Found the perfect resale HDB flat? Great! But before you get too excited, here’s something many buyers overlook: when to request your HDB valuation.

Ask too early, and HDB rejects it. Too late? You could miss your loan window or get hit with surprise Cash Over Valuation (COV).

In this guide, we’ll show you the right timing, how it affects your HDB loan and CPF usage, and the common mistakes to avoid in 2025—so you won’t blow your budget or your chance at the flat.

Quick Overview of HDB Valuation Timing (2025 Snapshot)

Before you stress over your loan approval or CPF limits, let’s take a step back and get clear on when to request your HDB valuation — because timing is everything. In Singapore’s resale flat process, this one action can literally decide whether your deal flows smoothly… or crashes into paperwork chaos.

In 2025, with resale prices climbing and Cash Over Valuation (COV) becoming common again, knowing when and how to request valuation is not just helpful — it’s critical.

Let’s break it down.

What You Must Know About Valuation Timing

The key rule to remember?

👉 You can only request your HDB valuation after receiving the signed Option to Purchase (OTP) — and before you exercise it.

You’ve got a 21-day window. That’s it.

Requesting too early (like before OTP)? – HDB will reject it.

Requesting too late? – You risk not securing your loan or being hit with unexpected COV.

🔎 HDB’s official site confirms this: valuations are tied directly to your OTP submission.

💡 Expert Tip: Always aim to submit your valuation request on Day 1 or 2 after receiving the OTP. This gives you enough buffer to get the valuation report back in time and avoid rushing through your HDB loan application.

Who Needs to Request HDB Valuation and When

If you’re planning to use your CPF savings, take up an HDB housing loan, or go for a bank loan for HDB, the valuation isn’t optional — it’s mandatory. Both CPF and your lender will base your loan amount on HDB’s official valuation, not the seller’s asking price.

Even if you’re paying in cash, a valuation gives you peace of mind — especially in 2025, where some buyers are unknowingly overpaying due to rising property loan rates in Singapore.

🔗 Pro tip: If you’re unsure which loan suits you better, compare options using our mortgage loan repayment calculator or speak with a Singapore mortgage broker to explore the best fit for your situation.

Summary Table: OTP → Valuation → Loan → Completion

Here’s a quick reference table to help you understand where valuation fits into the bigger resale picture.

Step-by-Step Timeline for HDB Valuation and Resale Completion in Singapore (2025)

| 📅 Step | ⏰ When It Happens | 💡 What You Need to Do |

|---|---|---|

| Seller grants OTP | Day 0 | Secure signed OTP, pay option fee |

| Request HDB valuation | Day 1–3 | Log in to MyHDBPage and submit request |

| HDB processes valuation | Within 5–7 working days | Wait for valuation report from HDB-appointed valuer |

| Apply for loan | After receiving valuation report | Apply for your HDB loan or refinance HDB loan |

| if needed | ||

| Exercise OTP | Before Day 21 | Pay exercise fee and proceed to Sale Agreement |

| Submit resale application | After OTP is exercised | Upload documents and await HDB approval |

| Completion appointment | ~8 to 10 weeks after application | Attend key collection and final payment |

📝 Real Talk: Buyers often forget that HDB takes time to assign a valuer and process the report. Don’t risk missing your deadline just because you waited a few days too long to click “submit.”

Why HDB Valuation Timing Is So Important in 2025

The timing of your HDB valuation request can make or break your entire resale flat journey. With stricter loan conditions and rising Cash Over Valuation (COV) risks in 2025, requesting it too early or too late could derail your financing, delay your purchase, or cost you real money.

Let’s look at what can go wrong — and how smart timing protects your CPF, your loan, and your peace of mind.

What Happens If You Request It Too Early

Many first-time buyers assume they should be “kiasu” and submit their valuation early — sometimes even before receiving the Option to Purchase (OTP). Unfortunately, this backfires.

🛑 HDB will immediately reject your valuation request if it’s not tied to a valid OTP.

