Buying a home in Singapore? Chances are, you’re planning to use your CPF Ordinary Account (OA) to pay part — or all — of your monthly mortgage. Whether you’re eyeing a BTO flat, resale HDB, or a private condo, understanding how CPF can be used for housing loans is essential.

In this guide, we break down CPF housing loan repayment rules, usage limits, and smart strategies to help you make the most of your CPF savings — for both HDB and private property.

Expert tip: Many buyers unknowingly max out their CPF too early. Knowing when and how to use it can save you from cashflow stress later.

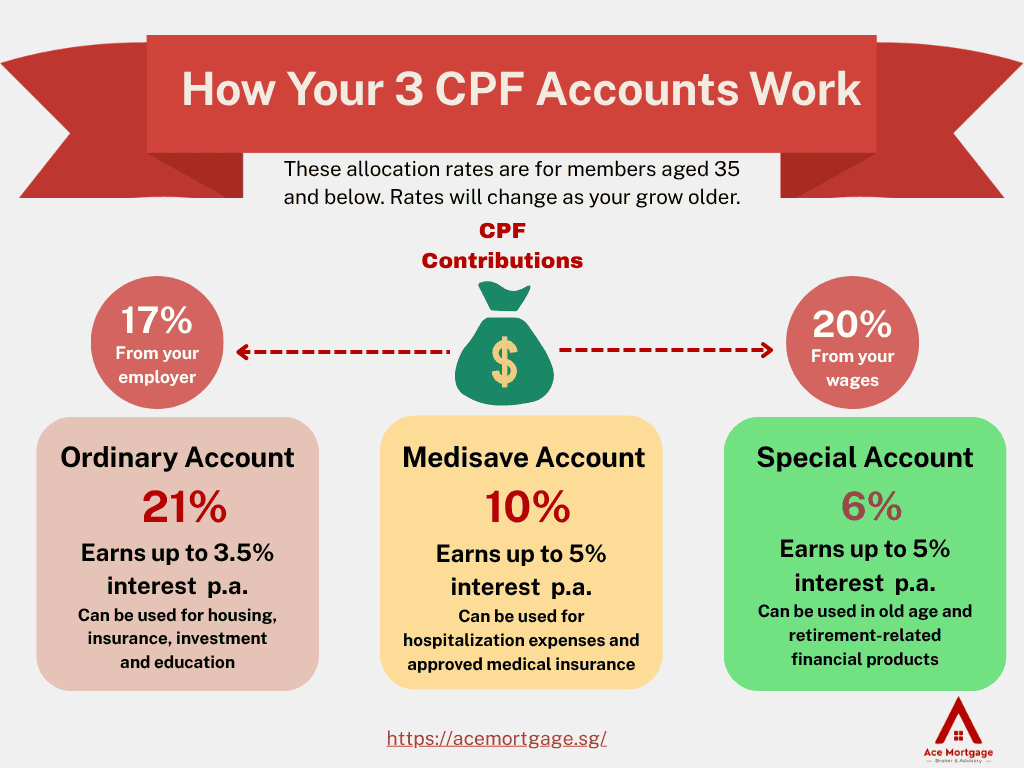

What Is CPF and How Does It Help You Buy a Home?

CPF isn’t just a retirement savings tool — it’s one of the most commonly used resources for homeownership in Singapore.

Your CPF Ordinary Account (OA) can help cover major housing costs like downpayments, legal fees, and even your monthly mortgage. But while it feels like “free money,” there are important limits and long-term trade-offs to understand before relying on it entirely.

What is the CPF Ordinary Account and how does it support housing purchases?

Your CPF OA can be used to pay for various housing expenses — including the initial downpayment, stamp duties, legal costs, and monthly loan repayments.

It’s automatically topped up by your salary each month (up to the CPF allocation rate), and can significantly reduce your upfront financial burden.

To plan ahead, try this helpful mortgage repayment calculator to see how much of your CPF you might actually need.

How can CPF be used differently for HDB vs private properties?

The rules change depending on what you’re buying:

- For HDB BTOs or resale flats, CPF usage is generally more flexible.

