Planning to buy a property in Singapore? Then you need to know about TDSR — the Total Debt Servicing Ratio.

TDSR is one of the key rules that decides how much you can borrow from the bank. It looks at how much of your monthly income is already going to debts — like credit cards, car loans, or other mortgages.

If you’re applying for a home loan, whether for a condo, HDB, or refinancing, TDSR affects you.

In this guide, we’ll explain:

- What TDSR really means

- How it’s calculated

- And how to keep your ratio healthy to get better loan deals

Expert tip: A good TDSR doesn’t just improve loan approval — it also helps you avoid overstretching your finances.

Let’s dive in.

Understanding TDSR: The Basics

Let’s be real — buying a home in Singapore already feels complicated. But before you even get to the viewing stage, there’s one thing that can make or break your loan approval: TDSR. It stands for Total Debt Servicing Ratio, and it directly affects how much you’re allowed to borrow, no matter which bank you go to.

Whether you’re applying for a DBS home loan, looking into private property financing, or just trying to figure out how much monthly repayment you can handle — understanding TDSR is non-negotiable.

Here’s a simple breakdown of what it is, why it exists, and how it’s calculated.

What is the Total Debt Servicing Ratio (TDSR)?

TDSR is a rule that limits how much of your monthly income can go toward repaying loans. It takes into account all your existing debts — credit cards, car loans, student loans, and of course, your mortgage.

If your total monthly debt payments exceed 55% of your gross income, you won’t qualify for the loan amount you’re hoping for. And yes, this applies to both new property loans and refinancing.

It doesn’t matter if you’re earning $3K or $15K a month — if your debts are too high, the loan’s a no-go.

Why was TDSR introduced in Singapore?

TDSR was rolled out by the Monetary Authority of Singapore (MAS) in 2013. Back then, property prices were climbing fast and borrowing was cheap. People were stretching their budgets thin — sometimes too thin.

The government stepped in with TDSR to cool things down. It wasn’t meant to make life harder. It was meant to keep things sustainable. Banks now have a standard rule to follow, and borrowers are better protected from overcommitting.

From a long-term view, this helps avoid mortgage stress — especially during economic downturns or rate hikes.

What is the current TDSR limit?

The current TDSR threshold is 55%. This means your total monthly loan repayments (including your new property loan) can’t exceed 55% of your gross monthly income.

Here’s a simple table to show what that looks like:

TDSR 55% Income Limit Table for Home Loan Eligibility

| Monthly Income | Max Total Debt Allowed (55%) |

|---|---|

| $4,000 | $2,200 |

| $6,000 | $3,300 |

| $10,000 | $5,500 |

Even if your income is high, other debts will reduce how much you can borrow for a home. This is why many homebuyers choose to refinance their HDB loan to manage their monthly commitments better.

Tip: Just because you can borrow up to the limit doesn’t mean you should. Life happens — leave space for emergencies, renovations, or even future investments.

