Thinking of taking a home loan this year? Then you’ll want to keep an eye on SORA — the rate that’s affecting almost every floating mortgage in Singapore right now.

In 2026, the 3-month SORA is sitting around 1.0-1.5%, and it’s a big deal if you’re paying off a home or planning to buy one soon. It’s what banks use to calculate your floating rate — so when SORA moves, your monthly instalment moves too.

A bit stressful? Maybe. But also a chance to plan smart.

Quick tip: Not sure how much your loan will change if SORA goes up or down? Try this mortgage calculator to estimate your monthly payments.

In this article, we’ll explain what SORA is, why it matters in 2026, and how you can make better decisions — whether you’re buying, refinancing, or just want to avoid bill shock.

Understanding SORA and Its Significance

If you’ve been shopping for a home loan lately, chances are the bank didn’t mention SIBOR at all — because it’s officially out. From 2024 onwards, SORA (Singapore Overnight Rate Average) has taken over as the main benchmark for floating home loans in Singapore. And in 2026, understanding how SORA works isn’t just useful — it’s essential.

Whether you’re planning to buy a BTO, upgrade to a condo, or refinance your current loan, knowing how SORA behaves will help you avoid surprises — and maybe even save money long term.

What is SORA and how does it work?

SORA tracks the average interest rate that banks in Singapore charge each other for overnight borrowing, based on actual transactions. That’s a big upgrade from older benchmarks like SIBOR, which were based on quotes rather than real trades.

Banks don’t just look at one day’s SORA. Most home loans today use the 3-month compounded SORA, which smooths out daily fluctuations and gives a more stable picture of borrowing costs.

So when you take a floating rate mortgage today, you’ll see something like:

3M SORA + Bank Spread = Your Loan Rate

SORA Rate Breakdown: How Floating Mortgage Interest Is Calculated (Singapore - May 2025)

| SORA Mortgage Component | Estimated Value (May 2025) |

|---|---|

| 3M SORA | 3.7% |

| Bank Spread | 0.8% |

| Total Loan Interest Rate | 4.5% |

Expert tip: SORA is published daily by MAS. You can check the latest rate here. It’s free, transparent, and updated straight from the source — so no surprises.

Why did Singapore replace SIBOR with SORA?

Here’s the short version: SIBOR wasn’t based on real transactions, and that made it easier to manipulate, especially during volatile markets.

SORA, on the other hand, is:

- Based on actual interbank deals

- Published and monitored by MAS

- Fully aligned with global interest rate reform standards

That’s why Singapore made the full shift to SORA in 2024. And if you’re still on a SIBOR-linked package, it’s worth checking with your bank or a mortgage broker if you should switch or refinance to a SORA-based loan.

Quick note: Platforms like Ace Mortgage offer free advice on whether it’s worth switching out of an old SIBOR loan — especially if you’re paying more than 4.5% right now.

Why does SORA matter for home loans in 2026?

In 2026 almost every floating home loan in Singapore is tied to SORA. That means your interest rate isn’t just a fixed number — it shifts with market conditions.

When SORA goes up, your monthly instalments increase. When it drops, you might enjoy some savings — but only if your bank passes them on.

So if you:

- Just bought a flat or condo with a floating package

- Are planning to refinance soon

- Or want to compare fixed vs floating rates

…then understanding how SORA behaves is critical. And trust us — it’s way better to know before the bills go up.

Personal take: In our opinion, SORA makes sense for borrowers who can ride out short-term fluctuations and don’t want to overpay on fixed rates. But if you value stability and peace of mind, you might prefer locking in a fixed deal for now — especially if you’re risk-averse.

Current SORA Rates and Market Trends

If you’re on a floating home loan or thinking of refinancing, the first number you’ll want to check is the current 3-month SORA. This number directly affects your interest rate — and your monthly repayments.

