Thinking of buying a home across the Causeway? You’re not alone. With more space, lower prices, and weekend convenience, Malaysia is an attractive option for many Singaporeans in 2025.

But here’s the big question: Can Singaporeans actually buy property in Malaysia? The short answer — yes, but with conditions. From minimum price rules to MM2H requirements and loan options, there’s quite a bit to unpack.

This guide breaks it all down so you know exactly what to expect — no legal jargon, just clear steps to help you buy with confidence.

Can Singaporeans Legally Buy Property in Malaysia in 2025?

Yes, Singaporeans can legally buy property in Malaysia — but there are rules to follow. In 2025, foreigners face restrictions based on property type, minimum purchase prices, and in some cases, MM2H visa requirements. Let’s break it down.

What Types of Properties Are Foreigners Allowed to Buy?

As a foreigner, your buying options in Malaysia are limited to certain types of residential and commercial properties. Here’s what you can buy as a Singaporean:

- Strata-titled condos or serviced apartments

- Landed properties in gated and guarded communities (varies by state)

- Commercial units and offices (with state approval)

And here’s what’s off-limits:

- Low-cost or affordable housing

- Properties on Malay Reserved Land

- Agricultural land, unless you have special government consent

Expert tip: If you’re new to the market, stick with strata condos in urban zones like Johor Bahru, KL, or Penang. These are not only foreigner-friendly but also easier to finance and manage from Singapore.

Thinking of a condo loan? Getting pre-approved in Singapore before shopping in Malaysia could give you better bargaining power with developers or agents.

What Is the Minimum Property Price for Singaporeans by State?

Unlike in Singapore, where pricing is mostly market-driven, Malaysia sets a minimum property purchase price for foreigners — and it varies by state.

Minimum Property Purchase Price in Malaysia for Singaporeans (2025)

| State | Minimum Purchase Price (Foreign Buyers) |

|---|---|

| Johor (outside Medini) | RM 2 million |

| Johor (Medini / SFZ) | RM 1 million |

| Selangor (landed) | RM 2 million |

| Kuala Lumpur | RM 1 million |

| Penang (strata) | RM 1 million |

| Melaka / Perak | RM 500,000 - RM 1 million |

🎯 Personal take: For value and accessibility, Medini is a sweet spot — it’s part of the Special Financial Zone (SFZ), offers lower entry prices, and is close to the future RTS (Rapid Transit System) link. Just double-check that the project has state approval for foreign ownership.

Pro tip: Before you commit, use a mortgage loan repayment calculator to estimate affordability — especially since most Malaysian banks offer 70–80% LTV for foreigners.

What Are the Key MM2H Program Benefits and Requirements?

If you’re planning to spend more time in Malaysia — whether it’s for retirement, frequent stays, or semi-relocation — applying under the Malaysia My Second Home (MM2H) programme could give you more flexibility and long-term peace of mind.

As of 2025, MM2H is now split into three tiers, each with different financial requirements and perks:

MM2H Programme Tiers and Property Ownership Benefits for Singaporeans (2025)

| Tier | Asset Requirement | Visa Duration | Key Perks |

|---|---|---|---|

| Platinum | RM 5 million+ | 15 years (renewable) | No property limits, top-tier benefits |

| Gold | RM 2 million+ | 10 years (renewable) | Buy landed property (in some states) |

| Silver | RM 1 million+ | 5 years (renewable) | Entry-level access to MM2H benefits |

Why MM2H matters for Singaporeans:

- ✅ Smoother state approval for property purchases

- ✅ Option to buy landed property (where allowed)

- ✅ Long-term visa for you and your family

- ✅ Easier access to mortgage loan options from local banks

💡 Expert tip: You don’t need MM2H to buy property, but if you plan to stay in Malaysia more than a few months each year — or want the option to live there long-term — it’s a smart move. It also helps if you’re applying for a private property loan or buying higher-end units.

What Restrictions Should Singaporeans Be Aware Of?