Calculating TDSR: Formula and Examples

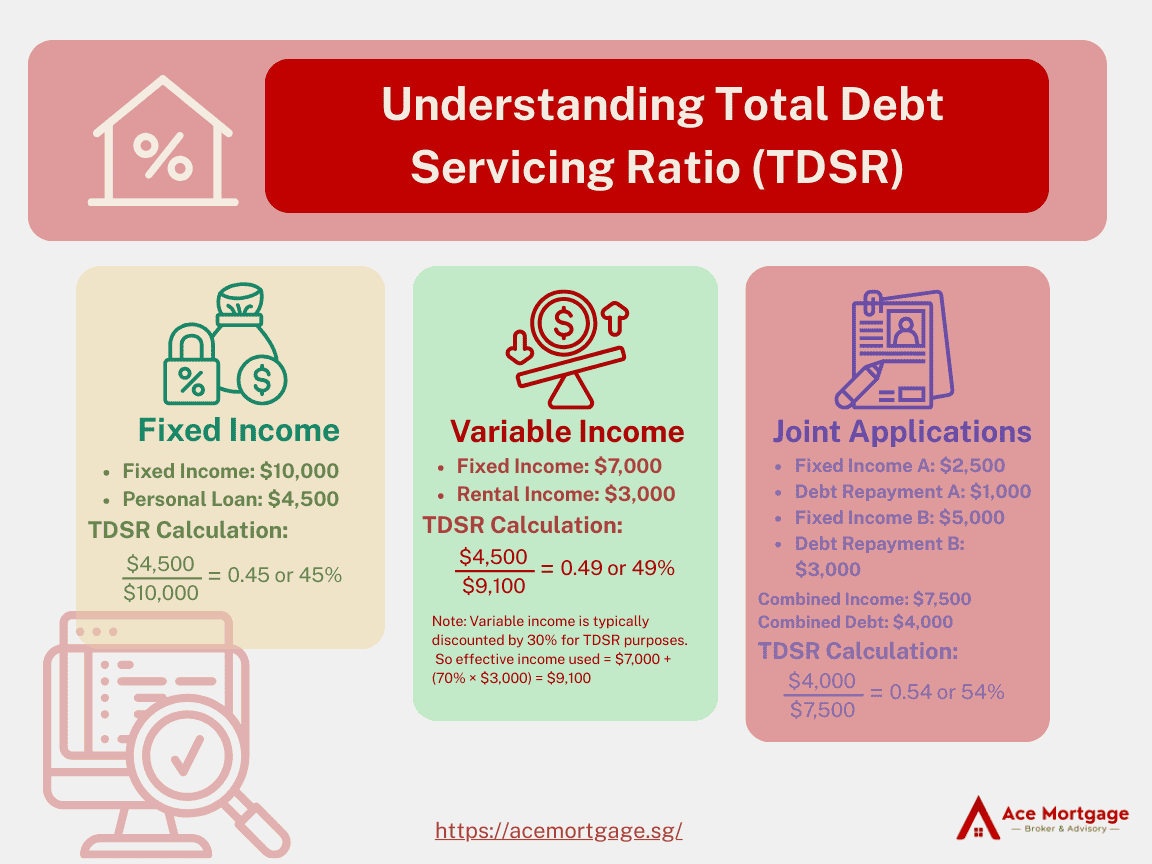

TDSR may sound complex, but the actual math is straightforward. What matters is knowing how lenders look at your finances — and what you can do to stay within the limit.

How is TDSR calculated?

Here’s the formula every bank uses:

TDSR = (Total Monthly Debt Obligations ÷ Gross Monthly Income) × 100%

Basically, your lender adds up all your monthly loan payments — including your future mortgage — and divides that number by your monthly income. The final percentage must be 55% or lower.

So if you’re earning $6,000 a month, your total loan repayments can’t exceed $3,300.

If you’re unsure where you stand, try using this mortgage repayment calculator to run your numbers.

Tip: Don’t just calculate TDSR on your own. A mortgage broker can show you which banks are more flexible with income recognition — like variable bonuses or commissions.

What debts are included in the TDSR calculation?

TDSR takes into account all your monthly loan obligations, not just your housing loan. Here’s what’s included:

- Existing home loans

- Personal loans

- Car loans

- Education loans

- Credit card minimum payments

- Renovation loans

- Hire purchase schemes

Yes — even if you’re only paying the minimum sum on a credit card, it still counts against your TDSR.

Hot take: If you’re planning to buy a home soon, avoid taking on new debts. Clear off small loans first — it gives your loan application a better shot.

Can you provide a TDSR calculation example?

Sure — let’s break it down with an easy example:

You earn $7,000/month before CPF.

You currently pay:

- $600 for a car loan

- $300 for a student loan

- $200 for credit card bills

Total existing monthly debt = $1,100

To stay within the 55% TDSR limit, here’s the math:

- 55% of $7,000 = $3,850

- $3,850 – $1,100 = $2,750 left for your property loan

So if your new mortgage repayment is less than $2,750/month, you’re within the limit.

TDSR Calculation Example: How Income and Debt Affect Your Loan Limit

| Income | Existing Debt | Max Home Loan Monthly Repayment |

|---|---|---|

| $7,000 | $1,100 | $2,750 |

| $8,500 | $2,000 | $2,675 |

| $10,000 | $0 | $5,500 |

Want help checking if your target loan fits the limit? Speak with an expert — we’ll break it down for you.

TDSR vs MSR: Key Differences for HDB and Private Properties

TDSR isn’t the only rule you’ll come across when applying for a home loan in Singapore. There’s also MSR — and yes, it’s different. If you’re buying an HDB flat or an EC, you’ll likely be assessed on both.

What is the Mortgage Servicing Ratio (MSR)?

MSR stands for Mortgage Servicing Ratio. It limits how much of your monthly income can be used just for your property loan repayment.

Currently, the MSR cap is 30% of your gross monthly income. That means, even if your TDSR is fine, your home loan still needs to pass this stricter test — but only for HDB and EC properties.

