You’ve just said “I do,” and now comes the next big step — buying your first home together.

Maybe you’re scrolling property listings at night, wondering if you can actually afford a place. Sound familiar?

Here’s the thing: newly married couples in Singapore can stack up to $230,000 in housing grants — if you know what to apply for.

In this mini guide, we’ll walk you through the exact HDB grants you can stack in 2025, how much you could get, and what conditions to look out for — so you don’t leave free money on the table.

The 3 Main Grants You Can Stack as a Newly Married Couple

Buying your first flat as a couple in Singapore? Great news — you might qualify for three major CPF housing grants, and yes, you can stack them. That’s potentially up to $230,000 shaved off your flat price. Here’s how to make the most of them in 2025.

Maximise Your First Grant with the Enhanced CPF Housing Grant (EHG)

The Enhanced CPF Housing Grant is available for both BTO and resale flats, offering up to $120,000 — depending on your household income.

✅ Key requirements:

- Income ceiling: $9,000/month (combined)

- Flat must have ≥20 years lease and last till age 95

- Must be a first-time buyer under either married or fiancé-fiancée scheme

💡 Expert tip: If your income is on the lower end (say, under $5,000/month), you could qualify for the higher EHG tiers. You can even defer income assessment if you’re just starting work — a lesser-known strategy many couples miss.

Need help figuring out your eligibility? Use our mortgage loan repayment calculator to plan your budget around expected grants.

Unlock the Family Grant — Only If You Choose a Resale Flat

Want to move in quickly without waiting for a BTO? The Family Grant is your reward for buying resale — up to $80,000 if you meet these conditions:

- $14,000 income ceiling

- Flat must be a resale unit

- At least one spouse is a Singapore Citizen (SC + PR gets slightly less)

🎯 When paired with EHG and PHG, this grant can make a resale unit surprisingly more affordable — especially if you use a Singapore mortgage broker to compare rates across banks.

Boost Your Budget with the Proximity Housing Grant (PHG)

The Proximity Housing Grant gives you a bonus:

- $30,000 if living with your parents

- $20,000 if living within 4km of them

- No income ceiling ✅

- Stackable with EHG + Family Grant ✅

🔑 Pro tip: HDB checks that your parents’ address is updated on their NRIC. Miss that, and you could lose the PHG entirely — even if you live next door. Double-check before applying!

💰 Total Stacking Potential (for resale):

- EHG: Up to $120,000

- Family Grant: Up to $80,000

- PHG: Up to $30,000

→ Total: Up to $230,000 in CPF grants

Eligibility Rules Every Newly Married Couple Needs to Know

Stacking HDB grants sounds great — but you’ll need to meet a few key conditions first. Many couples assume they qualify, only to find out later they missed something small (and expensive). Here’s what to check before you apply.

Choose the Right Scheme — Fiancé-Fiancée vs Married Application

If you’re not legally married yet, you’ll need to apply under the HDB Fiancé-Fiancée Scheme. This allows you to buy a flat before registering your marriage — but you’ll need to submit your ROM cert before key collection to receive the grants.

If you’re already married, you’ll simply apply under the Married Couple Scheme.

🔎 Expert tip: If you’re applying for a bank loan for your HDB flat, both schemes are accepted — but some lenders may ask for your marriage cert upfront. Speak to a mortgage consultant early to avoid surprises.

Meet the Income and Lease Criteria to Unlock Full Grants

Your household income directly affects how much grant you receive:

- EHG: Income ceiling of $9,000

- Family Grant: Income ceiling of $14,000

- PHG: No income ceiling at all

The other big rule? Your flat must have at least 20 years of remaining lease, and it must last until the youngest applicant is 95. Anything less and your grant amount could be pro-rated or even denied.

💡 Use this rule of thumb:

The shorter the lease or the higher your income, the smaller your grant.

Avoid Common Mistakes That Disqualify You from Stacking

Here are some real issues couples have faced:

- Income increased between HFE application and key collection → Grant amount reduced

- Parents’ address on NRIC not updated → PHG denied

- Bought a flat with short lease (e.g. under 60 years) → Grants prorated significantly

- Missed HFE step → Ineligible to apply for grants in the first place

🎯 Before you commit to any flat, use the mortgage loan repayment calculator to estimate what you’ll need after grants — and always double-check with HDB or a trusted advisor.

How Much Can You Really Get? (Example Scenario)

It’s one thing to know the grants exist — it’s another to see what they actually look like in dollars. Let’s break down how much a typical newly married couple in Singapore could receive in 2025 when stacking all three main HDB grants.

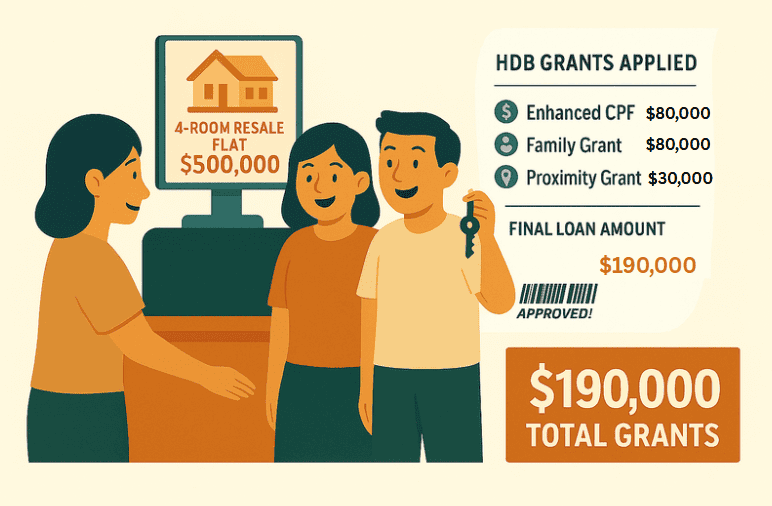

This Couple Got $190,000 in Grants — Here’s Their Breakdown

Meet Sarah and Daniel: They’re both Singapore Citizens, recently married, and buying their first home — a 4-room resale flat near Sarah’s parents.

