Adding or removing an occupier from your HDB flat may seem like a small admin task, but it can have big implications — especially if you’re applying for grants, planning for resale, or restructuring ownership.

Whether you’re listing a parent, fiancé, or sibling as an essential occupier, or trying to remove someone after a life event like divorce or relocation, there are strict HDB eligibility rules to follow in 2025.

In this guide, we’ll walk you through:

- How to add an occupier in HDB

- Who qualifies (and who doesn’t)

- The exact process to remove or update occupiers via MyHDBPage

- What happens to grants, CPF use, and future loan eligibility when you make these changes

👉 Quick Answer (for Featured Snippet):

Yes, you can add or remove an occupier from your HDB flat — but it depends on your flat type, ownership structure, and who the person is. The process is done via MyHDBPage, and approvals are subject to HDB’s eligibility rules

What Is an HDB Occupier?

In HDB terms, not everyone listed on your flat application is an owner. Some are essential to qualify — but don’t hold any legal rights to the property. That’s where the HDB occupier comes in.

Who qualifies as an occupier vs owner?

An owner is someone whose name is on the flat’s official title deed. They have full legal rights: they can sell the flat, use CPF for the mortgage, apply for HDB loans, and receive CPF housing grants.

An essential occupier, on the other hand:

- Is listed in the flat application from the start

- Must be a Singapore Citizen or PR

- Has no legal ownership of the flat

- Must live in the flat for the Minimum Occupation Period (MOP)

Common examples of occupiers include:

- A spouse who is not contributing financially to the flat

- A fiancé or fiancée under the Fiancé/Fiancée Scheme

- A child, sibling, or parent included to meet family nucleus requirements

🧠 Even if someone is not co-paying the mortgage, listing them as an occupier may be necessary to qualify for the flat.

Why occupiers matter for eligibility and grants

Occupiers are often critical for meeting HDB eligibility schees. For example:

- Under the Proximity Housing Grant, an occupier’s address may determine whether you qualify.

- Under family-based schemes like Multi-Generation or Orphan Scheme, you may not be able to apply without listing a qualified occupier.

Also, if an occupier owns another property, this may affect your grant eligibility or disqualify your application entirely.

✅ Tip: Always confirm occupier eligibility before applying for HDB grants. You can refer to our HDB home loan guide for more on CPF usage, grants, and owner-occupier rules.

Can you convert an owner to an occupier (or vice versa)?

Yes — but this process is not automatic. If you’re restructuring your flat (e.g. after a divorce, inheritance, or transfer within the family), you can request a change in flat ownership through HDB.

This is where the term “HDB change owner to occupier” becomes relevant. For instance:

- A parent might transfer ownership to a child and become an occupier

- A former spouse may give up legal rights and remain as an occupier post-divorce

See HDB’s official change in ownership eligibility for full criteria and conditions.

Remember: HDB must approve the change, and both parties must meet eligibility criteria. This may affect CPF refunds, loan responsibility, and resale rules.

How to Add an Occupier in HDB

If you’re applying for a new flat or structuring your application to meet HDB’s eligibility criteria, adding an essential occupier can sometimes be the key to qualifying. But don’t assume you can add anyone you like — HDB has strict rules on who qualifies and how to add them.

Step-by-step process to add an occupier

Adding an occupier must be done during your HDB flat application — it cannot be backdated once ownership is legally established.