Even though Singaporeans can legally buy property in Malaysia, there are still key restrictions that could affect your plans — especially if you still own an HDB flat, or if you’re hoping to buy certain types of landed homes. Missing these rules could lead to delays or even a failed transaction, so it’s worth getting clear before you commit.

Can You Buy Malaysian Property If You Own an HDB Flat?

Yes — but timing matters.

If you’re still within your HDB’s Minimum Occupation Period (MOP), you’re not allowed to purchase any residential property overseas, including in Malaysia. This applies whether it’s a weekend condo in Johor or a long-term stay unit in KL.

Once your 5-year MOP is fulfilled, you’re free to explore overseas property — but you’ll still need to inform HDB if you plan to live outside Singapore for extended periods.

Tip: Planning to buy across the border after your MOP? Check out HDB home loan refinancing to restructure your mortgage and free up cash flow before purchasing in Malaysia.

Which Property Types Are Off-Limits to Foreign Buyers?

Not every home in Malaysia is open to foreigners — including Singaporeans. Here’s what you cannot buy:

- Low-cost and affordable housing units

- Properties built on Malay Reserved Land

- Agricultural or plantation land (unless specially approved)

These restrictions are designed to protect local housing supply and preserve land for Bumiputera interests.

You’re safe sticking to:

- Strata-titled condos and serviced apartments

- Landed homes in gated developments (subject to state rules)

- Commercial or mixed-use units (case-by-case basis)

What Happens If You Breach Ownership Rules in Malaysia?

Buying a restricted property type or failing to get state consent doesn’t just void the deal — it can trigger serious consequences:

- Your sale may be cancelled, even after paying a deposit

- You may be fined or face legal complications

- You risk losing part or all of your payment if you’re found ineligible

Malaysia takes foreign property compliance seriously, especially as more buyers from Singapore and China enter the market.

Expert tip: Always use a licensed Malaysian lawyer who understands foreign ownership laws. Better yet, speak to a mortgage advisor in Singapore who can flag red flags before you commit.

How Do You Buy Property in Malaysia? (Step-by-Step)

Once you’ve confirmed your eligibility and found a unit you love, here’s what the actual purchase process looks like. It’s similar to buying property in Singapore — but with a few key differences foreign buyers should be aware of.

How to Make an Offer and Secure the Property

The process starts with a Letter of Offer or booking form — this isn’t legally binding yet, but it reserves the property for you.

- You’ll typically pay a 2%–3% booking fee to take the unit off the market.

- This fee goes to the developer or seller’s agent and counts toward your total purchase price.

Tip: Always ask if the price includes furnishings, legal fees, or taxes. Developers in Malaysia often bundle these as part of promo packages — especially for new condos near the border.

What Happens During the SPA and 10% Deposit Stage

Next comes the Sale & Purchase Agreement (SPA) — a legally binding contract that outlines the property details, payment schedule, and conditions of sale.

- You’ll need to sign the SPA within 14–21 days of booking.

- At this stage, you’ll pay the balance of the 10% downpayment (i.e. 7%–8% more after the booking fee).

- You should engage a local lawyer to review the SPA — it’s not optional for foreigners.

Pro tip: If you’re applying for a mortgage loan in Singapore to finance your Malaysia property, get pre-approval early so you can meet payment deadlines without stress.

How Long Does Approval and Legal Completion Take?

After the SPA is signed, the transaction goes into the state consent phase — a requirement for all foreign buyers in Malaysia.

- Approval usually takes 2 to 6 months, depending on the state.

- During this time, your lawyer will handle land office filings, valuation, and title checks.

- Once approved, you’ll pay the remaining balance (usually via bank loan or full cash) and receive vacant possession.

The full process — from offer to handover — typically takes 3 to 9 months. For faster completion, target projects in places like Medini or KL where foreigner approvals are streamlined.

How Can Singaporeans Finance a Property in Malaysia?