Because the valuation is meant to reflect the agreed sale price, it must be pegged to the actual OTP terms. Jumping the gun just wastes time and delays your loan process.

📌 Pro tip: Always wait for the signed OTP before logging into MyHDBPage to request valuation.

What Happens If You Request It Too Late

Now, on the flip side — waiting too long can be even worse.

Here’s why: once the seller grants you the OTP, you have exactly 21 calendar days to:

- Request your valuation

- Receive the report (this takes 5–7 working days)

- Confirm loan approval

- Then exercise the OTP

If you wait till Day 15 or later to request valuation, you may not get your report in time to apply for your HDB loan or get final bank approval.

Worst case? You lose the flat and your option fee — all because of poor timing.

📎 To avoid this, use our mortgage loan repayment calculator to pre-check your affordability and lock in your loan application the moment your valuation is confirmed.

How Timing Affects Your Loan and CPF Usage

Let’s clear up one big myth: your HDB loan and CPF usage are not based on the seller’s asking price.

Instead, they’re capped by HDB’s official valuation — no matter how much you agreed to pay.

Here’s what this means in real terms:

How HDB Valuation Affects CPF and Loan Amounts in 2025

| 🏡 Example Scenario | 💲 Resale Price | 🏢 HDB Valuation | 📑 CPF/HDB Loan Covers | 💵 COV to Pay in Cash |

|---|---|---|---|---|

| Buyer A | $600,000 | $580,000 | $580,000 | $20,000 |

| Buyer B | $500,000 | $500,000 | $500,000 | $0 |

If you request the valuation too late and can’t adjust your offer based on the result, you may be forced to fork out COV with little time to prepare.

Expert tip: Always budget for a possible COV buffer and speak with a Singapore mortgage broker to structure your financing early.

When Exactly Should You Request HDB Valuation?

Once you’ve secured the Option to Purchase (OTP) from the seller, the clock starts ticking. Your next move? Submit your HDB valuation request — and the timing matters more than you think.

Getting it right means avoiding unnecessary Cash Over Valuation (COV), loan delays, or even forfeiting your option fee. Let’s nail down the exact window.

The Ideal Timeframe After OTP Grant Date

You should request your HDB valuation immediately after receiving the signed OTP — ideally on Day 1 or Day 2. Why?

- HDB takes around 5–7 working days to assign a valuer and process the report

- You’ll still need time to confirm your HDB home loan or bank loan approval before exercising the OTP

⚠️ Don’t delay. Leaving it to the second week gives you very little wiggle room if the valuation comes in lower than expected.

📌 Submit your request through MyHDBPage using your Singpass and the OTP document.

Valuation Validity and Expiry Rules in 2025

As of 2025, a completed HDB valuation is valid for 3 months from the date of the report. That means if your resale process is delayed beyond that, your valuation expires — and you’ll need to request a fresh one.

Key points to remember:

- The expiry countdown starts the day the valuation is issued (not requested)

- Expired valuation = new COV risk if prices shift

- Valuation re-requests may result in a different figure (higher or lower)

🔄 If your completion timeline looks long, factor this into your loan and refinancing strategy. You can also explore early home loan refinancing if rates move before your valuation expires.

How the 21-Day OTP Window Impacts Valuation Deadline

Your OTP gives you 21 calendar days to exercise your option — and that includes:

- Time to request your HDB valuation

- Time for HDB to issue the report

- Time to get your loan approval and confirm funds

💥 If you miss the window, the OTP lapses. That means:

- You may lose your option fee (typically $1,000)

- You’ll have to start the flat search all over again

- You risk price changes or missing out on the unit entirely

🧠 Smart move: Set a reminder the moment you get your OTP and aim to submit the valuation request within the first 48 hours.