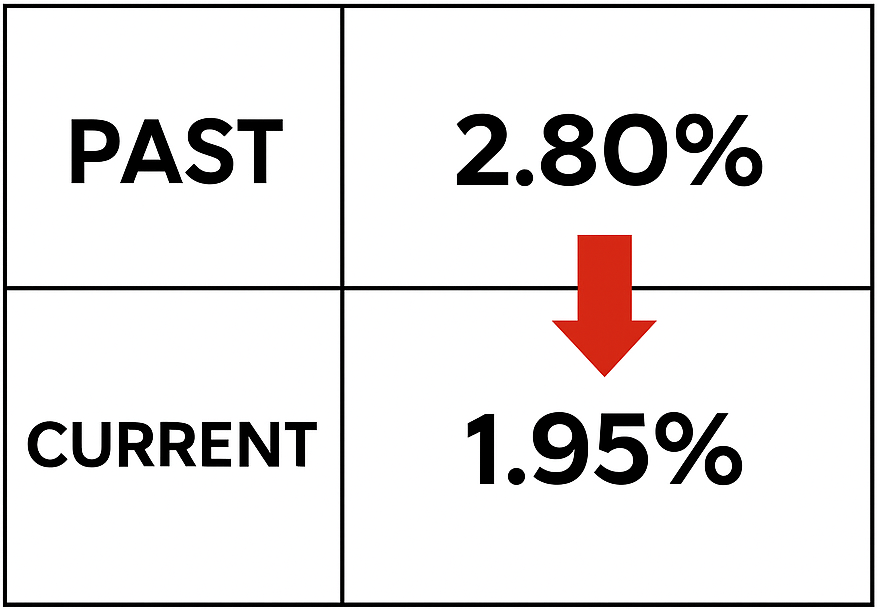

As of 2025, SORA has dipped slightly compared to late 2024. But rates are still high compared to pre-COVID levels, and many homeowners are feeling the pinch.

What is the current SORA rate?

At the time of writing, the 3-month compounded SORA is hovering around 1.0-1.5%. That’s waydown from the 3.85% highs we saw in Q4 2024.

3-Month SORA Rate Movement: Singapore - May 2024-2025

| SORA Mortgage Component | Estimated Value (May 2025) |

|---|---|

| 3M SORA | 3.7% |

| Bank Spread | 0.8% |

| Total Loan Interest Rate | 4.5% |

What this means:

If your loan is pegged to SORA, your interest rate (SORA + bank spread) could be 1.3% to 1.8% right now, depending on the package.

Tip: If you’re unsure what your current rate is, check your loan statement or use this refinance guide to explore if switching to a better deal is worth it.

What factors influence SORA movements?

SORA changes daily — but not randomly. It’s shaped by a mix of global and local forces, including:

- US Fed interest rate decisions

- Monetary policy from MAS

- Singapore’s banking liquidity and interbank lending volume

- Economic indicators like inflation and GDP growth

Expert tip: Even if MAS doesn’t move directly like the Fed, Singapore often sees follow-through effects. So if the Fed cuts rates, SORA typically softens within a few months — but it’s not immediate.

And because SORA is backward-looking (it’s calculated based on past transactions), it reacts gradually, not overnight. That’s why SORA feels “slower” than fixed deposit or board rates — and why it’s seen as more stable.

What are the expert forecasts for SORA in 2026?

Most analysts expect SORA to trend sideways slowly through the rest of 2026 — but not dramatically.

According to recent projections:

- The 3-month SORA may dip slightly in 1H2026

- MAS is expected to maintain a cautious monetary stance

- Harder to predict what’ll happen in the second half of 2026

But don’t count on it crashing. We’re unlikely to see sub-1% rates like in 2020–2021 again — at least not anytime soon.

Personal opinion: If you’re waiting for SORA to “drop more” before refinancing, you might be waiting too long. A smaller rate cut now could still be worth switching — especially if you’re sitting on an old SIBOR or high board rate loan. Check out this guide if you’re on an HDB loan and want to explore better rates.

