Thinking of upgrading your home with a fresh reno? Just be careful — some renovations might look amazing, but they could actually hurt your home valuation or mess with your mortgage approval in Singapore.

From illegal hacking to overly custom designs, certain mistakes can lead to lower property value, or worse — get your home loan delayed or rejected.

In this guide, we’ll show you what not to do, so you can renovate smart without sabotaging your loan.

Structural Works Without Approval That Lead to Loan Rejection

One of the biggest (and most costly) renovation mistakes in Singapore? Doing structural works without approval. It might seem harmless to hack a wall or shift a doorway — but if you didn’t check with HDB or BCA first, you could be violating building regulations. That alone can affect your housing loan approval, resale timeline, or even insurance claims.

Common Illegal Renovation Works That Violate HDB or BCA Rules

Some homeowners unknowingly carry out works that require formal approval. These include:

- Hacking structural walls without a permit

- Reconfiguring bathrooms or kitchens

- Extending floor areas (e.g. balcony enclosures)

- Raising floor levels or installing false ceilings beyond guidelines

For HDB flats especially, BCA and HDB are strict. If the renovation compromises the building’s structure or fire safety, you could face penalties or be forced to reinstate everything — at your own cost. Always refer to HDB home loan and renovation guidelines before starting.

How Unauthorized Layout Changes Affect Valuation Reports

Here’s the thing — property valuers don’t just assess size and location. They also inspect the internal layout. If your home has unapproved modifications, valuers may:

- Lower your property valuation

- Flag it to the bank as “non-compliant”

- Trigger delays or rejection in your home loan in Singapore

This is especially risky if you’re trying to secure a mortgage with one of the major banks. Whether you’re exploring DBS home loan, OCBC home loan, or UOB home loan, a poor valuation can reduce your loan quantum or disqualify you altogether.

Expert tip: Even with a solid credit score and low mortgage interest rate Singapore, a bad valuation caused by illegal works can derail your application. Always renovate with financing in mind.

Steps to Get Approval for Unpermitted Renovation Works

If you’ve already done the works — don’t panic. Here’s what you can do:

- Engage a PE (Professional Engineer) to assess if the modification is structurally safe

- Submit a reinstatement or approval request through HDB’s or BCA’s portal

- Work with a licensed renovation contractor for all future works

And if you’re planning a resale or hoping to refinance your HDB loan, it’s a good idea to consult a mortgage broker in Singapore.

Poor Workmanship and DIY Renovations That Devalue Your Property

Not all renovations increase your property value — especially when they’re rushed or done on the cheap. Whether it’s uneven tiling, peeling laminate, or exposed wiring, poor workmanship makes valuers think twice. And if you’ve gone full-on DIY without the right skills? Banks might see your home as a liability, not an asset.

How Low-Quality Finishes Trigger Negative Appraisals

When property valuers assess your home, they don’t just look at layout and size. They also notice details — and unfortunately, they’ll pick up on anything that looks like it might break or deteriorate fast.

Some examples that hurt your property valuation include:

- Misaligned tiles, bubbling paint, or warping vinyl flooring

- Loose carpentry, wobbly fixtures, or cracked countertops

- Exposed pipes or electrical works that don’t meet safety standards

Even if your reno looks “good enough,” banks might give you a lower mortgage loan valuation, which reduces how much you can borrow — especially if you’re applying for a private property loan or condo loan.

Why DIY Renovations Raise Red Flags for Mortgage Lenders

We get it — YouTube tutorials are tempting, and DIY can save money upfront. But from the bank’s point of view, unprofessional works often mean future repair costs and potential safety hazards.

If you’re applying for a mortgage loan in Singapore, lenders may:

Lower your approved loan amount

Request additional inspections or conditions

Reject your application entirely if safety is in question

This applies throughout all banks as they rely heavily on professional valuation reports. And DIY issues? They’re often dealbreakers

Fixes That Can Reverse Poor Renovation Impact

The good news? You can still turn things around — especially if you plan to refinance your home loan or list the property in the near future. Here’s how:

- Hire a licensed contractor to redo key problem areas

- Replace visibly low-grade materials with mid-range quality finishes

- Document everything properly (receipts, contractor details, before/after photos)

Before applying for refinancing, use a mortgage loan repayment calculator to estimate your options. Then consult a Singapore mortgage broker to check if your home’s current state might affect your refinancing eligibility.