Buying a property across the border? Unless you’re paying in full, you’ll need to explore financing options in either Malaysia or Singapore. The good news? There are multiple paths — but understanding the pros, cons, and rules in 2025 is crucial to avoid surprises.

Can You Qualify for a Bank Loan in Malaysia or Singapore?

Yes — Singaporeans can apply for a mortgage loan in Malaysia, but not every bank will lend to foreigners, and the terms vary. Local Malaysian banks like Maybank, CIMB, and RHB offer foreigner packages, though you’ll usually need:

- A clean credit history

- Proof of income and CPF contributions

- A higher downpayment (typically 30–40%)

Alternatively, some Singapore-based banks offer cross-border mortgage packages for Malaysian property. These are usually more convenient but may come with stricter requirements or higher interest rates.💡 Tip: Work with a licensed mortgage broker in Singapore to compare loan options on both sides — they can flag hidden fees and help you structure your loan smartly

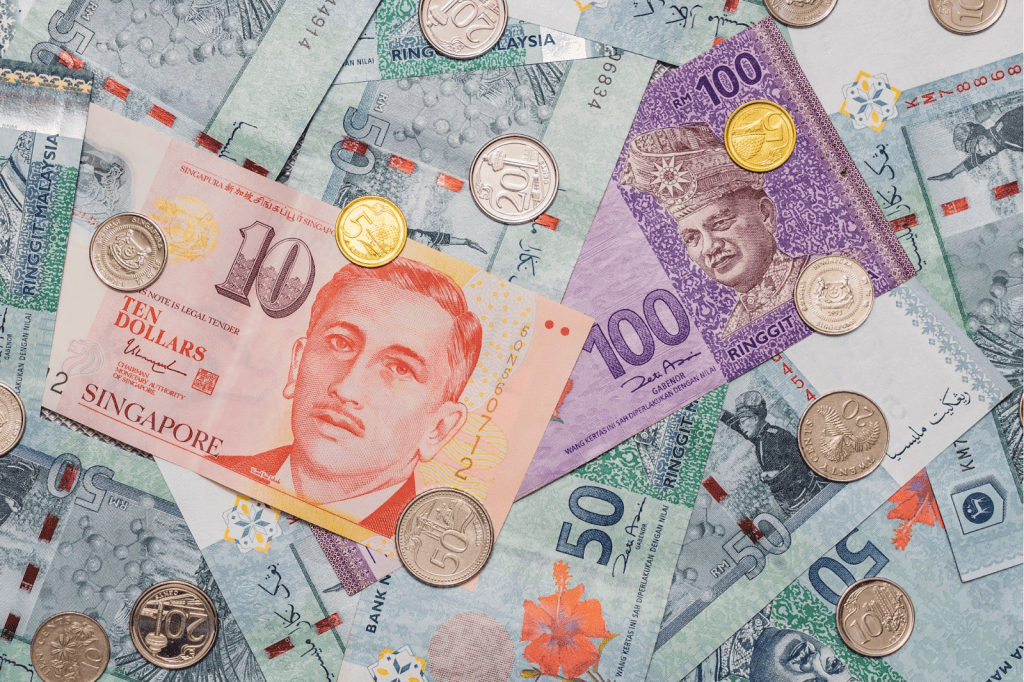

Should You Take a Loan in MYR or SGD?

This is one of the most important decisions to make.

MYR vs SGD Property Loan Comparison for Singaporeans Buying in Malaysia (2025)

| Criteria | MYR Loan | SGD Loan |

|---|---|---|

| Currency Match | ✅ Matches property value (no currency mismatch) | ⚠️ Subject to exchange rate volatility |

| FX Risk | ✅ No FX risk during monthly repayment | ⚠️ Exposed to SGD/MYR fluctuations |

| Interest Rates | ✅ Lower (~3.8%–4.5% as of 2025) | ⚠️ Higher (~4.5%–5.5% or more) |

| Loan Availability | ✅ More widely offered in Malaysia | ⚠️ Limited — only some banks offer SGD loans for overseas property |

| Ease of Management | ⚠️ FX transfer fees, foreign bank setup required | ✅ Easier to manage if earning in SGD |

| Best For | Long-term own stay, MM2H buyers | Singapore-based investors who prefer local loan control |

Expert tip: For own-stay or retirement, a MYR loan often makes more sense. But if you’re buying purely as an investor — especially with SGD income — a local SGD loan may offer more stability.