Comparing SORA with Other Interest Rate Benchmarks

Even though SORA is the default benchmark now, many homeowners still compare it to SIBOR, SOR, and fixed deposit rates — especially when deciding on loan packages. If you’re confused by all these terms, don’t worry. You’re not alone.

Let’s break it down in plain English.

How does SORA differ from SIBOR and SOR?

Here’s a quick comparison table:

SORA vs SIBOR vs SOR: Benchmark Rate Comparison for Singapore Home Loans

| Benchmark | Basis | Still in Use? | Volatility |

|---|---|---|---|

| SORA | Actual overnight transactions | Yes (default benchmark) | Low to Medium |

| SIBOR | Quoted interbank estimates | Phased out | Higher |

| SOR | FX swap-based rates | Discontinued | Very High |

SORA is based on real overnight lending activity between banks, while SIBOR was based on estimates. That makes SORA more transparent and harder to manipulate — which is exactly why Singapore made the switch.

Quick note: If your current loan is still pegged to SIBOR, you should start planning a switch. Most banks no longer offer SIBOR packages, and some might auto-convert your loan in the coming months.

Not sure where to start? Speak to a mortgage broker — Ace Mortgage offers no-obligation advice if you want to explore your options.

What are the pros and cons of SORA vs fixed deposit rates?

Some banks still offer floating packages based on Fixed Deposit Home Rate (FHR) — usually tied to a 9- or 18-month fixed deposit rate.

Here’s how they compare:

SORA vs Fixed Deposit Home Rate (FHR): Which Floating Package Is Better in 2025?

| Feature | SORA | Fixed Deposit Rate (FHR) |

|---|---|---|

| Transparency | High (MAS-published) | Low (bank-controlled) |

| Frequency of Change | Monthly or Quarterly | Irregular |

| Predictability | Moderate | Moderate to High |

| Common in 2025? | Yes | Still available (fewer options) |

SORA is more standardised and regulated, while FHR is bank-specific. That means FHR can sometimes stay flat even when market rates move — but it also depends on the bank’s internal pricing.

Expert tip: If you’re the type who tracks MAS updates and wants more control, SORA gives you visibility. But if you’re the “set it and forget it” type, you might prefer FHR — just note that banks can revise FHRs without much notice.

Should you choose SORA or fixed rates in 2026?

This is the big question. And the answer really depends on your financial goals and how much rate volatility you’re okay with.

Here’s a simple breakdown:

- Choose SORA if:

- You believe rates will fall in 2026-2027

- You want a transparent, market-based loan

- You can handle some ups and downs in your repayments

- You believe rates will fall in 2026-2027

- Choose Fixed Rate if:

- You want repayment stability for 2–3 years

- You expect SORA to remain high short-term

- You’re budgeting tightly and don’t want surprises

- You want repayment stability for 2–3 years

Personal opinion: Right now, fixed rates are slightly lower than most SORA packages — which is unusual. If you’re getting offers below 4%, it may be worth locking in. That said, if you’re in it for the long game and expect rates to ease, SORA could save you more in the next 2–3 years.

If you’re stuck between choices, it helps to compare across banks. You can use this DBS home loan guide or check UOB’s latest rates to see which lender is offering better spreads or fixed options.

Impact of SORA on Home Loans and Refinancing

By now, you know SORA plays a big role in how home loan rates are set. But what does that actually mean when it comes to your monthly repayments or your decision to refinance?

Let’s break it down in simple, Singaporean terms.

How does SORA affect your monthly mortgage repayments?

When your home loan is pegged to SORA, your interest rate is no longer fixed — it changes over time, based on market conditions.