Here’s a quick snapshot:

MSR vs TDSR: Key Differences for HDB and Private Property Loans

| Rule | Applies To | Limit |

|---|---|---|

| MSR | HDB & EC | 30% |

| TDSR | All homes | 55% |

Quick tip: Planning to buy a resale flat with a bank loan? MSR still applies. It doesn’t matter if you’re not taking an HDB loan.

How does MSR differ from TDSR?

If you’re unsure how MSR differs from TDSR, don’t worry — you’re not alone. While both are used to assess your loan eligibility, they look at very different things. MSR focuses only on your property loan repayments, while TDSR takes into account all your debts.

Here’s a side-by-side comparison to help you understand the key differences:

Key Differences Between MSR and TDSR for Home Loan Eligibility

| Feature | MSR (Mortgage Servicing Ratio) | TDSR (Total Debt Servicing Ratio) |

|---|---|---|

| What it measures | % of income used to repay only your property loan | % of income used to repay all debt obligations |

| Applies to | HDB & EC purchases (new and resale) | All property loans (HDB, private, commercial) |

| Includes other debts | No | Yes — includes car loans, credit cards, personal loans |

| Benchmark Limit | 30% | 55% |

| Regulated By | MAS & HDB | MAS |

| Gross Income Use | Fixed income + 70% of variable income | Fixed income + 70% of variable income |

| Used For | HDB/EC loan eligibility | Loan eligibility for all property types |

Here’s the main difference:

- TDSR includes all your debts — mortgage, car loan, credit cards, etc.

- MSR only includes the property loan portion.

So even if you have no other debts, you could still fail the MSR test if your monthly mortgage repayment exceeds 30% of your income.

Think of it like this:

- TDSR = big picture (your whole financial life)

- MSR = just the home loan part

This is why some HDB buyers choose to go for longer loan tenures or use more CPF — to keep their MSR under control.

When does MSR apply instead of TDSR?

MSR only applies when you’re buying:

- A new HDB flat

- A resale HDB flat

- An Executive Condominium (EC) bought directly from a developer

It applies regardless of whether you’re using an HDB loan or a bank loan for HDB.

TDSR, on the other hand, applies to all property types — including condos, landed homes, and commercial properties.

If you’re buying a condo, MSR doesn’t apply — but TDSR still does.

So, if you’re planning to buy your first home, it’s worth checking both ratios early. A good mortgage broker can calculate them for you and help you decide what’s realistic based on your current income.

Tools and Resources: TDSR Calculators and Guidelines

Before speaking to a bank, it’s smart to get a rough idea of how much you can borrow. That’s where TDSR tools come in. They help you estimate your loan eligibility — fast.

Where can I find a TDSR calculator?

There are plenty of free calculators online, but not all are created equal.

If you want one that’s actually tailored for Singapore buyers, try this mortgage loan repayment calculator from Ace Mortgage. It estimates your monthly repayment based on loan amount, interest rate, and tenure — so you can see how it might affect your TDSR. Some platforms, like OCBC’s home loan portal, also offer similar tools if you’re comparing across banks.

How accurate are online TDSR calculators?

They’re pretty useful for ballpark figures — but they’re not perfect.

Here’s why:

- They may not reflect special income types (e.g. variable bonus, freelance income).

- They don’t factor in your credit report, which affects loan approval.

- Some don’t include existing debts unless you key them in manually.

So while a TDSR calculator gives you a good head start, your actual limit may differ. For a clearer picture, it’s best to speak with a broker who can simulate it using real bank criteria. That’s where services like Ace Mortgage’s free consultation come in handy.

Expert tip: If your income is partly commission-based or from self-employment, most banks will only count 70% of it toward your TDSR.

What guidelines should I follow to maintain a healthy TDSR?

Here are a few quick dos and don’ts to keep your TDSR in check:

✅ Do:

- Pay off short-term debt (credit cards, personal loans)

- Keep a steady and trackable income source

- Consider refinancing if your current rate is eating into your ratio

❌ Don’t:

- Stack loans before applying for a home loan

- Overstretch just to buy a more expensive property

- Assume CPF usage reduces your TDSR (it doesn’t — it’s still a loan)

And if you’re juggling multiple property goals — like buying a condo while still paying off an HDB — check out how condo loans work so you don’t unknowingly blow past the 55% limit.

Real talk: You don’t need to hit the TDSR ceiling to “maximize” your budget. Sometimes borrowing less gives you more peace of mind.