- For condos, ECs, or landed homes, CPF usage depends on the property’s remaining lease and market valuation.

If you’re considering a private home, review your options with this guide to private property loans to understand financing better.

Expert tip: Always check the remaining lease. If it doesn’t last till you or your partner turn 95, CPF usage will be limited — or disallowed entirely.

Why do most buyers use CPF instead of cash for their home loan?

Using CPF reduces the need for upfront cash, which many homeowners prefer — especially first-timers. This frees up funds for other costs like renovation, furnishing, or emergencies.

That said, draining your CPF can impact your long-term savings and limit your future investment opportunities. Some borrowers intentionally preserve CPF and fund part of their monthly instalments in cash, particularly when applying for bank loans from DBS, OCBC, or UOB.

How Much CPF Are You Allowed to Use for Housing?

CPF may feel like a flexible tool for homebuyers, but there are hard limits on how much you can actually use. These are mainly defined by two terms: the Valuation Limit (VL) and the Withdrawal Limit (WL).

On top of that, CPF usage depends on the property’s lease duration — something many buyers overlook. Let’s break it all down so you don’t get caught off guard.

What is the Valuation Limit (VL) and when do you hit it?

The Valuation Limit is the lower of your property’s market value or purchase price at the time of purchase. Once your CPF usage hits this amount, you can’t use more unless you meet additional conditions, such as setting aside your Basic Retirement Sum (BRS).

For example, if you buy a flat valued at $500,000 and pay $20,000 in cash downpayment, your VL is $480,000 — and that’s the maximum CPF you can use unless you have enough in your CPF RA.

Expert tip: Once you approach the VL, start planning to use more cash or explore loan refinancing options. You can check your eligibility here: refinance your home loan.

What is the Withdrawal Limit (WL) and how is it calculated?

The Withdrawal Limit is 120% of your Valuation Limit. This is the absolute CPF cap — even if you’ve got plenty in your OA. Once you hit the WL, CPF usage stops completely unless you’ve topped up your Retirement Account.

Here’s a quick table for clarity:

CPF Withdrawal Limit (WL) vs Property Value: How Much Can You Use?

| Property Value | Valuation Limit (VL) | Withdrawal Limit (WL = 120% of VL) |

|---|---|---|

| $400,000 | $400,000 | $480,000 |

| $600,000 | $600,000 | $720,000 |

| $800,000 | $800,000 | $960,000 |

Once you hit WL, you’ll need to pay any remaining loan entirely in cash.

Why does your property’s lease length affect your CPF usage?

CPF usage is also restricted based on the remaining lease of the property. Here’s how it works:

- If the lease covers the youngest buyer until age 95, CPF usage is unrestricted (within VL/WL limits).

- If not, CPF usage will be pro-rated, or in some cases not allowed at all.

This often catches resale flat buyers by surprise, especially in mature estates. If you’re eyeing an older flat but want to maximize your CPF usage, check out the latest guidelines from CPF Board or use a platform like Ace Mortgage to explore alternate financing paths.

How Do Monthly CPF Deductions Work for Your Home Loan?

Once you’ve bought your property, CPF OA can continue supporting your home through monthly installment deductions. But how much can be deducted — and what happens when your CPF starts to run low? This section breaks down how to manage your CPF funds smartly, especially for long-term repayment.

How much CPF can be used for monthly mortgage installments?

There’s no fixed monthly cap on how much CPF you can use — as long as you’re still within your Valuation Limit (VL) or Withdrawal Limit (WL). Most homeowners simply use whatever CPF they have available to cover the full installment.

If you’ve taken an HDB loan, monthly CPF deductions are automatically set up when you apply. For bank loans, you’ll need to arrange CPF payments manually via your bank and CPF portal.

To see what your repayments might look like, use this mortgage loan calculator — it’ll help you forecast whether your CPF OA balance can keep up.

What happens if you don’t have enough CPF in your OA?