This means:

- Your monthly instalments go up when SORA rises

- They drop (slowly) when SORA falls

- You’ll see new repayment amounts every few months

Here’s an example:

SORA Rate vs Monthly Mortgage Repayment: How Loan Costs Change Over Time

| Month | 3M SORA | Interest Rate (SORA + 1%) | Monthly Repayment (Loan: $600K, 25 yrs) |

|---|---|---|---|

| Jan 2024 | 3.2% | 4.2% | $3,248 |

| Dec 2024 | 3.85% | 4.85% | $3,438 |

| May 2025 | 3.7% | 4.7% | $3,386 |

Expert tip: Always check how often your rate resets — some banks revise every month, others every 3 months. If budgeting is tight, consider a hybrid package or lock in a fixed rate for a few years.

What should you know about refinancing into a SORA-pegged loan?

If you’re still on a SIBOR loan or a board rate package, refinancing into a SORA loan could lower your interest — especially now that SORA is slightly trending down.

Here’s what to watch out for:

- Lock-in period: Make sure your existing loan isn’t under penalty

- Legal and valuation fees: Can add up, but some banks offer subsidies

- Bank spread: That 1% margin varies, so shop around

Want to explore refinancing? Ace Mortgage makes it easy to compare SORA-based packages across banks — and they’ll tell you if switching makes sense or not.

Personal opinion: If your current rate is above 4.8%, it’s definitely worth checking. Even a 0.5% drop could mean savings of over $10,000 over your loan tenure.

How can you manage a home loan linked to SORA?

SORA loans don’t have to be stressful — you just need a strategy. Here are a few smart ways to stay ahead:

- Monitor the SORA rate monthly (you can check MAS’s site)

- Keep a buffer for months when instalments spike

- Prepay when possible — even $5K lump sums help cut interest

- Use tools like this calculator to project payments at different rates

Bonus tip: You don’t have to do this alone. A mortgage broker can help you track rate changes and suggest better options over time. If you’re managing multiple properties, even more so — private property loan specialists can help streamline things.

Expert Insights and Recommendations

SORA-based loans can work in your favour — but only if you understand how to ride the ups and downs. Whether you’re a seasoned upgrader or first-time homebuyer, timing and planning matter.

We spoke with mortgage advisors and reviewed market trends to give you practical, no-nonsense advice for 2026.

When is it a good time to choose a SORA-pegged loan?

SORA works best when:

- Rates are expected to fall or stabilise

- You’re financially flexible and can absorb small increases

- You’re planning to sell or refinance again in a few years

As of 2026, SORA is quite low but analysts expect a gentle dip toward the end of the year. So if you’re confident rates won’t spike again, now could be a sweet spot to enter a floating package with no lock-in.

Expert view: “A no-lock-in SORA loan gives you room to refinance when rates fall. If fixed rates are higher than 4.2%, going with SORA now and switching later might be smarter,” shares a consultant from Ace Mortgage.

What are the risks of SORA-based interest rates?

Let’s be real — the biggest risk is rate volatility.

Here’s what to keep in mind:

- Monthly repayments can creep up without warning

- Budgeting is harder if your income is fixed

- Stress-test rates could go up during new loan applications

Also, banks typically apply a stress-tested rate of 4.5–5% when calculating your Total Debt Servicing Ratio (TDSR) — so your borrowing power may shrink even if current rates look manageable.

Personal take: Floating loans reward the patient, but punish the unprepared. If you don’t track rates or check your loan frequently, a fixed rate might give you better sleep at night.

What should first-time homebuyers consider in 2026?

Buying your first flat or condo in today’s rate climate? Here’s what to look out for:

Do:

- Compare SORA vs fixed packages carefully

- Use tools like Ace Mortgage’s BSD calculator to estimate upfront costs

- Choose a bank with transparent loan terms and a clear repricing policy

Don’t:

- Blindly pick the lowest headline rate

- Ignore the bank spread — it matters just as much as SORA

- Forget about lock-in clauses, especially if you’re unsure of your future plans

Expert tip: First-time buyers often focus on grants and prices — but your loan package can save (or cost) you more over 25 years than any grant. Sites like Ace Mortgage have breakdowns of what HDB and bank loans look like side by side.

