects loan approval or grants, it’s worth checking with a Singapore mortgage broker who understands the nuances across districts.

Exploring Singapore’s Five Regions

Beyond districts and postal codes, Singapore is also split into five key planning regions — a framework used by the Urban Redevelopment Authority (URA) to shape development, transport and housing.

These regions reflect more than geography. They represent infrastructure investment, amenities, and future growth — all essential for savvy property decisions.

What each region (Central, East, West, North, North-East) is known for

Each region in Singapore comes with its own strengths — and stereotypes. Here’s a quick breakdown:

Singapore Region | Property Perks, Lifestyle, and Buyer Appeal

| Region | Known For |

|---|---|

| Central | Prime districts, CBD, top schools, Orchard, high-end condos |

| East | Beachfront lifestyle, Changi Airport, food havens like Katong & Joo Chiat |

| West | Tech and business hubs (e.g. Jurong), large parks, future Tuas Port expansion |

| North | Affordable housing, nature parks, peaceful neighbourhoods |

| North-East | Fast-growing, young estates (Punggol, Sengkang), new MRT lines |

From a lifestyle standpoint, the East is great for families, while the West is increasingly attractive for investors due to massive development plans around Jurong Lake District.

Why regional planning affects long-term capital gains and MRT connectivity

The URA doesn’t develop regions equally — and that’s a huge clue for investors.

Some regions, like the Central and West, benefit from major infrastructure spending. Think:

- Jurong Region Line

- Cross Island Line

- Greater Southern Waterfront (Central/South)

Regions with new transport links and master plans typically see:

- Faster appreciation

- Improved rental demand

- Better resale liquidity

If you’re planning ahead, study URA’s plans and pair them with loan strategies like refinancing your mortgage before major area upgrades push prices up.

How to pick the right region for your lifestyle or investment goals

Your region choice should match your intent — are you buying for own stay or ROI?

If you’re buying to live in:

- Prioritise East and North-East for family-friendly layouts and new schools

- Look at Central if you’re working in the CBD and value time savings

If you’re investing:

- West offers upside with the Jurong transformation

- North and OCR areas yield better rental returns for the price

Tip: You don’t need to commit blindly. Use the refinance HDB loan calculator to check monthly payments based on region-specific price PSF.

Residential Areas and Neighborhoods in Singapore

Choosing a place to live isn’t just about what fits your budget — it’s about the neighborhood character, future resale value, and what type of housing suits your stage in life.

Singapore’s mix of mature and non-mature estates, combined with diverse property types, makes each area unique in both price and potential.

What separates mature estates from non-mature — and why it matters

The HDB classifies estates into “mature” and “non-mature” based on age, infrastructure, and amenities.

Estate Type | Key Traits for Buyers & BTO Applicants

| Mature Estates | Non-Mature Estates |

|---|---|

| Toa Payoh, Queenstown, AMK | Sengkang, Punggol, Tengah |

| Well-developed, near MRTs | Newer towns, future potential |

| Higher prices, strong demand | More supply, better BTO odds |

Why does this matter?

- BTO applicants often face stiffer competition in mature estates

- Loan servicing and grant limits may differ based on area value

- Private home buyers in mature towns enjoy stable demand — ideal for condo loan planning

In my opinion, for first-time buyers, a non-mature estate with upcoming transport links may offer better long-term ROI — especially if you’re open to waiting for growth.

Why some neighborhoods hold value better than others (with real resale trends)

Property value isn’t only about location — it’s about access, reputation, and scarcity.

Here’s what boosts value:

- Proximity to top schools (e.g. Rosyth, RGS, ACS)

- Nearby MRT stations or interchange lines

- Access to malls, markets, and healthcare

- Low-density estates like Mount Sinai or Opera Estate

According to HDB’s resale data, areas like Bishan and Queenstown consistently command high prices. On the private side, Districts 15 and 19 show steady growth due to location and family-friendly appeal.

Before you commit, use Ace’s Buyer Stamp Duty calculator to see what extra costs kick in based on neighborhood pricing trends.

How to choose between HDB, condo, or landed based on your district profile

Your property type should match both your lifestyle and your district.

- HDB: Great for most OCR and RCR districts; well-supported by CPF grants.

- Condo: Ideal in city-fringe and prime districts (CCR) for rental income or expat appeal.

- Landed: Found in districts like 10, 11, and 21 — high capital, but high exclusivity.

District Type | Ideal Property Type | Lifestyle & Investment Fit

| District Type | Best Matched Property | Why? |

|---|---|---|

| CCR | Condo or Landed | Prestige, lifestyle, rental yield |

| RCR | Condo / HDB (Executive) | Balance of price + location |

| OCR | HDB, EC, Mass-market condo | Value for families, space to grow |

Looking at multiple property types? Consider speaking to a mortgage specialist to compare HDB vs private loan approval options side-by-side.

Singapore’s CBD & Commercial Districts

The Central Business District (CBD) remains the beating heart of Singapore’s economy — but it’s not just for office towers and MNCs anymore.

With URA’s decentralisation push and mixed-use developments, the CBD is evolving fast. Understanding what qualifies as the CBD today — and what surrounds it — can help you score better rental returns, capital growth, and even more affordable alternatives nearby.

What counts as Singapore’s CBD — and how it’s evolving in 2025

Traditionally, the CBD includes:

- Raffles Place

- Marina Bay

- Shenton Way

- Tanjong Pagar

In 2025, the definition is expanding with:

- Downtown Core rejuvenation (new housing, green spaces)

- Greater Southern Waterfront plans bringing residential into play

- Integration of office, retail, and liveable spaces

CBD District Zone | New Developments in 2025

| CBD Zone | What’s New in 2025 |

|---|---|

| Shenton Way | Mix of business hotels + lifestyle condos |

| Marina South / Bay | Upcoming BTO and private launches |

| Tanjong Pagar | Commercial to residential transformation trends |

Expert insight: As CBD zones become more liveable, expect a rise in interest from both expat renters and singles looking for shorter commutes.