What Are the 2025 Loan-to-Value (LTV) and Tenure Rules?

Here’s what you need to know before applying for financing in Malaysia:

Key Financing Rules for Foreigners Buying Property in Malaysia (2025 Guide)

| Factor | Typical Range (2025) |

|---|---|

| LTV for foreigners | Up to 70%, sometimes 80% (with MM2H) |

| Loan tenure | Max 30 years or until age 65 |

| Interest rate | MYR: ~4.0% |

State approval and MM2H status may affect your loan limit. Also, properties in areas like Medini and KL tend to have more flexible loan support for foreigners.

Before applying, use a mortgage loan repayment calculator to test different loan sizes and monthly payments based on interest rate scenarios.

What Are the Taxes and Costs Involved?

Buying a property in Malaysia isn’t just about the purchase price. As a Singaporean, you’ll need to factor in stamp duty, legal fees, taxes, and ongoing costs — which can quickly add up if you’re not prepared. Let’s break it down.

What Stamp Duties and Legal Fees Will You Need to Pay?

Here’s what most Singaporean buyers can expect to pay upfront:

Upfront Stamp Duty and Legal Fees for Singaporeans Buying Property in Malaysia (2025)

| Cost Type | Estimated Range |

|---|---|

| Stamp Duty | 1%–4% based on property value (tiered scale) |

| Legal Fees | ~0.5%–1.0% of purchase price |

| Disbursements | RM 1,000–2,000 (admin, registration, etc.) |

Expert tip: Ask if the developer includes legal fees or stamp duty rebates. New launch projects near Johor often offer such perks to attract Singaporean buyers.

Also, if you’re not sure how stamp duty works in Singapore for comparison, use our Buyer’s Stamp Duty Calculator to explore the difference.

Is Real Property Gains Tax (RPGT) Applicable to Singaporeans?

Yes — RPGT (Real Property Gains Tax) applies to foreigners, including Singaporeans, when you sell Malaysian property.

As of 2025, RPGT is charged based on the number of years you’ve held the property:

RPGT Malaysia 2025: Tax Rates for Singaporeans Selling Property

- Sell within 5 years of purchase → RPGT rate is 30% on net gains.

- Sell after 5 years → RPGT rate drops to 10%, making long-term holding more tax-efficient.

- Deductions allowed → renovation costs, legal fees, and agent commissions can be subtracted from taxable gains (keep receipts as proof).

- Tip for investors → many Singaporeans time their sale after the 5-year mark to reduce RPGT from 30% to 10%.

You can deduct renovation costs, legal fees, and commissions when calculating net gains — but keep your receipts.

What Are the Ongoing Costs Like Maintenance, Tax, and Insurance?

Don’t forget the recurring expenses that come after you collect your keys. Here’s a summary:

Recurring Property Expenses for Singaporeans Owning Malaysian Homes (2025)

- Maintenance Fees (MCST) → RM 150–600/month, depending on condo size, facilities, and location. High-end condos with pools and gyms can be at the upper range.

- Assessment Tax (Cukai Pintu) → RM 200–500/year, charged by local councils based on property annual rental value.

- Quit Rent (Cukai Tanah) → RM 100–300/year, a mandatory land tax for property owners.

- Property Insurance → RM 300–600/year. Premiums vary depending on fire coverage, natural disaster add-ons, and property value.

- Agent Fees (if renting out) → Usually one month’s rent, paid once per successful tenant placement. Renewal fees may apply with some agents.

✅ Investor Tip: Many Singaporean owners underestimate MCST fees and insurance costs. Always include these in your cash flow projections to avoid negative rental yields.