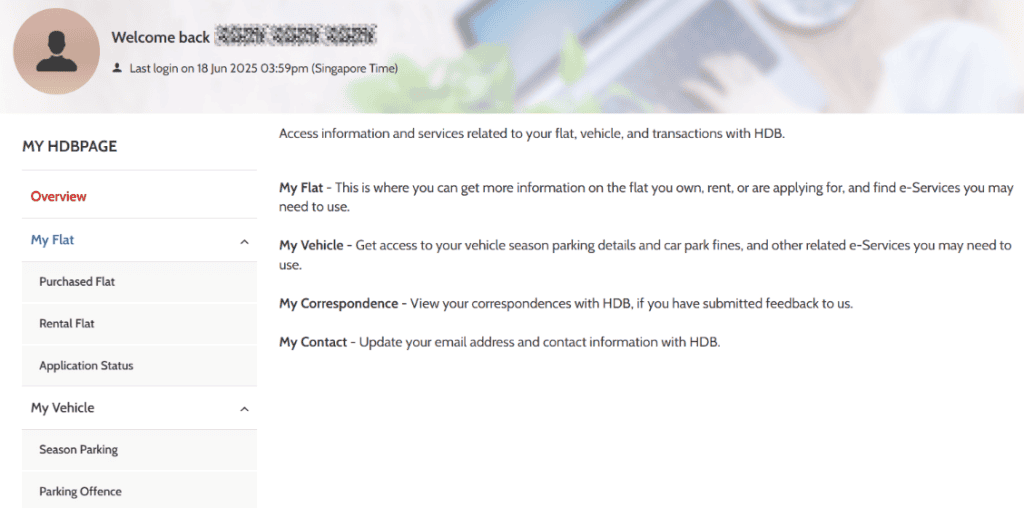

How to Request Your HDB Valuation the Right Way

Now that you know when to request your valuation, here’s how to actually do it — step by step. The good news? You won’t need to visit any HDB branch. Everything is done online via MyHDBPage, and the process is pretty straightforward if you know what to expect.

Let’s walk through it so you don’t get stuck halfway through.

Step-by-Step Guide via MyHDBPage (June 2025 Version)

To request your HDB valuation online, follow these updated steps as of June 2025:

- Log in to MyHDBPage using your Singpass

- Navigate to: My Flat > Application for Valuation > Request Valuation

- Upload the scanned Option to Purchase (OTP) document (PDF format only)

- Confirm the resale flat address and seller/buyer details

- Submit the request and take note of the reference number

📌 You can only submit the request once — so double-check all details before clicking “submit.”

Required Documents and Common Upload Errors

Here’s what you’ll need to prepare before starting the valuation request:

🔑 Required:

- Scanned Option to Purchase (OTP) (signed by both parties)

- Flat address and block/unit details

- Buyer and seller NRIC details (as reflected in OTP)

- Valid Singpass login

⚠️ Common Upload Mistakes:

- Wrong file format: Only PDF is accepted

- Missing pages: Ensure the OTP includes both signature pages

- Illegible scans: Blurred or cut-off documents may delay processing

- Wrong OTP date: If it’s not properly dated, HDB may reject it

💡 If unsure, speak with a mortgage advisor who can help you avoid these submission errors — especially if you’re rushing against the 21-day OTP clock.

How Long It Takes to Receive the Valuation Report

Once your request is submitted, HDB will assign a valuer and notify you when the report is ready.

⏳ Standard processing time:

- 5 to 7 working days in most cases

- Up to 10 working days during peak seasons (e.g. year-end, post-BTO launches)

You’ll receive an SMS or email alert once the valuation is complete — and you can download the report directly from your MyHDBPage account.

⚠️ Don’t assume it’ll be immediate. Always build in a few buffer days before your OTP deadline to avoid last-minute panic.

Common Mistakes to Avoid When Requesting Valuation

It’s surprisingly easy to mess up your HDB valuation request — especially if it’s your first time buying a resale flat. And in 2025, with rising housing loan interest rates in Singapore, even a small mistake can turn into a big financial headache.

Here are the most common slip-ups Singaporean buyers make, and how to stay one step ahead.