💡 Pro tip: If you’re unsure what matters most to valuers, ask your broker to review recent valuation reports. They’ll spot issues you might miss — and help you decide whether to repair, replace, or repaint.

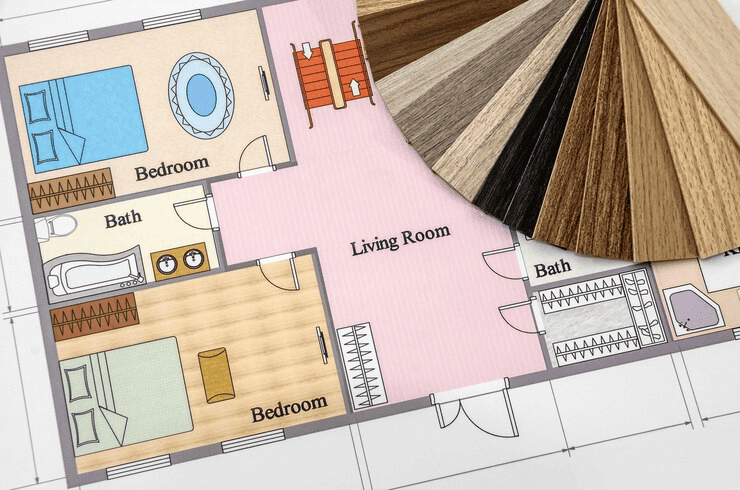

Over-Customised Designs That Hurt Resale and Valuation

We all want a home that feels uniquely “us.” But if your renovation gets too unique, it may backfire — especially when it comes to selling or refinancing. Valuers and banks aren’t swayed by Pinterest-worthy aesthetics.

They’re focused on practical, mass-market appeal. And when your flat or condo looks more like a boutique hotel than a typical home? That can drag your valuation down.

Renovation Features That Appeal to You — But Not the Market

Here’s the truth: not every buyer wants a bold emerald green kitchen or a ceiling-mounted swing chair in the living room.

Some renovation features that seem cool now but scare off future buyers (and valuers) include:

- Platform beds permanently fixed to the floor

- Walk-in wardrobes that take up entire bedrooms

- Built-in aquarium walls, neon lighting, or “themed” rooms

- Ultra-trendy finishes that age quickly (like terrazzo-everything)

If you’re planning to sell or refinance your home loan, these unique features can reduce buyer interest and, in turn, your property valuation.

How Unique Layouts and Fixtures Lower Your Appraised Value

When valuers assess your home for a mortgage in Singapore, they compare it to recent transactions of similar units in your area. If your unit has odd layouts, missing standard features (like a common bedroom), or overly personal upgrades, it becomes harder to compare — and valuers tend to go conservative.

That means:

- Lower loan amounts from banks like DBS, UOB, or OCBC

- Higher chances of under-valuation if you’re buying or refinancing

- Less flexibility when calculating your housing loan interest rate Singapore

💡 Expert insight: The more difficult your home is to “quantify,” the more likely your valuation gets pushed down to the safer end of the scale.

Safe Renovation Choices That Retain Broad Buyer Appeal

The sweet spot? Keep it tasteful, timeless, and reversible. Renovation works that improve liveability without alienating future buyers are always a safer bet.

Go for:

- Neutral tones and finishes (think light wood, soft greys, or white walls)

- Storage solutions that don’t eat into floor area

- Modular furniture instead of fixed structures

And before you dive into any major design overhauls, it’s a smart move to check your current position with a mortgage loan repayment calculator — or better yet, chat with a Singapore mortgage broker who can advise if that bold idea might come back to haunt your financing.

Removing Functional Spaces That Lower Appraisal Scores

Minimalism might be trending, but when you start removing entire bedrooms or hacking away storage space, you’re not just “decluttering” — you’re potentially cutting into your property valuation. Valuers don’t care how open or stylish your home looks.