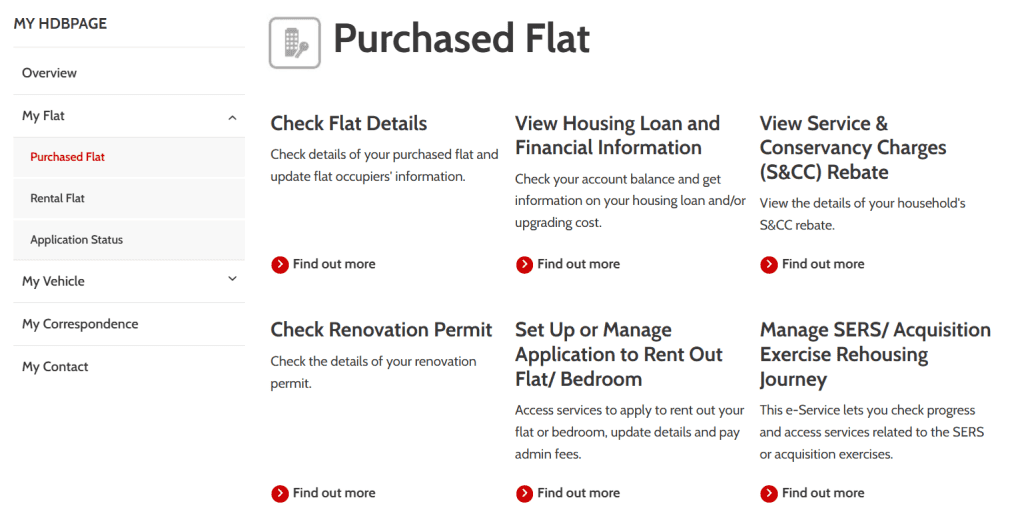

Here’s how to do it via MyHDBPage:

- Login to MyHDBPage using Singpass

👉 MyHDBPage Login - Go to “Apply for Flat” section

- In the applicant details form, add your intended occupier’s full name, NRIC, relationship, and citizenship

- Submit relevant supporting documents (e.g. marriage certificate, birth cert if parent/child)

- Wait for HDB to review — this typically takes 7–14 working days

Once approved, the occupier is locked in and subject to the flat’s Minimum Occupation Period (MOP).

Read more about MOP rules for BTO and resale flats in 2025 to understand how it affects both owners and occupiers.

Who can you add — spouse, fiancé, friend, family?

You can generally add:

- Spouse or fiancé/fiancée (if applying under Fiancé/Fiancée Scheme)

- Parents, siblings, or children (for family nucleus or Multi-Gen schemes)

❌ Can I add my friend as occupier in HDB?

No — HDB does not allow unrelated individuals (like friends or housemates) to be listed as essential occupiers unless a valid family relationship or legal tie exists.

To qualify, the occupier must help form a valid family nucleus as defined by HDB — this is a legal requirement, not a personal preference.

What to consider before adding someone

Adding someone as an occupier affects more than just eligibility — it can impact:

- HDB grants: Some grants (like the Proximity Housing Grant) depend on the occupier’s address.

- Loan structure: Occupiers don’t contribute CPF or take on loan liability.

- Future home ownership: An occupier may face restrictions on buying another HDB flat or Executive Condominium (EC) until the MOP is over.

💡 Before deciding who to add, it’s worth understanding your financing options and grant strategy. Check out our full HDB home loan guide to plan smarter.

How to Remove an Occupier from Your Flat

While adding an occupier must happen during the HDB application stage, removing one is a more sensitive and regulated process. Whether due to divorce, death, or family restructuring, you’ll need HDB’s approval — and it’s not as simple as clicking “edit.”

H3: Reasons for removal: death, divorce, relocation

Here are some typical situations where occupier removal is permitted:

- Death of the occupier

E.g. An elderly parent listed as an occupier passes away - Divorce or separation

E.g. Your ex-spouse remains listed after the flat is legally transferred - Relocation or change in family status

E.g. A child moves out permanently or gets their own property

💡 Example: If your adult child was listed as an occupier to qualify under the Orphan Scheme, and he later gets married and applies for his own BTO flat, you’ll need to remove him from your flat to avoid double-counting for eligibility.

Unsure what happens if the HDB flat owner passes away?

Read our full guide on What happens to an HDB flat when the sole owner dies — including who’s allowed to take over, how inheritance works with or without a will, and what occupiers need to know.

Removal process: MyHDBPage or in-person?