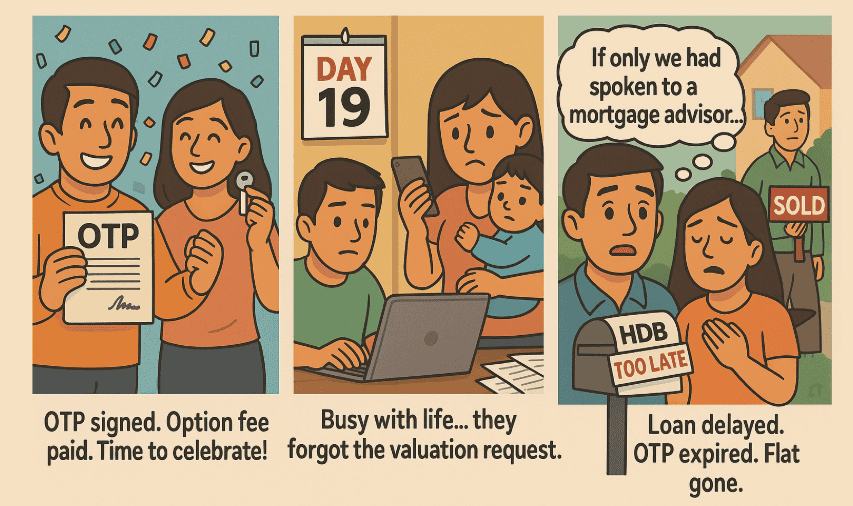

Forgetting to Submit Your Request Within the Option Period

You only get 21 calendar days from the date the Option to Purchase (OTP) is issued. That sounds like plenty of time — until life gets in the way.

Buyers often forget that HDB takes 5–7 working days to return the valuation. If you delay your request to Day 14 or later, you may not get the report in time to confirm your loan, which could result in a forfeited option fee or even losing the flat altogether.

🔗 Avoid this by locking in your timeline early. If you’re unsure about the resale process or need help structuring your loan strategy, speak to a mortgage consultant who can help track deadlines and document flow.

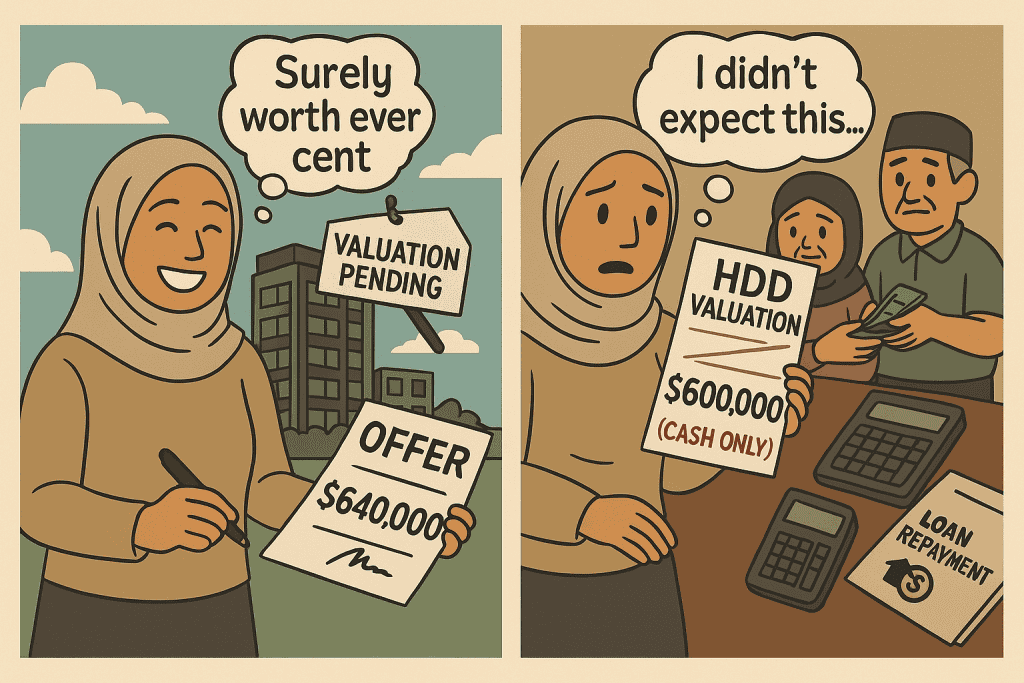

Assuming Resale Price Equals the HDB Valuation

This is a common and costly misconception.