They care whether it meets standard expectations of functionality, especially if you’re applying for or refinancing a mortgage in Singapore.

How Converting Bedrooms or Storage Affects Valuation Metrics

Let’s say you turned your third bedroom into a massive walk-in wardrobe. Or maybe you converted your store room into a pet spa (yes, people actually do this). From a bank’s point of view, that’s one less bedroom — and bedrooms directly influence valuation benchmarks.

When comparing to nearby units, a 3-bed HDB resale flat with only 2 usable rooms might be valued more like a 2-bed. That means:

- A lower valuation

- A smaller loan quantum

- And possibly higher home loan interest rates in Singapore depending on your lender’s risk assessment

This applies across all major banks, whether you’re taking a UOB home loan, OCBC housing loan, or exploring a DBS HDB loan.

What Valuers Look for in Functional Layouts

Appraisers are trained to assess utility and layout efficiency. They look for:

- Number of clearly defined bedrooms

- Availability of essential amenities (e.g. bathroom-to-bedroom ratio)

- Presence of storage or bomb shelter for HDB flats

- Kitchen and service yard accessibility

Even if you’ve transformed a common bedroom into a home theatre with no bed in sight, it no longer counts as a bedroom in most valuation models. That can affect your financing when applying for or trying to refinance your HDB loan or private property loan.

Reversing Layout Changes to Restore Loan Eligibility

Good news: these issues are often fixable — but timing matters.

Before applying for a mortgage, you can:

- Reinstate missing walls to restore original floor plan

- Add freestanding wardrobes or beds to clearly indicate room function

- Engage a contractor who understands valuation-sensitive renovations

If you’re planning to refinance, speak to a mortgage broker early. They’ll assess whether reinstating certain spaces could help you qualify for better mortgage loan rates or avoid an under-valuation risk.💡 Pro tip: Even partial restoration (like reinstalling a door or bed) before the valuation appointment can make a big difference.

Incomplete Renovations That Delay or Derail Financing

Half-done renovations aren’t just an eyesore — they can be a major red flag for banks and valuers. Whether it’s an unfinished kitchen, bare concrete flooring, or uninstalled lighting, lenders often see these as signs of financial risk. And unfortunately, that could mean delays, reduced valuations, or even a rejected mortgage application.

Why Banks Penalise Properties With Ongoing Reno Works

When lenders see ongoing works, they worry about hidden costs and incomplete handovers. A valuer walking into a dusty, mid-reno flat won’t give credit for future value — only for what’s physically ready right now.

That’s why banks may:

- Lower your property loan valuation

- Withhold full disbursement

- Reject the loan outright if safety is compromised

This is especially true if you’re selling a unit or applying for a Singapore commercial property loan, where valuation standards are even tighter.

Impact of Incomplete Renovations on Home Loan Approvals

A half-finished reno = half the value. Banks want certainty, and they’re not going to take your word that everything will be “done by next week.”

This can lead to:

- A much lower loan-to-value ratio

- Additional cash top-up from your own funds or CPF

- Delays in your approval, or stricter loan conditions

It becomes even riskier when refinancing. If you’re looking to refinance your HDB loan mid-reno, the bank may undervalue your flat and offer you far less than expected.

Timeline Tips for Finishing Renovations Before Refinancing or Sale

Want a smooth valuation? Here’s how to time it right:

- Wrap up all structural and wet works before your valuation appointment

- Remove all renovation debris and tools from the unit

- Prepare a simple summary of completed works (photos + receipts)

Need help estimating your numbers? Use our BSD (Buyer’s Stamp Duty) calculator if you’re planning a sale — or get prepped with a full cost breakdown through a broker’s guidance.

💡 Pro tip: If you’re on a tight timeline, speak to a mortgage expert to find out if it’s better to wait, or proceed based on what’s already done. A clean, fully completed unit will always give you the best shot at strong financing.

Missing Permits and Documentation That Reduce Home Value

Even if your renovation is beautifully done, it could still cost you if you can’t prove it was done right. In Singapore, banks and appraisers don’t just look at the final finish — they also want to see that your works were approved, legal, and well-documented. If you don’t have the proper permits or paperwork? That could lead to a lower property valuation, delayed loan approval, or worse — loan rejection.

