Thinking of getting a place in Australia? Maybe it’s for your child studying there, or you’re just curious about investing overseas. Either way, you’re not the only one — a growing number of Singaporeans are looking beyond our borders.

The good news? It’s totally doable. The not-so-good news? There are a few hoops to jump through — FIRB approvals, extra stamp duties, and different loan rules to figure out.

Don’t worry, though. We’ll walk you through it all in plain English — no jargon, no stress. Let’s make this overseas home dream a little clearer.

Why More Singaporeans Are Buying Property in Australia

Australia isn’t just a holiday spot for Singaporeans anymore — it’s a serious real estate play. From strong housing demand to familiar systems and English-speaking environments, more buyers here are making the leap Down Under.

And yes — even with tighter foreign buyer restrictions, demand hasn’t slowed.

Top reasons Singaporeans choose Australia over other countries

Why Australia and not the UK, Malaysia, or even Japan? Here’s what stands out:

- Foreigners are legally allowed to buy, with proper FIRB approval

- English-speaking environment makes the legal and loan process smoother

- Better value per square metre than most global cities

- Growing support from Singapore mortgage brokers who can structure cross-border loans

💡 Pro tip: Always compare total cost per sqm — Australia often edges out London and New York when you factor in taxes, legal fees, and loan access.

Common goals — children’s education, rental income, retirement

Every buyer has a different goal, but these are the most common:

- 🏫 Education: Buying near universities like UNSW or Monash instead of renting for 4–6 years

- 💼 Rental income: Lock in a unit and let it earn — even before you migrate

- 🏖️ Future retirement: Places like Perth or Brisbane offer lifestyle + affordability

💬 “We bought a small unit in Melbourne for our daughter’s studies. Ended up keeping it as a rental after she graduated.” — SG buyer, age 52

What makes it appealing even with tighter restrictions

Yes, there are extra costs for foreigners — including stamp duty surcharges and FIRB application fees (see official FIRB site here).

But Australia remains attractive because:

- It’s politically and economically stable

- Rental demand is strong in major cities

- You may benefit from the Double Tax Agreement between SG & Australia (less tax leakage)

And with today’s mortgage rates in Singapore, many are funding their Aussie purchase through local banks or refinancing existing properties to free up capital.

What Types of Property Can Singaporeans Buy in Australia?

Before you get too excited browsing listings, it’s important to know that not all properties are available to foreign buyers — even if you’re ready to pay in full.

As a Singaporean, you’ll need to understand the limits and approval process before you commit to anything.

New vs resale properties — which are allowed

✅ Allowed:

- Brand new condos or landed homes

- Off-the-plan units directly from developers

- Vacant land (if you plan to build soon)

❌ Not allowed:

- Resale properties (unless you plan to redevelop them into multiple new dwellings)

💡 Buying new? Look for developer projects in Melbourne or Brisbane approved for foreign buyers — your mortgage broker in Singapore can help shortlist them.

FIRB approval: when is it required for Singaporeans?

Almost always.

Singaporeans are considered foreign non-residents unless you’re already an Australian PR or citizen. This means you’ll need to apply for Foreign Investment Review Board (FIRB) approval before signing any contract.

Here’s what to know:

- Application fees range from AUD $14,100 to $42,300 (as of 2025)

- Processing usually takes 2 to 4 weeks

- You must apply before settlement — and usually before signing a contract

Check the official FIRB fee table here →

Special exemptions (e.g. buying with Australian PR spouse)

There are a few exceptions where FIRB approval may not be required:

- You’re buying jointly with a spouse who is an Australian citizen or PR

- You’re purchasing the property under a long-term visa (with conditions)

- You’re inheriting the property, not buying it

Still unsure? It’s best to speak to a property lawyer or experienced broker who’s handled cross-border purchases before — a mistake at this stage can cost you thousands in penalties or rejected applications.

Step-by-Step: How a Singaporean Can Buy Property in Australia

Buying a property overseas might sound intimidating, but once you break it down — it’s really just a process of preparation, paperwork, and the right people helping you along the way.

Here’s how it works, step by step.