For rental properties, factor in vacancy and agent fees. And if you’re financing with a private property loan, consider adding mortgage insurance for extra protection.

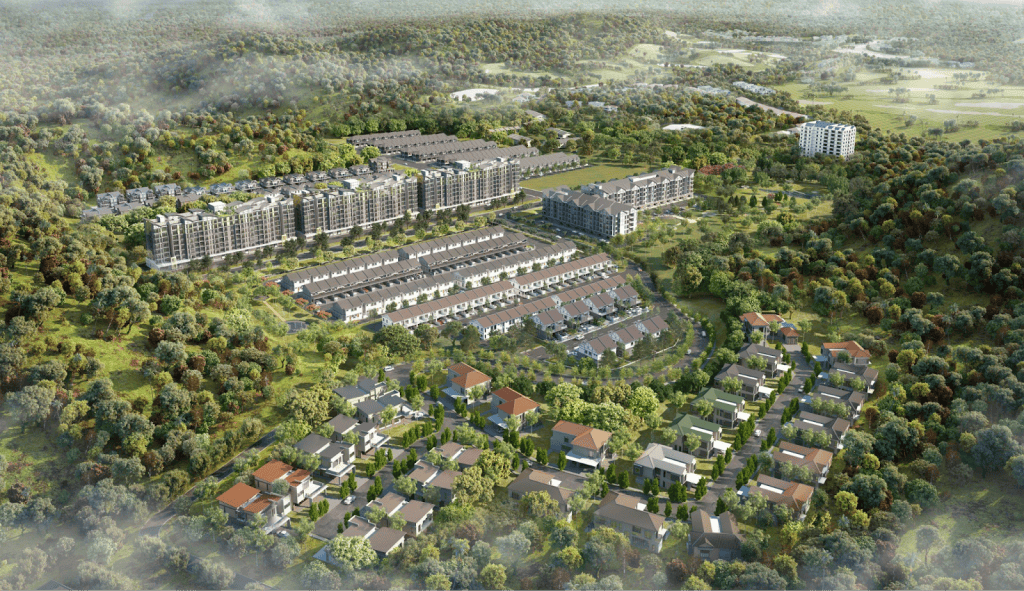

Where Are Singaporeans Buying in Malaysia?

When it comes to overseas property, most Singaporeans don’t look far — Johor remains the top choice, thanks to proximity, convenience, and growing infrastructure. But other cities like Kuala Lumpur and Penang are starting to attract more interest, especially among those buying for investment or retirement.

Let’s take a look at the hotspots.

Why Johor and Iskandar Are Still the Most Popular Choices

For most Singaporeans, Johor Bahru (JB) is the natural first pick — and for good reason:

- It’s just a short drive or bus ride away

- Property prices are significantly lower than in Singapore

- Daily commuting may soon become easier with the upcoming RTS Link

Within JB, areas like Iskandar Puteri, Medini, and Bukit Indah are especially popular for condos and mixed-use developments.

Pro tip: Looking for a condo loan to finance your JB unit? Singapore banks may offer better FX terms if you buy in popular zones with high liquidity.

What to Know About Forest City and Special Financial Zones (SFZs)

Forest City has made headlines — for both its ambition and controversy. But in 2025, it’s getting a second wind as part of Johor’s Special Financial Zone (SFZ) initiative.

Key updates:

- SFZ status brings tax incentives and reduced minimum property thresholds

- RM 1 million minimum still applies for foreigners in this zone

- Better connectivity planned with RTS and high-speed rail in the future

For buyers with MM2H or long-term plans, Forest City could offer value — but it’s best suited for own-stay or hybrid live/work usage rather than quick flip investments.

Should You Consider Other Cities Like KL or Penang?

If you’re buying primarily for investment, Kuala Lumpur (KL) and Penang offer compelling alternatives:

Kuala Lumpur vs Penang: Which is Better for Singaporeans Buying Property in Malaysia (2025)?