Why Banks and Appraisers Require Renovation Proof

Banks take renovation legality seriously because unauthorised works can pose safety, compliance, and resale risks. During valuation, appraisers may downgrade your unit or label it “non-standard” if they suspect:

- Walls were hacked without HDB or BCA approval

- Wet areas (like bathrooms) were shifted

- Structural elements were altered with no permit

This affects not only your home loan in Singapore, but also your ability to compare mortgage rates Singapore effectively — because valuation directly affects how much you can borrow.

Documents You Must Prepare Before a Loan or Sale

If you’re planning to sell, refinance, or apply for a new mortgage in Singapore, prepare a “reno file” with the following:

- HDB/BCA permit approvals (if applicable)

- Invoices from licensed contractors

- Before-and-after renovation photos

- Floor plan showing original vs modified layout

- Receipts for major fixtures and installations

This helps valuers justify a higher valuation — and gives the bank confidence that your renovation won’t cause regulatory headaches down the road.

💡 Bonus tip: When using a mortgage calculator to estimate your monthly instalments, keep in mind that the approved loan amount is tied directly to your valuation — which your documents support.

How to Regularise Unapproved Works with Authorities

Already done the works without permits? Don’t panic. Many homeowners in Singapore have successfully regularised unapproved renovations, but timing is key.

Here’s what to do:

- Engage a Professional Engineer (PE) or Qualified Person (QP) to inspect the works

- Submit a retrospective application to HDB or BCA, depending on your property type

- Be prepared for minor reinstatement works if required

For those dealing with older resale units or planning to apply for a condo loan, it’s especially important to sort this out before valuation day. Regularising early could mean thousands more in approved loan quantum.

Final Checklist: Renovation-Safe and Valuation-Ready

Before you apply for a loan, refinance, or put your flat on the market, use this quick checklist to make sure your home renovation works for your property value — not against it.

Ensure Your Renovation Is HDB/BCA-Compliant

If you’ve done any structural works — like wall hacking or layout shifts — make sure they were approved by HDB or BCA. Unapproved modifications are one of the fastest ways to get flagged during valuation.

Planning to apply for a new mortgage soon? Start by exploring your options through our Singapore mortgage broker service — we’ll help check if your reno works pose any risk to your financing.

Retain All Key Functional Spaces and Fixtures

Valuers and banks expect functional homes. If you’ve converted a bedroom into a walk-in wardrobe or knocked out your study, it may lower your valuation.

Whether you’re aiming for a condo loan or financing a resale HDB, keeping your space as close to its original approved layout as possible gives you the best shot at full loan approval.

Prepare a Renovation File With Invoices, Floor Plans, and Photos

Be ready to show proof that your home was renovated responsibly. Your “reno file” should include:

- Before/after floor plans

- HDB or BCA approvals

- Receipts from licensed contractors

- Clear photos of major works

Need help estimating your loan size before applying? Use our mortgage loan repayment calculator to check your budget — or head to our homepage to get started with expert advice.

Renovate Smart, Protect Your Home Value and Loan Approval

Renovating your home can be exciting — but the wrong choices can quietly sabotage your property valuation or stall your mortgage in Singapore. From hacking walls without approval to turning bedrooms into yoga studios, these decisions might look good now but could cost you later.

The key is to balance design with compliance. Always check with HDB or BCA, retain core functional spaces, and keep your reno documents well-organised — especially if you’re planning to refinance your home loan or sell in the near future.

Need Help Navigating Your Loan After Renovation?

Whether you’re upgrading your HDB, buying a condo, or planning to refinance, our team at Ace Mortgage is here to help. As a trusted Singapore mortgage broker, we compare the best loan packages and help you avoid costly mistakes — no guesswork, no sales pressure.

Start by checking your estimated monthly repayment with our mortgage loan repayment calculator. We’ve got your back — so you can focus on building a home you love, without risking the loan that makes it possible.

All the best with your reno journey — and if you need us, we’re just a click away.