What documents you need as a non-resident

Before you can even make an offer, get these ready:

- A copy of your Singapore passport

- Proof of address (e.g. utility bill or bank statement)

- Proof of funds or bank statements for loan or cash purchase

- Income documents (payslips or NOA) — especially if you’re applying for a home loan

- FIRB approval letter (mandatory for most non-residents — see official FIRB fee page)

💡 Tip: If you’re planning to use a Singapore mortgage broker for cross-border financing, they’ll usually guide you through the exact documents required by different lenders.

Timeline: from expression of interest to final settlement

Here’s how a typical purchase flows:

- Shortlist and view properties (online or via agent)

- Make an offer and sign an Expression of Interest

- Apply for FIRB approval

- Sign Sales & Purchase Agreement (usually with a 10% deposit)

- Secure financing (can be parallel with FIRB step)

- Finalise legal checks and transfer funds

- Settlement day – ownership is transferred

🗓️ Typical duration: 6 to 12 weeks from offer to settlement

⚠️ Buying off-the-plan? Your settlement might be 12–24 months later, depending on completion.

Who helps you: agent, lawyer, mortgage broker

You’ll need a reliable team on both ends — Singapore and Australia:

- 🏡 Buyer’s agent in Australia: Helps find and negotiate property

- ⚖️ Conveyancer or property lawyer: Reviews contracts, handles settlement

- 💰 Mortgage broker in Singapore: Compares bank loans that support overseas purchases and handles loan approval

Having the right experts saves time, reduces risk, and ensures you don’t overpay — especially when you’re unfamiliar with local rules.

How Much Does It Cost Singaporeans to Buy in Australia?

Buying a home in Australia isn’t just about the property price — there are quite a few extra costs for foreign buyers, especially if you’re purchasing as a Singaporean non-resident.

Let’s break down what you’re really paying.

FIRB fees, stamp duty surcharges for Singaporean buyers

Most Singaporeans will need to pay two major one-time fees:

1. FIRB Application Fee

This depends on your property price. As of now:

- AUD $14,100 for properties under $1M

- Increases by tiers (e.g. $28,200 for $1M–$2M)

Check the latest FIRB fee chart

2. Foreign Buyer Stamp Duty Surcharge

Charged on top of regular stamp duty, and varies by state:

- New South Wales: +8%

- Victoria: +7%

- Queensland: +7%

📌 Use this BSD calculator to compare against what you’d pay in Singapore — it’s often much lower locally!

Foreign owner land tax and annual vacancy fee

Owning the property comes with ongoing costs too:

- Land tax for foreign owners (varies by state and property value)

- Annual vacancy fee: Applies if your unit is left empty for 6+ months/year

- Roughly 1% of property value in affected zones (mostly inner city)

These policies are meant to discourage speculative foreign holding — so be prepared to show rental or usage evidence each year.

💡 Tip: Renting it out full-time not only offsets your mortgage, but avoids the vacancy fee altogether.

Total example cost for Singaporeans buying a $900K unit

Wondering what the actual numbers look like? Here’s a realistic snapshot of the total cost of buying property in Australia as a Singaporean — including stamp duties, FIRB fees, and common legal costs.

This example assumes you’re purchasing a new residential unit in New South Wales (NSW) at AUD $900,000.

Estimated Cost Breakdown for Singaporeans Buying a $900K Property in Australia

| Cost Item | Estimated Amount (AUD) |

|---|---|

| Property Price | $900,000 |

| FIRB Application Fee | $14,100 |

| Standard Stamp Duty (NSW example) | ~ $36,000 |

| Foreign Buyer Surcharge (8%) | $72,000 |

| Legal & Conveyancing Fees | $2,500–$3,500 |

| Loan Setup or Valuation Fees | $1,000–$2,000 |

| 🏡 Total Estimated Upfront | ~ $1,025,000+ |

🧠 Note: These numbers will vary based on the state, loan structure, and whether you’re buying off-plan. Always speak to a qualified broker or legal advisor to get exact figures.

How Can Singaporeans Finance an Australia Property?

You don’t need to pay 100% in cash to buy in Australia — in fact, many Singaporeans fund their overseas purchases through bank loans, both locally and abroad.

Let’s look at your financing options and what to watch out for.

Singapore bank vs Australian bank — who offers overseas loans?