Just because you and the seller agreed on a $600,000 price doesn’t mean that’s what HDB values the flat at. If HDB values it at $570,000, you’ll be responsible for the $30,000 Cash Over Valuation (COV) — in cash, without CPF or loan support.

🏠 Especially in 2025, when property loan rates in Singapore are fluctuating, you can’t afford to overlook this gap.

🔗 Always confirm your valuation before locking in the loan. Use tools like our mortgage loan repayment calculator to plan your finances with the valuation, not the sale price.

Not Budgeting for COV Due to Wrong Valuation Timing

If you request valuation too late and receive a lower-than-expected figure close to your OTP deadline, you won’t have enough time to:

- Renegotiate the price

- Arrange a higher cash buffer

- Explore alternatives like refinancing your HDB loan

The result? You may feel forced to proceed with a deal that stretches your budget uncomfortably — or worse, drains your savings for COV.

💡 Tip: Always factor in a potential COV buffer of 5–10% when house hunting, especially in popular estates or near MRTs.

Understanding COV (Cash Over Valuation) and Its Impact

Cash Over Valuation (COV) is one of those resale flat terms that feels confusing — until you’re hit with a $30,000 cash top-up you didn’t plan for.

And in 2025, as demand for well-located HDB flats rises, COV is becoming more common again. Understanding how it works — and how your HDB valuation affects it — can save you serious money.

Let’s break it down.

What COV Means and Why It Exists

COV is the difference between the resale price and HDB’s official valuation of the flat.

Example:

- Seller wants: $600,000

- HDB valuation: $570,000

- ➡️ COV = $30,000 (must be paid in cash only)

You cannot use your CPF or any HDB loan to cover the gap. This amount must come from your own savings.

Why does COV exist? Simple: some sellers price above valuation due to location, condition, or renovations — but HDB only values flats based on recent past transactions, not emotions or upgrades.

How HDB Valuation Affects Loan Eligibility

Your loan amount is tied to the valuation, not the price you pay. That applies whether you’re using:

- A bank loan for HDB, or

- A standard HDB housing loan

This means:

- If the valuation is lower, your maximum loan is also lower

- You’ll have to make up the difference (COV) in cash

- Your Loan-to-Value (LTV) ratio applies only to the valuation amount

📌 Pro tip: Always wait for the official valuation before deciding how much loan you need — not after.

Tips to Avoid Overpaying or Misjudging COV

- Study past valuations in the same block or estate (check the HDB resale portal)

- Request valuation ASAP after getting the OTP — this gives you time to renegotiate if needed

- Use a mortgage broker to help estimate likely valuations before offering a price

🔗 You can also compare loan structures from banks like UOB or OCBC to see which fits best if COV eats into your cash buffer.

💡 Final thought: COV isn’t always bad — but not budgeting for it definitely is.

Real Buyer Mistakes from Poor Valuation Timing

Sometimes, the best lessons come from seeing what not to do. These are real examples of Singaporean buyers who misunderstood how HDB valuation works — and paid the price for it (literally).

If you’re serious about buying smart in 2025, take these stories as cautionary tales.

Buyer A – Forgot to Request in Time, Lost OTP

Jason and his wife finally found a 4-room resale unit in Toa Payoh. They signed the OTP, paid the $1,000 option fee… and celebrated.

But between juggling work and viewing reno quotes, they completely forgot to submit the valuation request. By the time they remembered — it was Day 19.

HDB issued the report just after the 21-day window ended. Their loan approval was delayed, and they couldn’t exercise the OTP in time.

🛑 Result: they lost the flat, and the seller kept the option fee.

👉 If they had spoken with a mortgage advisor or used a checklist, they would’ve caught this early.