- Kuala Lumpur (KL)

- Malaysia’s capital and financial hub

- Strong rental market with high tenant demand

- Popular with expats and investors

- Better potential for capital appreciation over the long term

- Malaysia’s capital and financial hub

- Penang

- Known for its slower pace and scenic lifestyle

- Popular with retirees and lifestyle-focused buyers

- Strong healthcare and retirement hubs

- Appeals to those seeking quality of life rather than high yields

- Known for its slower pace and scenic lifestyle

💡 Expert Insight: KL is ideal if your goal is investment growth and rental yield, while Penang suits buyers looking for retirement comfort or lifestyle benefits.

Still unsure where to buy? It’s worth discussing your long-term goals with a mortgage advisor in Singapore to understand which city aligns with your financing and usage plan.

Is Buying Property in Malaysia Practical for Singaporeans in 2025?

With rising home prices in Singapore and stronger infrastructure links across the Causeway, more Singaporeans are exploring Malaysian property as a real option — not just a weekend dream. But is it really the right move for you in 2025?

Let’s look at the upside, the risks, and how to know if it fits your long-term plan.

What Makes Malaysia Attractive to Singapore Buyers?

There are several reasons Malaysia remains one of the top overseas property choices for Singaporeans:

- Affordability – Prices can be 60–70% cheaper than equivalent condos in Singapore.

- Proximity – Easy access via the Causeway, upcoming RTS, and even daily commutes for some.

- Space & Lifestyle – Larger units, more facilities, and a slower pace — especially in Penang or Johor.

- Retirement & MM2H – The MM2H programme offers long-term stay options for those planning to semi-retire or relocate.

- Rental Yield – Some areas like KL and Iskandar still offer 5–6% gross rental yields for well-located units.

If you’re looking for a second home or future retirement plan, Malaysia ticks many boxes — especially with a private property loan structured to match your cash flow

What Challenges and Risks Should You Expect?

While the benefits are clear, it’s not all smooth sailing:

- Currency Risk – MYR volatility can affect repayments and resale value if you earn in SGD.

- Financing Hurdles – Malaysian banks may offer lower LTV for foreigners; rates can be higher if you don’t qualify for MM2H.

- Vacancy Risk – Some areas (e.g. Forest City) have high supply and low occupancy.

- State Approvals & Delays – Legal completion for foreign buyers can take months.

- Property Management – If you’re not staying there, managing tenants and maintenance from Singapore can be tricky.

📝 Using a trusted mortgage broker in Singapore can help you structure your loan properly and assess risks before signing.

How to Decide If Buying in Malaysia Fits Your Personal Goals

Ask yourself:

- ✅ Are you buying for own-stay, retirement, or pure investment?

- ✅ Can you handle possible vacancy or FX losses?

- ✅ Are you financially ready for upfront + ongoing costs?

- ✅ Do you have a plan for managing the property remotely?

If your goal is to enjoy weekend living, retire with space, or diversify your property portfolio affordably — Malaysia could be a practical fit in 2025.

But if you’re stretched financially or hoping for quick gains, it may be better to wait or speak with an advisor first.

💡 Need help figuring out if it’s right for you? Use a mortgage loan repayment calculator to test scenarios, or speak to an advisor for a personalised breakdown.

Frequently Asked Questions (FAQ)

Still have questions about buying property in Malaysia as a Singaporean? Here are some quick answers to the most common ones we hear:

Can I Buy Malaysian Property Without MM2H?

Yes, you don’t need to apply for MM2H to buy property in Malaysia.

Singaporeans can legally purchase residential property (above state-specific minimum prices) even without being part of the Malaysia My Second Home programme. However, MM2H may give you access to better financing terms and the ability to buy landed property in more areas.

Think of MM2H as a long-stay visa — not a purchase requirement.

Can I Rent Out My Property After Purchase?

Yes, foreigners can legally rent out their property in Malaysia — whether it’s a short-term rental or long-term lease.