Some Singapore banks and brokers do offer financing for overseas properties, including units in Australia. These can be structured as:

- A home equity loan (using your existing Singapore property as collateral)

- A direct overseas mortgage with participating banks (less common)

You can also explore getting a mortgage in Australia through local banks — but be aware that:

- Foreigners often face tighter lending rules

- You may need a higher downpayment (30%–40%)

- Income must be verifiable in SGD (converted for eligibility)

🔗 Start by checking with a mortgage broker in Singapore who can help compare options across both countries.

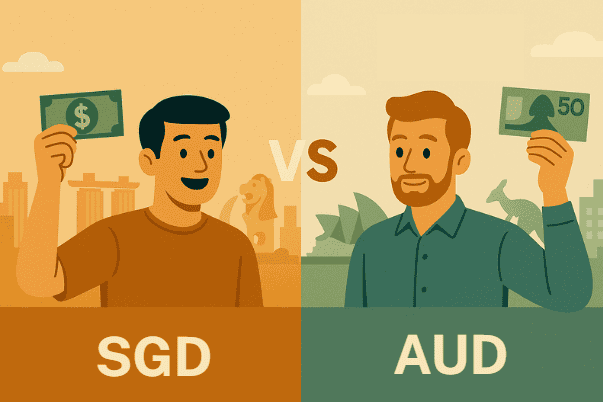

Currency risks when repaying in SGD vs AUD

One thing many first-time overseas buyers overlook is currency risk.

If you’re earning in SGD but repaying a loan in AUD, you’ll be exposed to exchange rate fluctuations. A weaker SGD could mean paying more in real terms each month.

To manage this:

- Some banks offer foreign currency accounts or hedging tools

- Others may allow SGD-based repayments — though this limits your lender choices

- Fixed rate home loans (either locally or in Australia) can provide some short-term stability

💡 Tip: Before committing, run the numbers using a mortgage loan repayment calculator to test your monthly costs in different exchange rate scenarios.

What MAS and Australian rules say about overseas borrowing

Here’s what to know before you take a cross-border loan:

In Singapore:

- The Total Debt Servicing Ratio (TDSR) still applies, even for overseas loans

- Your existing home loan and car loan obligations may reduce your max borrowing

In Australia:

- Foreign buyers are assessed under stricter lending guidelines

- You may be charged higher interest rates than locals

- Proof of foreign income, bank statements, and tax filings are usually required

And don’t forget — if you refinance your Singapore home to fund your Aussie purchase, check out the latest options for refinancing your home loan in Singapore.

Best Cities & Suburbs in Australia for Singaporean Buyers

You’ve got your financing sorted — now comes the big question: Where should you actually buy? For Singaporeans, the answer often depends on whether you’re investing, planning for your child’s education, or thinking about retirement.

Let’s break down where most are buying, and why.

Where Singaporeans tend to buy — and why

Based on broker insights and developer sales data, the most popular cities among Singaporean buyers are:

- Melbourne – known for education, lifestyle, and affordability

- Sydney – premium location, higher rental demand (but also higher prices)

- Brisbane – rising star, great value and infrastructure growth

💬 “We picked Melbourne because it felt most livable for our daughter studying medicine — but rental returns made it worthwhile too.”

These cities offer access to new residential projects that are FIRB-compliant, with good long-term upside. And thanks to Australia’s urban planning, even suburban units enjoy connectivity and amenities that rival city cores.

Education hotspots vs investment hotspots

Whether you’re buying for your child’s studies or aiming for long-term returns, location matters — a lot. Some suburbs are better suited for rental yield, while others offer stability near top universities.

Use this comparison to decide which areas align with your goals.

Best Suburbs in Australia for Education vs Investment (Singaporean Buyer Focus)

| If your goal is... | Consider areas like... |

|---|---|

| Education (for children) | Clayton, Carlton (Melbourne), Kensington (Sydney), St Lucia (Brisbane) |

| Rental income & high yield | South Brisbane, Parramatta, Box Hill, Fortitude Valley |

| Long-term capital appreciation | North Sydney, Melbourne CBD fringe, Woolloongabba, Chatswood |

💡 Tip: Prioritise suburbs with strong local demand — not just ones heavily marketed overseas.