If your CPF balance can’t cover the full instalment:

- The bank or HDB will auto-deduct the shortfall from your linked bank account

- If there’s no cash backup, you’ll get a warning — and risk going into arrears

- Over time, this could affect your credit score and housing stability

Expert tip: Set a monthly CPF OA alert on the CPF app. When your balance drops near zero, you can adjust payments before problems arise.

How can you combine CPF and cash for flexible repayment?

Many savvy homeowners now use a CPF + cash combo each month. This strategy helps balance near-term affordability with long-term savings.

Here’s how it typically works:

- Use CPF to cover a fixed base amount

- Top up with cash to reduce CPF drain

- Prioritise cash first if you’re aiming to preserve CPF for retirement

Some also switch to this model after hitting the Valuation Limit, or when preparing to refinance. If you’re considering refinancing, this refinance loan guide may help you time it right.

Can You Use CPF to Buy a Condo or Pay a Bank Loan?

Yes — CPF isn’t just for HDB buyers. You can use your CPF Ordinary Account to fund purchases of ECs, private condos, and even landed homes. But the rules are tighter, especially if you’re using a bank loan or buying an older property. Here’s what you need to know.

What CPF rules apply to ECs, condos, and private homes?

CPF usage is allowed for:

- Executive Condominiums (ECs) bought directly from a developer

- Resale ECs and private condos, subject to lease rules

- Legal and stamp fees for private property purchases

But remember, CPF can’t be used for the minimum cash downpayment for private homes — usually 5% of the purchase price. Looking at condos? This condo loan guide breaks down how much CPF and cash you’ll need at each step.

How does CPF usage differ between HDB and bank loans?

The key difference is how strict the CPF withdrawal conditions are:

- For HDB loans, you can use CPF up to the full Valuation Limit (VL) without needing to meet the Basic Retirement Sum.

- For bank loans, you’ll hit a wall at the VL unless you set aside your BRS in cash or CPF.

This often surprises first-time condo buyers — they assume CPF works the same regardless of loan type.

Expert tip: If you’re planning to buy private property with a bank loan, check out DBS, UOB, or OCBC home loan packages early. Rates and terms can affect how much CPF you’ll need to commit.

When are CPF limits stricter for private property purchases?

CPF rules get stricter when:

- The property’s lease doesn’t cover the youngest buyer to age 95

- The Withdrawal Limit (120% of VL) is reached

- You’re buying a second property (CPF usage is more restricted)

This is why many private home buyers turn to mortgage brokers for guidance. You can compare rates and CPF usage options through a Singapore mortgage broker for better clarity before committing.

What Happens When You Sell a Home Paid with CPF?

Selling a home you paid for with CPF? Be prepared to refund what you’ve used — and not just the principal. CPF Board requires you to return the amount you used plus the interest it would’ve earned. This catches many sellers off guard, so it’s crucial to plan for it in advance.

Why must you refund CPF used, including accrued interest?

Every dollar you use from CPF OA for housing stops earning its usual 2.5% interest. So when you sell the property, CPF expects you to “pay back” what your savings could have grown into — this is called accrued interest.

The refund ensures your CPF savings are replenished for retirement. You won’t feel the impact immediately, but it could affect how much you can use for your next home or retirement payout.

How is the refund calculated during a property sale?

CPF refunds are calculated as:

CPF used for property + 2.5% accrued interest (compounded yearly)

Example:

If you used $200,000 in CPF over 5 years, the refund amount could exceed $225,000, depending on usage timing. This refund is automatically deducted from your sale proceeds and returned to your CPF OA. You can track this on your CPF dashboard or consult CPF’s official guide.

What if your sale proceeds are not enough to repay CPF?

Good news — if your sale is at fair market value, and your proceeds aren’t enough to fully refund CPF, you’re not required to top up the shortfall in cash.

That said, CPF will still take whatever is left from your proceeds and refund that amount to your OA. It may reduce what you can roll over into your next property — so it’s smart to check the numbers ahead.

Expert tip: Planning to upgrade or buy a second home? Knowing your CPF refund obligation helps you estimate the true cash you’ll walk away with. A quick chat with a mortgage advisor can help you run the numbers.