Buyer B – Assumed Price = Valuation, Faced $40K COV

Aisha offered $640,000 for a high-floor unit in Queenstown, confident it was worth every cent. She didn’t bother checking past transactions or factoring in COV — assuming valuation would match the price.

When the HDB valuation came back at $600,000, she had to cough up $40,000 in Cash Over Valuation — out of pocket.

With her CPF already committed, she had to borrow from family to proceed.

💡 Lesson? Never assume. Always wait for the official valuation report before finalising your housing loan strategy. Use tools like the mortgage loan repayment calculator to stress test scenarios.

Buyer C – Requested Too Early, Got Rejected by HDB

Ben thought he was being efficient. The seller verbally agreed on a price, and he quickly logged in to MyHDBPage to request valuation — before getting the signed OTP.

HDB rejected it straightaway.

By the time he got the signed OTP and resubmitted, there was a delay during the peak period. The valuation report only came back on Day 19 — leaving barely enough time for bank loan approval.

😓 It caused unnecessary panic and nearly cost him the deal.🔗 Tip: Always request valuation after the OTP is signed and dated. If you’re unsure what counts as “valid”, check with your agent or refer to the HDB resale process guide.

What to Do If the Valuation Comes in Too Low

It happens more often than you’d think — the HDB valuation report comes back, and it’s lower than expected. Now you’re facing a situation where the COV is higher than your budget, and the deal might no longer make sense.

Don’t panic. If you’re still within your OTP window, you’ve got options.

Renegotiating with the Seller Within the OTP Window

If the valuation is significantly lower than the agreed resale price, you’re not stuck — yet.

Buyers are legally allowed to walk away without exercising the OTP (you’ll only lose the option fee). But often, the better first move is to renegotiate.

🗣️ Here’s how:

- Politely explain that the valuation came in lower

- Show the seller the report and the new expected COV

- Offer a revised price — ideally closer to valuation, or at least a split on the COV

📌 The seller isn’t obligated to agree, but if they’re motivated, they might accept a revised offer rather than relisting.

💬 Tip: If you need help navigating price talks or running new loan numbers quickly, reach out to a mortgage broker in Singapore who can help you evaluate all angles within your OTP timeframe.

Handling Unexpected COV Without Breaking Your Budget

Sometimes, you still want the flat — even if the valuation is low. Maybe it’s a rare unit, close to your parents, or near a great school.

If you choose to go ahead, here’s how to soften the financial blow:

- Reassess your loan structure: Would a UOB home loan or OCBC home loan offer better cash flow options?

- Tap other financing tools: Check if you qualify for a refinance home loan later to offset early cash strain

- Recalculate your monthly commitment using the mortgage repayment calculator

💡 And always keep at least 3–6 months of emergency cash separate — don’t empty everything into your flat just to make it work.

Confused about Cash Over Valuation?

Don’t worry — we’ve broken it all down in our COV Explained: How HDB Valuation Affects Your Purchase guide.

Includes examples, calculations, and smart tips to avoid overpaying.

Why HDB Doesn’t Allow Valuation Appeals in Most Cases

This surprises many buyers: HDB’s valuation is final. There is no formal appeal process.

The valuation is conducted by a private licensed valuer appointed by HDB, based on:

- Recent transactions in the same block or area

- Flat size, storey, orientation

- Remaining lease

- Overall condition (from the exterior)

Even if you believe it’s unfair, you can’t request a revaluation unless there was a factual error (e.g. wrong flat size or address). And even then, corrections are rare.

🛑 So before offering high above market, always check past resale prices — or review the HDB resale process guide for how valuation fits into the flow.

Visual Checklist Before You Exercise Your OTP

You’re almost at the finish line — but don’t rush. Before exercising your OTP, take a moment to run through this 3-step resale flat checklist. A few minutes now could save you from loan mismatches, cash shortfalls, or overpaying on stamp duty later.

Here’s what every buyer should double-check before signing on the dotted line.