You can initiate removal through:

- MyHDBPage: For simple changes like death or legal name updates

- In-person at HDB Hub: For complex cases like divorce, inheritance, or full change in flat ownership

Steps to remove an occupier:

- Log in to MyHDBPage

- Go to “My Flat” > “Flat Details” > “Update Occupant Information”

- Submit supporting documents:

- Death certificate (if applicable)

- Divorce papers or deed of separation

- Statutory declarations or court orders (if needed)

- Death certificate (if applicable)

⏱️ Processing time: Usually 2–4 weeks depending on case complexity.

What happens after removal?

Removing an occupier won’t affect your loan repayments — because occupiers aren’t borrowers and their income isn’t factored into your HDB loan.

However, there may still be knock-on effects:

- Grant or resale eligibility: If removing them breaks your family nucleus, you may no longer be eligible to resell the flat before the MOP is up.

- Ownership restructuring: If you’re also changing ownership (e.g. after divorce or inheritance), you may need to update your loan structure, tenure, or CPF usage.

💡 Making changes to your flat’s ownership? Compare your HDB refinancing options to make sure your mortgage stays manageable.

Common Scenarios & FAQs

Some of the trickiest HDB questions come from edge cases — like trying to list a friend as an occupier or figuring out if that status affects future homeownership. Here’s what you need to know:

Can I add a non-family member like a friend or partner?

No — HDB does not allow unrelated individuals (like a friend, colleague, or housemate) to be listed as essential occupiers unless there is a legal relationship such as:

- Fiancé/fiancée (supported by a signed declaration form)

- Spouse (legally married)

- Parent, child, or sibling

You cannot add someone just to “help qualify” for a flat. Occupiers must help form a valid family nucleus, which is a key eligibility requirement in most HDB flat applications.

⚠️ Listing someone incorrectly can cause your application to be rejected or disqualify you from CPF housing grants.

Can an occupier become the owner later on?

Yes — but only under specific conditions.

An essential occupier can become the flat owner through:

- Inheritance (if listed in a will or if eligible under the Intestate Succession Act)

- Transfer of ownership (e.g. a parent transferring the flat to a child)

- Resale or buyout (if one party buys over the other’s share)

In all cases, the new owner must meet HDB’s flat ownership eligibility and complete a formal change in flat ownership application with supporting documents.

🧠 Tip: If you’re planning this transition, factor in CPF refunds, stamp duties, and remaining loan repayment — these can affect your timeline and financial planning.

💼 Does being an occupier affect buying another property?

Yes — and this is where many people get caught off guard.

Even though occupiers don’t legally own the flat, HDB still considers their occupancy when assessing future eligibility. For example:

- You cannot apply for another BTO or EC as a first-timer while you’re listed as an occupier in an existing flat still under MOP.

- You may also be subject to resale levy or reduced CPF grant if you’ve previously been an occupier in a subsidised flat.

- If you plan to buy a private property, your HDB history as an occupier may still be considered, especially for CPF use and ABSD.

💡 Planning to upgrade or invest in a second property? Check out our full guide on mortgage planning in Singapore for advice tailored to your situation.

Visual Guide: Who Can Be an Occupier?

Can I Add or Remove an Occupier from My HDB Flat? – Final Thought

Adding or removing an occupier in your HDB flat might seem like a small update, but it can have a big impact on your loan eligibility, CPF usage, and even your ability to buy another property later on. Whether you’re applying with family, changing your household structure, or planning for the future, it’s important to understand the rules before making any moves.

💡 Pro Tip: If you’re unsure whether to add someone now or later, always consider the Minimum Occupation Period (MOP) and your long-term property goals first.

👉 Read: HDB MOP Rules for BTO & Resale Flats in 2025

📞 Need help planning your next move?

Whether you’re restructuring flat ownership, planning for inheritance, or looking to refinance your HDB loan — we’re here to help.

✅ Talk to a licensed mortgage broker in Singapore

✅ Compare refinancing options for your HDB loan

✅ Use our free mortgage loan repayment calculator