What Are the Downsides of Overusing CPF for Housing?

CPF is a helpful tool, but using too much too early can hurt your future plans. Many homeowners focus on short-term affordability, not realising the long-term cost — especially when it comes to retirement savings. Here’s what to watch for before wiping out your OA.

Why should you always keep $20,000 in your CPF OA?

The CPF Board encourages homeowners to leave at least $20,000 in your OA. This isn’t a hard rule — but it’s a smart one.

That $20,000 acts as a buffer:

- For emergencies or temporary job loss

- To cover unexpected loan adjustments

- To meet future home-related costs (like resale levy or bridging loans)

Also, CPF interest is risk-free and guaranteed at 2.5%, so keeping a small balance growing in your OA is never a bad idea.

How does heavy CPF usage affect your retirement savings?

The more CPF you use for your home, the less you have for retirement. Even if you plan to sell and “refund” it later, you’re missing out on years of compounding interest.

Here’s how that can play out:

- $100,000 left untouched in CPF OA for 25 years grows to nearly $170,000

- If used for housing instead, that growth is delayed — or lost

That’s why some homeowners prefer to pay more in cash each month and preserve their CPF for the long haul.

Expert tip: If you’re thinking long-term, it’s worth exploring a custom repayment mix. Some even refinance their loan to adjust CPF usage — start with a refinance calculator to see what works for your timeline.

What risks should you consider before using CPF fully?

Before maxing out your CPF for property, consider:

- Will you still have enough OA funds for property taxes, insurance, or emergencies?

- Can you meet future Retirement Account (RA) requirements?

- Will you need CPF again for your next property — or for dependents?

Using CPF is not “free money” — it’s your retirement, repurposed early. The goal is to strike a balance between today’s needs and tomorrow’s security.

How Can You Maximise CPF for Housing and Retirement?

Using CPF wisely isn’t just about paying for your home. It’s about protecting your future too. With the right approach, you can stretch your CPF savings to support your housing needs today and your retirement income tomorrow. Here’s how to get the best of both.

What are the benefits of voluntary housing refunds to CPF?

Voluntary housing refunds let you return CPF money used for your home — even before you sell it. This helps:

- Reduce the accrued interest you’ll owe upon sale

- Rebuild your OA balance faster

- Boost future eligibility for CPF housing use (especially if buying again)

It’s not a move everyone considers, but it’s great for those with stable income and long-term plans. For those who’ve recently refinanced or plan to, a refund strategy could complement your new loan terms. Learn more here: refinance your HDB loan.

How can you balance CPF usage between mortgage and savings?

The smartest CPF users don’t go all in — they split.

Try this approach:

- Use CPF for a portion of your monthly instalments

- Pay the rest in cash, even if CPF is available

- Leave a reserve in your OA to grow interest

This method keeps your retirement fund growing, while still easing your home loan burden. If you’re unsure how to structure your payments, a mortgage broker can help customise a plan based on your income and life stage.

Why should you plan your CPF strategy based on long-term goals?

CPF is more than just a housing tool — it’s your retirement engine. Every decision you make now, from downpayments to monthly deductions, affects your future balance.

Ask yourself:

- Do I plan to upgrade homes in 5–10 years?

- Will I need CPF for another purchase later?

- How much do I want available in my CPF OA at age 55?

Expert tip: Don’t just focus on what’s affordable now — plan for flexibility later. CPF usage today should still support your future financial freedom.

Making the Most of Your CPF for Housing Without Sacrificing Retirement

Using CPF to pay your housing loan is one of the smartest ways to afford a home in Singapore — but only if you understand the rules and limits. From knowing how much CPF you can use, to deciding when to use cash instead, every choice impacts your long-term savings.

Whether you’re buying your first HDB flat, upgrading to a condo, or planning for retirement, a clear CPF strategy puts you in control — not the other way around.

If you’re unsure about the best path forward, speak with a mortgage advisor at Ace for personalised insights. They can help you compare bank loan options or refinancing strategies that complement your CPF plan.