What locals warn about oversupply zones

Not all new projects are equal.

Local property advisors in Australia often caution against:

- Overbuilt CBD micro-units (especially in Melbourne and Brisbane)

- Areas with high vacancy rates and limited owner-occupier demand

- Projects marketed heavily overseas but less popular locally

Always verify:

- Rental demand

- Future infrastructure plans

- Local buyer sentiment

🔍 Use tools like CoreLogic or Domain, or better — consult a trusted Singapore mortgage advisor who works with Australian partners to avoid these traps.

Can Singaporeans Rent Out Their Australian Property?

Yes — as a Singaporean, you’re allowed to rent out your Australian property. In fact, many buyers do exactly that to offset costs or generate passive income. But before you list it on the rental market, make sure you understand how taxes work and what’s legally required from abroad.

How rental income is taxed in both countries

As a non-resident landlord in Australia, you’ll need to pay tax on your rental income — usually around 32.5% on the net amount (after expenses like mortgage interest and property management fees).

You must:

- File an Australian tax return each year

- Declare rental income, minus eligible deductions

And in Singapore?

- Rental income earned overseas is not taxed here as long as it isn’t brought into Singapore

- But it’s still advisable to declare it under other income for transparency

💡 If you’re unsure how to structure it properly, speaking to a property tax consultant or trusted mortgage broker in Singapore can help you avoid mistakes.

Double tax agreement (DTA) between SG and Australia

The good news: Singapore and Australia have a Double Tax Agreement (DTA).

This means:

- You won’t be taxed twice on the same rental income

- You may claim credits in Singapore for taxes paid in Australia (if brought in)

This makes Australia far more tax-efficient for Singaporeans than countries without such agreements.

More about the SG–AU tax treaty here →

🔗 IRAS List of Double Tax Agreements

Do you need a property manager as an overseas owner?

If you’re not living in Australia, yes — you’ll almost always need a licensed property manager. They handle:

- Finding and vetting tenants

- Collecting rent and issuing statements

- Repairs, maintenance, and tenant disputes

- Lodging your bond with the proper tenancy authority

Expect to pay around 6%–10% of monthly rent for this service — and it’s often well worth it for peace of mind.

🧠 Tip: Many developers or project agents will offer property management bundles — but always compare quotes independently.

Mistakes Singaporeans Often Make When Buying in Australia

It’s easy to get caught up in the excitement of buying overseas — especially when glossy brochures and developer pitches make everything sound effortless. But the truth is, some Singaporean buyers end up overpaying, overcommitting, or just plain misinformed.

Here are some common pitfalls to avoid.

Buying without understanding FIRB or stamp duties

Many assume buying overseas is like buying in Singapore — but Australia’s rules are different.

FIRB (Foreign Investment Review Board) approval is usually required before you can purchase residential property. Missing this step can lead to rejected applications or even fines.

Also, stamp duties for foreign buyers can add 7–8% on top of regular rates, depending on the state.

💡 Tip: Always budget using the full cost, including FIRB fees and foreign buyer stamp duty, not just the listing price.

Choosing location based on hype, not fundamentals

Just because a project is marketed heavily in Singapore doesn’t mean it’s a good investment.

Many Singaporeans unknowingly buy in:

- Oversupplied CBD fringe zones

- Areas with low local demand

- Suburbs far from transport or schools

Instead of relying on flashy launches, base your decision on:

- Rental vacancy rates

- Local population growth

- Infrastructure plans (rail lines, schools, hospitals)

Using cash transfers without AML documentation

If you’re transferring large sums from Singapore to Australia, be prepared for anti-money laundering (AML) checks.

Australian banks and lawyers will ask for:

- Source of funds (e.g. income, savings, investment returns)

- Proof of legality (bank statements, payslips, tax filings)

Skipping this step or moving money in chunks can trigger compliance delays — or worse, get your transaction flagged.

✅ Work with an experienced Singapore mortgage broker who knows how to pre-prepare your financial paperwork for overseas lenders.

Final Thoughts — Is It Worth It for Singaporeans to Buy in Australia?