Here’s their setup:

- Combined income: $6,500/month

- Flat type: Resale, 4-room

- Parents live 3.5km away

✅ Grant breakdown:

- Enhanced CPF Housing Grant (EHG): $80,000

- Family Grant: $80,000

- Proximity Housing Grant (PHG): $30,000

💰 Total stacked grants: $190,000

With this support, their mortgage loan size dropped significantly. Want to estimate your own numbers? Try this mortgage loan repayment calculator to see how much lower your monthly payments could be.

BTO vs Resale — Which Lets You Stack More in 2025?

Here’s the simple truth: resale flats offer more grant stacking potential.

BTO vs Resale Flat Grant Comparison for First-Time Married Couples (2025)

| Flat Type | Eligible Grants | Max Grant Potential |

|---|---|---|

| BTO | EHG only | Up to $120,000 |

| Resale | EHG + Family Grant + PHG | Up to $230,000 |

That’s a $110,000 difference, just for choosing resale — which can often offset the higher flat price or renovation costs.

✅ If your goal is to reduce upfront costs and move in sooner, resale may be the smarter move. Just make sure the flat meets the lease and location requirements.

The Grant Stacking Mistakes That Can Cost You Big

These are the most common missteps couples make (and regret later):

- Applied for BTO thinking all grants apply → Only EHG is available

- Didn’t update parents’ NRIC address → Lost PHG

- Income rose before key collection → Grant tier dropped

- Flat lease too short → Grants prorated or denied

- Skipped mortgage planning → Overborrowed and under-budgeted post-grant

🎯 Always double-check your eligibility before locking in a unit — even if you think you’re safe.

Maximise Your Grant Stack Before You Buy

Once you know what grants you qualify for, the next step is simple: lock them in before your income changes or the perfect unit slips away. Here’s how to plan ahead and stretch every dollar.

Use the HFE Letter to Lock in Your Grant Eligibility

Before you can apply for any grants, you’ll need to submit your HDB Flat Eligibility (HFE) letter. This document confirms your:

- Grant eligibility

- HDB or bank loan options

- Loan amount limits

The HFE locks in your household income at the time of application — which matters a lot if your salary is about to increase (and potentially disqualify you from higher-tier EHG amounts).

💡 Tip: If you’re expecting a pay raise soon, submit your HFE before it takes effect. That way, your grant eligibility stays pegged to your current income bracket.

Need help interpreting your HFE or matching it with the right bank loan? Speak with a Singapore mortgage broker who can help you compare all your options.

Match Your Flat Choice to Your Grant Strategy

Not all grants apply to every flat type:

Grant Eligibility Comparison for BTO vs Resale Flats (2025)

| Flat Type | Eligible Grants |

|---|---|

| BTO | Enhanced CPF Housing Grant (EHG) only |

| Resale | EHG + Family Grant + Proximity Housing Grant (PHG) |

🎯 If you want to stack all three grants, resale is your best shot — especially if you’re buying near your parents and need to move in sooner.

But if your budget is tight and you can wait a few years, a BTO with EHG might still be the better fit long-term.

Make Sure Your Grant Plan Matches Your Long-Term Budget

Grants can reduce your upfront cost, but they don’t cover everything — especially if you’re planning renovations, furnishing, or childcare down the road.

✅ Use a tool like this mortgage loan repayment calculator to:

- Estimate your monthly housing loan payments after grants

- Adjust for CPF usage vs cash

- Check how much you can comfortably borrow without overstretching

📌 Pro tip: Don’t just aim for the biggest grant — aim for the best fit for your income, goals, and lifestyle.

Frequently Asked Questions (FAQs)

Newly married couples often have the same worries when it comes to grants. Here are quick answers to the most common ones — minus the jargon.

Can I stack EHG, Family Grant and PHG together?

Yes — but only for resale flats.

If you buy a resale flat and meet all eligibility criteria, you can stack all three grants:

- Enhanced CPF Housing Grant (EHG)

- Family Grant

- Proximity Housing Grant (PHG)

👉 If you’re buying a BTO flat, only the EHG applies. The Family Grant and PHG are exclusive to resale purchases.

Need help comparing your options? Use our mortgage loan repayment calculator to see how these grants could reduce your monthly payments.

What’s the income ceiling for newly married couples?

- EHG: $9,000 (combined household income)

- Family Grant: $14,000

- PHG: No income ceiling at all

💡 Tip: If you’re close to the ceiling, consider applying for your HFE letter early to lock in your eligibility before your income increases.

Do I need to repay HDB grants if I sell the flat?

Not exactly — you don’t repay them in cash.

But when you sell your flat, the total grant amount you received (plus accrued interest) goes back into your CPF Ordinary Account. This ensures your CPF savings are preserved for your next property purchase or retirement.

It’s not a loss — it just means the funds are recycled into your CPF, not pocketed as cash.

Conclusion — Start Smart, Stack Right

Buying your first home as a couple is a huge milestone — and stacking the right HDB housing grants can give you a serious head start.

If you’re going for a resale flat, you could unlock up to $230,000 in CPF grants with the right strategy. But even if you’re eyeing a BTO, smart planning now can shape your finances for the next 20 years.

Final tip: Before you commit to anything, speak with a trusted Singapore mortgage broker who can help you match the best loan to your grant plan — and avoid hidden surprises later.

Start smart. Stack right. And step into your first home with confidence.