That said, make sure:

- The building allows for rentals (some condos restrict Airbnb-style usage)

- You appoint a reliable agent or manager if you’re based in Singapore

- You’re aware of Malaysia’s rental income tax, which applies to non-residents too

💬 Pro tip: If you’re buying with investment in mind, aim for KL city fringe or Iskandar areas near the RTS — these tend to have stronger rental demand.

Can Singaporeans Own Landed Property in Malaysia?

Yes — but with restrictions.

Foreigners (including Singaporeans) cannot buy landed properties in most states unless:

- The property is within a designated zone (e.g. Medini in Iskandar)

- You’re approved under the MM2H programme

- You meet the minimum price threshold (typically RM 1 million+)

For example, Johor may allow landed purchases under MM2H, but only in certain developments.

Always check the specific state rules and project guidelines before committing. Your lawyer or agent in Malaysia should confirm this before the SPA stage.

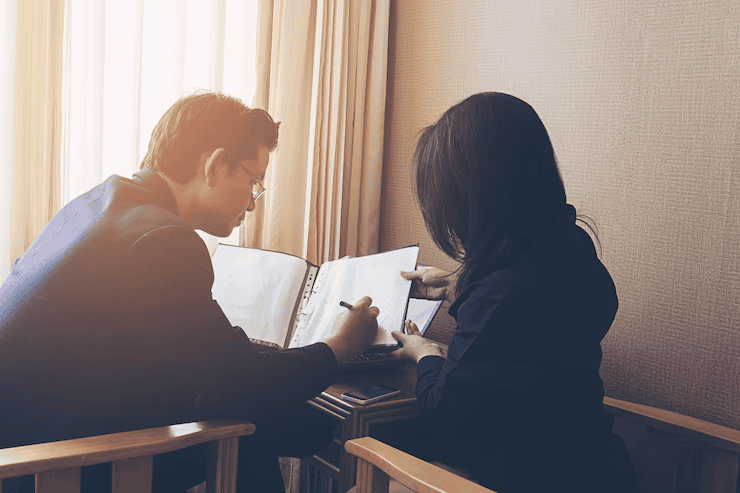

Final Advice – Speak to a Property Finance Advisor Before You Buy

Buying a property across the border may seem simple at first — but the legal, financial, and tax implications for Singaporeans can be a lot more complex than buying locally. Before you commit to a unit or put down a deposit, it’s wise to speak with someone who understands both markets inside out.

Why Cross-Border Advice Can Save You Costly Mistakes

From minimum purchase thresholds and legal delays to MM2H visa nuances, many Singaporeans fall into traps because they rely solely on Malaysian agents. The solution? Work with a Singapore-based mortgage advisor who’s experienced in Malaysian property financing.

💬 Expert tip: It’s not just about getting a loan — it’s about structuring your financing to protect your cash flow, currency exposure, and long-term plans.

When to Start Comparing Loans, FX Rates, and Legal Support

Ideally, do this before even placing a booking fee. Many banks in Malaysia require different documentation from foreigners, and your FX strategy (MYR vs SGD loan) can affect your monthly repayments drastically.

Here’s what to compare:

- Bank loan interest rates (Malaysia vs Singapore)

- MYR vs SGD home loan risks

- Estimated cash outlay (stamp duty, legal, RPGT)

- Timeline for approval and completion

- Local vs Singapore legal rep coordination

💡 Use tools like our mortgage loan repayment calculator to run your numbers before signing anything.

Book a Free Consultation with a Mortgage Expert

At Ace Mortgage, we help Singaporeans navigate property financing — whether it’s HDB refinancing, private property loans, or buying overseas homes like in Johor or KL.

✅ 100% free consultation

✅ Advice on MYR vs SGD loans

✅ Bank comparisons from DBS, UOB, OCBC and more

✅ MM2H insights and risk planning

✅ Cross-border legal coordination

👉 Book a free consult here — and get peace of mind before you commit across the Causeway.