Buying property in Australia as a Singaporean isn’t just possible — it can be a smart long-term move. But it’s not for everyone. Whether it’s worth it really comes down to your intent, timeline, and risk appetite.

When it makes sense (and when it doesn’t)

It’s worth considering if:

- You’re supporting a child’s education in Australia

- You plan to migrate or retire there later

- You’re looking to diversify beyond Singapore’s property market

It may not be the right move if:

- You’re unsure about holding costs (e.g. land tax, vacancy fees)

- You’re just chasing hype with no long-term plan

- Your financing isn’t solid — especially with currency risks and stricter loan rules

🎯 Bottom line: If you’re clear on your “why” and plan around the costs and rules, Australia can offer steady value and capital growth.

Buying for your child vs buying for rental — very different paths

Don’t confuse the two.

- If you’re buying for your child’s university stay, prioritise location, liveability, and exit value.

- If you’re buying for rental income, look at rental yields, vacancy rates, and tax structure.

Trying to do both in one unit often leads to compromise — so be clear about your goal upfront.

💬 “We thought we’d rent it out after our son graduated — but the unit wasn’t in demand. Wish we planned with rental in mind from the start.” — SG parent, age 58

Why a cross-border mortgage broker gives better clarity

Here’s where it gets real: you can DIY a lot of this, but cross-border property purchases are not like local ones. A good mortgage broker in Singapore can:

- Break down bank loan options across both countries

- Help you structure your loan to manage SGD/AUD risks

- Guide you through FIRB, stamp duty, and foreign buyer rules

- Recommend developer or legal contacts in Australia

It’s not about selling you a loan — it’s about helping you avoid costly blind spots.

Frequently Asked Questions for Singaporeans Buying Property in Australia

Can I use CPF to buy property in Australia?

No — CPF funds can only be used for properties in Singapore. You cannot use your CPF Ordinary Account for downpayments, stamp duty, or monthly instalments on overseas property.

Do I still need FIRB approval if I’m a Singaporean PR in Australia?

If you’re a Singaporean who has obtained Australian PR status, you may no longer need FIRB approval. But this depends on your visa type, purchase intent, and whether you’re buying with a foreign spouse. Always check the latest FIRB requirements before committing.

Can I buy property under my child’s name if they’re studying there?

Yes, but only if your child is over 18 and legally able to hold property. FIRB approval will still apply unless they are an Australian PR or citizen. Also, note that the loan may still need to be under your name (as guarantor), depending on their income status.

Do I pay capital gains tax when I sell?

Yes — as a foreign owner, you’ll pay Capital Gains Tax (CGT) on any profit from selling Australian property. The current rate is 32.5% for non-residents. There’s no CGT in Singapore, but you may need to report it under foreign income if repatriated.

Can I rent it out without living there?

Absolutely. Singaporeans can legally rent out their property in Australia. Just make sure you:

- Pay tax on rental income in Australia

- Avoid the annual vacancy fee by having it occupied at least 6 months/year

- Work with a licensed property manager for legal compliance

Is the Double Tax Agreement (DTA) between Singapore and Australia still valid?

Yes. The DTA ensures you won’t be taxed twice on the same income. If you’re taxed in Australia, you typically don’t need to pay again in Singapore — but always refer to the IRAS DTA list for the latest treaty terms.

Final Summary: Key Takeaways for Singaporeans Buying Property in Australia

Buying property in Australia as a Singaporean is more than doable — but it’s not a decision to rush into. From FIRB approval and stamp duties to overseas loan options and rental tax, there’s a lot to navigate. The good news? With the right planning and support, it can be a smart, rewarding move — whether you’re buying for your child, investing for yield, or planning a future overseas.

💡 Key reminders:

- Always factor in the full cost, not just property price

- Choose your suburb based on purpose, not hype

- Get clear on currency and tax implications before you commit

- Talk to a cross-border mortgage expert to avoid costly blind spots

💬 Ready to explore your financing options or compare overseas loan rates?

Book a free consult with a trusted Singapore mortgage advisor — no pressure, just clarity.

Also exploring Malaysia?

If you’re still weighing your options, you may want to read our guide on buying property in Malaysia as a Singaporean — it’s another popular route with its own pros, costs, and rules.