Step 1 – Confirm Your Valuation Report Is Ready and Valid

- Make sure your HDB valuation report has been issued

- Check that the report is still within the 3-month validity window

- Ensure the valuation matches your expectations — and that no surprise Cash Over Valuation (COV) is creeping in

📌 If the valuation hasn’t come in yet, don’t exercise your OTP.

Step 2 – Review Loan, CPF and COV Impact Based on Valuation

- Use the valuation figure (not the resale price) to recalculate your maximum HDB or bank loan

- Check how much CPF OA funds you can legally use

- Calculate the COV gap you’ll need to pay in cash, if any

💡 If the cash component is too high, speak with a mortgage consultant about adjusting your loan strategy or exploring refinancing options.

Step 3 – Use BSD and Mortgage Calculators Before Exercising OTP

Before you commit, make sure you know your actual monthly and upfront costs.

✅ Use our Buyer’s Stamp Duty calculator to calculate the stamp duty on your resale purchase.

✅ Plug your numbers into our mortgage loan repayment calculator to estimate your monthly instalments based on the valuation.

📎 Doing this early gives you time to re-strategise before you’re locked in.

FAQs About HDB Valuation Requests (Updated for 2025)

Still unsure about the process? Here are some of the most common questions Singapore buyers ask when dealing with HDB resale valuations — especially with tighter loan regulations and rising COV risk in 2025.

Can I request HDB valuation before I get the OTP?

No — you must receive a signed Option to Purchase (OTP) before requesting valuation.

HDB strictly requires a valid OTP to be uploaded with your request. If you try to request it earlier, the system will reject your submission. This is to ensure the valuation is based on an actual agreed transaction amount.

🔗 Refer to the HDB resale process guide for official steps and timing requirements.

How long does HDB take to issue the valuation?

In most cases, 5 to 7 working days.

However, during peak periods — such as school holidays, year-end rush, or major BTO launch windows — it may take up to 10 working days for HDB to assign a valuer and generate the report.

📌 Plan for delays. Don’t wait until Day 14 of your OTP period to submit your valuation request.

What if the valuation expires before I exercise OTP?

If your valuation expires (after 3 months), it is no longer valid for loan or CPF calculations. You’ll need to submit a new valuation request — which means:

- Delays in processing

- Potentially different valuation if market conditions have changed

- Possible COV increase if resale prices have risen

💡 Tip: If your resale timeline looks long, work with a mortgage broker to coordinate financing early, and aim to exercise your OTP within the validity period of your report.

Final Thoughts: Mastering Your HDB Valuation Timing in 2025

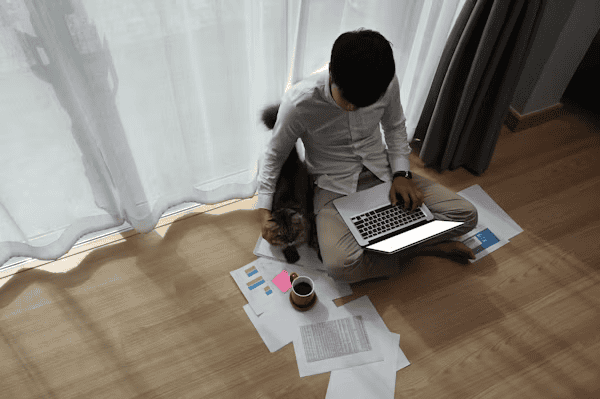

Buying a resale flat in Singapore can feel like a race against time — especially when you’re juggling the HDB valuation, loan approval, and OTP deadlines. But once you understand when and how to request your valuation, everything becomes clearer and far less stressful.

✅ Time it right after getting your OTP

✅ Always factor in the official valuation before calculating your loan or CPF usage

✅ Watch out for Cash Over Valuation (COV) traps, and plan your budget carefully

Need help navigating the numbers? Use our mortgage loan repayment calculator or reach out to a trusted mortgage broker in Singapore who can guide you through every step — for free.

Whether you’re a first-time buyer or a seasoned upgrader, knowing exactly when to request HDB valuation could save you thousands — and a whole lot of headache.

👋 Good luck, and may you find a home you love — without overpaying for it.