Tools and Resources for Monitoring SORA

SORA may be technical, but keeping track of it doesn’t have to be. Whether you’re already on a floating rate or just exploring your loan options, there are free tools and expert help out there to guide you.

Let’s look at how to stay informed — and in control.

Where can you check daily SORA rate updates?

The Monetary Authority of Singapore (MAS) publishes the official SORA rate daily — no fluff, no delay. It’s the most accurate and reliable source.

You can find the daily 1-month, 3-month, and 6-month compounded SORA rates on MAS’s interest rate statistics page.

Alternatively, you can:

- Ask your bank’s RM for rate updates

- Follow trusted mortgage blogs like Ace Mortgage’s blog for rate trends and forecasts

- Use platforms like Redbrick and Mortgage Master for market insights

Tip: Bookmark the MAS page and check it monthly — especially if your loan reprices every 90 days.

How do you use a mortgage calculator with SORA rates?

Once you know the current 3M SORA rate, you can estimate your home loan repayments using a calculator.

Here’s how:

- Input your loan amount and tenure

- Enter your interest rate (e.g. 3M SORA + bank spread = 4.5%)

- See your monthly instalment instantly

Try it here: SORA mortgage calculator

SORA Mortgage Calculator Example: Monthly Repayment Based on Loan Size and Interest Rate

| Sample Calculation |

|---|

| Loan: $500,000 |

| Tenure: 25 years |

| Rate: 4.5% (SORA + 0.8%) |

| Monthly: ~$2,779 |

Personal tip: Don’t just plug in one number. Try different scenarios — what if SORA rises to 4%? Can you still afford the monthly? Planning ahead avoids stress later.

Should you speak to a mortgage advisor before choosing SORA?

Yes — especially if you:

- Don’t fully understand how floating rates work

- Are deciding between fixed and SORA

- Are juggling multiple home or investment properties

A good mortgage broker will:

- Explain bank spreads and lock-in terms

- Help you compare across DBS, OCBC, UOB, and more

- Flag hidden fees or conditions in fine print

You can always get in touch with Ace Mortgage’s advisors — they don’t charge you for comparisons, and they’ll recommend only what fits your risk level.

Personal view: I used to think mortgage advisors were just middlemen — until one helped me avoid a $2K legal fee during refinancing. Definitely worth talking to someone who lives and breathes this stuff.

Is SORA Right for You in 2026?

By now, you’ve seen what SORA is, how it affects your home loan, and how it compares with fixed and FHR packages.

So — is it the right move for you?

Let’s help you wrap things up.

What are the key takeaways from this article?

- SORA is now the default benchmark for floating rate loans in Singapore

- It’s more stable and transparent than SIBOR or board rates

- Your interest rate = 3M SORA + bank spread

- Rates are expected to drop slightly through late 2026

- Refinancing can help if you’re still stuck on older high-interest loans

If you want the flexibility to switch, or expect rates to ease, SORA makes sense. But if budgeting certainty is more important to you? Consider fixed.

When should you lock in a SORA-based loan?

You might want to go with SORA now if:

- Your current rate is above 4.8%

- You can handle some payment variation month to month

- You want to keep refinancing options open in the next few years

But:

- If you’re getting a good fixed offer (~4% or less),

- Or if you prefer predictable repayments,

- A fixed-rate might be better — especially if it’s your first home

Expert insight: Not sure if it’s the right time to make a move? Try a free consultation with Ace Mortgage — they’ll run the numbers for you across all banks, without pressure.

What’s your next step if you’re still deciding?

- Test different repayment scenarios with a mortgage calculator

- Compare actual offers across banks like DBS and UOB

- Read tips and guides on the Ace Mortgage blog

- Or just talk to a mortgage advisor — sometimes 15 minutes is all it takes to clarify things

Personal take: SORA isn’t for everyone. But if you’ve got some financial breathing room and want to optimise your loan long-term, it can be a smarter move than chasing low fixed rates.