For affordability, some buyers are turning to UOB home loans or refinancing strategies to manage higher monthly repayments in prime locations.

Why proximity to the CBD boosts rental yields and job accessibility

Living near the CBD isn’t just a status symbol — it’s a practical choice for tenants and landlords.

Why it pays off:

- Shorter commute = higher tenant demand

- Easier access to international schools and Grade-A offices

- Properties near transport hubs (e.g., MRT interchanges, expressways)

Districts like 1, 2, and 7 offer strong rental performance for one-bedroom and dual-key units. Even compact units here see steady take-up from professionals.

Tip: If you’re buying for rental yield, do a cost-benefit check using our mortgage repayment calculator to model different loan sizes vs rental income.

How to find fringe districts with CBD-like perks at lower prices

Want CBD convenience without the price tag?

Here are some smart alternatives:

- District 3 (Redhill, Queenstown): 2 MRT stops from Raffles Place, rising condo demand

- District 7 (Bugis, Rochor): Arts + culture + direct Downtown Line access

- District 4 (Harbourfront, Telok Blangah): Part of the GSW transformation zone

Top Fringe Districts With CBD-Like Benefits in Singapore

| Fringe District | CBD Perks You Get |

|---|---|

| 3 | Near CBD + mature town amenities |

| 4 | Sea views, office hubs + Sentosa connection |

| 7 | Downtown Line, retail + lifestyle precincts |

Personal opinion: If you’re a younger buyer or investor, these fringe zones offer more balanced value — especially if you’re combining lifestyle needs with rental income.

Get personalised advice from a Singapore mortgage broker to pick the right financing solution based on your district pick.

Spotlight on District 10 & Other Prime Zones

If you’re searching for the gold standard in Singapore real estate, District 10 is often where the conversation begins. Located within the Core Central Region (CCR), it’s home to some of the most coveted addresses on the island. But what exactly makes D10 and other CCR districts so valuable — and is it still possible to buy smart in these pricey zones?

What makes District 10 (Bukit Timah, Tanglin, Holland) so desirable

District 10 includes Bukit Timah, Holland Road, and Tanglin — names that instantly suggest prestige. But it’s not just branding. Here’s why demand stays strong:

- Top-tier schools (e.g. Hwa Chong, Nanyang Primary, ACS International)

- Low-density housing with landed enclaves and boutique condos

- Nature proximity – Botanic Gardens, Bukit Timah Nature Reserve

- Embassy zone – attracting diplomats and wealthy expats

Expert view: Families with school-going children and investors looking for long-term appreciation see D10 as a “buy-and-hold” district, especially with freehold land becoming scarcer

Why CCR districts outperform others — even in cooling markets

Unlike mass-market areas, CCR districts often retain their value due to:

- Limited new land supply

- Freehold status of many properties

- Steady demand from foreign buyers and family offices

- Brand-name condos with iconic architecture and facilities

Even when cooling measures hit, resale prices in D9, D10, and D11 tend to hold firm or rebound quickly. Rental yields may be slimmer, but capital protection is stronger.

Why D9, D10, and D11 CCR Districts Hold Value in Cooling Markets

| CCR Districts | Key Areas | What Stands Out |

|---|---|---|

| D9 | Orchard, Cairnhill, River Valley | Luxury shopping + international vibe |

| D10 | Bukit Timah, Holland, Tanglin | Schools, parks, embassies |

| D11 | Newton, Novena | Medical + city fringe appeal |

Thinking long-term? Consider refinancing early with a bank loan to lock in lower interest while values appreciate.

How to enter prime districts smartly with leasehold, resale, or boutique condos

Buying into prime districts doesn’t always mean going all-in on luxury.

Here are smarter ways to enter:

- Leasehold condos: More affordable than freehold, especially older projects near MRTs.

- Resale units: Prices may be negotiable and often come with larger layouts.

- Boutique condos: Smaller developments in D10 offer privacy at lower PSFs.

Affordable Entry Strategies for Buying into Prime CCR Districts

| Entry Strategy | Why It Works |

|---|---|

| Leasehold resale units | Lower upfront cost, value in undervalued projects |

| Boutique developments | Fewer units = exclusivity + long-term appeal |

| Resale in mixed-use devs | Amenities + location = solid rental income |

Don’t shy away from older resale leasehold condos in District 10 — many have great bones, generous layouts, and sit within elite school zones.

Use our contact form to explore financing paths that make these purchases more accessible.

Making Sense of Singapore’s Districts, Regions & Property Potential

Understanding how Singapore’s district map, postal code system, and regional planning zones work is more than academic — it’s practical. Whether you’re looking to buy your first HDB flat, upgrade to a private condo, or invest in a prime CCR unit, this knowledge gives you a critical edge.

To recap:

- Use postal prefixes and district codes to shortlist homes smarter

- Consider how regions and MRT lines shape long-term value

- Match your property type to the district’s typical price point and buyer profile

The best opportunities are often in “transition districts” — places just outside of the CBD or matured estates where prices haven’t yet caught up with convenience and lifestyle offerings.

Before you make a move, make sure your finances align with your property goals. Use tools like our

- Mortgage Loan Calculator

- BSD Stamp Duty Estimator

or speak to a Singapore mortgage broker for tailored advice based on your income, location, and plans.

Ready to explore your loan options? Contact us here or explore our latest blog insights to stay ahead of the property curve.