TDSR Exemptions and Special Considerations

Most people think TDSR is a hard cap — but that’s not always true. In some cases, especially when refinancing your mortgage, there are exceptions.

Let’s go through when (and how) the rules can bend.

Are there any exemptions to the TDSR framework?

Yes — especially for owner-occupied properties. If you’re living in the home you’re refinancing (not renting it out), and not trying to borrow more, you may be eligible for a TDSR exemption.

The idea is this: MAS doesn’t want to penalise homeowners who are trying to manage their debt better — especially if you’re switching to a lower interest rate.

This is one reason many people explore refinancing their HDB loan even if their TDSR is slightly above 55%.

What are the criteria for TDSR exemption in refinancing?

To qualify for a TDSR exemption, you’ll typically need to meet all of these:

- The property must be owner-occupied (not tenanted).

- You’re not borrowing more — just refinancing your existing loan.

- The loan tenure is not being extended beyond the original loan term.

- The new package improves your repayment terms (e.g. lower interest rate).

Good to know: If your income has dropped since your original loan, refinancing without exemption may be tough — this path gives you an alternative.

Also, some banks — like UOB or DBS — may apply slightly different internal checks. That’s why it’s useful to shop around or get a broker to compare offers across lenders.

Can financial institutions grant exceptions to TDSR limits?

Yes, but only in exceptional cases — and it’s rare.

Banks can request approval from MAS to exceed TDSR if:

- The borrower has strong net worth or liquid assets

- The property has unique value or circumstances

- The loan is low-risk despite breaching the 55% threshold

But unless you’re ultra-high net worth or refinancing a luxury property, this probably won’t apply.

Still, it’s worth speaking to a mortgage advisor to explore your options. Some buyers assume they’re stuck — when they actually just need a smarter loan structure.

If you’re unsure whether you qualify for an exemption, ask before you apply. One phone call can save weeks of delay.

Strategies to Improve Your TDSR

If your TDSR is over the 55% limit — or just cutting it close — don’t panic. There are practical ways to lower it and increase your loan eligibility. It’s all about managing your debts and boosting your income smartly.

How can I reduce my existing debt obligations?

This is the most direct way to improve your TDSR. Here are a few simple wins:

- Pay off short-term loans like credit cards and personal loans.

- Avoid new borrowing before applying for your mortgage.

- Refinance existing property loans to reduce monthly payments.

If you’re already holding a housing loan, switching to a lower interest package through refinancing could bring your monthly repayments down — and help free up TDSR room.

Expert tip: Even a small $300/month reduction in existing debt can make a big difference to your TDSR ratio.

How does increasing my income affect my TDSR?

TDSR is based on your gross monthly income, so increasing your earnings will improve your ratio — even if your debts stay the same.

Here’s what counts as gross income:

- Fixed salary

- Rental income

- Commissions or bonuses (usually 70% counted)

- CPF contributions

If you’re earning variable income or are self-employed, banks may discount part of it. This is why having a clear income trail helps. Side gigs or rental income from a second property (like a condo) can help, but only if properly documented.

Should I consult a mortgage advisor to improve my TDSR?

Honestly? Yes — especially if you’re close to the limit.

A licensed mortgage advisor can:

- Show you which banks accept different income structures

- Help you restructure loans to lower your monthly debt

- Compare interest rates across banks like OCBC or DBS

And if your numbers really aren’t working, they’ll tell you early — saving you from painful rejections.

Tip: Advisors usually don’t charge you — they’re paid by the bank. So getting help doesn’t cost more, but it could save you thousands.

Impact of TDSR on Property Buying Decisions

TDSR isn’t just a backend calculation — it directly affects what kind of home you can afford. If you don’t factor it in early, you might waste time shortlisting properties that your loan won’t cover.

How does TDSR influence my property budget?

TDSR sets the upper limit on how much you can borrow. Even if your CPF and cash savings are strong, your loan size still depends on your income and existing debts.

That’s why two buyers with the same savings can have very different budgets — one may afford a $1.2M condo, the other only $950K, purely due to TDSR.

If you want to explore real-world numbers, try this home loan calculator to see how loan amounts scale with income.

What is the role of TDSR in loan approval?

It’s huge. Even if everything else looks good — credit score, stable income, property value — if your TDSR exceeds 55%, your application may be rejected or scaled down.

Here’s what banks typically check:

- Your TDSR percentage (must be ≤55%)

- Your credit history (to verify repayment behaviour)

- Income type (fixed salary vs commission-based)

If you’re applying for a private property loan, your TDSR becomes the main affordability gate. This is especially important when buying new launches or bigger-ticket condos.

Pro tip: If your TDSR is borderline, even a small bank rate difference can change your eligibility. Compare across lenders, or ask a broker to help.

How can I plan my property purchase with TDSR in mind?

Here’s a quick checklist to stay within safe borrowing limits:

- Check your monthly debt obligations before house-hunting.

- Use tools or get pre-qualified with an in-principle approval to lock in your estimated budget.

- Choose properties where monthly repayments stay comfortably below the 55% cap.

If you’re already financing a flat and planning an upgrade, consider refinancing first to free up monthly capacity.

Also, remember to include other cost factors like stamp duties. You can estimate them using this handy BSD calculator.

Bottom line: Don’t reverse-engineer your finances to fit a dream home. Instead, let your TDSR guide what’s realistic — it saves you stress later.

TDSR and Market Trends: What Buyers Should Know

TDSR doesn’t exist in a vacuum. It’s closely tied to market conditions — especially interest rates and government policies. If you’re watching the news or trying to time your next move, here’s what to keep in mind.

How do interest rate changes affect TDSR?

When interest rates rise, your monthly loan repayments increase — and that pushes your TDSR higher. Even if your income stays the same, you could end up breaching the 55% limit just because rates spiked.

This is especially important for buyers considering floating rate loans, where monthly repayments aren’t fixed.

Tip: If you’re close to the TDSR ceiling, choosing a loan with a lower starting rate can give you more borrowing room.

For some buyers, that’s where refinancing becomes useful — switching to a better package with lower repayments helps bring TDSR down even in a rising rate environment.

What is the significance of the TDSR stress test interest rate?

Banks in Singapore don’t just use current rates when calculating your TDSR. They apply a stress test interest rate — usually 3.5% for residential loans — to ensure you can still afford your repayments even if rates go up.

This makes your TDSR calculation more conservative than it looks. So if your actual bank package is at 2.6%, your loan might still be assessed as if it were at 3.5%.

You can check the latest MAS guidelines here.

From a planning perspective, it’s smart to calculate both — your real monthly repayments and the “stress-tested” version.

How do property cooling measures relate to TDSR?

TDSR was one of the original cooling measures introduced in 2013 to slow runaway housing prices. Since then, it’s been adjusted — most recently in 2021 when the cap was tightened from 60% to 55%.

TDSR works alongside other policies like:

- Additional Buyer’s Stamp Duty (ABSD)

- Loan-to-Value (LTV) limits

- MSR for HDB buyers

Each one controls a different part of the housing market — but TDSR is what reins in how much people can borrow. It’s a permanent feature now, not a temporary rule.

If you’re planning a long-term move, keep tabs on both interest rates and policy tweaks. They’re the two biggest forces shaping affordability today.

Want to see how other rules affect loan sizing? Use our BSD stamp duty calculator to estimate your upfront costs.

Conclusion: Navigating TDSR for Successful Home Financing

TDSR can feel like just another hurdle — but once you understand how it works, it becomes a powerful tool to plan smarter and borrow responsibly. Here’s how to make it work for you.

What are the key takeaways about TDSR?

- TDSR caps your monthly debt obligations at 55% of your gross income.

- It includes all loans — not just your housing loan.

- It affects everyone, whether you’re buying a new home or refinancing.

It’s not just a bank requirement — it’s a safeguard for your long-term financial health.

The more control you have over your debt levels, the more flexibility you’ll have when interest rates shift or life throws surprises.

How can I prepare for a mortgage application considering TDSR?

Before you even start shopping for a property, get your numbers sorted. Here’s a simple checklist:

- Calculate your current monthly debts

- Estimate your loan size using a TDSR calculator

- Clean up small loans or credit card balances

- Consider refinancing your existing home loan to lower repayment burdens

- Apply for an In-Principle Approval (IPA) to know your true loan limit before committing

Planning ahead helps you avoid disappointment — and makes you a stronger buyer in the eyes of both agents and banks.

Where can I seek assistance for TDSR-related queries?

You don’t have to figure it all out on your own.

If you’re unsure whether you meet the 55% requirement or how your income and debt stack up, speak with a licensed mortgage advisor. They’ll help you:

- Review your current debt position

- Compare packages across banks like UOB or OCBC

- Get better rates and terms that suit your income profile

You can also check out our full mortgage blog for more deep dives like this one.

End of the day, TDSR isn’t there to stop you from buying — it’s there to help you buy safely.